nybot global ltd 2025 Review: Everything You Need To Know

1. Abstract

This article serves as an in-depth "nybot global ltd review" of a broker that has drawn significant negative attention in the market. Nybot Global Ltd claims to be a leader in overseas Chinese capital management. However, its lack of any recognized financial regulation and multiple user reports of deceptive trading conditions and transparency concerns cast serious doubts on its legitimacy. The broker, which purports to have been established in 2005 and is headquartered in London, appears to present embellished credentials aimed at luring unsuspecting investors.

Critical issues include the absence of any regulatory license from established financial authorities and widely reported concerns regarding its trading environment. These factors contribute to perceived fraud risks. Investors, particularly those with low risk tolerance or limited trading experience, are strongly advised to exercise extreme caution. This summary draws upon user feedback, regulatory information, and various financial reports that unanimously stress the high risks associated with engaging with this platform.

2. Notice

It is important to note that the legal protection available to investors varies significantly across different regions due to the broker's unregulated nature. This review is based solely on publicly available data, user reviews, and company background information. No on-site verification was conducted. Consequently, discrepancies between sources may exist, and certain operational details are either unclear or omitted from available reports.

Users should conduct further due diligence and seek independent advice before making any trading decisions involving Nybot Global Ltd. The analysis herein adheres strictly to the details provided in the available reports. However, several key operational aspects remain unspecified.

3. Scoring Framework

4. Broker Overview

Nybot Global Ltd claims to have been established in 2005, boasting a long-standing presence in the financial market. The company is headquartered in London. It positions itself as a prominent leader in overseas Chinese capital management. Despite these claims, several critical aspects raise red flags.

Transparency is severely lacking with incomplete details regarding its operational practices and regulatory status. The company appears to amplify its credentials, perhaps in a bid to attract investors who might otherwise be deterred by inexperienced brokers. Notably, the firm has not secured any authorization from recognized financial bodies. This fact should prompt concerns among potential clients. This "nybot global ltd review" relies heavily on available regulatory information and user evaluations which unanimously suggest that many aspects of the firm are designed more to impress on paper rather than operate with genuine financial integrity.

Delving deeper, the trading infrastructure of Nybot Global Ltd remains ambiguous in terms of its trading platform and available asset classes. No evidence has been provided that details the types of trading instruments on offer. This leaves investors largely in the dark regarding operational capabilities. The broker's promotional narrative emphasizes leadership in Chinese capital management; yet it omits crucial details that are standard in regulated environments, such as clear guidelines on trading conditions or client fund security.

The absence of any regulatory license further exacerbates concerns and underscores the possibility of risky or even deceptive practices. This "nybot global ltd review" underscores the need for extreme vigilance, especially for investors with lower risk tolerance. The operational framework and transparency issues significantly undermine trust.

-

Regulatory Regions: Nybot Global Ltd has not secured any licenses from internationally recognized regulatory bodies. The lack of approval from a credible financial authority means that investors receive minimal protection, regardless of their country of residence.

Deposit and Withdrawal Methods: Information regarding acceptable deposit and withdrawal methods is not mentioned in the available summaries.

Minimum Deposit Requirement: There is no available data on the minimum deposit required to open an account with Nybot Global Ltd.

Bonus Promotions: The broker has not disclosed any details or promotional bonuses aimed at attracting new traders.

Tradable Assets: The list of asset classes or trading instruments offered by Nybot Global Ltd is not provided in any official document or review. This leaves investors unaware of any potential opportunities.

Cost Structure: Essential cost elements such as spreads, commissions, and other related fees are conspicuously absent from the available information. The broker fails to detail any specific pricing structures. This makes it impossible for investors to assess potential trading costs effectively.

Leverage Options: Details regarding leverage ratios are not provided. This is a critical oversight given that leverage can substantially affect trading risk exposure.

Platform Selection: No mention is made of the specific trading platforms that the broker supports. Whether the platform is proprietary or powered by a well-known provider remains unclear.

Regional Restrictions: Information regarding any regional or jurisdictional limitations is not mentioned. Investors may face varying legal protections based on their location.

Customer Service Languages: There is no detail regarding the range of languages supported by Nybot Global Ltd's customer service team. This is particularly relevant for a broker claiming a global presence.

