Is Smart Contract safe?

Pros

Cons

Is Smart Contract A Scam?

Introduction

Smart Contract is a forex broker that has garnered attention in the trading community for its offerings in forex, cryptocurrencies, and CFDs. However, with the proliferation of online trading platforms, traders must exercise caution and conduct thorough evaluations before committing their funds. The importance of assessing a broker's credibility cannot be overstated, as the financial landscape is fraught with risks, including scams and unregulated entities. This article aims to provide a comprehensive analysis of Smart Contract, utilizing a combination of narrative insights and structured data to evaluate its safety and reliability. We will delve into the broker's regulatory status, company background, trading conditions, customer experience, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its safety and legitimacy. Smart Contract claims to operate under regulations; however, multiple sources indicate that it is unregulated, raising red flags about its operations. Brokers that lack proper regulation often expose traders to significant risks, including potential fraud and the inability to recover funds in case of disputes.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of a regulatory framework means that Smart Contract does not adhere to the stringent standards that regulated brokers must meet, such as maintaining segregated client accounts and ensuring transparency in operations. The lack of oversight from a recognized authority makes it difficult for traders to trust Smart Contracts claims and raises concerns about the potential for fraudulent activities. Historically, brokers without regulation have been associated with higher instances of customer complaints and operational issues, further solidifying the need for caution when considering such platforms.

Company Background Investigation

Smart Contract‘s history and ownership structure are crucial in assessing its credibility. Unfortunately, detailed information about the company’s establishment, ownership, and operational history is scarce. The company claims to be based in the United Kingdom; however, there are no corroborating registration data, leading to doubts about its legitimacy. The lack of transparency regarding its management team and their professional backgrounds adds to the uncertainty surrounding the broker.

Effective management and a professional team are essential for a broker's success and reliability. A brokers management team should ideally have a proven track record in the finance and trading sectors. However, Smart Contract has not provided adequate information about its management, which raises concerns about the quality of leadership and the potential for mismanagement. Without clear information about the company's structure and the individuals behind it, traders are left in the dark regarding the broker's operational integrity.

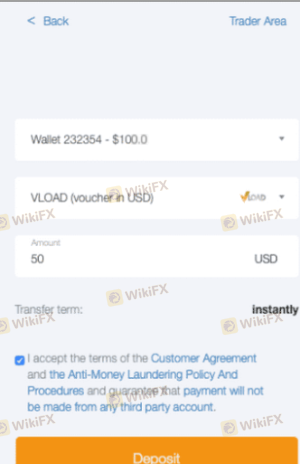

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for evaluating its attractiveness and reliability. Smart Contract presents two account types: a standard account and a prime account. However, the overall fee structure and trading conditions have raised eyebrows among traders.

| Fee Type | Smart Contract | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.3 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

The spreads offered by Smart Contract appear higher than the industry average, which could eat into traders profits. Additionally, the absence of clear information regarding commission structures and overnight interest rates suggests a lack of transparency that could be detrimental to traders. Unusual fee policies can often indicate hidden costs, which may not be immediately apparent to new traders. It is essential to investigate these aspects thoroughly, as they can significantly impact trading outcomes.

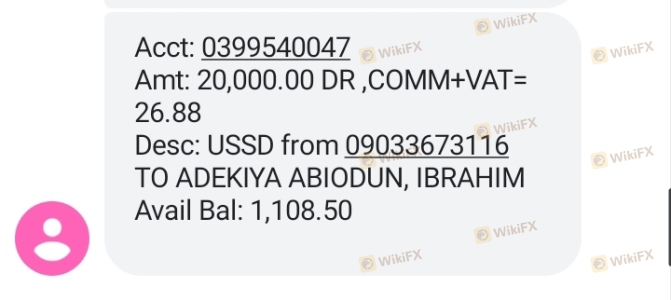

Customer Funds Security

The safety of customer funds is paramount when choosing a broker. Smart Contract's measures for fund security are critical in evaluating whether it is safe for traders. However, the broker's lack of regulatory oversight raises concerns about its ability to safeguard client funds.

