Soho Markets 2025 Review: Everything You Need to Know

Executive Summary

Soho Markets is an emerging forex broker. It has established itself in the competitive trading landscape since its inception in 2022, despite being relatively new to the market. This soho markets review reveals that the broker has secured regulatory approval from CySEC (Cyprus Securities and Exchange Commission). The broker positions itself as a legitimate player in the forex industry and operates under the ownership of Vstar & Soho Markets Ltd, with headquarters located in Limassol, Cyprus.

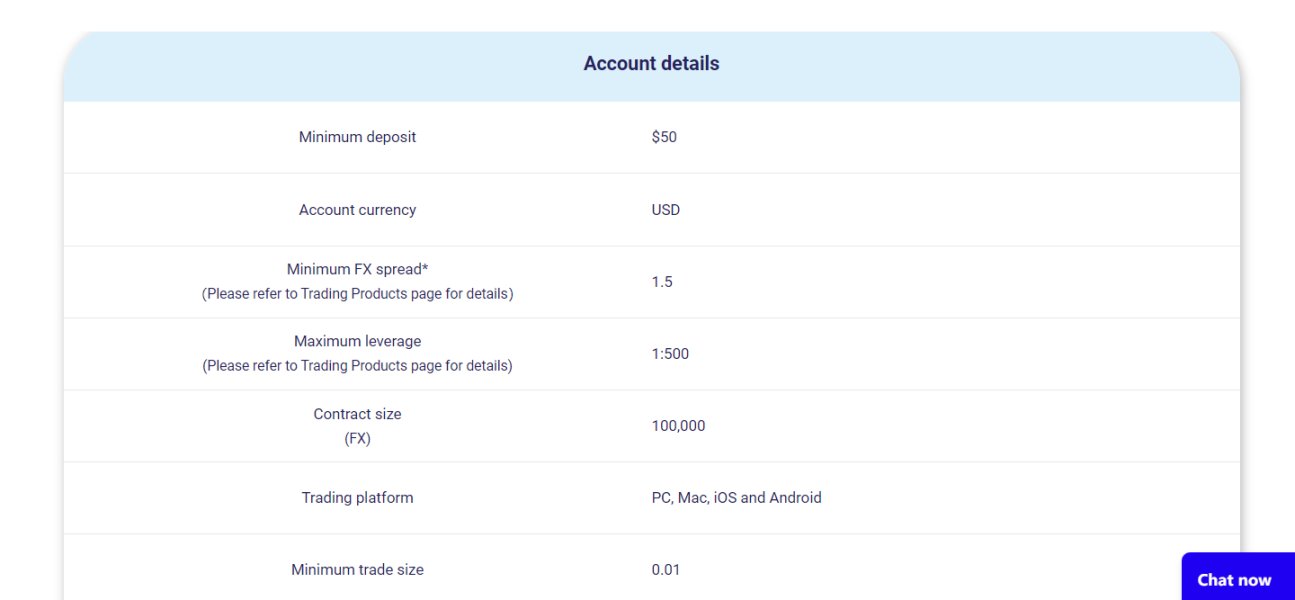

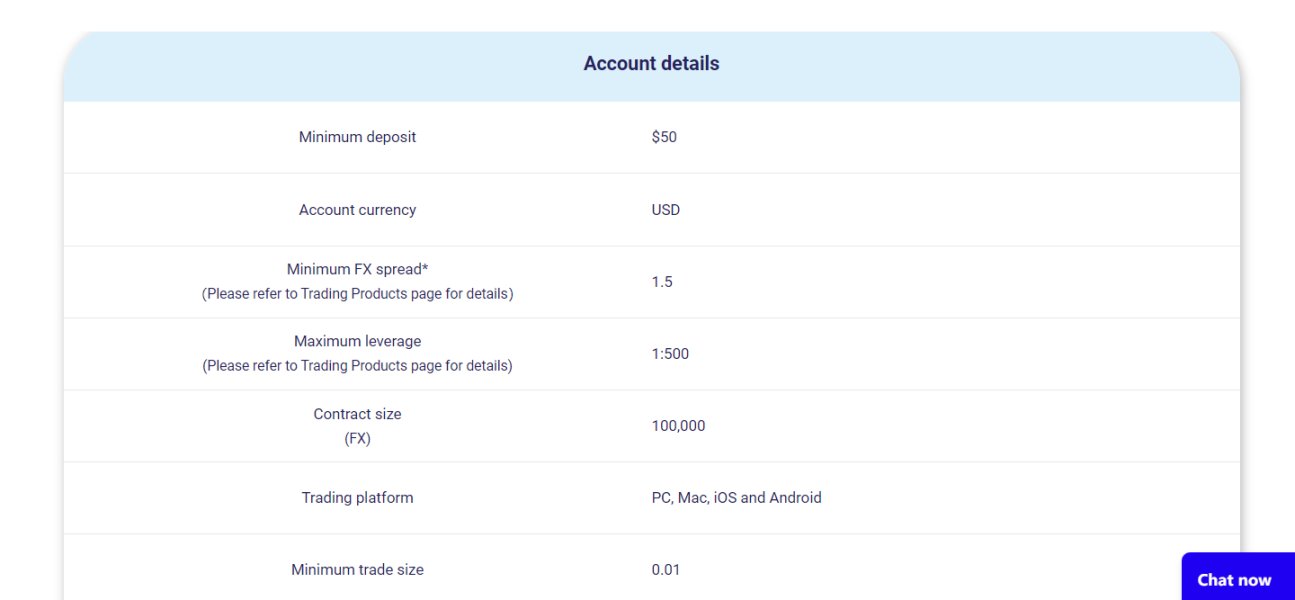

The platform distinguishes itself by offering the popular MetaTrader 4 (MT4) trading platform. It provides access to multiple asset classes including forex, commodities, indices, stocks, and cryptocurrencies such as Bitcoin, Litecoin, and Ethereum. With a minimum deposit requirement of just $200 USD and leverage ratios of 1:30 in compliance with regulatory standards, Soho Markets positions itself as an accessible option for traders seeking to enter the forex market with relatively low capital requirements.

The broker's target demographic primarily consists of beginner and intermediate traders. These traders value regulatory oversight and prefer established trading platforms. The combination of CySEC regulation, competitive minimum deposit requirements, and the reliability of the MT4 platform makes Soho Markets an attractive proposition for traders who prioritize security and ease of use over advanced features or institutional-grade services.

Important Notice

This soho markets review is based on publicly available information and user feedback collected from various sources as of 2025. Readers should be aware that Soho Markets operates under CySEC regulation, which may differ from regulatory requirements in other jurisdictions. The broker's services and offerings may vary depending on the client's location and applicable local regulations.

The evaluation presented in this review aims to provide a comprehensive understanding of Soho Markets' services. However, traders should conduct their own due diligence and consider their individual trading needs and risk tolerance before making any investment decisions. Regulatory frameworks and broker offerings can change over time, so prospective clients should verify current information directly with the broker before opening an account.

