MICFX Review 1

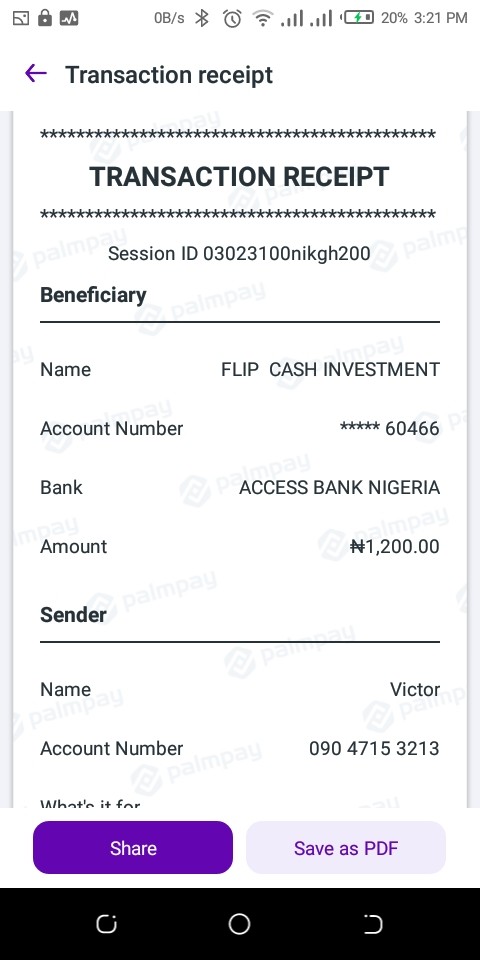

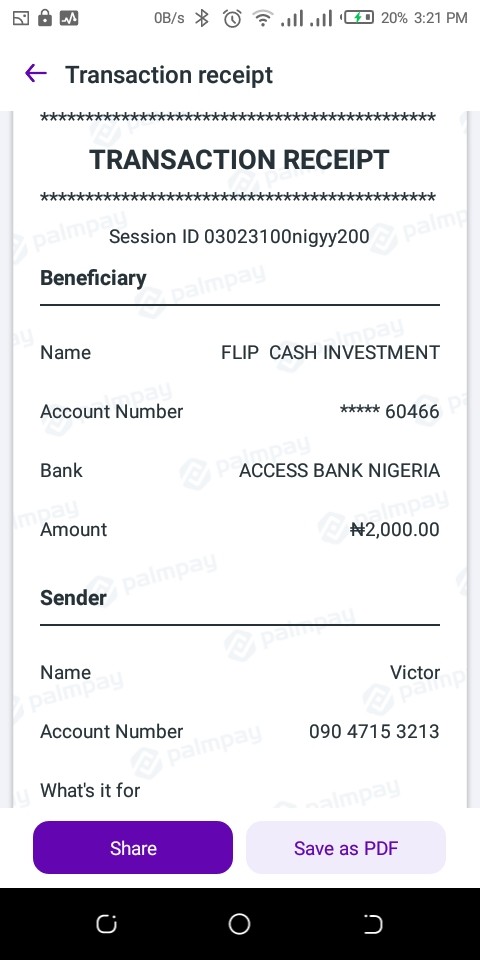

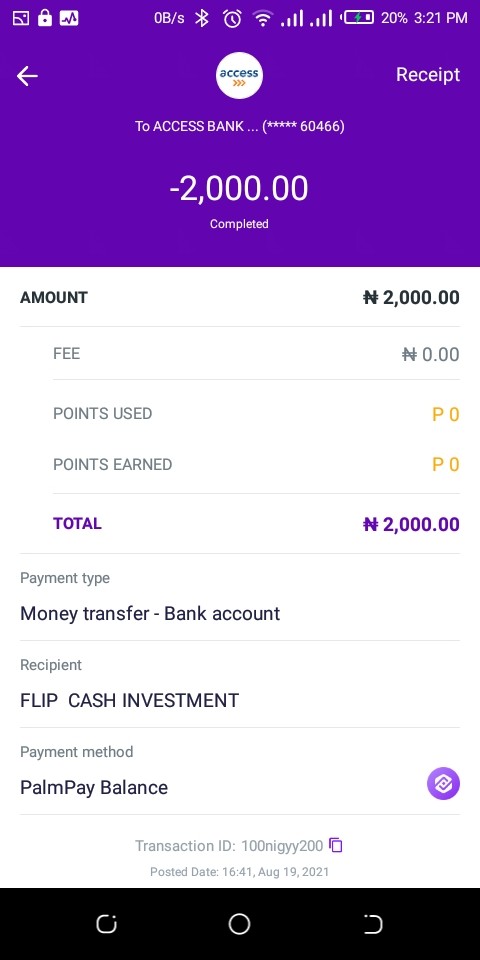

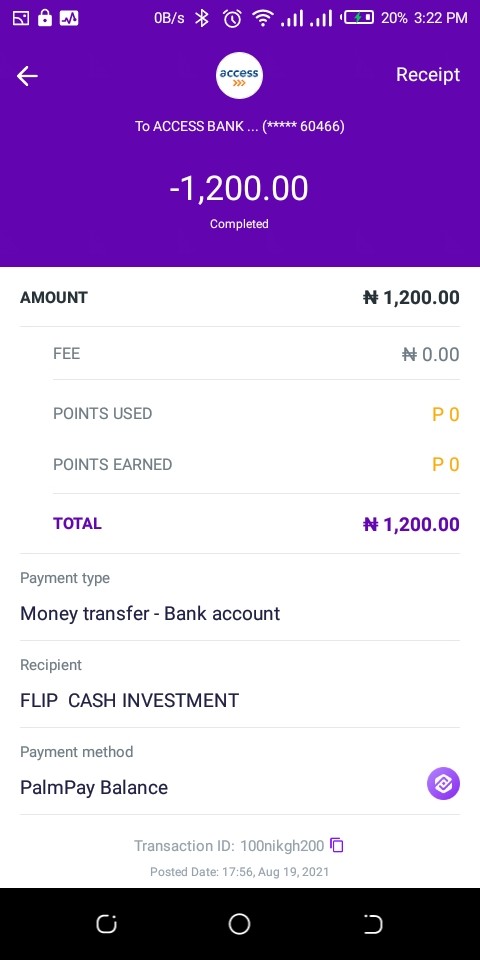

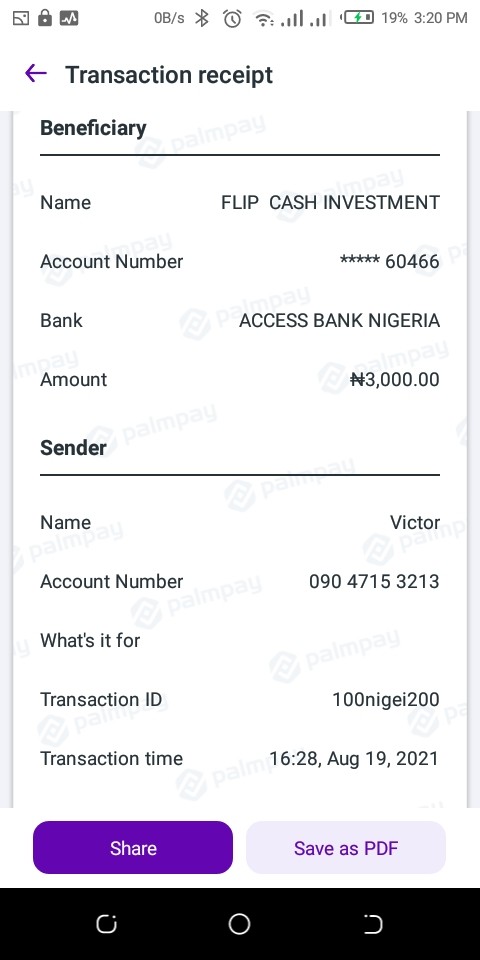