This section, as part of the "nybot global ltd review," clearly shows that key operational details are missing or inadequately addressed. As such, potential clients are left with numerous unanswered questions regarding the company's services and operational standards.

6. Detailed Scoring Analysis

6.1 Account Conditions Analysis

The account conditions offered by Nybot Global Ltd are shrouded in uncertainty. There is a notable absence of specific details regarding the types of accounts available, including the spreads, commissions, and minimum deposit requirements necessary to initiate trading.

Standard industry practices involve clear communication about leverage options and detailed account opening procedures, but in this case, the available information fails to provide such clarity. Users have expressed high levels of dissatisfaction due to the opaque nature of account setup and unspecified fee structures. This omission not only hampers the investor's ability to make informed decisions but also raises further concerns about the broker's operational transparency.

Compared to established brokers, the complete lack of disclosure is alarming and contributes heavily to the unfavorable score of 1/10. The negative user feedback specifically criticizes the uncertainty surrounding the account opening process and associated costs. Numerous reports from independent sources suggest that the absence of detailed account conditions might be a deliberate tactic to obscure potential hidden fees or unfavorable terms.

Overall, the account conditions remain a critical concern, rendering this aspect of the broker extremely risky for potential investors.

In terms of tools and resources, Nybot Global Ltd falls considerably short of industry standards. The review highlights that there is a notable lack of information regarding the trading platforms, analytical tools, and educational resources available to users.

There is no mention of a reliable trading platform, nor are there details regarding research tools which are typically vital for making informed trading decisions. The absence of any automated trading features or in-depth market analysis tools further diminishes the broker's value proposition. Users frequently reported that the lack of clear and functional trading tools compromises the overall experience, making it unlikely to cater to even moderately experienced traders.

Without adequate resources, investors face significant difficulties in executing trades, managing risks, or staying abreast of market movements. This ambiguity in available tools effectively leaves clients ill-equipped and contributes to the overall low score of 1/10. When compared to other established brokers, the deficit in crucial resources is glaring and reflects poorly on the firm's operational capabilities.

As emphasized in this "nybot global ltd review," the absence of fundamental trading support tools poses an unacceptable risk to any potential investor.

6.3 Customer Service and Support Analysis

Customer service remains one of the most critical factors for any brokerage, but in the case of Nybot Global Ltd, this component is heavily lacking. Reports and user testimonials consistently describe the customer support as unresponsive and insufficiently attentive.

The absence of details regarding available support channels such as live chat, telephone lines, or email communication only compounds the issue. Customers have remarked on long waiting times and inadequate responses when seeking assistance with account or transaction issues. Moreover, there is no evidence that the broker offers support in multiple languages, which is a considerable disadvantage for an institution with purported international aspirations.

This lack of dedicated and effective customer care undermines client confidence and directly impacts the overall trading experience. The inadequate service quality, paired with the ambiguous support structure, justifies the low score of 2/10 in this area. In summary, the inadequacies in customer service, as highlighted through numerous complaints and critical evaluations, significantly detract from the broker's credibility and operational integrity.

6.4 Trading Experience Analysis

The overall trading experience provided by Nybot Global Ltd appears extremely problematic based on user feedback and the sparse operational details available. Users report that the trading environment is unstable, with numerous concerns regarding order execution.

The platform lacks any verifiable details related to latency, order slippage, or re-quotes—features that are essential for a reliable trading experience. Additionally, the absence of detailed information about the platform's functionality leaves investors without sufficient insight into whether they can conduct trades efficiently. Reports indicate that the trading conditions might be deliberately structured in a way that increases the risk exposure of traders, potentially contributing to experiences typical of fraudulent schemes.

Given these concerns, the overall trading experience has been rated very poorly, with a score of only 1/10. The negative user feedback describing a compromised and untrustworthy trading environment reinforces the conclusion that the platform does not meet industry standards. This analysis is consistent with the various negative reviews noted in this "nybot global ltd review," where traders cite severe issues pertaining to the execution quality and platform stability.

6.5 Trustworthiness Analysis

Trustworthiness is paramount in the financial services industry, yet Nybot Global Ltd falls dramatically short in this respect. The broker has not been granted any license or regulatory oversight from a recognized financial authority, a fact that immediately raises significant red flags.

