Macro Markets 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive macro markets review provides an in-depth analysis of Macro Markets. Macro Markets is an online forex brokerage platform that operates under the Macro Group umbrella since 2010. Based on available user feedback and public information, Macro Markets presents a mixed profile in the competitive forex trading landscape.

The company has headquarters in Sydney, Australia. The company has maintained operations for over a decade, which suggests institutional stability. According to available data, Macro Markets holds regulatory licenses across multiple jurisdictions including Australia, Seychelles, and Hong Kong. This provides a degree of regulatory oversight. User satisfaction appears moderate. Employee reviews indicate general satisfaction with the work environment.

However, this macro markets review reveals significant transparency concerns. These concerns particularly involve trading conditions, platform specifications, and fee structures. The brokerage primarily targets forex traders and investors seeking online trading opportunities. However, detailed service offerings remain unclear from available sources. Potential clients should exercise caution due to limited publicly available information about specific trading terms and some user concerns regarding operational practices.

Important Notice

Regional Entity Differences: Macro Markets operates through multiple regulatory jurisdictions including Australia, Seychelles, and Hong Kong. Regulatory protection levels and oversight standards may vary significantly between these regions. Clients should verify which entity they are dealing with. They should also understand the applicable regulatory framework for their specific situation.

Review Methodology: This evaluation is based on publicly available information and user feedback compiled from various sources. Due to limited detailed information about specific trading conditions and services, some aspects of this review may be incomplete. Prospective clients are strongly advised to conduct independent verification of all trading terms and conditions before opening an account.

Rating Framework

Broker Overview

Company Background and Establishment

Macro Markets operates as an online brokerage platform under the Macro Group. The Macro Group was established in 2010 with headquarters located in Sydney, Australia. According to available information, Macro Group has undergone steady development over more than a decade. The company has expanded its operations to include multiple subsidiaries. The group structure encompasses Macro Global, Macro Markets, and Macro Bullion. This indicates a diversified approach to financial services within the organization.

The company's longevity in the market suggests a degree of operational stability. The company has navigated various market conditions since its inception. As part of the broader Macro Group ecosystem, Macro Markets benefits from the parent company's established infrastructure and regulatory relationships across multiple jurisdictions.

Regulatory Framework and Business Operations

Macro Group, including its Macro Markets subsidiary, maintains regulatory licenses across several key financial jurisdictions. The company legally holds financial regulatory authorizations in Australia, Seychelles, Hong Kong, and other locations. This provides a multi-jurisdictional regulatory framework. This macro markets review notes that while multiple regulatory licenses can provide broader market access, the varying standards between jurisdictions may result in different levels of client protection depending on the specific entity and region of operation.

The primary business focus appears to center on forex trading services. However, specific details about additional asset classes or trading instruments remain limited in available public information. The company's operational model and specific service offerings require further clarification for potential clients seeking comprehensive trading solutions.

Regulatory Jurisdictions: Macro Markets operates under licenses from financial regulatory authorities in Australia, Seychelles, and Hong Kong. The multi-jurisdictional approach provides market access across different regions. However, clients should verify which specific entity and regulatory framework applies to their account.

