Regarding the legitimacy of SOHO MARKETS forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is SOHO MARKETS safe?

Business

License

Is SOHO MARKETS markets regulated?

The regulatory license is the strongest proof.

CYSEC Derivatives Trading License (STP)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (STP)

Licensed Entity:

EVBX LTD

Effective Date: Change Record

2022-01-31Email Address of Licensed Institution:

info@evbxltd.comSharing Status:

No SharingWebsite of Licensed Institution:

http://vestofx.com/euExpiration Time:

--Address of Licensed Institution:

Spyrou Kyprianou 41 Avenue, Steratzias Court 2, 1st Floor, Flat 101, 4003, Mesa Geitonia, Limassol, CyprusPhone Number of Licensed Institution:

+357 25 323 120Licensed Institution Certified Documents:

Is Soho Markets A Scam?

Introduction

Soho Markets is a relatively new player in the forex market, having been established in 2022 and operating under the regulation of the Cyprus Securities and Exchange Commission (CySEC). As the online trading landscape becomes increasingly crowded, traders must exercise caution in selecting brokers. This article aims to provide a comprehensive evaluation of Soho Markets, examining its regulatory status, company background, trading conditions, customer experience, and overall safety. The assessment is based on a thorough review of available online resources, including regulatory filings, user reviews, and expert analyses.

Regulation and Legitimacy

Understanding the regulatory framework surrounding a broker is crucial for assessing its legitimacy and trustworthiness. Soho Markets is regulated by the Cyprus Securities and Exchange Commission (CySEC), which is considered a tier-2 regulatory authority. While CySEC provides a level of oversight, it does not offer the same level of investor protection as tier-1 regulators like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC).

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 409/22 | Cyprus | Verified |

CySEC regulation mandates that brokers maintain a minimum capital requirement and segregate client funds, which can enhance investor protection. However, the absence of more stringent oversight raises questions about the broker's long-term reliability. Furthermore, the fact that Soho Markets has only been in operation for a year limits the ability to assess its compliance history comprehensively. Although no significant regulatory infractions have been reported thus far, the broker's youth necessitates a cautious approach from potential clients.

Company Background Investigation

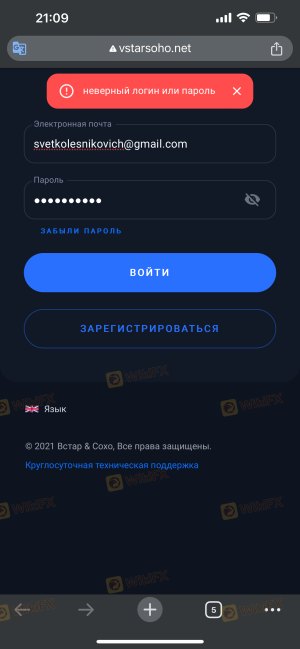

Soho Markets operates under the ownership of Vstar & Soho Markets Ltd, based in Limassol, Cyprus. The broker's relatively short history may raise concerns regarding its stability and reliability. The management teams background is not extensively documented, which could hinder transparency. A well-established management team with industry experience is often a positive sign for potential investors.

The company claims to prioritize transparency, but the lack of readily available information about its operational history and team members may lead to skepticism among traders. A broker's willingness to disclose information about its management and operations is often indicative of its commitment to building trust with clients. Therefore, the limited transparency surrounding Soho Markets may be a red flag for cautious traders.

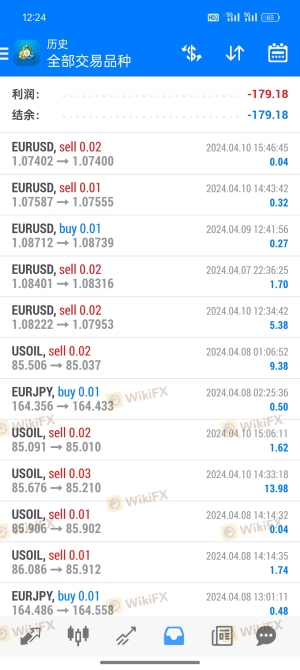

Trading Conditions Analysis

Soho Markets offers a variety of trading conditions, including two main account types: a standard STP account and an ECN account. The minimum deposit for the standard account is set at $200, while the ECN account requires a significantly higher minimum deposit of $10,000.

