Is NYBOT Global Ltd safe?

Business

License

Is NYBOT Global Ltd A Scam?

Introduction

NYBOT Global Ltd has emerged as a player in the forex market, claiming to offer a range of trading services to individuals looking to invest in currencies and other financial instruments. With the rise of online trading platforms, it has become increasingly essential for traders to evaluate the legitimacy and safety of these brokers before committing their funds. The forex market is fraught with risks, and unregulated brokers can lead to significant financial losses. This article aims to provide an objective analysis of NYBOT Global Ltd, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. The findings are based on a thorough review of various online sources, including user reviews, regulatory information, and industry analyses.

Regulation and Legitimacy

Regulation is a critical aspect of any financial trading platform, as it ensures that brokers adhere to specific standards designed to protect investors. Unfortunately, NYBOT Global Ltd operates without proper regulatory oversight from recognized authorities such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). This lack of regulation raises significant concerns regarding the safety and transparency of the platform.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of a verifiable license from a reputable authority means that NYBOT Global Ltd is not subject to regular audits or compliance checks that protect investors. Unregulated brokers often engage in unethical practices, such as misleading marketing and high-pressure sales tactics. This lack of oversight also means that if the platform were to go bankrupt or disappear, investors would have little recourse to recover their funds. The historical compliance records of NYBOT Global Ltd reveal no evidence of regulatory adherence, further underscoring the risks associated with trading on this platform.

Company Background Investigation

NYBOT Global Ltd claims to be a UK-registered company, yet its actual operational status is dubious. The company has not provided sufficient information regarding its ownership structure, and details about its management team are scarce. This lack of transparency is concerning, as reputable brokers typically disclose information about their founders and key personnel, including their qualifications and experience in the financial sector.

The company's website does not provide a physical address or contact information, which is another red flag for potential investors. Legitimate brokers usually have clear and accessible contact details, allowing clients to reach out for support or inquiries. The absence of such information raises questions about the company's credibility and operational legitimacy. Moreover, the website's design and content quality appear unprofessional, contributing to the overall impression that NYBOT Global Ltd may not be a trustworthy entity.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is paramount. NYBOT Global Ltd advertises various trading options, including forex pairs and other financial instruments. However, the overall fee structure and trading conditions remain unclear and potentially unfavorable.

| Fee Type | NYBOT Global Ltd | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies by broker |

| Overnight Interest Range | N/A | 0.5% - 1.5% |

The lack of specific information regarding spreads, commissions, and other trading costs makes it difficult for traders to assess the overall cost of trading with NYBOT Global Ltd. Moreover, several complaints from users indicate that they have encountered unexpected fees and difficulties when attempting to withdraw their funds. Such practices are often indicative of untrustworthy brokers and can lead to significant financial losses for traders.

Customer Fund Safety

The safety of customer funds is a crucial consideration when choosing a trading platform. NYBOT Global Ltd has not provided clear information regarding its fund security measures. The absence of details about fund segregation, investor protection, and negative balance protection policies raises serious concerns about the safety of client deposits.

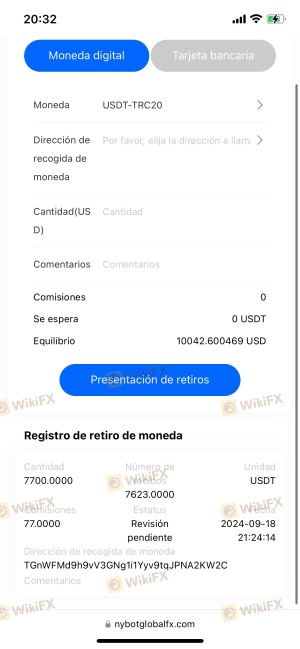

Investors should be particularly wary of platforms that do not clearly outline their policies regarding the protection of client funds. Historical reports indicate that users have faced issues with fund withdrawals, often citing delays and unresponsive customer support. Such problems are common among unregulated brokers and can be a strong indicator of fraudulent practices.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the credibility of a trading platform. Reviews and testimonials about NYBOT Global Ltd reveal a pattern of dissatisfaction among users. Common complaints include difficulty in withdrawing funds, unresponsive customer support, and aggressive marketing tactics.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Support | Medium | Slow response |

| Misleading Information | High | No acknowledgment |

For instance, several users have reported being unable to withdraw their funds after making deposits. In many cases, they were met with excuses or demands for additional payments before their withdrawal requests could be processed. This pattern of behavior is a significant red flag and suggests that NYBOT Global Ltd may engage in deceptive practices to retain clients' funds.

Platform and Execution

The performance of a trading platform is essential for a satisfactory trading experience. NYBOT Global Ltd claims to offer a user-friendly trading environment; however, reports from users suggest otherwise. Many have experienced issues with order execution, including slippage and rejected orders.

The platform's stability and reliability are crucial for traders, especially in a fast-paced market like forex. Any signs of manipulation or technical issues can severely impact trading outcomes. Unfortunately, the lack of transparency regarding the platform's operational capabilities raises concerns about its reliability.

Risk Assessment

Engaging with NYBOT Global Ltd presents various risks that potential investors should consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or license |

| Fund Safety Risk | High | Lack of transparency regarding fund security |

| Customer Service Risk | Medium | Reports of unresponsive support |

| Withdrawal Risk | High | Common complaints about withdrawal issues |

To mitigate these risks, potential investors should conduct thorough research and consider trading with regulated brokers that provide clear information about their operations, fees, and customer support.

Conclusion and Recommendations

Based on the evidence presented, it is clear that NYBOT Global Ltd exhibits several characteristics commonly associated with fraudulent trading platforms. The lack of regulatory oversight, transparency issues, and numerous customer complaints raise significant concerns about the safety and legitimacy of this broker.

For traders seeking reliable and secure trading experiences, it is advisable to avoid NYBOT Global Ltd and consider alternative options that are regulated and have a proven track record of customer satisfaction. Reputable brokers such as IG, OANDA, or Forex.com offer safer trading environments and better protection for investors. Always prioritize due diligence and research before committing your funds to any trading platform.

Is NYBOT Global Ltd a scam, or is it legit?

The latest exposure and evaluation content of NYBOT Global Ltd brokers.

NYBOT Global Ltd Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NYBOT Global Ltd latest industry rating score is 1.29, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.29 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.