Rating Framework

Broker Overview

Soho Markets entered the forex brokerage industry in 2022. It emerged as a relatively new player in the competitive trading landscape. The company operates under the ownership of Vstar & Soho Markets Ltd, with its headquarters strategically located in Limassol, Cyprus. This Cyprus-based operation allows the broker to benefit from the European Union's regulatory framework while serving clients across multiple jurisdictions. According to available information, the broker has focused on building a reputation as a regulated entity that prioritizes compliance with international financial standards.

The business model of Soho Markets centers around providing Contract for Difference (CFD) trading services across multiple asset classes. The broker has positioned itself to serve both novice and experienced traders by offering access to traditional forex pairs alongside more diverse instruments including commodities, stock indices, individual equities, and cryptocurrency assets. This diversified approach allows traders to build varied portfolios and explore different market opportunities from a single trading account. This feature is particularly valuable for those seeking to diversify their trading strategies across multiple asset classes.

The regulatory framework under which Soho Markets operates is anchored by its CySEC (Cyprus Securities and Exchange Commission) authorization. This authorization classifies it as a Tier 2 regulated broker. This regulatory status provides clients with certain protections and ensures that the broker adheres to specific operational standards, capital requirements, and client fund segregation protocols. The MT4 platform serves as the primary trading interface, offering traders access to advanced charting tools, technical indicators, and automated trading capabilities that have made MetaTrader 4 one of the most popular platforms in the retail forex industry.

Regulatory Jurisdiction: Soho Markets operates under the supervision of the Cyprus Securities and Exchange Commission (CySEC). This provides regulatory oversight and ensures compliance with European financial regulations. This regulatory framework offers client protections including segregated fund storage and adherence to specific operational standards that govern licensed investment firms within the European Union.

