Is ST safe?

Pros

Cons

Is STForex A Scam?

Introduction

STForex is a forex broker that has emerged as a player in the online trading market since its inception in 2019. It claims to offer a wide array of trading instruments, including forex pairs, commodities, and cryptocurrencies, catering to both novice and experienced traders. However, the forex market is notoriously rife with scams and unreliable brokers, making it essential for traders to conduct thorough due diligence before committing their funds. This article aims to provide a comprehensive analysis of STForex, assessing its legitimacy and safety for potential clients. Our investigation is based on a review of regulatory information, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

Understanding the regulatory framework under which STForex operates is crucial for evaluating its credibility. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards of conduct and transparency.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | Not Applicable | United Kingdom | Not Verified |

| Australian Securities and Investments Commission (ASIC) | Not Applicable | Australia | Not Verified |

| Securities and Exchange Regulator of Cambodia (SERC) | 00049975 | Cambodia | Verified |

From the table, it is evident that STForex lacks regulation from top-tier authorities such as the FCA or ASIC, which raises concerns about its operations. While it claims to be regulated by the SERC, the quality of this regulation is questionable, as Cambodia is not recognized as a leading jurisdiction for forex trading. The lack of verification from more reputable regulatory bodies suggests that traders should exercise caution when dealing with STForex.

Company Background Investigation

STForex was founded in 2019 and is headquartered in Portugal. The company has positioned itself as a user-friendly platform designed for a diverse range of trading activities. However, details regarding its ownership structure and management team remain opaque, raising questions about transparency.

The management teams experience is crucial in establishing trust, but there is limited information available regarding their backgrounds. This lack of transparency could be a red flag for potential investors. It is essential for brokers to disclose their key personnel and their qualifications to build trust with their clients. Without such information, it becomes challenging to assess the reliability of STForex.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions offered is vital. STForex claims to provide competitive trading costs, but it is essential to scrutinize its fee structure for any hidden charges.

| Fee Type | STForex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Structure | Variable | Fixed or Variable |

| Overnight Interest Range | 0.5% - 1.5% | 0.5% - 1.0% |

The spread for major currency pairs is higher than the industry average, which could impact trading profitability. Additionally, the commission structure is not clearly defined, leading to potential confusion for traders regarding the actual costs of trading. Transparency in fees is crucial for traders to make informed decisions, and the lack of clarity in STForex's pricing could be a cause for concern.

Client Fund Security

The safety of client funds is a primary concern for any trader. STForex claims to implement several security measures, including segregated accounts and SSL encryption for personal data. However, the effectiveness of these measures is contingent upon the broker's regulatory status.

STForex states that client funds are kept in reputable financial institutions, but without robust regulatory oversight, these claims are difficult to verify. Additionally, the absence of investor protection schemes raises concerns about the potential risks to client funds. Historical data on any past incidents involving client fund mismanagement or disputes would further clarify the safety of trading with STForex.

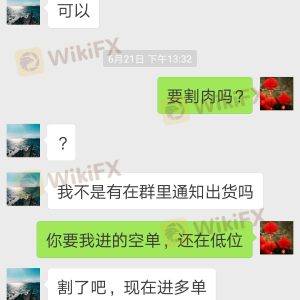

Customer Experience and Complaints

Customer feedback provides valuable insights into the broker's reliability and service quality. A review of online forums and feedback platforms reveals a mixed bag of experiences from STForex users. While some users commend the platform's user-friendly interface and range of trading instruments, others express frustration over withdrawal issues and inadequate customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Account Management Issues | Medium | Inconsistent Support |

| Lack of Transparency | High | No Response |

One notable case involves a trader who reported significant delays in withdrawing funds, leading to an extended period of frustration. This case highlights the importance of assessing a broker's responsiveness and reliability, particularly when it comes to accessing funds.

Platform and Trade Execution

The trading platform's performance is critical for a seamless trading experience. STForex utilizes the popular MetaTrader 4 (MT4) platform, known for its reliability and comprehensive trading tools. However, user reviews indicate mixed experiences regarding order execution quality and slippage.

Concerns about potential platform manipulation have also been raised, particularly regarding the execution of trades during volatile market conditions. Traders need assurance that their orders are executed fairly and promptly, without undue interference.

Risk Assessment

Engaging with STForex carries certain risks that potential clients should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of top-tier regulation raises concerns about safety. |

| Financial Risk | Medium | Higher spreads and unclear fees can impact profitability. |

| Operational Risk | Medium | Mixed customer experiences indicate potential service issues. |

To mitigate these risks, traders should consider starting with a demo account to familiarize themselves with the platform and its features before committing real funds. Additionally, maintaining a diversified trading strategy can help manage exposure to any single broker.

Conclusion and Recommendations

In conclusion, while STForex presents itself as a viable trading option, multiple factors warrant caution. The lack of robust regulatory oversight, coupled with mixed customer feedback and unclear fee structures, raises significant concerns about its legitimacy.

Traders should approach STForex with caution and consider testing the platform with minimal funds before making larger investments. For those seeking more reliable alternatives, brokers regulated by top-tier authorities such as the FCA or ASIC should be prioritized. Ultimately, the decision to trade with STForex should be made with careful consideration of the associated risks and the broker's overall credibility.

In summary, is STForex safe? The answer remains ambiguous, and potential clients are advised to conduct thorough research and exercise due diligence before proceeding.

Is ST a scam, or is it legit?

The latest exposure and evaluation content of ST brokers.

ST Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ST latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.