FTX 2025 Review: Everything You Need to Know

Executive Summary

This ftx review looks at a cryptocurrency exchange that once held a big market position. The platform has since faced major challenges that changed its place in the industry completely. FTX started as a centralized cryptocurrency trading platform that offered many trading options including derivatives and leveraged products, and it featured new tools such as MOVE contracts and leveraged tokens. The platform served investors who wanted cryptocurrency and derivatives trading. It gave access to multiple asset classes including cryptocurrencies, derivatives, stocks, and ETFs.

The platform's reputation has been badly hurt by collapse events that raised serious concerns about trust and reliability. FTX operates under SEC regulation in the United States, though the regulatory landscape has become complex after recent developments. User feedback shows mixed results with a 3.5 TrustScore. This reflects the divided feelings among users who experienced both the platform's capabilities and its later challenges. Some users praised things like customer service quality. Others have expressed major concerns, with some ratings as low as 1/5, showing substantial dissatisfaction among certain user groups.

Important Notice

This evaluation addresses FTX's operations mainly in the United States context, where the platform falls under Securities and Exchange Commission oversight. Readers should know that the regulatory status and operational capacity may vary a lot across different jurisdictions due to recent developments affecting the platform's global operations. The compliance framework that once governed FTX's activities has been subject to substantial changes. Potential users should verify current regulatory standing in their specific regions.

This ftx review is based on comprehensive analysis of available user feedback, market conditions, and publicly accessible information. Given the dynamic nature of the situation surrounding FTX, readers are strongly advised to conduct additional due diligence and consult current regulatory guidance before making any trading decisions.

Rating Framework

Broker Overview

FTX was established in 2018 by Sam Bankman-Fried. The platform quickly positioned itself as a major player in the cryptocurrency trading landscape. FTX was founded with the vision of providing sophisticated trading tools and derivatives products to both retail and institutional cryptocurrency traders, and during its operational peak, FTX gained recognition for its innovative approach to cryptocurrency derivatives, offering products that were previously unavailable in the crypto space. The company's business model centered on providing a centralized cryptocurrency trading platform with advanced features typically found in traditional financial markets.

The platform's primary business model focused on operating as a centralized cryptocurrency exchange. It facilitated trading in various digital assets while also providing sophisticated derivative products and leveraged trading options. FTX distinguished itself through its technology-forward approach and commitment to providing institutional-grade trading infrastructure, and the exchange supported multiple asset classes including cryptocurrencies, derivatives, stocks, and ETFs, making it a comprehensive trading destination for diverse investment strategies.

FTX operated under the oversight of the Securities and Exchange Commission in the United States according to regulatory information. The platform utilized its proprietary FTX trading platform as the primary interface for users. However, the current operational status and platform availability have been significantly affected by subsequent developments. This ftx review reflects the platform's historical capabilities while acknowledging the substantial changes that have occurred in its operational status.

Regulatory Jurisdiction: FTX operated under the regulatory oversight of the United States Securities and Exchange Commission, providing a framework for compliance with U.S. financial regulations. The current regulatory standing has become complex due to recent developments affecting the platform's operations.

