Rallyville Review 3

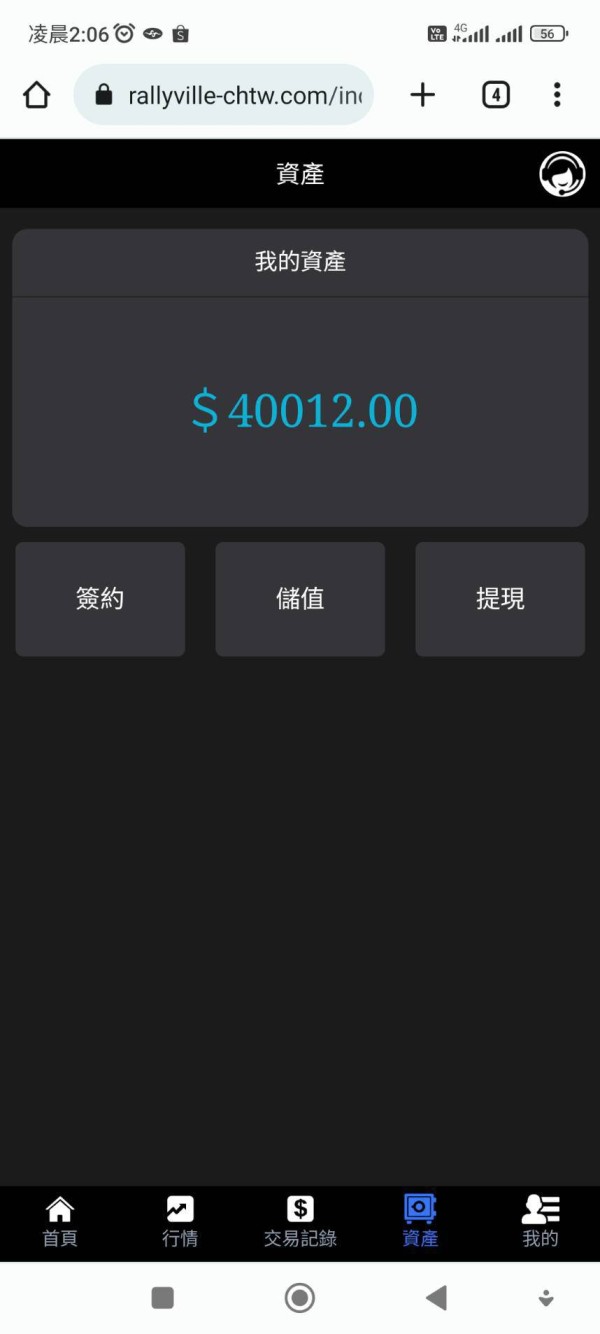

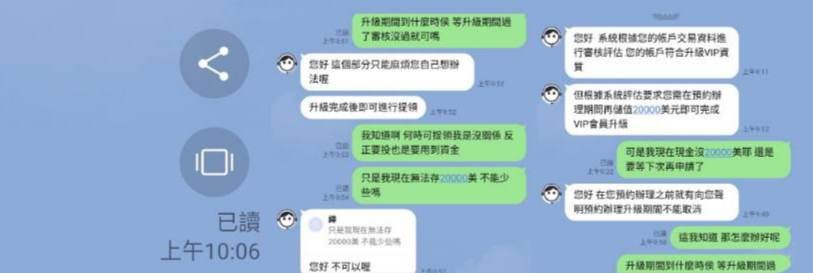

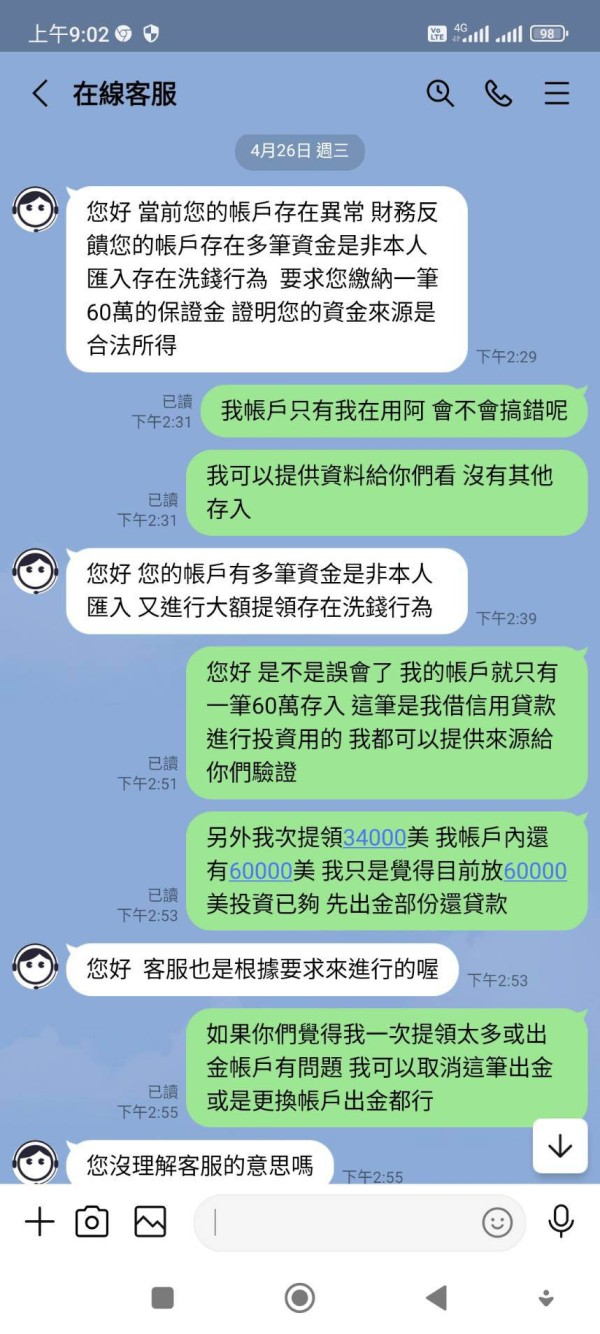

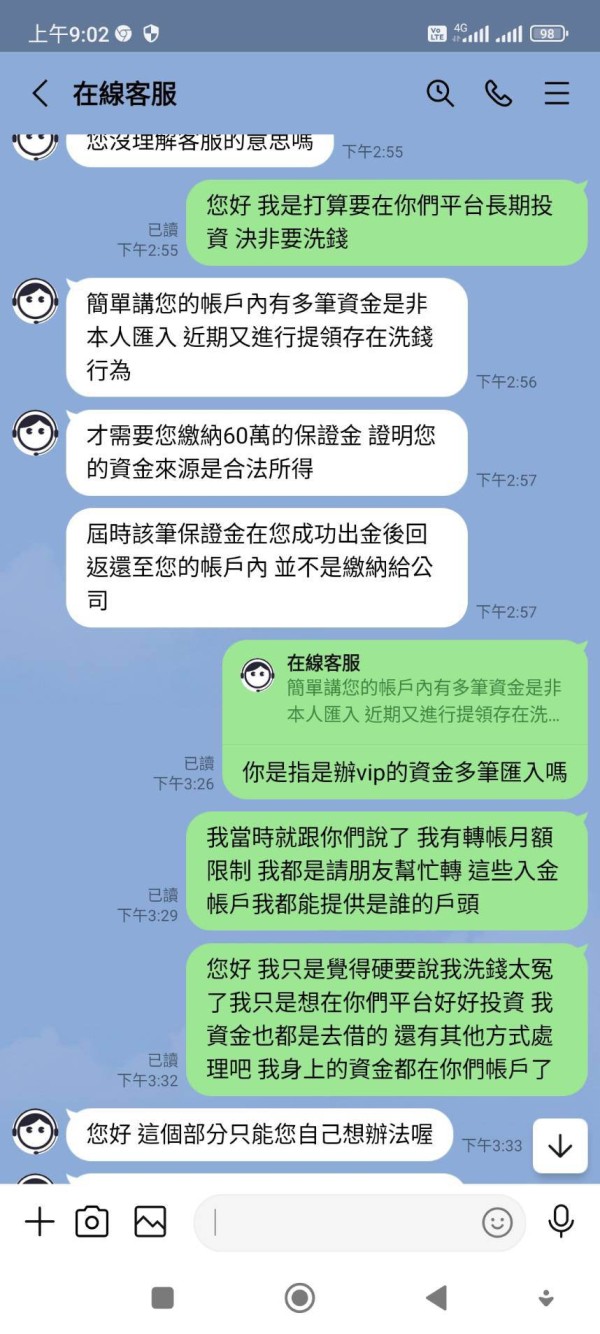

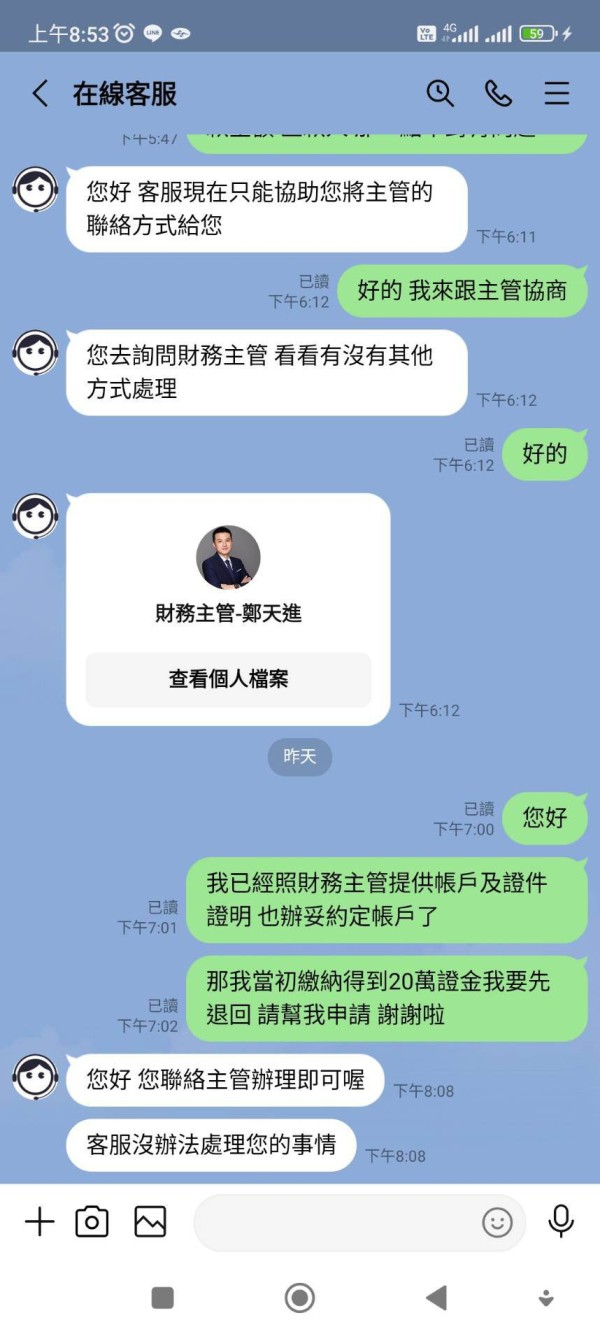

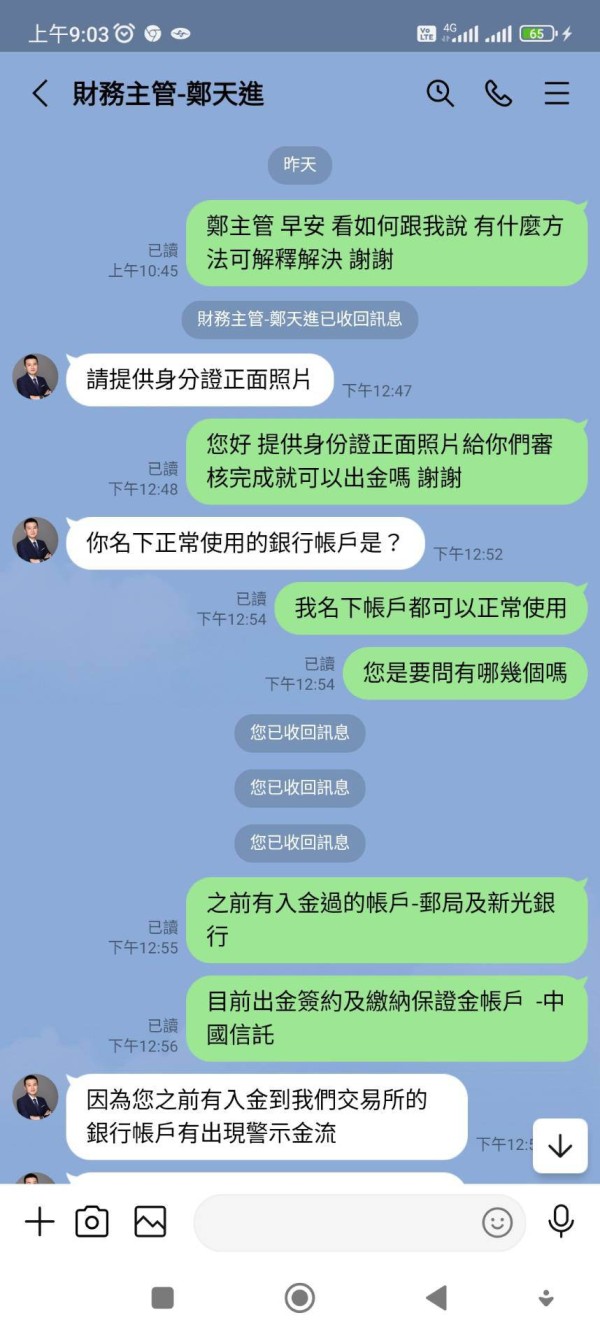

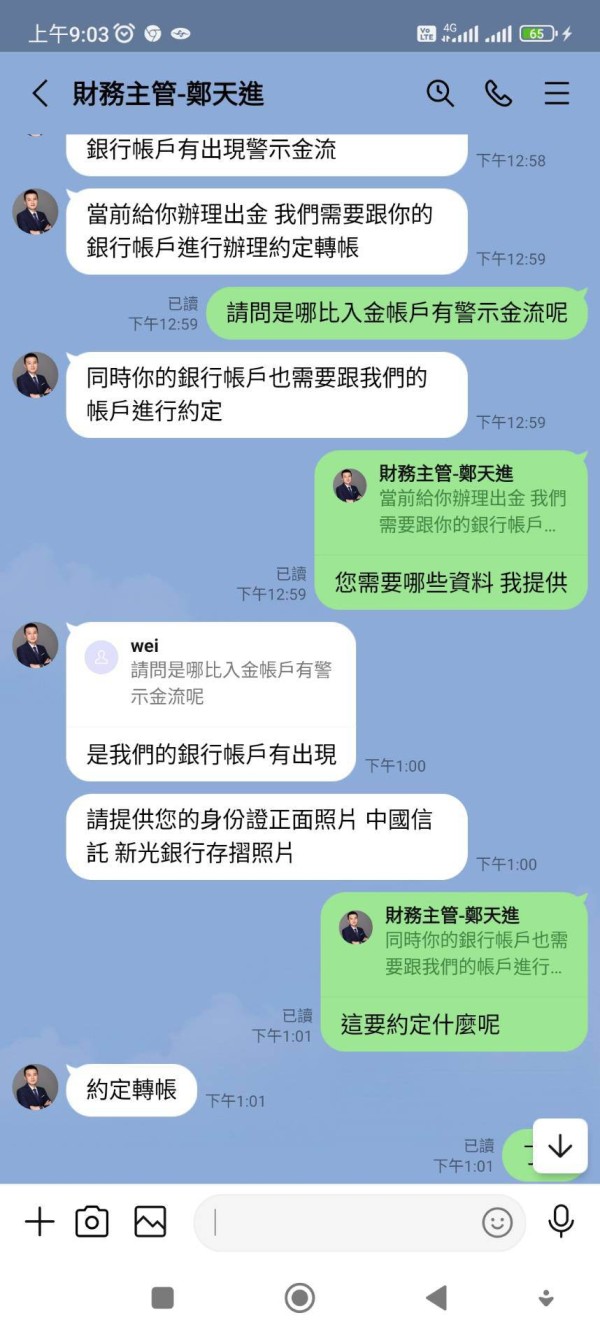

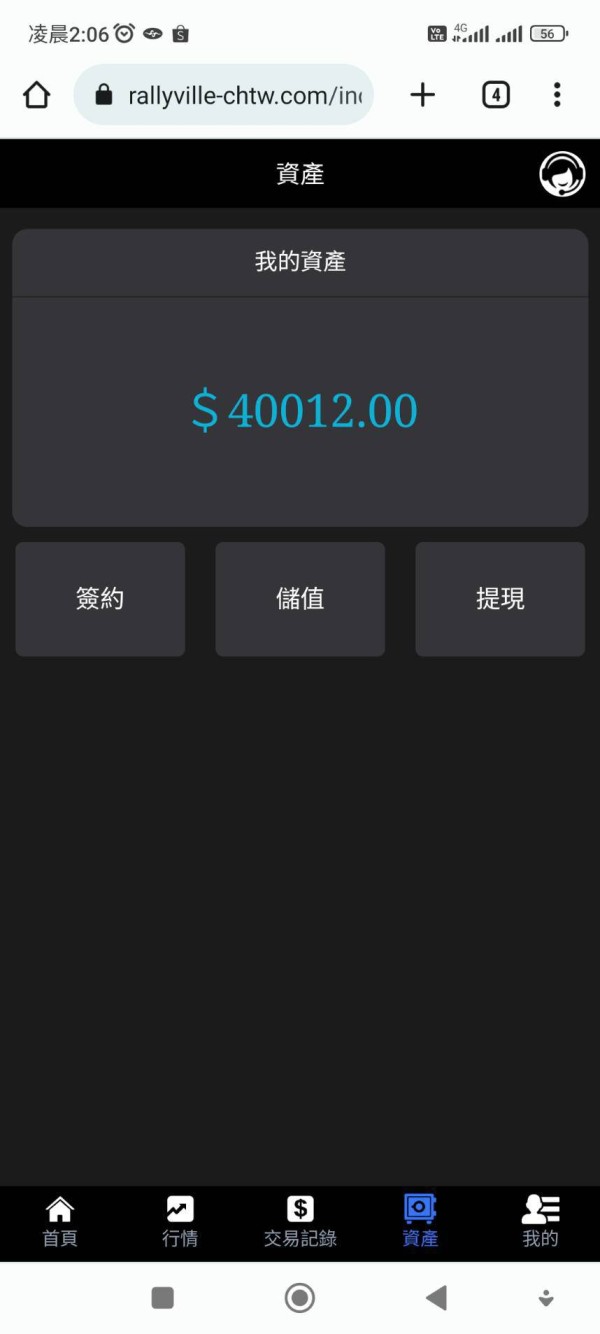

The whole thing happened at the end of March this year. I met a netizen on a dating website and later talked about investing in foreign exchange. Due to my inherent habit of investing, the netizen recommended me to place an order on this Rileyville platform. This platform is priced in US dollars, with a ratio of 1:30 New Taiwan dollars to US dollars. At first, I only invested a small amount of 400 US dollars. At first, I made a profit, but later, I invested more and more funds. The netizen also told me that I could apply for a VIP customer, and he said that when applying to become a VIP customer, there is a discount of 10% fee exemption for withdrawal of funds. I will go to the customer service of the platform to