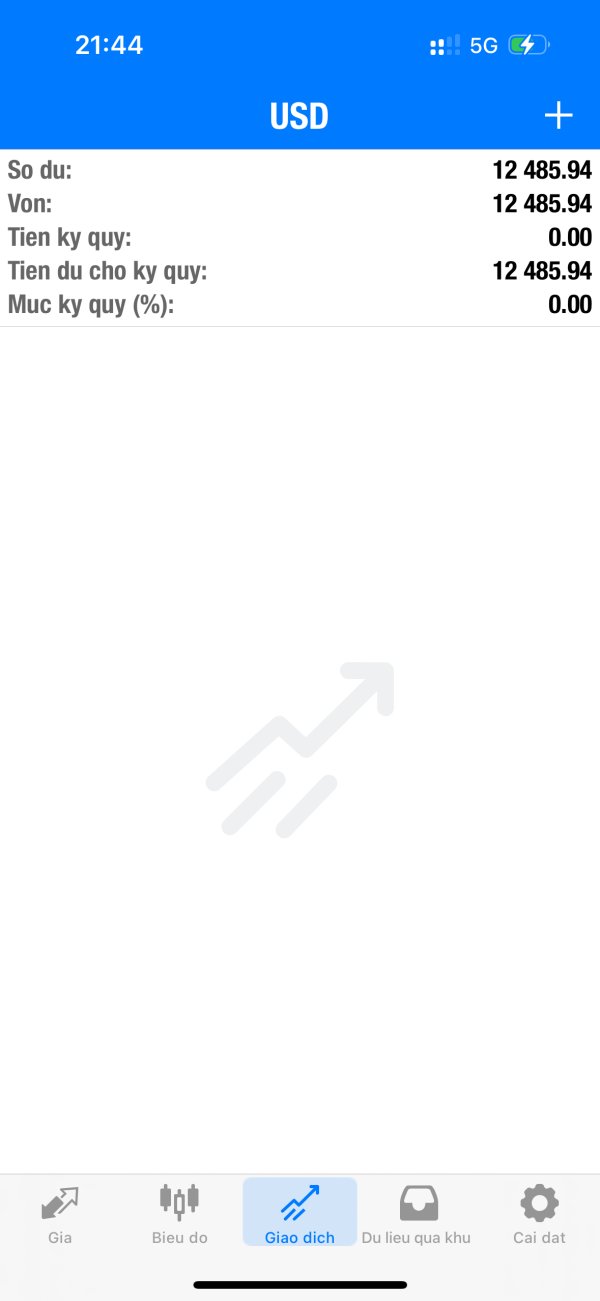

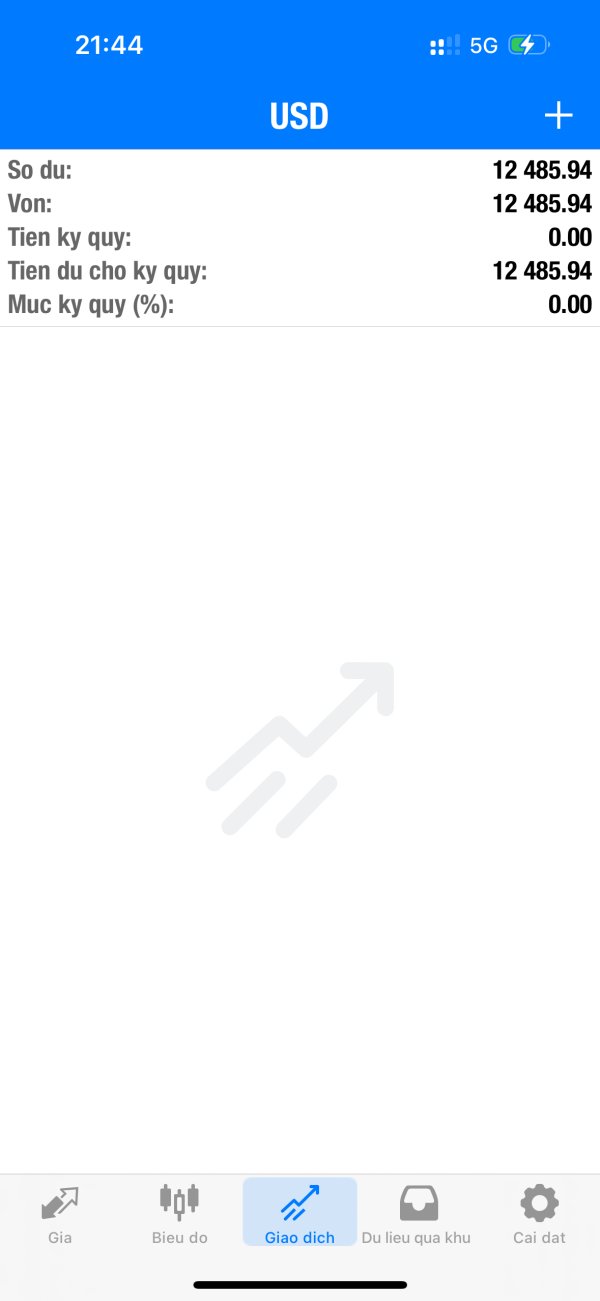

Deposit and Withdrawal Methods: While specific deposit and withdrawal methods are not extensively detailed in available sources, the broker accepts clients with a minimum deposit requirement that makes the platform accessible to retail traders. The exact payment processing options, withdrawal timeframes, and any associated fees require verification directly with the broker.

Minimum Deposit Requirements: The platform requires a minimum initial deposit of $200 USD. This positions itself as accessible to traders who prefer to start with relatively modest capital. This threshold is competitive within the retail forex industry and allows new traders to begin their trading journey without significant financial barriers.

Bonus and Promotional Offers: Available sources do not provide specific details about current bonus structures, promotional offers, or incentive programs that may be available to new or existing clients. Prospective traders should inquire directly with the broker about any available promotions.

Available Trading Assets: The broker provides access to a comprehensive range of tradeable instruments. These include major, minor, and exotic forex currency pairs, commodity CFDs covering precious metals and energy products, stock index CFDs representing global markets, individual equity CFDs, and cryptocurrency CFDs including Bitcoin, Litecoin, and Ethereum. This diverse asset selection enables traders to implement various trading strategies across different market sectors.

Cost Structure and Fees: While the general cost structure information is not extensively detailed in available sources, traders should expect typical forex industry fee structures including spreads on currency pairs and potential commission charges on certain asset classes. Specific spread ranges, commission rates, and any additional fees require direct verification with the broker.

Leverage Ratios: The broker offers leverage ratios of up to 1:30. This complies with European regulatory requirements for retail clients. This leverage level provides traders with reasonable capital efficiency while maintaining risk management standards mandated by CySEC regulations.

Platform Options: Trading is conducted through the MetaTrader 4 platform. The platform provides comprehensive charting capabilities, technical analysis tools, automated trading functionality through Expert Advisors, and mobile trading applications for iOS and Android devices.