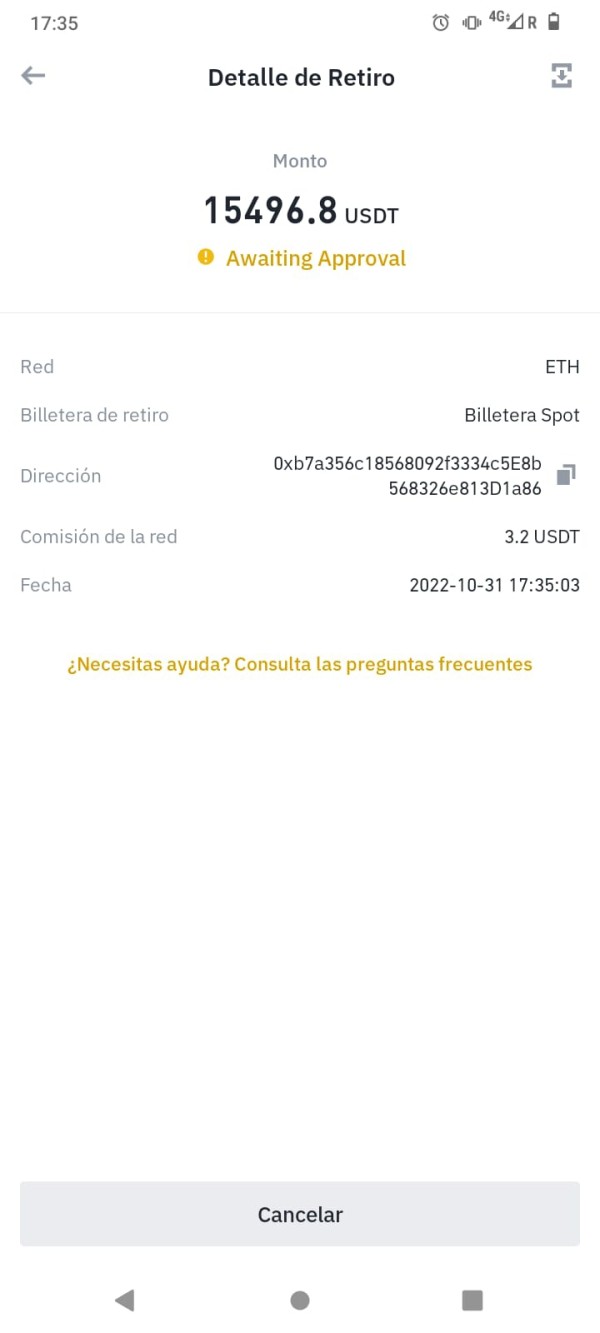

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in available materials. The platform historically supported various cryptocurrency and fiat currency options for funding accounts.

Minimum Deposit Requirements: Details regarding minimum deposit requirements are not specified in available documentation. Potential users would need to verify current account opening requirements through official channels.

Bonus Promotions: Information about specific bonus promotions or incentive programs is not available in current materials. This reflects the limited operational information accessible at this time.

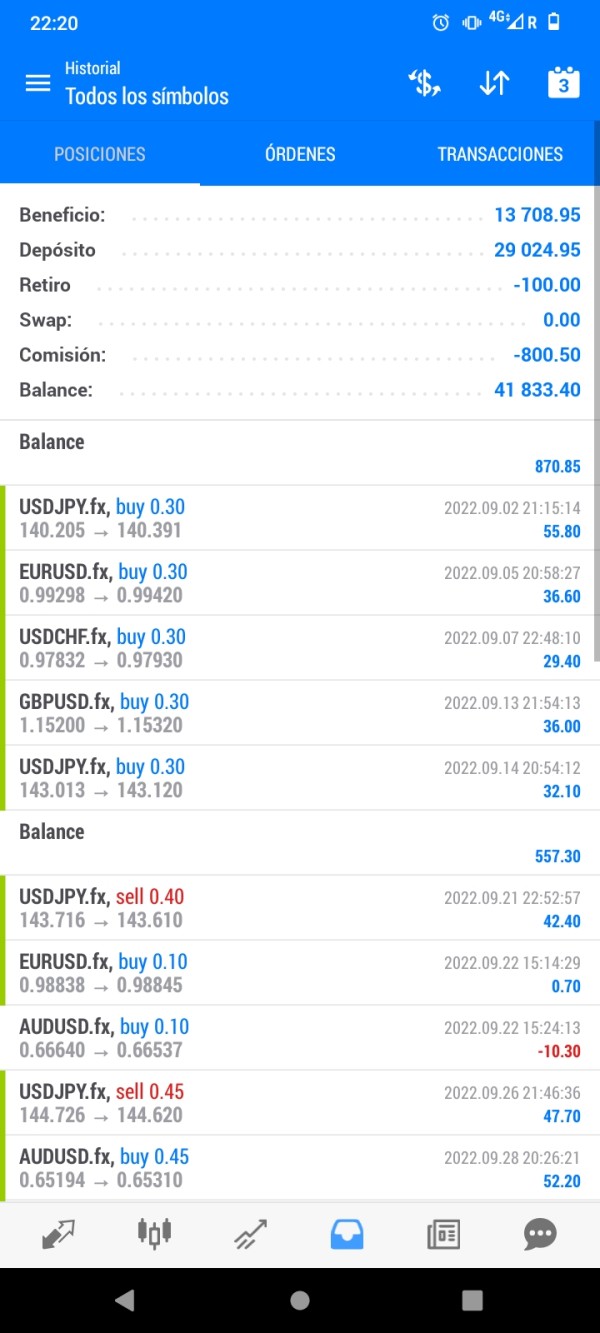

Tradeable Assets: The platform provided access to a diverse range of tradeable assets including cryptocurrencies, derivatives products, stocks, and ETFs. This variety allowed users to implement various trading strategies across different asset classes within a single platform environment.