become a VIP member with deep affection. The customer service only told me that during the application period, the deposit cannot be cancelled. I think it doesn't matter, so I agreed to apply. However, the next day after the application, the customer service of the platform informed me that I needed to deposit an additional $20000 to successfully apply. I immediately informed the customer service that I didn't have such a large amount of funds and asked them to help me cancel the application. The platform is not willing to help me cancel it, as long as I find a way myself, otherwise the deposit cannot be cancelled. Because my bank account has monthly limits and daily transfer restrictions, I went to ask customer service for a deposit of $20000. I had to ask someone to transfer some of it from his account to the account provided by the platform, and the platform didn't have any objections. After transferring a total of $20000 with us, I finally made a deposit of $550 for the first time. Later, I continued to invest a large amount of funds, approximately NT $70000 to 800000, in foreign exchange trading. On April 25th, I requested a deposit of $34000. The next day, the platform informed me that I was involved in money laundering and required me to pay a NT $600000 deposit within 48 hours, otherwise my account would be frozen. Of course, I felt inexplicable and repeated responses from the platform were ineffective. In the end, I had to be forced to agree to pay the deposit, but due to the limit on my personal account transfer, I transferred NT $200000 to the platform in just one day, and after paying NT $200000, I urgently needed cash due to an accident with my girlfriend. I once again reported to the platform that I had also paid NT $200000 as a deposit, and I urgently needed a life-saving deposit. Please ask the platform to make the payment immediately, but the platform refused. After coordinating with customer service for a long time, the customer service transferred my matter to their finance department. Later, their finance department asked me to provide my ID card, the cover of my passbook, and agreed to provide an