The overall fee structure includes spreads starting from 1.2 pips for the standard account and as low as 0.2 pips for the ECN account. However, it is essential to consider that the spreads may vary based on market conditions.

| Cost Type | Soho Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 1.0 - 1.5 pips |

| Commission Model | $0 (STP), $6 (ECN) | $0 - $5 (varies) |

| Overnight Interest Range | Varies | Varies |

One notable concern is the broker's policy on deposit fees, which imposes a 2% charge for transactions below $2,000. This practice is not common among reputable brokers and could deter potential clients. Additionally, the lack of a completely free demo account, as access requires a deposit, may be seen as a tactic to encourage traders to commit real funds before trying the platform.

Client Fund Safety

The safety of client funds is paramount in the forex trading industry. Soho Markets claims to implement several measures to protect client funds, including maintaining segregated accounts and offering negative balance protection. The segregation of funds ensures that client deposits are kept separate from the broker's operational funds, providing a layer of security in the event of financial difficulties.

However, the absence of tier-1 regulatory oversight raises questions about the robustness of these protections. While CySEC does require brokers to maintain a minimum capital buffer, the lack of historical compliance data limits the ability to fully assess Soho Markets' commitment to safeguarding client funds. Furthermore, there have been no documented incidents of fund mismanagement or security breaches, but potential clients should remain vigilant and conduct thorough due diligence.

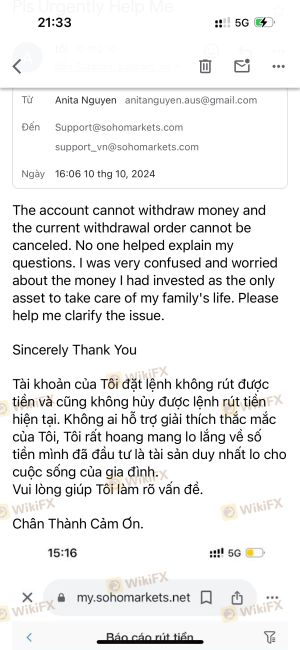

Customer Experience and Complaints

Customer feedback is an essential component of evaluating a broker's reliability. Reviews of Soho Markets reveal a mixed bag of experiences. While some users report positive interactions with customer service, others have raised concerns about withdrawal processes and the responsiveness of the support team. Common complaints include issues with accessing demo accounts and unexpected fees.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed responses |

| Unexpected Fees | Medium | Limited clarification |

| Customer Support | Medium | Generally positive |

A few case studies highlight these concerns. For instance, a trader reported difficulty withdrawing funds after submitting a request, leading to frustration and dissatisfaction. Another user mentioned a lack of transparency regarding the broker's fee structure, which contributed to their decision to cease trading with Soho Markets. While the company appears to address some issues, the overall sentiment suggests that improvements are needed in customer service and communication.

Platform and Execution

Soho Markets utilizes the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust functionality. The platform allows traders to execute orders efficiently and access various trading tools. However, there have been reports of slippage and occasional execution delays, which can impact trading performance.

The quality of order execution is crucial for traders, particularly in fast-moving markets. While Soho Markets claims to offer competitive execution speeds, user experiences vary. Some traders have reported instances of order rejections, leading to concerns about the platform's reliability. As with any broker, potential users should consider testing the platform with a demo account before committing significant capital.

Risk Assessment

Trading with any broker carries inherent risks, and Soho Markets is no exception. Several factors contribute to the overall risk profile of this broker, including its regulatory status, fee structure, and customer feedback.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Limited oversight from tier-1 regulators |

| Financial Risk | Medium | High deposit fees and withdrawal issues |

| Operational Risk | Medium | Mixed reviews on execution and platform reliability |

To mitigate these risks, traders are advised to conduct thorough research, start with a small investment, and utilize risk management strategies. Engaging with the broker's customer support before trading can also provide insights into their responsiveness and reliability.

Conclusion and Recommendations

In conclusion, while Soho Markets is regulated by CySEC, its status as a relatively new broker raises concerns about its reliability and long-term viability. The mixed customer feedback, combined with unusual fee structures and limited transparency, warrants caution from potential traders.

For those considering trading with Soho Markets, it is essential to weigh the risks and conduct thorough due diligence. If you are a beginner or risk-averse trader, it may be prudent to explore alternative brokers with stronger regulatory frameworks and more favorable trading conditions. Recommended alternatives include brokers like IG, OANDA, or Forex.com, which offer robust regulatory oversight and a track record of positive customer experiences.

Is SOHO MARKETS a scam, or is it legit?

The latest exposure and evaluation content of SOHO MARKETS brokers.

SOHO MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SOHO MARKETS latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.