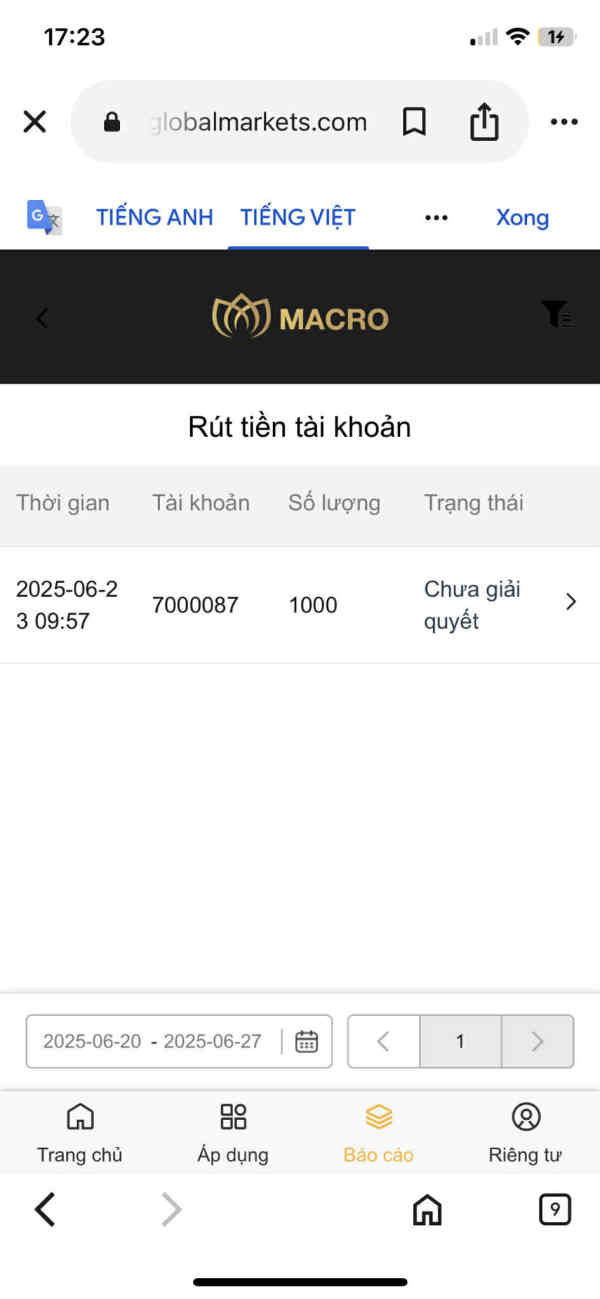

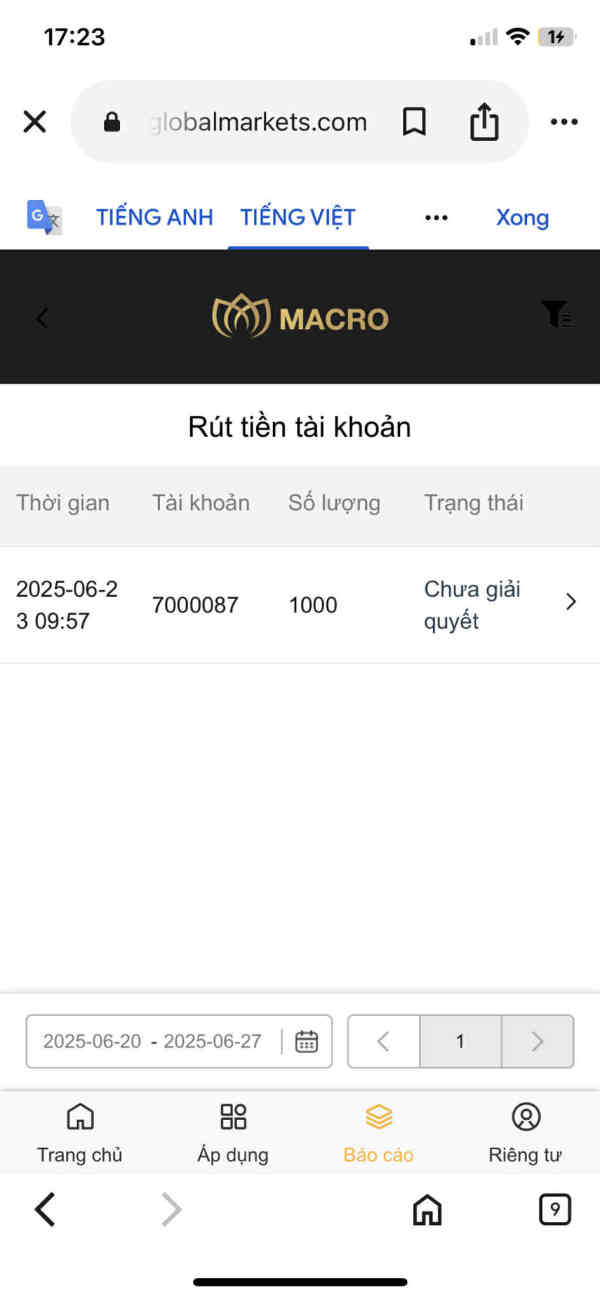

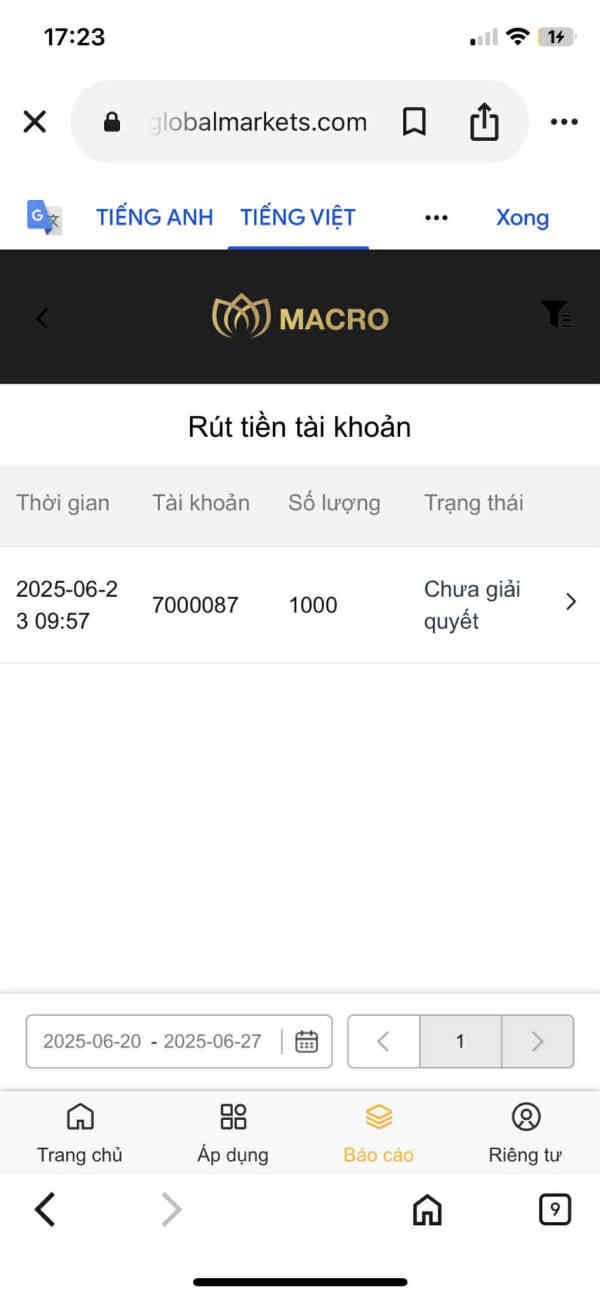

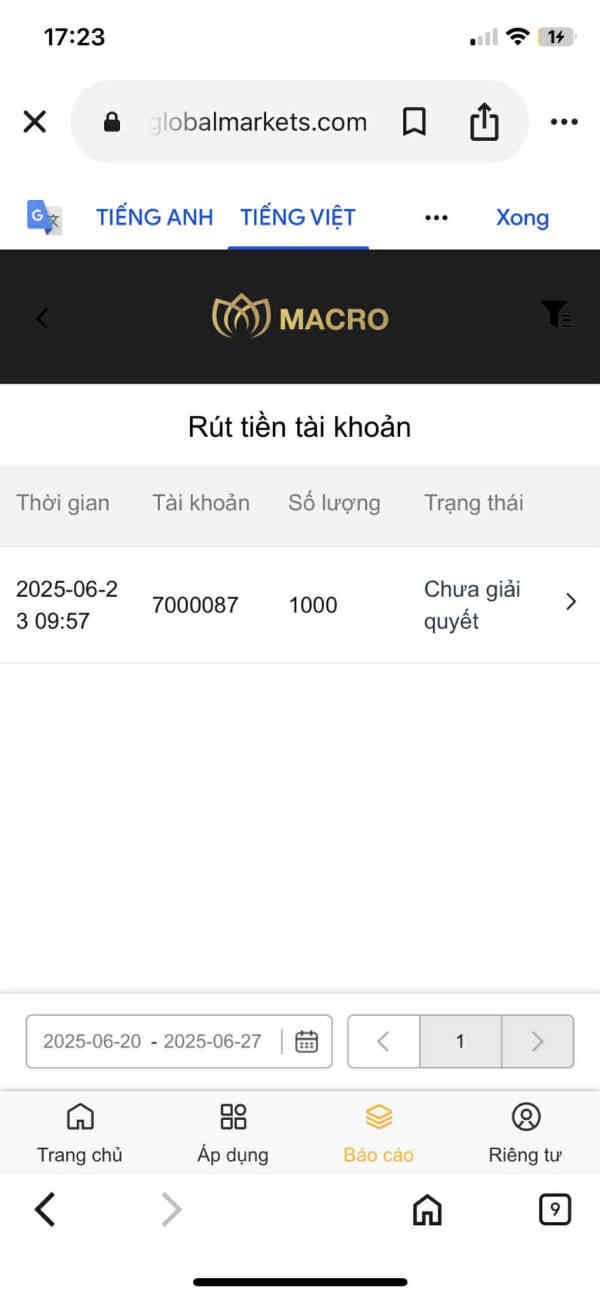

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods has not been detailed in available sources. Prospective clients should inquire directly about supported payment methods, processing times, and any associated fees.

Minimum Deposit Requirements: The minimum deposit requirement for opening an account with Macro Markets is not specified in available documentation. This represents a significant information gap that potential clients need to address through direct inquiry.

Promotional Offers: Details about current bonus programs, promotional offers, or account incentives are not mentioned in available sources. The absence of promotional information may indicate either a conservative approach to marketing or limited public disclosure of such programs.

