Is MICFX safe?

Pros

Cons

Is Micfx Safe or a Scam?

Introduction

Micfx is an online forex broker that has gained attention in the trading community for its claims of offering a diverse range of trading instruments, including forex, cryptocurrencies, and commodities. Positioned as a platform for both novice and experienced traders, Micfx has attracted users with its promises of high leverage and competitive spreads. However, the importance of thoroughly evaluating forex brokers cannot be overstated. The forex market is rife with unregulated entities that can jeopardize traders' funds, making it essential for investors to conduct proper due diligence before engaging with any broker. This article aims to investigate whether Micfx is a legitimate trading platform or a scam by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its safety and legitimacy. In the case of Micfx, the broker claims to be regulated by the St. Vincent and the Grenadines Financial Services Authority (SVG FSA). However, upon further investigation, it becomes evident that Micfx does not hold a valid license from any reputable regulatory body. The absence of regulation raises significant concerns regarding the safety of traders' funds and the broker's accountability.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SVG FSA | N/A | St. Vincent and the Grenadines | Not Validated |

The lack of a legitimate regulatory framework means that Micfx operates offshore, which typically subjects traders to higher risks. Regulatory bodies like the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC) impose strict guidelines to protect traders, including fund segregation and negative balance protection. The absence of such measures at Micfx raises serious questions about the safety of funds deposited with this broker. Therefore, the answer to whether Micfx is safe leans toward a negative conclusion.

Company Background Investigation

Micfx is operated by Multi Investment Company Ltd., which claims to be based in St. Vincent and the Grenadines. The company was reportedly founded in 2020, making it a relatively new player in the forex market. The lack of transparency regarding the company's ownership and management team is concerning. There is minimal publicly available information about the individuals behind Micfx, which complicates any assessment of their expertise or credibility.

A reputable broker typically provides detailed information about its management team, including their professional backgrounds and experience in the financial industry. In contrast, Micfx's website lacks such disclosures, leading to further skepticism about its operations. The absence of transparency is a red flag, implying that potential investors may not have sufficient information to make informed decisions. Thus, when assessing whether Micfx is safe, the company's lack of transparency and regulation raises significant concerns.

Trading Conditions Analysis

Micfx advertises various trading conditions, including high leverage ratios of up to 1:200 and competitive spreads. However, it is essential to scrutinize the overall fee structure and any potential hidden costs that may arise. The absence of a clearly stated minimum deposit requirement is also a point of concern, as it leaves traders uncertain about the initial investment needed to start trading.

| Fee Type | Micfx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 pips | 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While the advertised spreads appear attractive, the lack of clarity on commissions and overnight interest rates suggests that Micfx may not be fully transparent about its trading costs. Traders may find themselves facing unexpected fees that could erode their profits. Consequently, the overall trading conditions at Micfx do not inspire confidence, further questioning whether Micfx is safe for investors.

Customer Funds Safety

The safety of customer funds is paramount when evaluating any trading platform. Micfx claims to implement various measures to ensure the security of traders' funds, but the lack of regulatory oversight raises concerns about the effectiveness of these measures. Notably, there is no information available regarding fund segregation, which is a crucial practice that separates client funds from the broker's operational funds to protect against insolvency.

Additionally, the absence of investor protection schemes, such as those provided by regulated brokers, increases the risk associated with trading on Micfx. Without these safeguards, traders may find it challenging to recover their funds in the event of a dispute or broker misconduct. Given these factors, it is reasonable to conclude that Micfx is not safe for traders who prioritize the security of their investments.

Customer Experience and Complaints

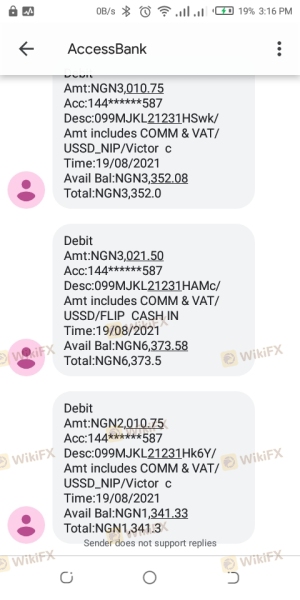

Customer feedback is invaluable in assessing the reliability of a broker. Reviews and testimonials about Micfx indicate a pattern of dissatisfaction among users. Common complaints include difficulty in withdrawing funds, lack of responsive customer support, and issues with account verification. These complaints highlight potential operational flaws within the broker's infrastructure.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Verification Delays | High | Poor |

For example, several users have reported that their withdrawal requests were delayed for extended periods, leading to frustration and financial strain. Such experiences are alarming and suggest that Micfx may not prioritize customer service or fund accessibility. Therefore, the evidence points towards a negative conclusion regarding whether Micfx is safe for traders.

Platform and Execution

The trading platform offered by Micfx is based on the widely-used MetaTrader 4 (MT4), which is known for its robust features and user-friendly interface. However, the platform's performance, stability, and execution quality must be evaluated to determine its reliability. Reports of slippage, order rejections, and execution delays have surfaced, indicating potential issues with trade execution.

Moreover, the absence of a transparent mechanism for resolving execution-related disputes raises concerns about the broker's commitment to fair trading practices. Without clear evidence of effective trade execution and customer support, it becomes increasingly difficult to assert that Micfx is safe for traders.

Risk Assessment

Using Micfx as a trading platform presents several risks that traders should be aware of. The lack of regulation, transparency, and customer support contributes to an overall high-risk profile. Additionally, the broker's operational practices may expose traders to potential fraud and financial loss.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid license |

| Fund Safety | High | Lack of segregation |

| Customer Support | Medium | Poor responsiveness |

To mitigate these risks, traders are advised to conduct thorough research before investing, consider using regulated brokers, and remain vigilant about their account activities. The overall assessment suggests that Micfx is not a safe option for traders seeking a secure and reliable trading environment.

Conclusion and Recommendations

In conclusion, the investigation into Micfx reveals multiple red flags that indicate it may not be a safe trading platform. The absence of regulation, lack of transparency, and numerous customer complaints raise significant concerns about the broker's legitimacy. Traders are strongly advised to exercise caution and consider alternative options that offer better regulatory oversight and customer support.

For those seeking reliable trading platforms, it is recommended to explore brokers that are regulated by reputable authorities, such as the FCA or ASIC. These brokers not only provide a safer trading environment but also prioritize customer service and fund protection. Ultimately, while Micfx may present itself as a viable trading option, the evidence suggests that it is best approached with caution, as Micfx is not safe for the average trader.

Is MICFX a scam, or is it legit?

The latest exposure and evaluation content of MICFX brokers.

MICFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MICFX latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.