Is SEA Investing safe?

Business

License

Is Sea Investing A Scam?

Introduction

Sea Investing is a forex brokerage firm that positions itself in the competitive landscape of online trading, offering a range of financial instruments including CFDs, commodities, stocks, and cryptocurrencies. As the forex market continues to attract traders globally, it is crucial for potential investors to carefully evaluate the reliability of their chosen brokers. Given the prevalence of scams and unregulated entities in the financial sector, traders must be vigilant in their assessments to safeguard their investments. This article aims to provide a comprehensive analysis of Sea Investing, using a structured approach that examines its regulatory status, company background, trading conditions, customer experience, and overall risk profile.

Regulation and Legitimacy

Regulatory oversight is a fundamental aspect of any reputable brokerage, as it ensures that firms adhere to strict standards of conduct and financial practices. Unfortunately, Sea Investing operates without valid regulatory oversight, which raises significant concerns about its legitimacy. Below is a summary of the regulatory information available for Sea Investing:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

Operating without regulation means that Sea Investing is not subject to the scrutiny of established financial authorities, which can lead to a lack of accountability. This situation is particularly alarming as it exposes traders to potential risks, including the possibility of fraud and misappropriation of funds. The absence of a regulatory framework also limits the avenues available for dispute resolution, leaving clients vulnerable in case of issues with the broker. Furthermore, the lack of transparency regarding its operational history and compliance track record raises further red flags about the safety of investing with Sea Investing.

Company Background Investigation

A thorough investigation into the background of Sea Investing reveals several critical insights. The firm claims to be headquartered in Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory environment, which often attracts unregulated brokers. The company does not provide clear information about its ownership structure or management team, which is a common practice among potentially fraudulent entities.

The management team's experience and qualifications are also crucial indicators of a broker's reliability. However, Sea Investing does not disclose any information about its leadership or operational history, making it difficult for potential clients to assess the firm's credibility. The lack of transparency regarding the company's ownership and management raises significant concerns about its legitimacy and operational integrity.

In summary, the absence of clear information about Sea Investing's company structure and management team contributes to the perception that it may not be a trustworthy entity. Investors are advised to exercise caution and conduct thorough due diligence before engaging with this broker.

Trading Conditions Analysis

When evaluating whether Sea Investing is safe, it is essential to consider the trading conditions it offers. The broker claims to provide competitive trading fees, yet it does not disclose specific details about its pricing structure. Below is a comparative table of the core trading costs associated with Sea Investing:

| Fee Type | Sea Investing | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.1 pips | 1.0 pips |

| Commission Model | $10 per lot | $5 per lot |

| Overnight Interest Range | Variable | Variable |

While the spreads appear competitive, the commission structure is notably higher than the industry average, which could impact overall trading profitability. Additionally, the lack of clarity regarding other potential fees, such as withdrawal or inactivity fees, raises concerns about hidden costs that could erode traders' returns.

It is crucial for traders to fully understand the fee structure before committing to a broker, as unexpected costs can significantly affect their trading outcomes. Therefore, while Sea Investing may present itself as an attractive option, the unclear fee policies warrant careful consideration and further investigation.

Client Funds Safety

The safety of client funds is paramount when assessing the reliability of a brokerage. Sea Investing claims to implement safety measures to protect client deposits; however, the specifics of these measures are not clearly outlined. A detailed analysis of the broker's fund security protocols reveals the following:

- Segregation of Funds: There is no information provided on whether client funds are kept in segregated accounts, which is a standard practice among regulated brokers to ensure that client assets are protected in the event of the firm's insolvency.

- Investor Protection: The lack of regulatory oversight means that there are no investor protection schemes in place, leaving clients without recourse in case of financial losses.

- Negative Balance Protection: Sea Investing has not disclosed any policies regarding negative balance protection, which could expose traders to significant financial risk.

The absence of robust safety measures for client funds raises serious concerns about the level of protection offered by Sea Investing. Potential investors should be aware that without proper safeguards, their investments could be at risk, further questioning whether Sea Investing is safe for trading.

Customer Experience and Complaints

Customer feedback serves as a valuable indicator of a broker's reliability and service quality. A review of user experiences with Sea Investing reveals a pattern of negative reviews and complaints. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Blocking | High | Poor |

| Poor Customer Support | Medium | Average |

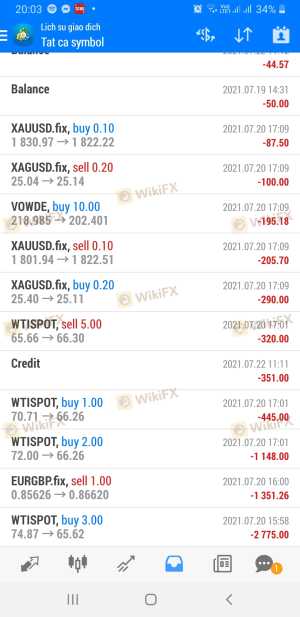

Many users have reported difficulties in withdrawing their funds, with some claiming that their accounts were blocked without explanation. The company's response to these complaints has been largely inadequate, leading to frustration among clients who feel their concerns are not being taken seriously.

For instance, one user recounted their experience of being unable to withdraw funds after multiple attempts, only to receive vague responses from customer support. This lack of responsiveness and accountability raises serious questions about the integrity of Sea Investing and whether it truly values its clients.

Platform and Trade Execution

The trading platform offered by Sea Investing is another critical aspect to consider when evaluating its reliability. The broker utilizes the MetaTrader 4 platform, which is widely recognized for its user-friendly interface and advanced trading features. However, several users have reported issues related to order execution, including slippage and rejected orders.

The quality of order execution is vital for traders, as delays or inaccuracies can lead to significant financial losses. Reports of frequent slippage and rejected orders on Sea Investing's platform suggest that traders may face challenges when attempting to execute their strategies effectively.

In conclusion, while Sea Investing offers a reputable trading platform, the issues surrounding order execution and potential manipulation raise concerns about the overall trading experience. Traders should be cautious and consider these factors when deciding whether to engage with this broker.

Risk Assessment

Engaging with Sea Investing presents several risks that potential traders should be aware of. Below is a summary of the key risk categories associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status exposes traders to potential fraud. |

| Fund Safety Risk | High | Lack of clear fund protection measures increases vulnerability. |

| Customer Service Risk | Medium | Poor response to complaints may lead to unresolved issues. |

Given these risks, it is essential for traders to implement risk mitigation strategies when considering Sea Investing. This may include diversifying investments, setting strict risk management parameters, and conducting thorough research before committing funds.

Conclusion and Recommendations

In conclusion, the evidence gathered in this analysis raises significant concerns about the reliability of Sea Investing. The lack of regulatory oversight, unclear fee structures, inadequate fund safety measures, and negative customer experiences suggest that this broker may not be a safe choice for traders.

For those considering entering the forex market, it is advisable to explore alternative, regulated brokers that offer greater transparency, robust safety measures, and a proven track record of customer satisfaction. Traders should prioritize their financial security and consider brokers that provide regulatory assurance and a commitment to protecting client interests.

Ultimately, while Sea Investing may present itself as an appealing option, the risks associated with trading through this broker warrant serious consideration and caution.

Is SEA Investing a scam, or is it legit?

The latest exposure and evaluation content of SEA Investing brokers.

SEA Investing Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SEA Investing latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.