Investors must note that the absence of such regulatory control means there is minimal recourse in the event of mismanagement or fraud. User feedback and multiple independent reports have consistently warned about the potential for deceptive practices, categorizing the platform as a likely investment scam. Moreover, the company's overall transparency is deeply compromised; critical details regarding fund security, client asset protection, and operational protocols remain undisclosed.

As a direct result of these factors, the trustworthiness rating for Nybot Global Ltd stands at a dismal 1/10. Risk-averse investors and those with low tolerance for uncertainty are highly discouraged from engaging with the platform. This analysis unmistakably echoes many of the concerns articulated in various sources, underscoring the severe limitations in investor protection measures.

6.6 User Experience Analysis

The user experience offered by Nybot Global Ltd is fraught with numerous issues that are consistently highlighted in various reviews. Overall satisfaction among users is extremely low, largely due to the complete lack of transparency and well-detailed operational aspects.

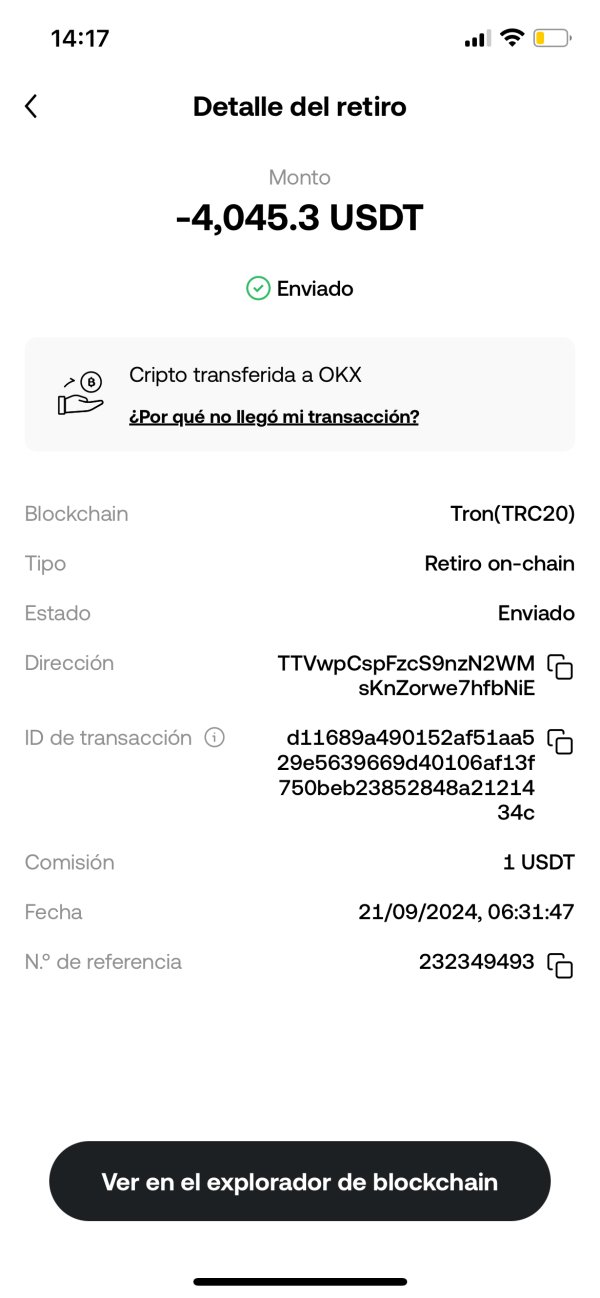

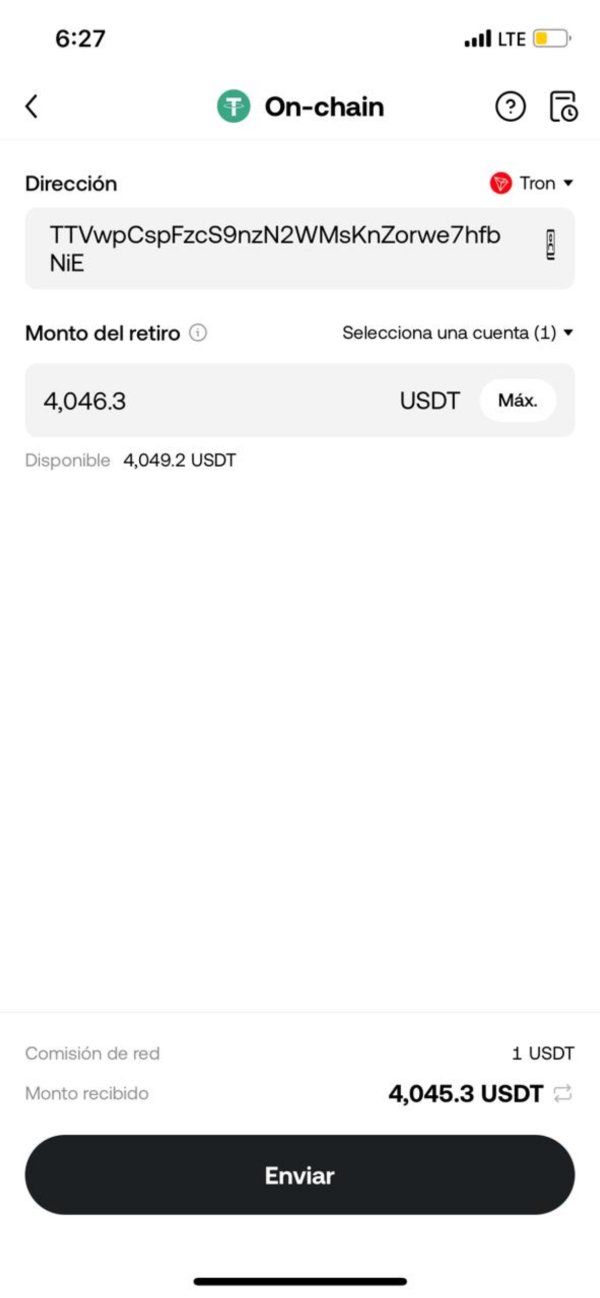

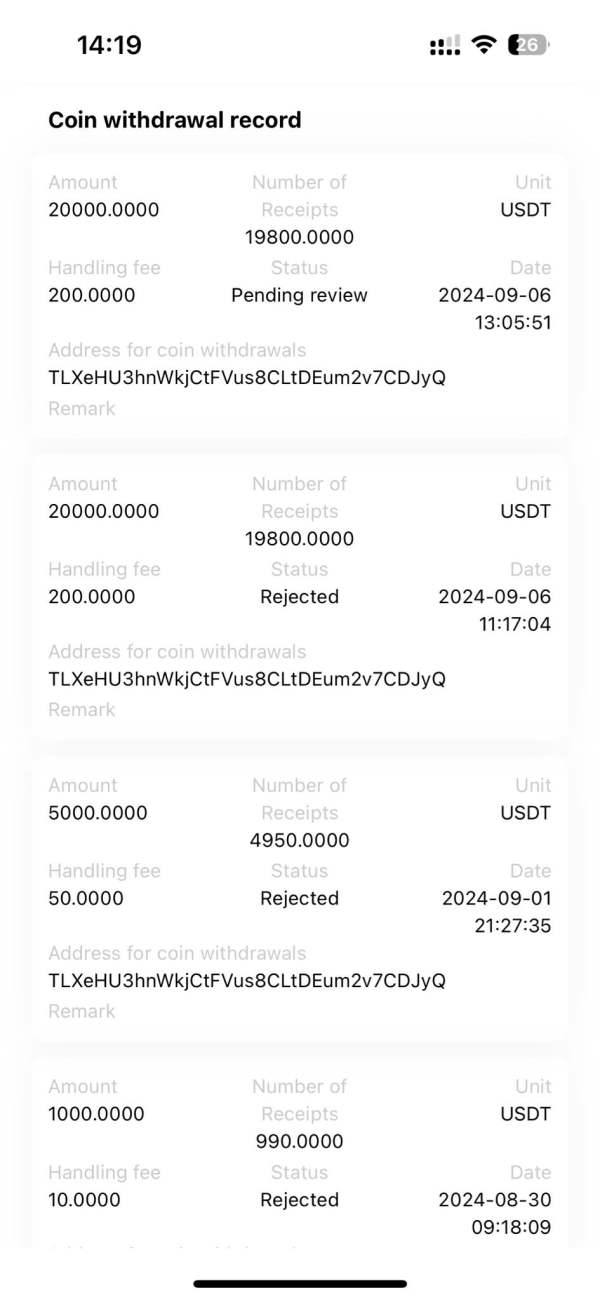

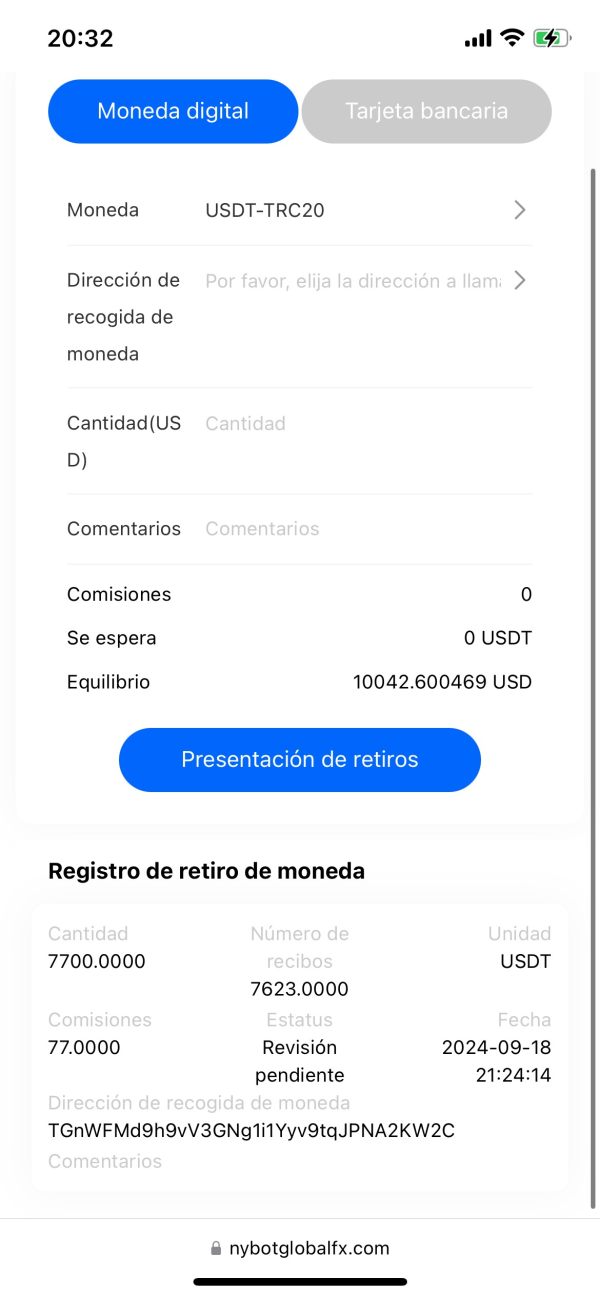

Investors frequently express frustration over the ambiguous registration and verification processes, which hint at potential underlying inefficiencies or intentional misdirection. Moreover, difficulties related to fund management and a complicated withdrawal process have been repeatedly mentioned, contributing to the negative overall sentiment. The platform's design and ease of use, which are critical for an effective trading experience, appear to fall short when compared to other brokers in the industry.

With commonplace complaints about unclear instructions and a lack of readily available support during crucial moments, users have rated the overall experience a low 2/10. This analysis reinforces the prevailing view that Nybot Global Ltd provides a user experience that is significantly below industry standards. In this "nybot global ltd review," the cumulative negative feedback reflects a platform that is not only inefficient but also dangerously misleading for potential investors.

7. Conclusion

In summary, Nybot Global Ltd poses substantial risks for investors, as evidenced by the lack of regulatory oversight, minimal transparency, and consistently negative user feedback. This "nybot global ltd review" clearly highlights significant deficiencies in essential operational areas, including account conditions, available trading tools, customer support, and overall trustworthiness.

For those with low risk tolerance or limited trading experience, engaging with Nybot Global Ltd is highly discouraged. The absence of detailed, reliable information coupled with numerous red flags suggests that investors should explore more reputable and transparent alternatives. Exercise extreme caution and conduct thorough due diligence before considering any investments with this broker.