Geographic Restrictions: According to available information, the broker accepts clients from the United States. However, specific geographic restrictions and availability in other jurisdictions may apply based on local regulatory requirements and the broker's business policies.

Customer Support Languages: Specific information about supported languages for customer service is not detailed in available sources. This requires direct inquiry with the broker's support team to determine multilingual capabilities.

This comprehensive soho markets review indicates that while the broker offers essential trading services with regulatory oversight, some operational details require direct verification with the company to ensure accuracy and current availability.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

The account conditions offered by Soho Markets present a mixed picture for potential traders. The broker's minimum deposit requirement of $200 USD positions it favorably within the competitive landscape of retail forex brokers. It makes the platform accessible to traders who prefer to start with modest capital. This threshold is particularly attractive for newcomers to forex trading who want to test their strategies without committing substantial funds initially.

However, this soho markets review reveals that specific information about account types, their distinct features, and tiered benefits is not extensively documented in available sources. The lack of detailed information about different account categories makes it challenging for traders to understand what specific benefits or trading conditions they might access at different deposit levels. Additionally, while the $200 minimum deposit is competitive, the absence of detailed information about spread ranges, commission structures, and potential account maintenance fees creates uncertainty for traders trying to calculate their total trading costs.

The account opening process details are not thoroughly documented. This could present challenges for prospective clients trying to understand verification requirements, documentation needs, and the timeline for account activation. Furthermore, specialized account options such as Islamic accounts for traders requiring Sharia-compliant trading conditions are not specifically mentioned in available sources. This potentially limits the broker's appeal to certain demographic groups.

Despite these information gaps, the regulatory oversight provided by CySEC ensures that basic client protections are in place. These protections include segregated fund storage and adherence to European financial regulations. This regulatory framework provides some assurance about the fundamental safety of client deposits, even though specific account condition details require direct verification with the broker.

Soho Markets' decision to offer the MetaTrader 4 platform as its primary trading interface represents a significant strength in terms of tools and resources. MT4 is widely recognized throughout the forex industry for its robust charting capabilities, comprehensive technical analysis tools, and reliable order execution functionality. The platform provides traders with access to numerous built-in technical indicators, multiple timeframe analysis, and customizable chart layouts that can accommodate various trading strategies and analytical approaches.

The platform's support for automated trading through Expert Advisors (EAs) adds considerable value for traders who prefer algorithmic trading strategies or want to implement systematic trading approaches. This functionality allows both novice and experienced traders to utilize pre-built trading robots or develop their own automated strategies using the MQL4 programming language.

However, this analysis reveals that specific information about additional research resources, market analysis tools, and educational materials is not extensively documented in available sources. Many competitive brokers provide daily market analysis, economic calendars, trading signals, and educational webinars to support their clients' trading development. The absence of detailed information about such supplementary resources represents a potential limitation for traders who value comprehensive market research and educational support.

The multi-asset trading capability across forex, commodities, indices, stocks, and cryptocurrencies provides traders with portfolio diversification opportunities and the ability to capitalize on various market conditions. This asset variety is particularly valuable for traders who prefer to spread risk across different market sectors or who want to explore trading opportunities beyond traditional currency pairs.

While the MT4 platform's mobile applications provide trading flexibility, specific information about additional proprietary tools, advanced charting packages, or institutional-grade resources requires further verification directly with the broker to fully assess the complete toolkit available to clients.