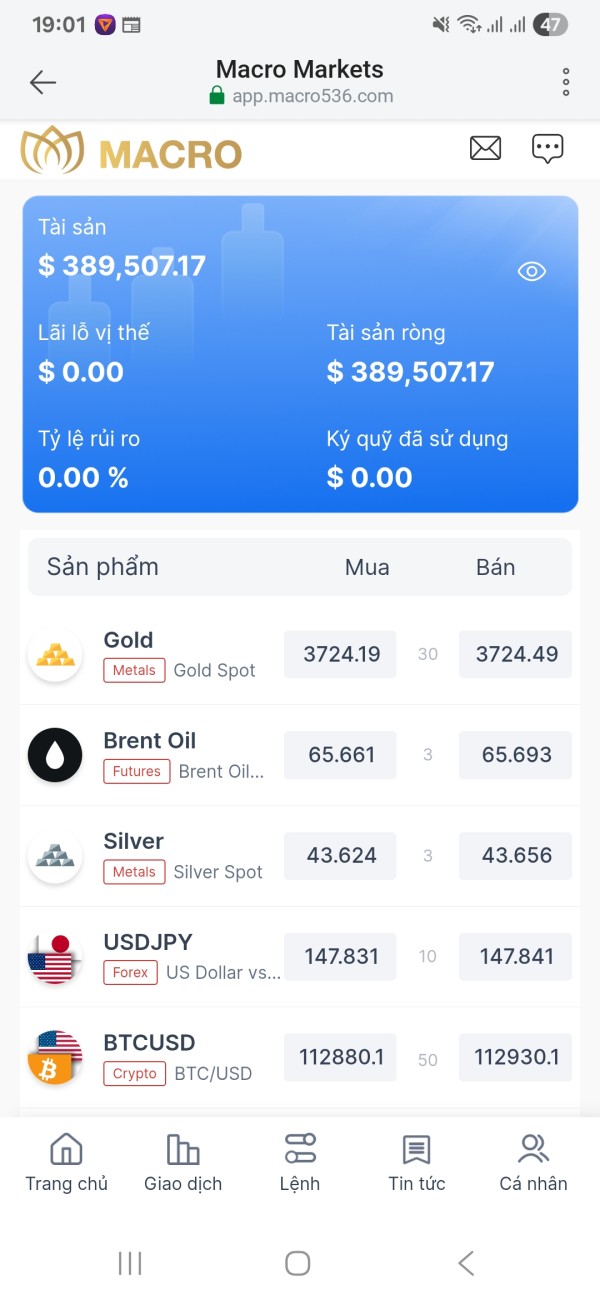

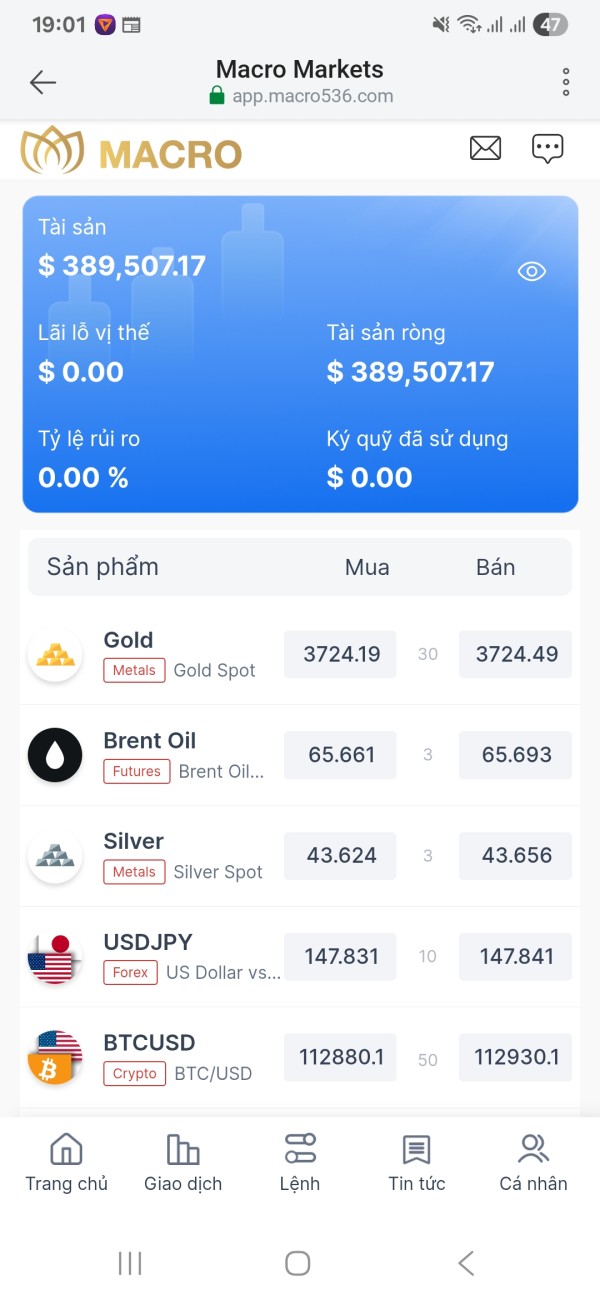

Tradeable Assets: The primary focus appears to be on forex trading. However, the complete range of available trading instruments, currency pairs, and asset classes requires clarification from the broker directly.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs is not available in current sources. This macro markets review identifies this as a major transparency concern requiring direct verification with the broker.