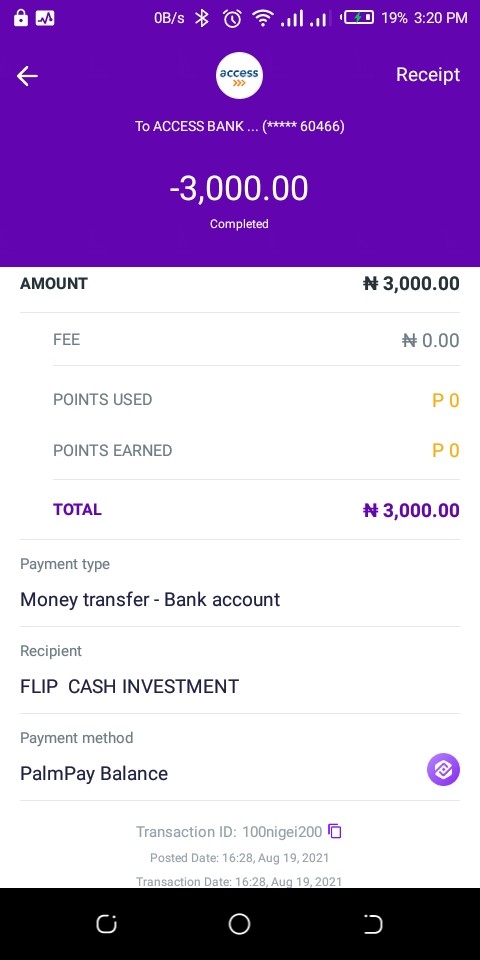

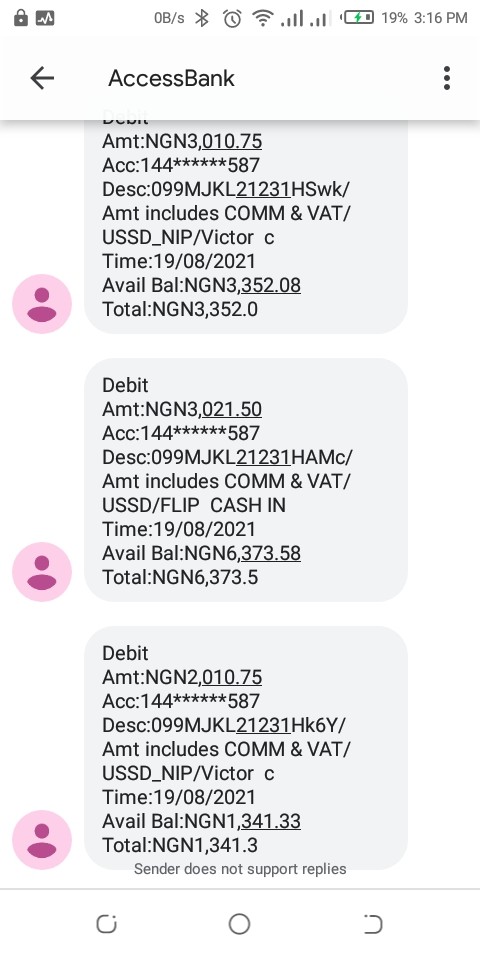

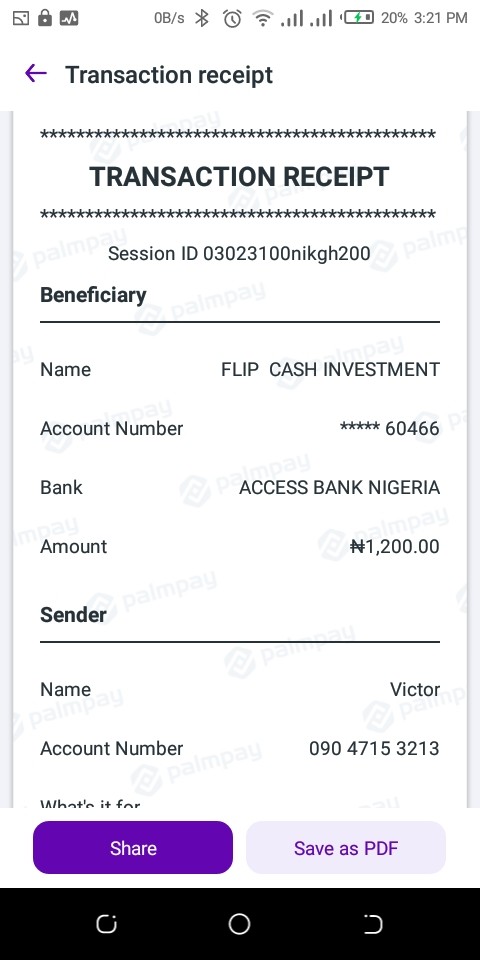

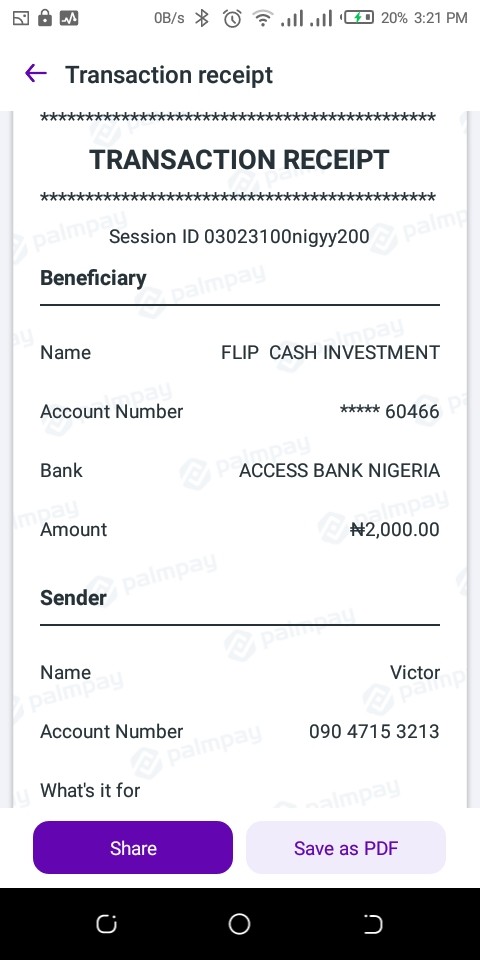

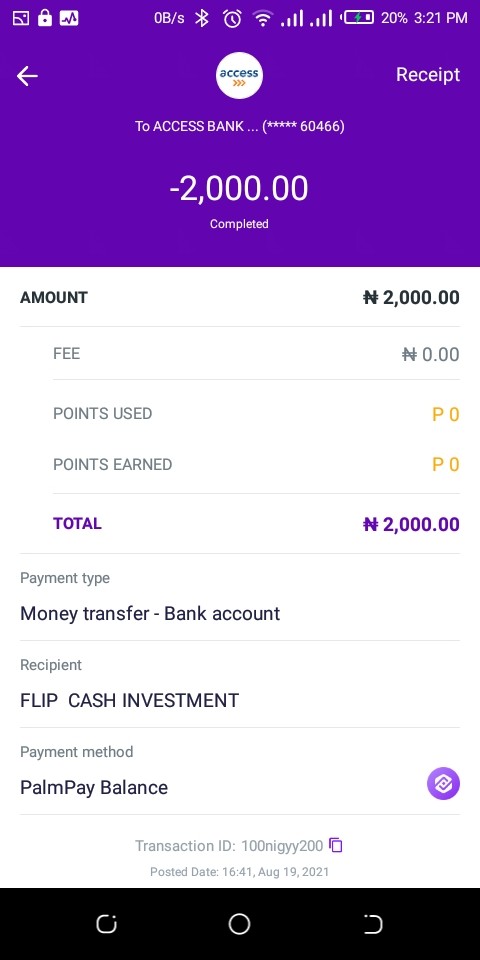

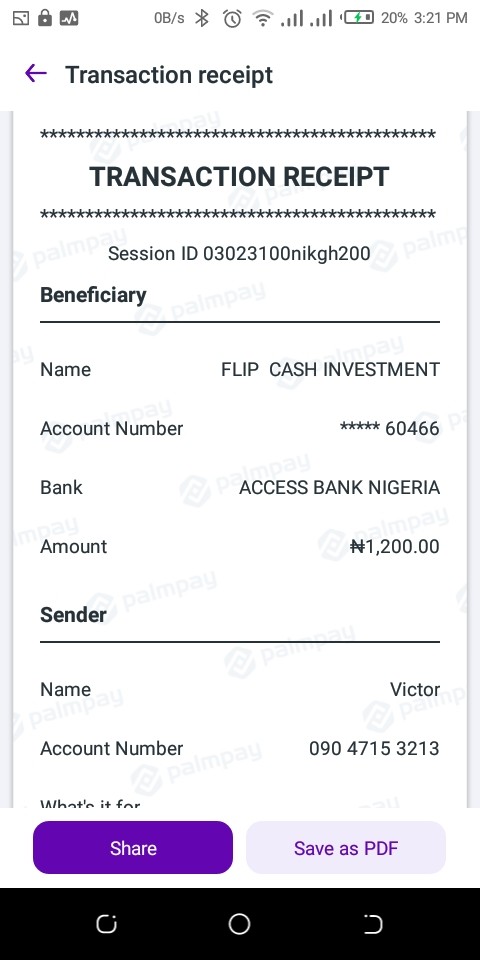