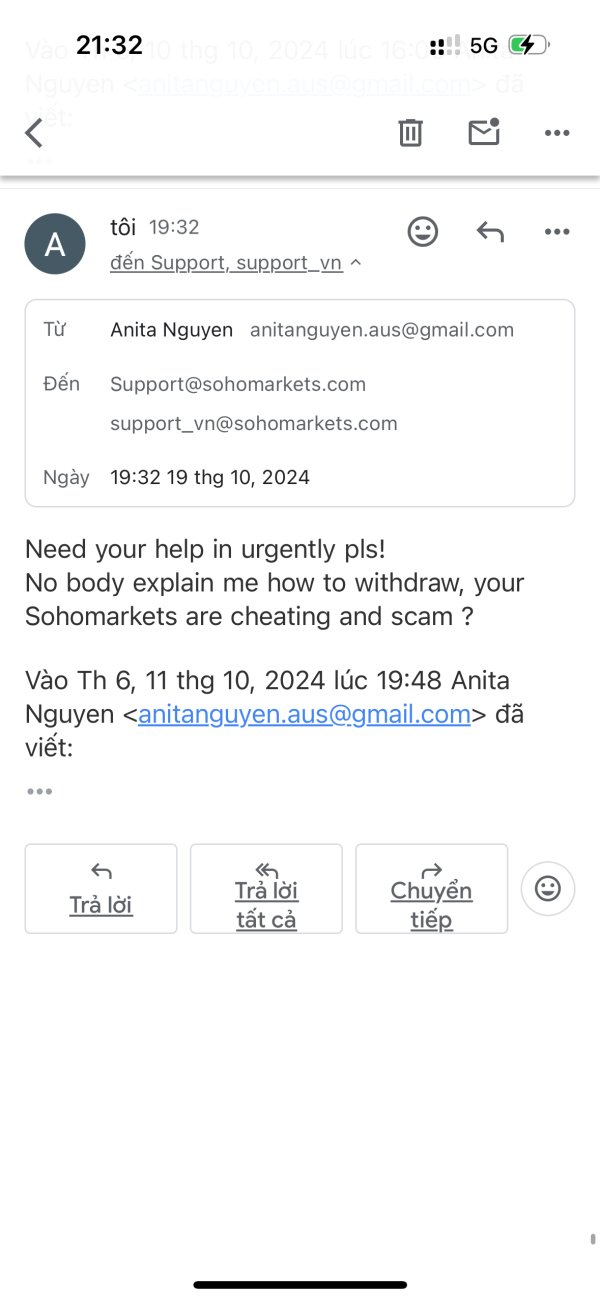

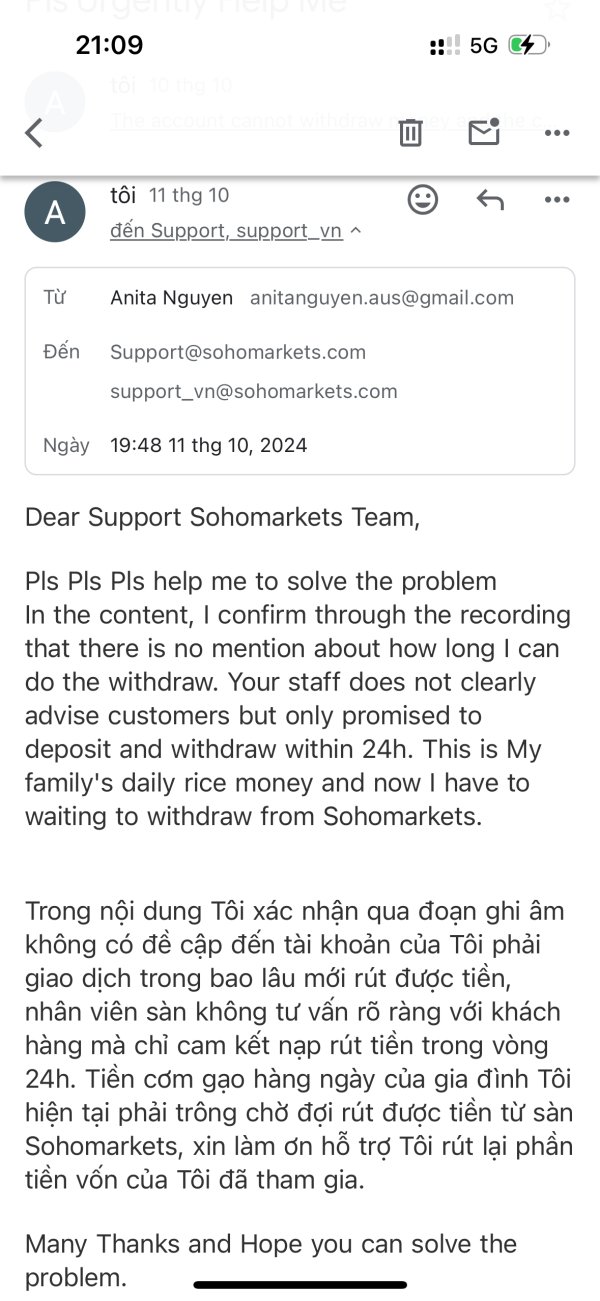

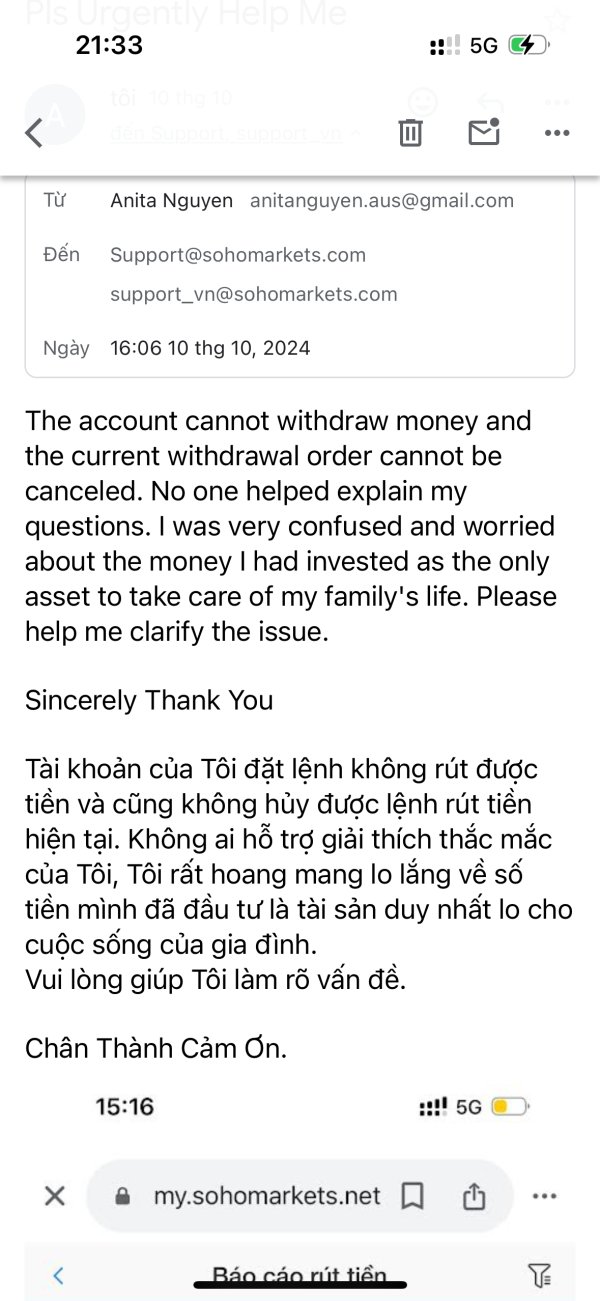

