Is Rallyville safe?

Business

License

Is Rallyville Safe or a Scam?

Introduction

Rallyville is a relatively new entrant in the forex market, positioning itself as a platform for trading various financial instruments, including forex, commodities, and indices. Given the growing number of online trading platforms, traders must exercise caution when choosing where to invest their hard-earned money. The potential for scams and unregulated brokers is a significant concern in the forex industry, making it essential for traders to conduct thorough due diligence before committing funds. This article investigates the legitimacy and safety of Rallyville by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a trading platform is crucial for assessing its safety. Rallyville claims to be regulated by the Vanuatu Financial Services Commission (VFSC), which, while providing a license, is known for its relatively lenient regulatory standards. Below is a summary of Rallyvilles regulatory information:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| VFSC | 41698 | Vanuatu | Verified |

While Rallyville is registered with the VFSC, it is important to note that this regulatory body does not offer the same level of protection as Tier-1 regulators like the FCA in the UK or ASIC in Australia. Offshore regulations often lack strict compliance requirements, investor compensation funds, and transparency, leading to heightened risks for traders. Furthermore, there have been no documented compliance records or disciplinary actions against Rallyville, which raises questions about its operational integrity.

Company Background Investigation

Rallyville Markets was established in 2021 and claims to have offices in Vanuatu, Australia, and Hong Kong. However, inconsistencies exist in its claims, as there is no verifiable registration with Australian or Hong Kong regulatory authorities. The ownership structure of Rallyville is not transparently disclosed, which is a common red flag in the industry. The management teams qualifications and experience are also not clearly outlined, making it difficult for potential clients to assess the competency of those running the platform. Transparency in company operations and leadership is vital for building trust, and Rallyville appears to fall short in this regard.

Trading Conditions Analysis

Rallyville offers trading conditions that may initially appear attractive, including a minimum deposit requirement of $100 and leverage of up to 1:400. However, the overall cost structure is not as favorable when scrutinized. Here's a breakdown of key trading costs:

| Cost Type | Rallyville | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 0.4 - 0.8 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

While the spreads may seem competitive, the lack of transparency regarding other potential fees and the absence of a commission structure could lead to unexpected costs for traders. Moreover, the absence of a detailed breakdown of overnight interest rates is concerning, as it could imply hidden charges that traders may face.

Customer Funds Security

The safety of customer funds is paramount when evaluating any trading platform. Rallyville claims to implement measures for fund security, such as segregated accounts. However, the effectiveness of these measures is questionable, given the lack of stringent regulatory oversight from a reputable authority. Additionally, the absence of negative balance protection means that traders could potentially lose more than their initial investment, increasing the financial risk associated with trading on this platform.

Customer Experience and Complaints

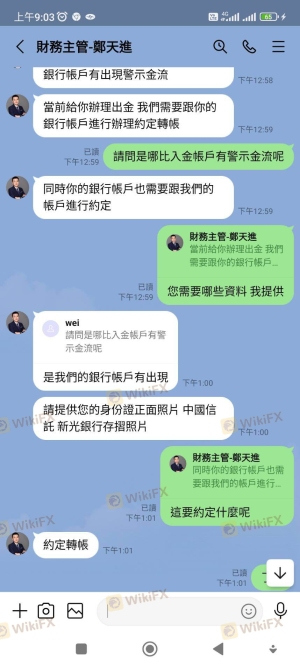

Customer feedback is a valuable resource for assessing the reliability of a broker. Reviews of Rallyville reveal a mixed bag of experiences, with some users reporting difficulties in withdrawing funds and encountering unresponsive customer service. Below is a summary of common complaint types:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or unresponsive |

| Customer Service Quality | Medium | Inconsistent |

| Platform Performance Issues | High | Unresolved |

For instance, some users have reported being unable to withdraw their funds after multiple requests, citing vague excuses from customer service representatives. Such patterns of behavior are alarming and suggest a lack of accountability on the part of the broker.

Platform and Trade Execution

Rallyville utilizes the widely recognized MetaTrader 4 (MT4) platform, which is known for its robust features and user-friendly interface. However, concerns have been raised regarding order execution quality, including instances of slippage and rejections. Traders have reported that during high volatility, the platform has failed to execute orders as intended, which can lead to significant financial losses. This raises questions about whether Rallyville is manipulating trade execution or simply struggling with platform reliability.

Risk Assessment

Using Rallyville comes with inherent risks that potential traders should consider. Below is a summary of the key risk areas associated with the platform:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates under offshore regulation, offering little protection. |

| Financial Risk | High | High leverage and lack of negative balance protection increase potential losses. |

| Operational Risk | Medium | Reports of withdrawal issues and platform performance concerns. |

To mitigate these risks, traders should consider setting strict limits on their investments, utilizing risk management tools, and conducting continuous monitoring of their trading activities.

Conclusion and Recommendations

In summary, the investigation into Rallyville raises several red flags regarding its safety and legitimacy. The lack of robust regulatory oversight, questionable company transparency, and reported customer grievances suggest that traders should proceed with caution. While some may find the trading conditions appealing, the potential risks associated with this broker outweigh the benefits.

For traders seeking a safer investment environment, it is advisable to consider alternative platforms that are well-regulated and have a proven track record of reliability. Brokers such as IG, OANDA, or Forex.com offer more robust regulatory protections and have demonstrated a commitment to customer service and transparency. Ultimately, the question "Is Rallyville safe?" leans towards caution, and potential investors should be wary of engaging with this broker.

Is Rallyville a scam, or is it legit?

The latest exposure and evaluation content of Rallyville brokers.

Rallyville Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Rallyville latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.