Cost Structure: Specific information regarding commission rates, spreads, and fee structures is not detailed in available materials. The lack of transparent cost information represents a significant information gap for potential users evaluating the platform.

Leverage Ratios: Details about available leverage ratios for different trading instruments are not specified in current documentation. The platform historically offered leveraged trading products.

Platform Options: FTX utilized its proprietary trading platform as the primary trading interface. Information about additional platform options or third-party integrations is limited in available materials.

Geographic Restrictions: Specific information about geographic restrictions or regional availability limitations is not detailed in current documentation.

Customer Service Languages: Information regarding the range of languages supported by customer service representatives is not specified in available materials.

This ftx review acknowledges that many specific operational details remain unclear due to limited accessible information about current platform specifications and requirements.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The account conditions evaluation for FTX faces significant limitations due to the lack of specific information regarding account types, minimum deposit requirements, and detailed fee structures. Available materials do not provide comprehensive details about the various account categories that may have been offered or their specific features and benefits, and this information gap makes it challenging for potential users to understand what account options were available and how they might have suited different trading needs and experience levels.

The absence of clear minimum deposit requirements in available documentation represents a significant concern for users attempting to evaluate accessibility and affordability. Without specific deposit thresholds, traders cannot adequately assess whether the platform aligned with their available capital and investment objectives, and user feedback suggesting mixed experiences, including some ratings as low as 1/5, may reflect frustrations related to account conditions that did not meet user expectations or were not clearly communicated.

The account opening process details are similarly unclear. This makes it difficult to evaluate the efficiency and user-friendliness of getting started with the platform. Special account features, such as Islamic accounts or other religiously compliant trading options, are not mentioned in available materials, and the lack of transparency regarding account conditions contributes to the overall uncertainty surrounding the platform's accessibility and user-friendliness.

This ftx review notes that the limited availability of account condition information significantly impacts the ability to provide a comprehensive evaluation of this crucial aspect of the trading experience.

FTX demonstrated strength in providing diverse trading tools and innovative financial instruments, particularly in the cryptocurrency derivatives space. The platform offered unique products such as MOVE contracts and leveraged tokens, which represented sophisticated trading instruments not commonly available on other cryptocurrency exchanges, and these tools provided traders with advanced options for expressing market views and managing risk in ways that were previously unavailable in the crypto market.

The platform's approach to trading tools reflected a commitment to bringing traditional financial market sophistication to cryptocurrency trading. Available information suggests limitations in educational resources, with insufficient details about webinars, tutorials, or comprehensive learning materials that could help users understand and effectively utilize the available tools, and this gap in educational support may have limited the platform's accessibility to less experienced traders who could have benefited from additional guidance.

Research and analysis resources appear to have been limited based on available information. There are insufficient details about market analysis, research reports, or analytical tools that could support informed trading decisions. The absence of comprehensive educational and research resources represents a missed opportunity to support user success and platform engagement, and automated trading support and API capabilities are not detailed in available materials, though such features would be expected for a platform targeting sophisticated traders.

The overall tools and resources offering showed promise in innovation but appeared to lack the comprehensive support structure needed to maximize user success.

Customer Service and Support Analysis (8/10)

Customer service emerges as one of FTX's stronger areas based on available user feedback, with multiple references to excellent customer service performance during the platform's operational periods. Users who experienced the platform's customer support generally reported positive interactions, and this suggests that the company invested in quality support infrastructure and training for their service representatives.

The quality of customer service appears to have reflected professionalism and competence in addressing user inquiries and resolving issues. This positive feedback indicates that FTX prioritized customer satisfaction and maintained service standards that met or exceeded user expectations, and the ability to provide effective support in the complex cryptocurrency trading environment demonstrates the technical competence of the support team.

Specific details about customer service channels, availability hours, and response times are not provided in available materials. The lack of information about multilingual support capabilities may have limited accessibility for international users, and details about escalation procedures and specialized support for different account types or trading activities are not specified.

The absence of specific problem resolution case studies or detailed service level agreements makes it difficult to fully evaluate the consistency and reliability of the customer service experience. Despite these information gaps, the positive user feedback regarding customer service quality represents a notable strength in the overall platform evaluation.