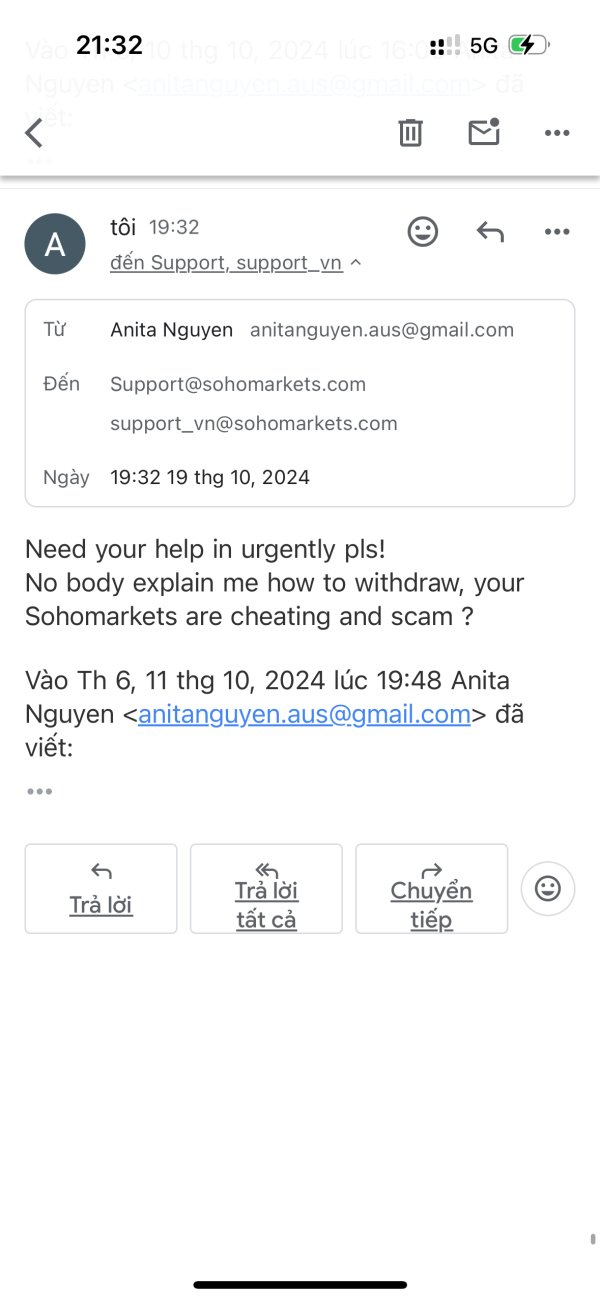

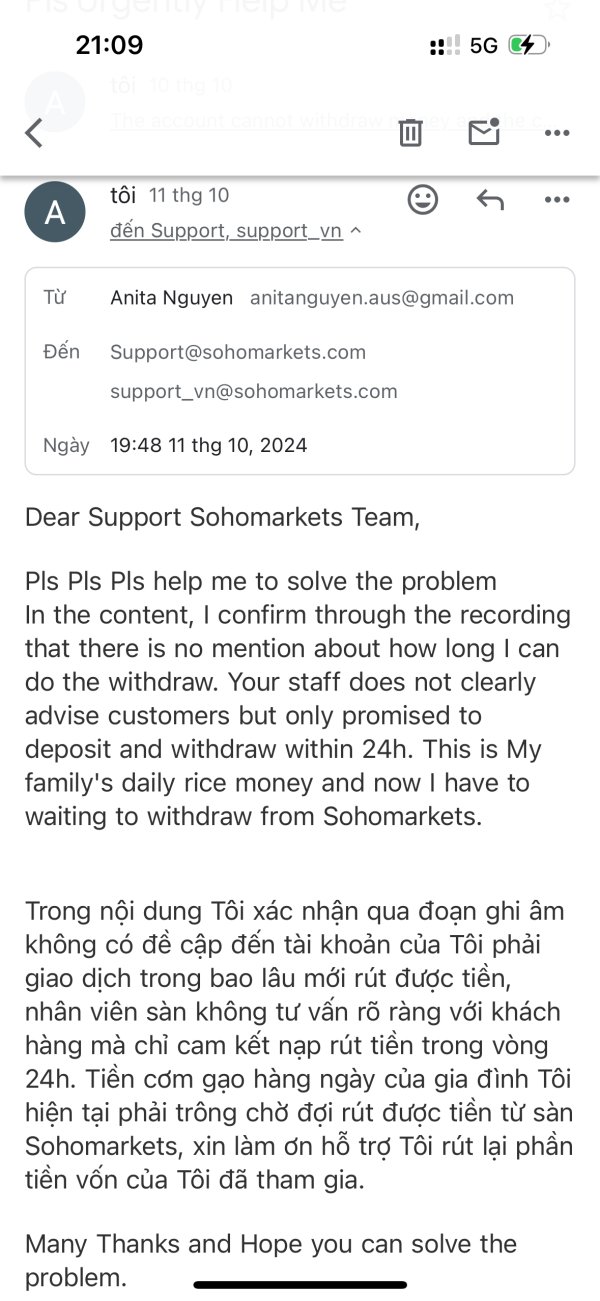

Customer Service and Support Analysis (Score: 5/10)