Furthermore, the absence of information regarding fund segregation, investor protection schemes, and negative balance protection policies is alarming. These measures are standard practices among regulated brokers to ensure that client funds are protected in the event of insolvency or operational issues. Without such assurances, traders may find themselves at risk of losing their investments without any recourse.

Historically, unregulated brokers have faced numerous allegations of mishandling client funds, leading to significant losses for traders. The lack of a robust security framework at Smart Contract suggests that traders should exercise extreme caution before depositing their funds.

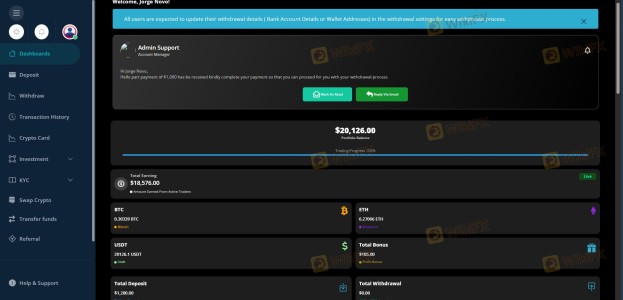

Customer Experience and Complaints

Analyzing customer feedback and complaints is essential in assessing a broker's reliability. Smart Contract has accumulated several negative reviews, with traders expressing concerns about withdrawal difficulties and poor customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Poor Customer Support | Medium | Unresolved Issues |

Common complaints include difficulty withdrawing funds, which is a significant red flag for any broker. Traders reported delays in processing withdrawals, leading to frustration and distrust. The company's slow response to these complaints further exacerbates the situation, indicating a lack of commitment to customer satisfaction.

One notable case involves a trader who reported being unable to withdraw funds for several months, only to receive vague responses from customer support. Such experiences highlight the potential risks associated with trading through Smart Contract and suggest that it may not be the ideal platform for traders seeking reliable service.

Platform and Trade Execution

The quality and performance of a trading platform are vital for a positive trading experience. Smart Contract utilizes the MT5 platform, which is known for its advanced features and user-friendly interface. However, user experiences have varied, with some traders reporting issues related to platform stability and execution quality.

Concerns regarding slippage and order rejections have also surfaced, with traders noting instances where their orders were not executed at the expected prices. Such issues can significantly impact trading performance and profitability, making it essential for traders to consider these factors when evaluating Smart Contract.

Risk Assessment

Engaging with Smart Contract presents several risks that traders must be aware of. The combination of unregulated status, poor customer feedback, and lack of transparency creates a precarious trading environment.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of fund protection measures |

| Customer Service Risk | Medium | Poor response to complaints |

| Trading Execution Risk | Medium | Issues with slippage and rejections |

To mitigate these risks, traders should consider setting strict limits on their investments, conducting thorough research, and potentially seeking regulated alternatives. Engaging with a broker that offers robust regulatory protections and a solid reputation can help safeguard traders' interests.

Conclusion and Recommendations

In conclusion, the evidence suggests that Smart Contract may not be a safe option for traders. The combination of unregulated status, poor customer reviews, and lack of transparency raises significant concerns about its reliability. Traders should approach Smart Contract with caution, as the potential for fraud and operational issues is high.

For traders seeking safer alternatives, it is advisable to consider regulated brokers that provide comprehensive client protections, transparent fee structures, and a strong commitment to customer service. Brokers such as [Alternative Broker 1] and [Alternative Broker 2] offer robust regulatory oversight and have established positive reputations in the trading community. Ultimately, conducting thorough due diligence is crucial in safeguarding one's investments in the forex market.

Is Smart Contract a scam, or is it legit?

The latest exposure and evaluation content of Smart Contract brokers.

Smart Contract Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Smart Contract latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.