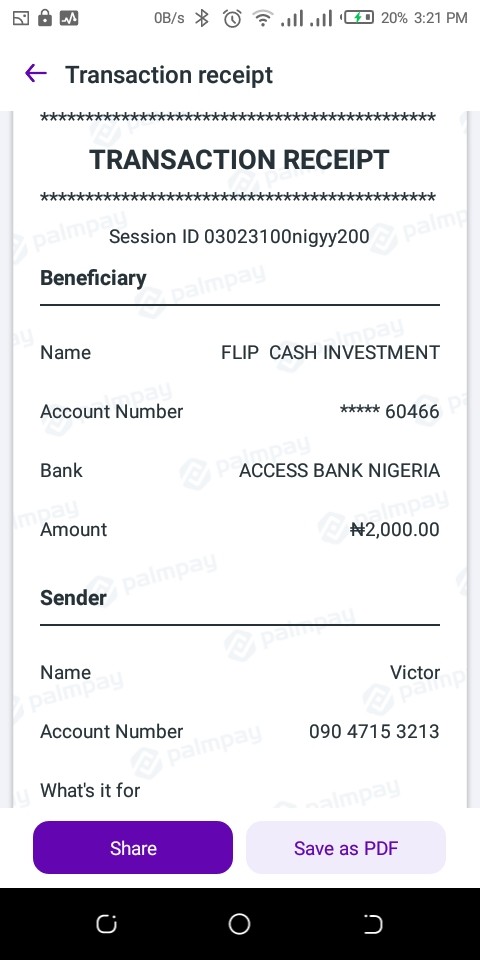

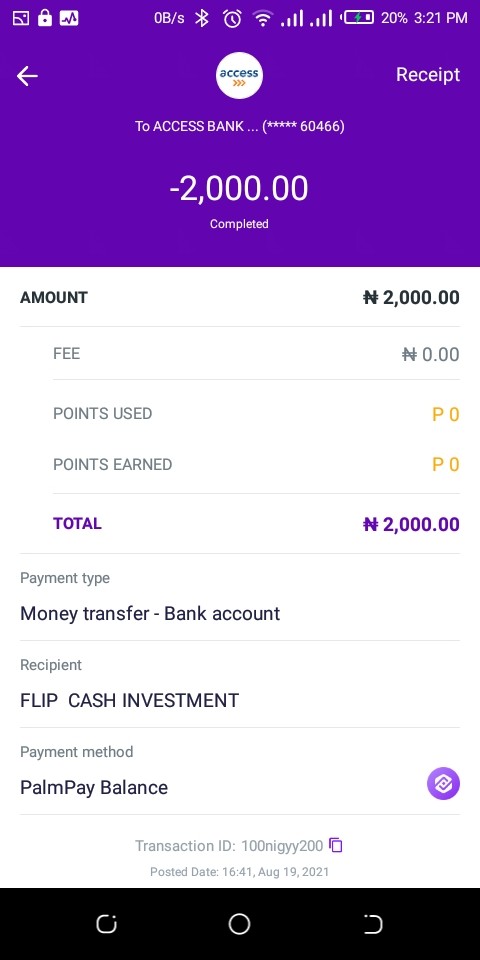

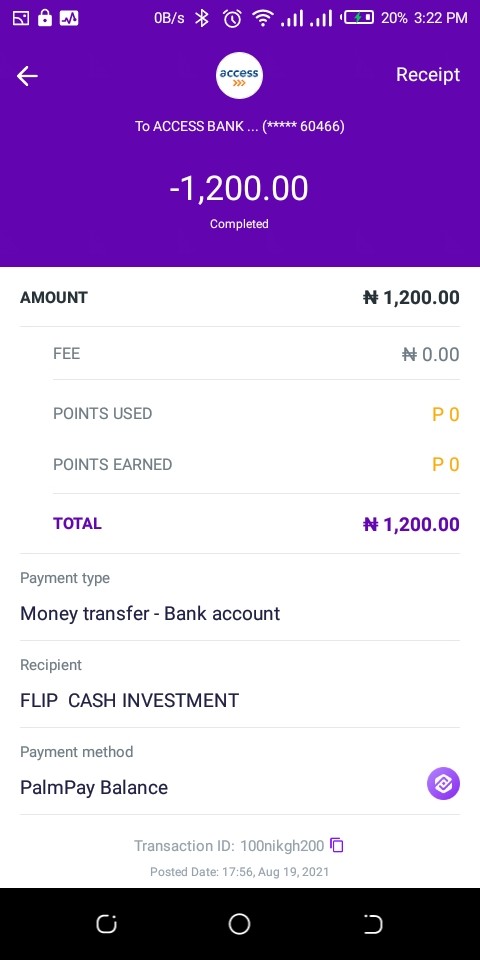

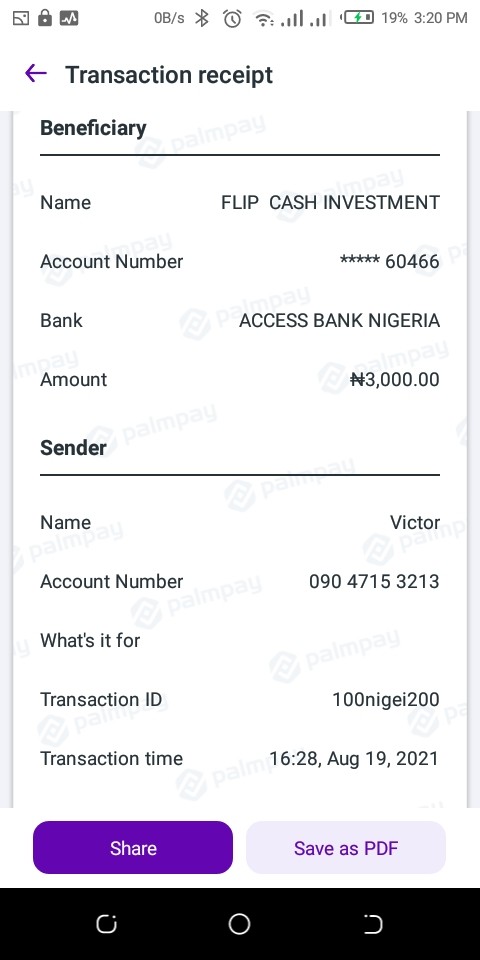

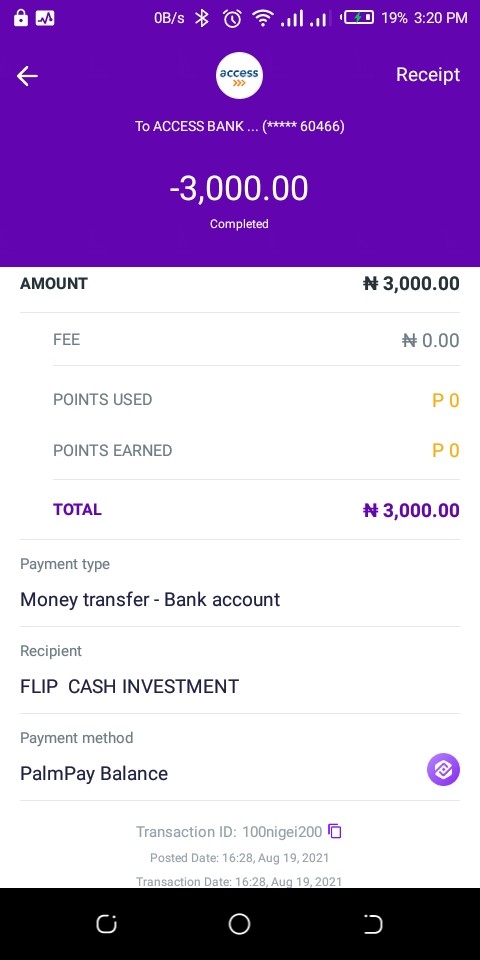

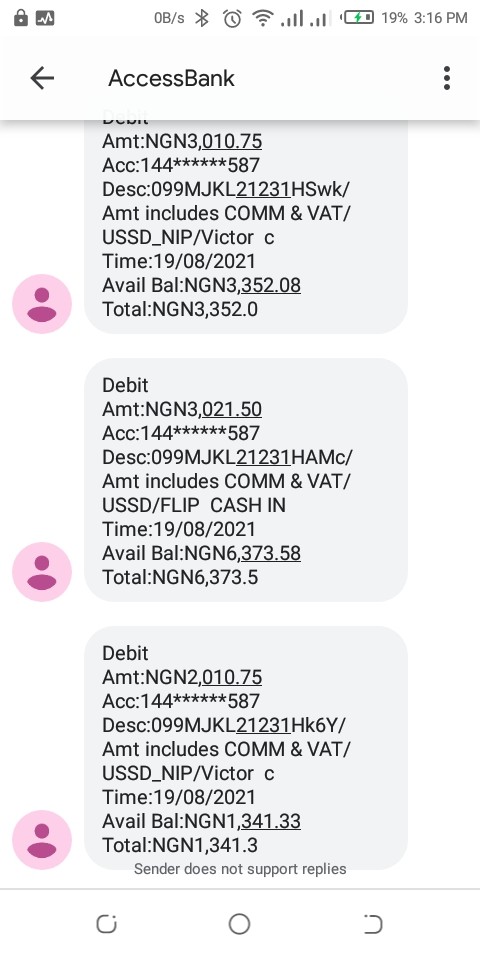