The customer service and support infrastructure of Soho Markets presents one of the more challenging areas to evaluate comprehensively. This is due to limited publicly available information about specific support channels, response times, and service quality metrics. This lack of detailed information about customer support capabilities represents a significant concern for traders who prioritize responsive and knowledgeable assistance when technical or account-related issues arise.

Effective customer support is crucial in the forex industry, where markets operate 24 hours a day during weekdays, and traders may require immediate assistance with platform issues, order execution problems, or account management questions. The absence of specific information about support availability hours, multiple contact methods (such as live chat, phone support, and email assistance), and multilingual capabilities makes it difficult for prospective clients to assess whether the broker can meet their support needs.

Professional forex brokers typically provide multiple support channels with trained representatives who understand both technical platform issues and market-related questions. They also usually offer support in multiple languages to serve their international client base effectively. Without documented evidence of these capabilities, Soho Markets may face challenges in meeting the expectations of traders who require comprehensive support services.

The regulatory oversight provided by CySEC does ensure that the broker must maintain certain operational standards. These include appropriate client communication and complaint handling procedures. However, regulatory compliance represents minimum standards rather than indicators of exceptional service quality. Traders considering Soho Markets should directly test the responsiveness and quality of customer support before committing significant funds to their trading accounts.

The lack of available user testimonials or documented case studies about problem resolution further compounds the difficulty in assessing the practical effectiveness of the broker's customer support infrastructure. This makes this area a potential concern for traders who value reliable assistance.

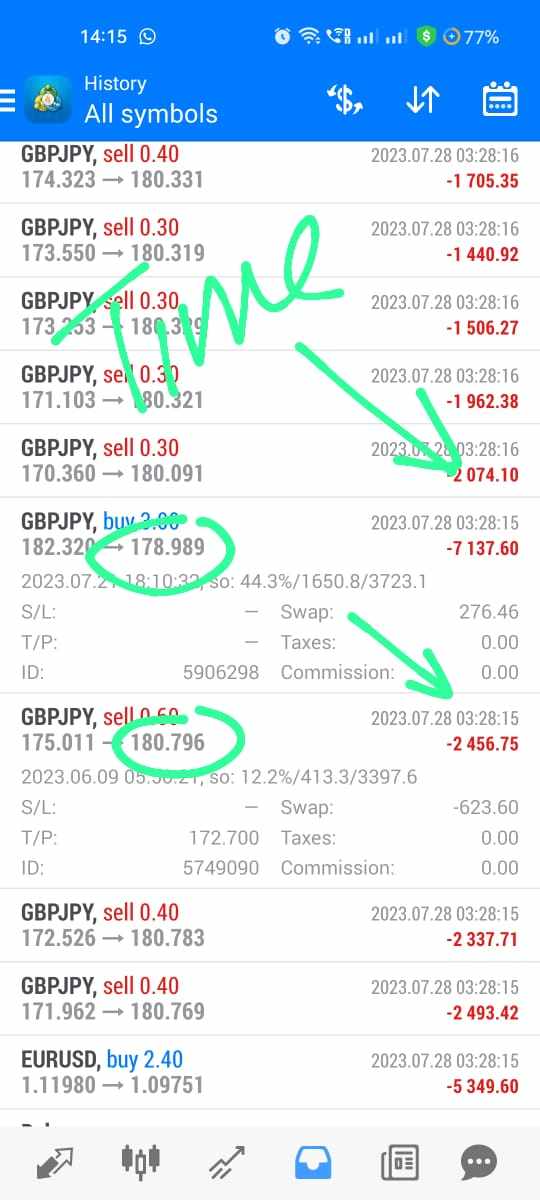

Trading Experience Analysis (Score: 7/10)

The trading experience provided by Soho Markets benefits significantly from its utilization of the MetaTrader 4 platform. MT4 has established itself as an industry standard for retail forex trading. MT4's reputation for stability, reliability, and comprehensive functionality provides a solid foundation for the trading experience. The platform's intuitive interface allows both novice and experienced traders to navigate efficiently between different functions, from basic order placement to advanced technical analysis.

The platform's charting capabilities represent a particular strength. They offer multiple timeframes, numerous technical indicators, and customizable chart layouts that can accommodate various analytical approaches and trading strategies. Traders can implement everything from simple trend-following strategies to complex multi-indicator systems using the platform's built-in tools. The ability to save and recall chart templates also enhances workflow efficiency for traders who use consistent analytical setups across different instruments.

