Is Sunrise safe?

Pros

Cons

Is Sunrise Safe or Scam?

Introduction

Sunrise is a forex broker that has gained attention in the trading community for its claims of providing lucrative investment opportunities. However, as with any financial service, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is rife with potential scams and unreliable brokers, making it essential for traders to evaluate the legitimacy of their chosen broker carefully. This article will investigate whether Sunrise is a safe trading option or a potential scam. Our research methodology includes a review of regulatory information, company background, trading conditions, client experiences, and risk assessments.

Regulation and Legitimacy

Regulation is a cornerstone of a broker's legitimacy. A regulated broker must adhere to strict standards set by financial authorities, which helps ensure the safety of clients' funds and fair trading practices. Sunrise's regulatory status has come under scrutiny, with several sources indicating that it lacks proper oversight from reputable regulatory bodies. Below is a summary of the key regulatory information regarding Sunrise:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation from top-tier authorities raises significant concerns about the broker's practices and the safety of clients' funds. Furthermore, the lack of a regulatory framework means that traders have limited recourse in case of disputes or issues with withdrawals. Historical compliance records have shown that unregulated brokers often engage in dubious practices, which further underscores the need for caution when trading with Sunrise.

Company Background Investigation

Sunrise's history and ownership structure are critical factors in assessing its reliability. The broker's website claims to have been operational for several years, but concrete information about its founding, ownership, and management team is scarce. This lack of transparency is concerning, as it raises questions about the broker's accountability.

The management teams background is another essential aspect to consider. A knowledgeable and experienced team typically indicates a broker's capability to provide quality services. However, the anonymity surrounding Sunrise's management raises red flags. Without clear information about the individuals running the company, traders are left in the dark regarding the broker's operational integrity and commitment to ethical practices.

Trading Conditions Analysis

Understanding the trading conditions offered by Sunrise is vital for evaluating its overall value proposition. The broker advertises competitive spreads and a range of trading instruments, but it is essential to scrutinize the fee structure for any hidden costs. Below is a comparison of key trading costs:

| Cost Type | Sunrise | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Not disclosed | 1.0 - 2.0 pips |

| Commission Model | Not disclosed | Varies |

| Overnight Interest Range | Not disclosed | Varies |

The lack of transparency regarding fees and spreads is alarming. Traders should be wary of brokers that do not provide clear information about their pricing structures, as this can lead to unexpected costs that erode profitability. Additionally, any unusual fees or commissions can signal that the broker may not be operating in good faith.

Client Fund Safety

The safety of client funds is paramount when selecting a forex broker. Sunrise's measures for protecting clients' funds are unclear, with no information available regarding the segregation of client accounts or investor protection schemes. These factors are critical in ensuring that traders' funds are secure and accessible.

Without proper safeguards in place, traders risk losing their investments in the event of broker insolvency or fraudulent activities. Historical issues related to fund safety, such as reports of clients being unable to withdraw their funds, further compound the concerns surrounding Sunrise.

Customer Experience and Complaints

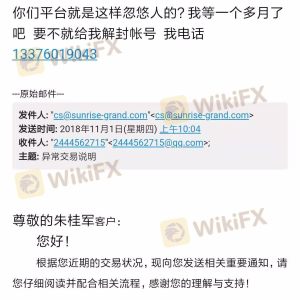

Analyzing customer feedback is essential for understanding the overall experience that traders have with Sunrise. Numerous complaints have surfaced about the broker, with common issues including difficulties in withdrawing funds and a lack of responsive customer service. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

| Misleading Promotions | High | Poor |

One typical case involved a trader who reported being unable to withdraw their funds for several days, with customer service providing little assistance. Such experiences raise serious questions about the broker's reliability and commitment to client satisfaction.

Platform and Execution

The trading platform is a crucial aspect of any broker's offering. Sunrise claims to provide a user-friendly platform; however, reviews indicate that the platform may not perform as advertised. Issues such as slow execution, slippage, and occasional rejections of orders have been reported, which can severely impact trading outcomes.

Traders should be cautious of any signs of platform manipulation, as this can indicate a lack of integrity on the broker's part. A reliable trading platform should offer consistent performance and a seamless user experience, which appears to be lacking with Sunrise.

Risk Assessment

Using Sunrise as a forex broker comes with inherent risks. The lack of regulation, transparency, and customer complaints all contribute to a higher risk profile. Below is a concise risk scorecard summarizing the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated, no oversight |

| Financial Risk | High | Potential for fund loss |

| Operational Risk | Medium | Complaints about service and execution |

| Reputational Risk | High | Negative feedback and warnings |

To mitigate these risks, traders should consider using regulated brokers that offer robust client protections and transparent trading conditions.

Conclusion and Recommendations

In conclusion, the evidence suggests that Sunrise may not be a safe trading option. The lack of regulation, transparency issues, and numerous client complaints indicate that traders should exercise extreme caution. While some may be tempted by the broker's promises of high returns, the potential risks far outweigh any perceived benefits.

For traders seeking reliable alternatives, it is advisable to consider brokers that are regulated by reputable authorities and have a proven track record of client satisfaction. Some recommended options include brokers regulated by the FCA, ASIC, or other top-tier financial authorities. These brokers typically offer greater security, transparency, and responsiveness to client needs, making them a safer choice in the volatile forex market.

Is Sunrise a scam, or is it legit?

The latest exposure and evaluation content of Sunrise brokers.

Sunrise Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Sunrise latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.