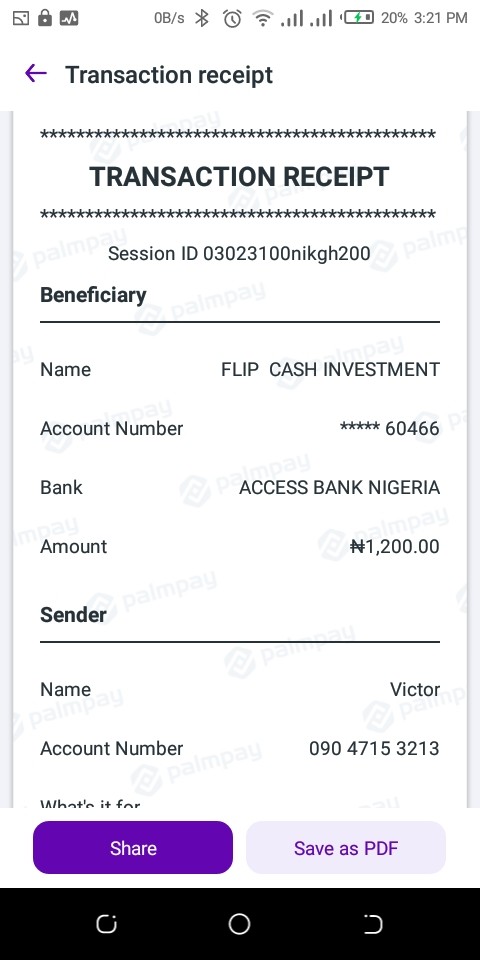

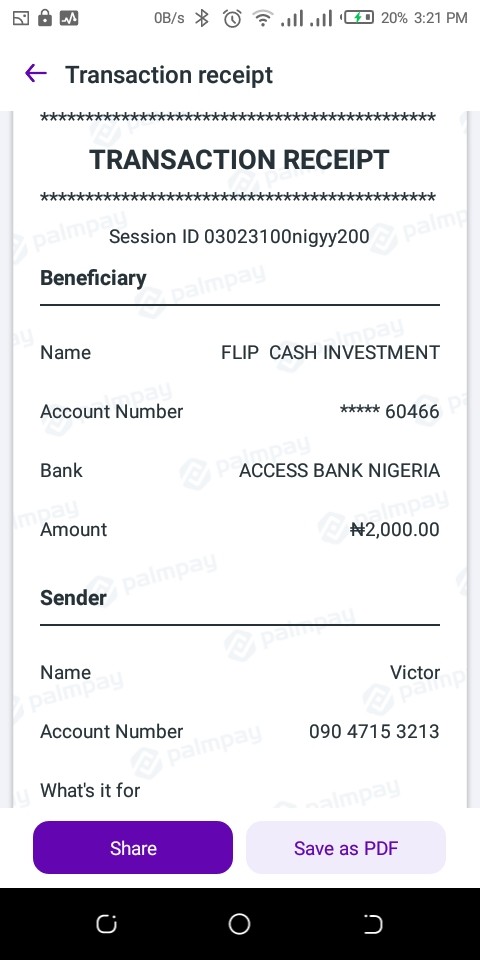

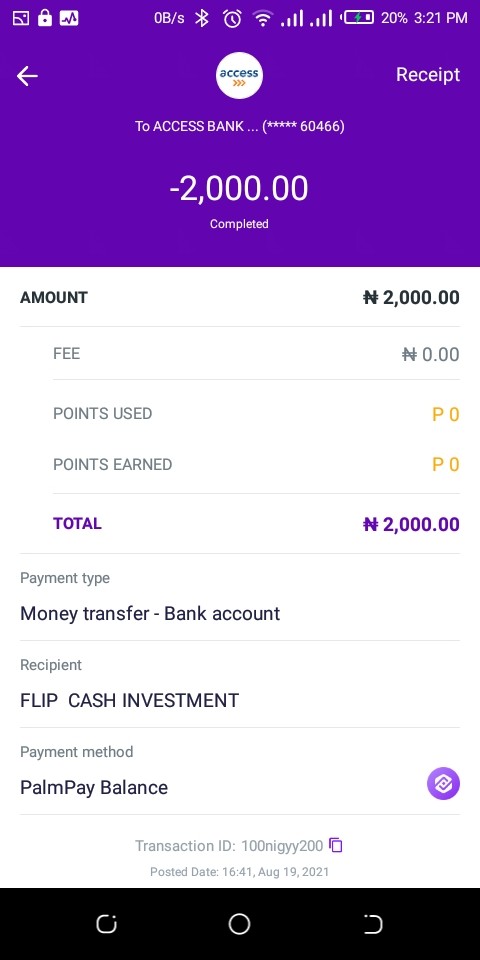

I used part of my school fees money to invest in flip cash and they blocked me and never paid me till now

MICFX Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I used part of my school fees money to invest in flip cash and they blocked me and never paid me till now

Micfx has emerged as a controversial player in the forex brokerage landscape, with numerous reviews indicating significant concerns regarding its legitimacy and operational practices. While the broker claims to offer a robust trading platform and a variety of account types, many sources highlight serious red flags, including unregulated status and questionable customer service experiences. This review synthesizes available insights to provide a comprehensive overview of Micfx, helping potential investors make informed decisions.