Order execution capabilities through MT4 typically provide reliable performance. However, specific information about Soho Markets' execution speeds, slippage rates, and order fill quality is not extensively documented in available sources. These execution metrics are crucial for active traders, particularly those implementing scalping strategies or trading during high-volatility market conditions where precise order execution can significantly impact profitability.

The multi-asset trading environment allows traders to diversify their activities across forex, commodities, indices, stocks, and cryptocurrencies from a single platform interface. This diversity can enhance the trading experience by providing opportunities to capitalize on various market conditions and implement cross-asset trading strategies. However, specific details about instrument availability, trading hours for different asset classes, and any restrictions on certain trading strategies require verification with the broker.

Mobile trading capabilities through MT4's mobile applications extend the trading experience beyond desktop environments. They allow traders to monitor positions, execute trades, and analyze markets while away from their primary trading setup. This soho markets review indicates that while the fundamental trading infrastructure appears solid, specific performance metrics and user experience details would benefit from direct evaluation.

Trust and Security Analysis (Score: 6/10)

The trust and security profile of Soho Markets is anchored by its regulatory authorization from the Cyprus Securities and Exchange Commission (CySEC). This provides important foundational protections for client funds and operational oversight. CySEC regulation requires licensed brokers to maintain segregated client fund accounts, ensuring that trader deposits remain separate from the broker's operational funds. This segregation provides crucial protection in the event of broker financial difficulties and represents a fundamental security measure for client capital.

The regulatory framework also mandates specific capital adequacy requirements, operational standards, and regular reporting obligations that help ensure the broker maintains appropriate financial stability and operational integrity. These regulatory protections are particularly important for newer brokers like Soho Markets, which has been operating since 2022 and therefore has a relatively short operational history compared to more established industry players.

However, the broker's brief operational timeline does present some considerations for risk-conscious traders. While regulatory oversight provides important protections, longer operational histories typically provide more extensive track records of crisis management, client service during volatile market conditions, and overall business stability. Traders who prioritize proven longevity may prefer brokers with decades of operational experience and established reputations.

Available sources do not provide extensive details about additional security measures such as client fund insurance schemes, advanced cybersecurity protocols, or specific fund segregation arrangements beyond basic regulatory requirements. Many established brokers provide additional security layers such as negative balance protection, enhanced encryption protocols, and comprehensive insurance coverage that extends beyond minimum regulatory requirements.

The transparency of company information, including detailed disclosure about company ownership, financial statements, and operational policies, is not extensively documented in publicly available sources. Enhanced transparency in these areas typically strengthens client confidence and demonstrates the broker's commitment to open communication with its client base. Prospective clients should consider requesting additional information about security measures and company transparency directly from the broker to make fully informed decisions about fund safety.

User Experience Analysis (Score: 5/10)

The overall user experience evaluation for Soho Markets faces significant challenges. This is due to limited availability of comprehensive user feedback, satisfaction surveys, and detailed interface assessments in publicly available sources. User experience encompasses multiple elements including platform usability, account management efficiency, problem resolution effectiveness, and overall satisfaction with the broker's services.

The MetaTrader 4 platform does provide a generally positive foundation for user experience, as it offers an interface that many traders find familiar and efficient. The platform's widespread adoption across the forex industry means that many traders can transition to Soho Markets without needing to learn new software. This can enhance the onboarding experience for experienced traders. The availability of mobile applications also supports flexible trading approaches that accommodate various lifestyle and schedule requirements.

However, the absence of detailed user testimonials, satisfaction ratings, or documented case studies makes it challenging to assess real-world user experiences with the broker's services. Factors such as account opening efficiency, withdrawal processing times, problem resolution effectiveness, and overall client satisfaction remain unclear without comprehensive user feedback data.

The registration and verification process details are not extensively documented. This could impact the initial user experience for new clients. Efficient onboarding processes with clear documentation requirements and reasonable verification timeframes contribute significantly to positive first impressions and overall user satisfaction. Similarly, fund management experiences including deposit processing, withdrawal procedures, and any associated fees or delays represent crucial elements of the user experience that require direct evaluation.

Common user complaints or recurring issues are not documented in available sources. This makes it difficult to identify potential problem areas or assess how effectively the broker addresses client concerns. The lack of available information about user experience improvements, platform updates, or client feedback integration suggests that prospective clients should directly engage with the broker's services to evaluate whether the user experience meets their specific requirements and expectations.

Conclusion

This comprehensive soho markets review reveals that Soho Markets presents itself as a legitimate, regulated forex broker that offers essential trading services through established infrastructure. The broker's CySEC regulation provides important foundational protections, while the MT4 platform delivers reliable trading functionality across multiple asset classes. The competitive minimum deposit of $200 USD makes the platform accessible to traders seeking to enter the forex market with modest initial capital.

However, the evaluation also highlights several areas where information transparency could be enhanced. These areas particularly include specific service details, user feedback, and operational policies. While regulatory oversight provides basic security assurances, the broker's relatively short operational history since 2022 means that long-term performance track records are still developing.

Soho Markets appears most suitable for beginner and intermediate traders who prioritize regulatory oversight, platform reliability, and accessible entry requirements over advanced features or extensive educational resources. Traders considering this broker should conduct direct due diligence to verify current service details, test customer support responsiveness, and ensure that the available features align with their specific trading requirements and risk tolerance levels.