Is VEBSON safe?

Pros

Cons

Is Vebson A Scam?

Introduction

Vebson is an online trading platform that positions itself as a comprehensive solution for forex and CFD trading. With claims of offering advanced trading tools and a user-friendly interface, Vebson aims to attract both novice and experienced traders. However, the foreign exchange market is fraught with risks, making it essential for traders to carefully evaluate the legitimacy and reliability of brokers before committing their funds. This article investigates Vebson's legitimacy by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The analysis is based on a review of multiple credible sources, including regulatory filings, user testimonials, and expert evaluations.

Regulation and Legitimacy

The regulatory status of a trading platform is a critical factor that determines its legitimacy and safety for traders. Vebson claims to be regulated, but a closer examination reveals a lack of credible oversight from recognized financial authorities. Below is a summary of Vebson's regulatory information:

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

Vebson operates without any legitimate regulatory oversight, which raises significant red flags for potential investors. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) provide essential protections for traders, ensuring that brokers adhere to strict standards of transparency and accountability. The absence of such regulation suggests that traders may be exposed to high risks, including potential fraud and mismanagement of funds. Furthermore, Vebson has received warnings from various financial watchdogs, indicating that it may not be a safe platform for trading.

Company Background Investigation

Vebson's company history and ownership structure are crucial in understanding its operations and reliability. The broker claims to be registered in Saint Lucia, but details about its establishment, ownership, and management team remain vague. This lack of transparency can be concerning, as reputable brokers typically provide clear information about their history and leadership.

The management teams background is also a significant factor in assessing the broker's trustworthiness. Unfortunately, there is little available information regarding the qualifications and experience of Vebson's leadership. This opacity raises questions about the broker's intentions and operational integrity. Moreover, credible brokers often disclose their financial audits and regulatory compliance records, but Vebson appears to lack such disclosures, further diminishing its credibility.

Trading Conditions Analysis

Understanding the trading conditions offered by Vebson is vital for potential traders. The fee structure and trading costs can significantly impact profitability. Based on available information, Vebson's trading costs appear to be competitive, but there are concerns regarding hidden fees and unclear terms. Below is a comparison of Vebson's core trading costs:

| Fee Type | Vebson | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | Varies widely |

| Commission Model | Not disclosed | Varies widely |

| Overnight Interest Range | Not disclosed | Varies widely |

The lack of transparency in Vebson's fee structure is alarming. Traders should be cautious of brokers that do not provide clear information about their costs, as this can lead to unexpected charges and lower overall profitability. Additionally, any unusual or excessive fees can be a warning sign of potential fraud.

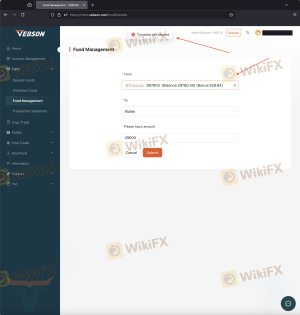

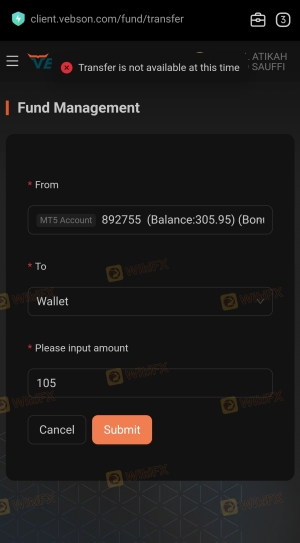

Client Fund Security

The safety of client funds is paramount when selecting a trading platform. Vebson claims to implement various security measures, but the lack of regulatory oversight raises concerns about the effectiveness and reliability of these measures. Traders should inquire about the following aspects:

- Segregated Accounts: Are client funds held in segregated accounts to protect them from operational risks?

- Investor Protection: Does Vebson offer any form of investor protection or compensation schemes?

- Negative Balance Protection: Are there policies in place to prevent clients from losing more than their initial investment?

Without credible answers to these questions, traders may be at risk of losing their entire investment. Furthermore, any historical issues regarding fund security or disputes should be carefully considered before engaging with Vebson.

Customer Experience and Complaints

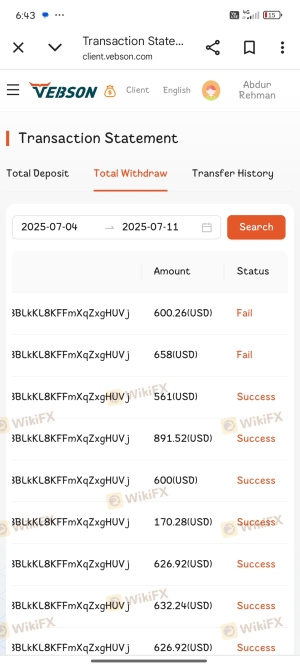

Analyzing customer feedback provides valuable insights into the reliability of a trading platform. Vebson has garnered numerous complaints from users, primarily concerning withdrawal issues, poor customer service, and high-pressure sales tactics. Below is a summary of common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Blocking | High | Poor |

| Misleading Information | Medium | Poor |

Many users have reported difficulties in withdrawing their funds, with delays lasting weeks or even months. Others have experienced account blocks without explanation, leading to suspicions of fraudulent practices. The company's response to these complaints has generally been unsatisfactory, further eroding trust among potential clients.

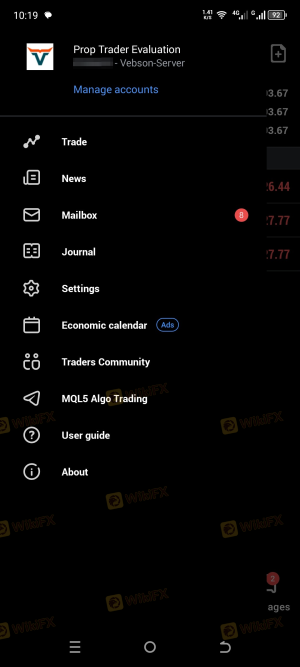

Platform and Trade Execution

The performance of a trading platform is crucial for a positive trading experience. Vebson claims to offer a stable and efficient trading platform, but user reviews suggest otherwise. Issues such as slow execution times, frequent downtime, and high slippage have been reported. Traders should be wary of platforms that do not provide reliable execution, as this can significantly impact trading results.

Additionally, any signs of potential platform manipulation, such as sudden changes in pricing or execution refusals, should raise alarms. A trustworthy broker should provide transparent and consistent trading conditions.

Risk Assessment

Engaging with Vebson involves several risks that potential traders should consider. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases vulnerability to fraud. |

| Financial Risk | High | Potential loss of funds with no recourse. |

| Operational Risk | Medium | Issues with platform reliability and execution. |

To mitigate these risks, traders should conduct thorough research, avoid investing more than they can afford to lose, and consider using regulated alternatives for their trading needs.

Conclusion and Recommendations

In conclusion, the evidence suggests that Vebson exhibits several characteristics commonly associated with scam brokers. The lack of regulation, transparency issues, and numerous customer complaints raise significant concerns about its legitimacy. Potential traders should exercise extreme caution when considering Vebson as their trading platform.

For those seeking reliable trading options, it is advisable to explore well-regulated brokers with proven track records. Some reputable alternatives include brokers regulated by the FCA, ASIC, or other recognized authorities, which offer robust protections and transparent operations. Always prioritize safety and due diligence in your trading journey.

Is VEBSON a scam, or is it legit?

The latest exposure and evaluation content of VEBSON brokers.

VEBSON Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VEBSON latest industry rating score is 1.96, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.96 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.