Regarding the legitimacy of Traders forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is Traders safe?

Risk Control

Software Index

Is Traders markets regulated?

The regulatory license is the strongest proof.

FSA Market Making License (MM)

Financial Services Agency

Financial Services Agency

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

トレイダーズ証券株式会社

Effective Date:

2007-09-30Email Address of Licensed Institution:

--Sharing Status:

Website of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

東京都渋谷区恵比寿4-20-3恵比寿ガーデンプレイスタワー28階Phone Number of Licensed Institution:

03-6736-9830Licensed Institution Certified Documents:

Is Traders Securities Safe or Scam?

Introduction

Traders Securities, a brokerage firm based in Japan, has gained attention in the forex market for its offerings in trading foreign exchange, CFDs, and cryptocurrencies. As the financial landscape increasingly attracts both novice and experienced traders, it is crucial to carefully evaluate the legitimacy and safety of trading platforms to safeguard investments. The rise of online trading has also led to the proliferation of unregulated and potentially fraudulent brokers, making it imperative for traders to conduct thorough research before committing their funds. This article aims to investigate the safety and reliability of Traders Securities by analyzing its regulatory status, company background, trading conditions, customer experience, and risk factors.

Regulation and Legitimacy

The regulatory status of a brokerage is one of the most critical factors in determining its safety. Traders Securities is regulated by the Japanese Financial Services Agency (FSA), which provides a layer of credibility. However, the quality of regulation can vary significantly across jurisdictions. Below is a summary of the key regulatory information for Traders Securities:

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| Financial Services Agency (FSA) | 123 | Japan | Verified |

While being regulated by the FSA suggests a level of oversight, it is essential to consider the history of compliance and the regulatory environment in Japan. The FSA has been known to impose stringent regulations, but there have been instances where brokers faced scrutiny for inadequate practices. Therefore, while Traders Securities is regulated, potential investors should remain cautious and consider the broader context of the regulatory landscape.

Company Background Investigation

Traders Securities was founded in 1999 and has since evolved into a financial services provider focusing on retail trading. The company is headquartered in Tokyo, Japan, and has undergone several changes over the years, including the acquisition of Emcom Securities in 2010, which expanded its offerings. The ownership structure of Traders Securities is relatively opaque, with limited information available regarding its stakeholders and management team.

The management team‘s background is crucial in assessing the company's reliability. A team with extensive experience in finance and trading can enhance the firm’s credibility. However, the lack of transparency regarding the management's qualifications raises concerns about the company's operational integrity. Furthermore, the level of information disclosure is vital for building trust with clients, and Traders Securities appears to fall short in this area, which may contribute to skepticism about its safety.

Trading Conditions Analysis

The trading conditions offered by a brokerage can significantly impact the overall trading experience. Traders Securities claims to provide competitive spreads and a straightforward fee structure. However, it is essential to analyze these conditions in detail to identify any potential red flags. Below is a comparison of core trading costs:

| Fee Type | Traders Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.2 pips | 0.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Variable | Variable |

While the spreads offered by Traders Securities are competitive, the absence of a clear commission structure may be concerning. Traders should be wary of hidden fees or unexpected costs that could arise during trading. Additionally, the variable overnight interest rates may lead to unforeseen expenses, especially for traders holding positions overnight.

Client Fund Safety

Protecting client funds is a paramount concern for any brokerage. Traders Securities claims to implement several safety measures, including segregated accounts for client funds. This practice ensures that client money is kept separate from the company's operational funds, providing a level of security in case of financial difficulties. Additionally, the firm reportedly follows local regulations regarding investor protection.

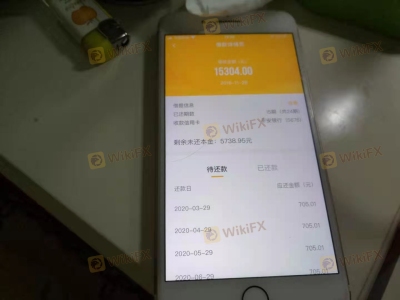

However, it is essential to scrutinize the effectiveness of these measures. Historical incidents involving fund safety and disputes can provide insight into the firms reliability. Traders Securities has faced complaints regarding withdrawal issues, which raises questions about its operational integrity. Therefore, potential investors should exercise caution and consider the implications of these safety measures before proceeding.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a brokerage's reliability and service quality. Reviews of Traders Securities reveal a mixed bag of experiences. While some users report satisfactory trading experiences, others have raised significant complaints regarding withdrawal difficulties and customer service responsiveness. Below is a summary of the primary complaint types and their severity assessment:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow |

| Customer Support | Medium | Inconsistent |

The prevalence of withdrawal issues is particularly alarming, as it directly impacts traders access to their funds. Prompt and effective customer support is crucial for resolving such issues, yet many users have reported slow responses from the firm. This inconsistency in handling complaints may indicate underlying operational inefficiencies that could pose risks to traders.

Platform and Trade Execution

The trading platform's performance is critical for a positive trading experience. Traders Securities offers several platforms, including web-based and mobile options. However, the overall stability and user experience of these platforms are essential factors to evaluate. Reports suggest that while the platform is generally user-friendly, there have been instances of slippage and order rejections, which can frustrate traders.

Order execution quality is another vital aspect to consider. A high rejection rate or significant slippage can lead to losses, especially in fast-moving markets. Traders should be cautious and monitor their execution quality closely to ensure they are not adversely affected by the platform's performance.

Risk Assessment

Using Traders Securities comes with an inherent set of risks that potential investors should carefully consider. Below is a concise risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Regulated by FSA, but concerns about oversight quality. |

| Withdrawal Risk | High | Numerous complaints regarding withdrawal difficulties. |

| Operational Risk | Medium | Issues with customer support and platform stability. |

To mitigate these risks, traders should conduct thorough due diligence, employ risk management strategies, and consider starting with smaller investments until they are comfortable with the broker.

Conclusion and Recommendations

In conclusion, the investigation into Traders Securities raises several red flags that potential investors should not overlook. While the firm is regulated by the FSA, the quality of that regulation, combined with a lack of transparency and numerous complaints regarding withdrawal issues, suggests that Traders Securities may not be the safest option for traders.

For those considering trading with Traders Securities, it is crucial to weigh the potential risks against the benefits. New traders may want to explore more established and well-regulated alternatives that provide clearer fee structures and a more robust customer service experience. Recommended alternatives include brokers that are regulated by top-tier authorities, such as the FCA or ASIC, which offer higher levels of investor protection and transparency.

Ultimately, while Traders Securities may provide some attractive trading conditions, the concerns surrounding its safety and reliability warrant caution. Therefore, traders should approach with care and consider their options thoroughly before investing.

Is Traders a scam, or is it legit?

The latest exposure and evaluation content of Traders brokers.

Traders Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Traders latest industry rating score is 6.97, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.97 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.