account and an online banking account, Of course I refuse, and I can only resolve the matter through legal means and expose it to the eyes of foreign exchange. I currently have a total of 94012 US dollars and a deposit of 200000 Taiwanese dollars on the platform that has been unreasonably withheld, equivalent to about 3 million Taiwanese dollars. I have chosen to expose the entire matter to the public and let the majority of investors know and recognize the platform. The entire matter is based on the platform's unfounded accusation of money laundering and the inability to provide evidence of money laundering, which is why I am unwilling to contribute, At the beginning, the platform also agreed that my personal and VIP funds could be partially transferred from a friend's account. However, I was not informed of any abnormalities after the transfer, so I obstructed my request for partial withdrawal. I also stated that I was willing to provide all the information of the transferred account and accept police investigation. The platform's people were unwilling to withdraw the funds, and they also asked me to provide account information, which was clearly a black platform. In the end, they directly deleted the customer's account information, I am currently unable to log in.

Alright, so I've been trading forex with Rallyville for a few months now. There are a few things I like, and a few things I don't. What I like is their straight-forwardness and transparency about transaction fees. You don't have to go digging around to know there won't be any nasty surprises. Their customer service is also worth mentioning. When I had a mix-up with an order, they dealt with it swifter than Say Bolt's sprint. Plus, their trading tools give you a clear edge. The advanced charting and analytical features have certainly given my EUR/USD trades better returns - a good 15% improvement I'd say. They also have a swift account set up process that is wholly online and fund transactions are smooth. Now, for the negatives. Although their customer service is prompt, I've found it to be somewhat impersonal. I missed the human touch there. And while their transaction fees are transparent, they're not the cheapest on the block. You need to weigh that against what you're earning. Their mobile app, while well-designed, tends to lag occasionally during high trading-volume times. This can, unfortunately, lead to a slightly stressful user experience.

When it comes to spreads and commissions, Rallyville doesn't charge you for extra fuel. During my regular trading with the EUR/USD pair, spreads stayed in a reasonable range of 1.0-1.3 pips. The commission policy is also pretty transparent, keeping the trading route clean and clear. However, not all laps were all sunshine and smooth asphalt. While the platform offered solid performance, their trading signals sometimes lacked the precise timing needed for profitable trades. There were occasions when their signals got a little off-track, leading to a few missed opportunities. Also, the journey to account setup seemed a bit like navigating through unwelcome speed bumps! The process seemed unnecessarily complex at times, turning a once straightforward racing track into a labyrinth.