Note: It is crucial to be aware that Micfx operates under various entities in different jurisdictions, which can complicate the regulatory landscape. This review aims for fairness and accuracy by relying on credible sources.

| Category | Rating (out of 10) |

|---|---|

| Account Conditions | 2 |

| Tools and Resources | 3 |

| Customer Service and Support | 1 |

| Trading Experience | 2 |

| Trustworthiness | 1 |

| User Experience | 2 |

We assess brokers based on a combination of user feedback, expert analysis, and factual data.

Micfx, established in 2020, is operated by Multi Investment Company Ltd, which claims to be based in Saint Vincent and the Grenadines. The broker primarily offers trading services via the popular MetaTrader 4 (MT4) platform, catering to various asset classes, including forex, commodities, indices, and cryptocurrencies. However, despite its claims of being regulated by the SVG Financial Services Authority (SVG FSA), several reviews indicate that Micfx lacks a valid regulatory license, raising significant concerns about its trustworthiness.

Micfx claims to be regulated by the SVG FSA, yet multiple sources have pointed out that it does not hold any valid financial services license. This lack of regulation poses a considerable risk to traders, as unregulated brokers often lack accountability and may engage in fraudulent practices. According to Topedgefx, "Micfx can only be described as a new broker whose trust rating is so poor that we wouldnt want to recommend or even include them in our list of the most trustworthy investing services."

Micfx offers limited information regarding its deposit and withdrawal methods, which is a significant red flag. Reports indicate that deposits can be made through various methods, including credit/debit cards and cryptocurrencies. However, the lack of clarity on withdrawal processes raises concerns. Users have reported difficulties in accessing their funds, with some claiming that withdrawal requests are either delayed or outright denied, further solidifying the broker's negative reputation.

The minimum deposit requirement for opening an account with Micfx remains unclear across various reviews. This ambiguity can deter potential traders who seek transparency in their investment commitments. According to Global Fraud Protection, "the minimum deposit hasnt been disclosed, which is a huge red flag."

Micfx has been noted for offering enticing bonuses and promotions, such as deposit bonuses ranging from 30% to 100%. However, many experts warn that these bonuses often come with stringent conditions that can trap traders into making further deposits. According to Valforex, "the platform will hold your withdrawal request until you pay back the full bonus or promotion amount," indicating that these promotions may serve more as a means to retain funds rather than genuinely reward traders.

Micfx advertises spreads starting from 1.0 pips, but the lack of clarity regarding commissions and additional fees raises questions about the overall cost of trading. Many reviews describe the trading environment as unfavorable, with hidden costs that can erode potential profits. As noted by Premium Recoup, "most likely, they will take away your hard-earned money and have no regulatory body to hold them accountable."

Micfx primarily operates on the MT4 platform, a widely recognized trading software favored by many traders for its robust features and user-friendly interface. However, the absence of a demo account option raises concerns, as potential users cannot test the platform before committing real funds.

Micfx appears to restrict users from certain regions, particularly the United States, which can limit its potential customer base. This restriction aligns with the broker's unregulated status, as many regulated brokers accept clients from a broader range of jurisdictions.

Customer service at Micfx has been widely criticized, with numerous reports of poor support experiences. Users have described the support team as unresponsive and lacking in helpfulness. According to Fxmerge, "customer support is very rude and bad," which is a significant concern for traders who may require assistance during their trading activities.

| Category | Rating (out of 10) |

|---|---|

| Account Conditions | 2 |

| Tools and Resources | 3 |

| Customer Service and Support | 1 |

| Trading Experience | 2 |

| Trustworthiness | 1 |

| User Experience | 2 |

In conclusion, the Micfx review paints a concerning picture of a broker that lacks transparency, regulatory oversight, and reliable customer support. Potential traders should exercise extreme caution and consider alternative, well-regulated brokers to ensure the safety of their investments.

FX Broker Capital Trading Markets Review