Trading Experience Analysis (6/10)

User feedback regarding trading experience suggests generally positive interactions with the platform during its operational periods, with users reporting satisfactory execution and platform functionality. The trading environment appears to have provided adequate liquidity and reasonable execution quality, though specific technical performance metrics such as latency, uptime statistics, and execution speed are not detailed in available materials, and platform stability and functionality received positive mentions from users, indicating that the technical infrastructure was generally reliable during normal operations.

The lack of specific data regarding slippage, requotes, and order execution quality makes it difficult to provide a comprehensive assessment of trading conditions. The absence of detailed performance metrics represents a significant information gap for evaluating the technical quality of the trading experience, and the completeness of platform features appears to have been adequate for most trading needs, with the FTX platform providing various trading functionalities.

Information about mobile application availability, advanced order types, and specialized trading tools is limited in available documentation. The user experience feedback suggests reasonable satisfaction with platform usability, though specific interface design and navigation details are not provided, and this ftx review acknowledges that while user feedback indicates generally positive trading experiences, the limited availability of technical performance data and detailed functionality information constrains the ability to provide a comprehensive evaluation of the trading experience quality.

Trust Factor Analysis (4/10)

The trust factor evaluation for FTX is significantly impacted by the collapse events that fundamentally altered the platform's reputation and user confidence. While the platform operated under SEC regulation, providing some regulatory framework, the subsequent developments have raised serious questions about transparency, risk management, and operational integrity that severely impact trustworthiness assessments, and the regulatory oversight by the SEC initially provided a foundation for trust, though specific license numbers and detailed regulatory compliance information are not provided in available materials.

The lack of detailed information about fund security measures, segregation of client assets, and risk management protocols represents significant concerns for evaluating the safety of user funds and platform operations. Company transparency has become a major concern following the collapse events, with questions arising about financial reporting, operational disclosures, and communication with users and stakeholders, and the platform's previously strong industry reputation has been fundamentally damaged, affecting not only direct users but also broader market confidence in centralized cryptocurrency exchanges.

The handling of negative events and crisis management has become a critical factor in trust evaluation. The collapse situation demonstrated significant deficiencies in risk management and operational resilience. User trust feedback reflects substantial concerns about safety and reliability, contributing to the overall decline in confidence, and third-party evaluations and industry reports have generally reflected the diminished trust status following recent developments.

User Experience Analysis (6/10)

The overall user experience evaluation reflects mixed feedback, with the 3.5 user rating indicating moderate satisfaction levels among those who used the platform. This rating suggests that while some users had positive experiences, others encountered significant issues that impacted their overall satisfaction with the platform and its services, and interface design and usability information is limited in available materials, though user feedback suggests that the platform was generally functional and accessible for trading activities.

The registration and verification processes are not detailed in current documentation. This makes it difficult to evaluate the convenience and efficiency of account setup procedures. Fund operation experiences, including deposit and withdrawal processes, are not specifically detailed in available materials, though these aspects are crucial for overall user satisfaction, and the speed and reliability of financial transactions significantly impact user experience, and the lack of specific information about these processes represents an important evaluation gap.

Common user complaints appear to include concerns that contributed to some very low ratings. This suggests that certain users experienced significant problems that substantially impacted their platform experience. The user demographic appears to have been primarily composed of investors interested in cryptocurrency and derivatives trading, indicating that the platform attracted users with specific trading interests and experience levels, and the balance of positive and negative feedback reflects the complex nature of user experiences, with some users appreciating the platform's capabilities while others encountered issues that led to dissatisfaction.

Potential improvements based on user feedback could address transparency, communication, and operational reliability concerns.

Conclusion

This comprehensive ftx review reveals a complex picture of a cryptocurrency trading platform that once demonstrated innovation and capability but has since faced substantial challenges that fundamentally impact its evaluation. FTX's historical strengths included diverse trading options, innovative derivative products like MOVE contracts and leveraged tokens, and generally positive customer service experiences, but the platform's overall assessment is significantly impacted by trust and reliability concerns stemming from collapse events that have altered its market position.

The platform appears most suitable for experienced cryptocurrency and derivatives traders who were seeking sophisticated trading instruments and were comfortable with the associated risks. The current situation substantially limits the platform's viability for any user category due to operational and trust concerns.

The main advantages historically included product innovation, diverse asset access, and quality customer support. Significant disadvantages now include severely reduced trust levels, limited transparency, and operational uncertainty. Potential users should exercise extreme caution and conduct thorough due diligence before considering any involvement with the platform, given the substantial changes in its operational status and market reputation.