Leverage Ratios: Specific leverage offerings and margin requirements are not detailed in available information. This represents another area where prospective clients need direct clarification.

Platform Options: Information about available trading platforms, whether proprietary or third-party solutions like MetaTrader, is not specified in current sources.

Geographic Restrictions: Specific countries or regions where services may be restricted are not detailed in available documentation.

Customer Support Languages: The range of languages supported by customer service is not specified in available sources.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

The account conditions evaluation for Macro Markets reveals significant information gaps. These gaps substantially impact the overall assessment. This macro markets review finds that essential details about account types, their specific features, and associated benefits are not readily available in public documentation. The absence of clear information about different account tiers, if they exist, makes it difficult for potential clients to understand what options might be available to them.

Minimum deposit requirements remain unspecified. These requirements are fundamental to account accessibility. This lack of transparency extends to account opening procedures, required documentation, and verification timelines. Without clear information about the onboarding process, potential clients cannot adequately prepare for account establishment or set appropriate expectations for the timeline involved.

The availability of specialized account features is not addressed in available sources. Such features include Islamic accounts for clients requiring Sharia-compliant trading conditions. Similarly, information about account currencies, base currency options, and any associated conversion fees is absent. This information deficit significantly hampers the ability to provide a comprehensive evaluation of account conditions.

The scoring reflects these substantial information gaps. Transparency in account conditions is crucial for informed decision-making. Prospective clients should prioritize obtaining detailed account information directly from the broker before proceeding with any account opening process.

The evaluation of trading tools and resources available through Macro Markets reveals a concerning lack of detailed information. Available sources do not specify which trading platforms are supported, whether the broker offers proprietary solutions, or if popular third-party platforms like MetaTrader 4 or 5 are available to clients.

Research and market analysis resources are not detailed in available documentation. These resources are essential components of a comprehensive trading environment. The absence of information about economic calendars, market news feeds, technical analysis tools, or fundamental analysis resources represents a significant gap in understanding the broker's value proposition for informed trading decisions.

Educational resources are not mentioned in current sources. These include webinars, tutorials, trading guides, or market education materials. For many traders, particularly those newer to forex markets, educational support can be a crucial factor in broker selection. The lack of information about such resources may indicate either their absence or insufficient promotion of available educational materials.

Automated trading support remains unspecified. This includes expert advisors, copy trading, or algorithmic trading capabilities. Modern traders often seek platforms that support various trading strategies and automation options. This makes this information gap particularly relevant for platform evaluation.

The low scoring in this category reflects the substantial uncertainty about available tools and resources. This emphasizes the need for direct verification of platform capabilities with the broker.

Customer Service and Support Analysis (Score: 5/10)

Customer service evaluation for Macro Markets faces limitations due to the sparse availability of detailed user feedback and service specifications. Available sources do not provide comprehensive information about customer support channels. This includes whether clients can access assistance through live chat, telephone support, email tickets, or other communication methods.

Response time expectations are not specified in available documentation. These expectations are crucial for active traders who may need urgent assistance. The absence of clear service level agreements or response time commitments makes it difficult to set appropriate expectations for support quality and availability.

Service quality assessment relies on limited user feedback. There is some indication of general satisfaction but lacking specific details about problem resolution effectiveness, staff knowledge levels, or overall support experience quality. The moderate scoring reflects this uncertainty while acknowledging that no significant negative patterns emerge from available information.

Multilingual support capabilities are not detailed in current sources. These capabilities can be essential for international clients. Given the broker's multi-jurisdictional presence, clarity about language support across different regions would be valuable for potential clients.

Support availability hours remain unspecified. These hours are particularly important for forex traders operating across global time zones. The 24/7 nature of forex markets often requires corresponding support availability. This makes this information gap particularly relevant for active traders.

Trading Experience Analysis (Score: 4/10)

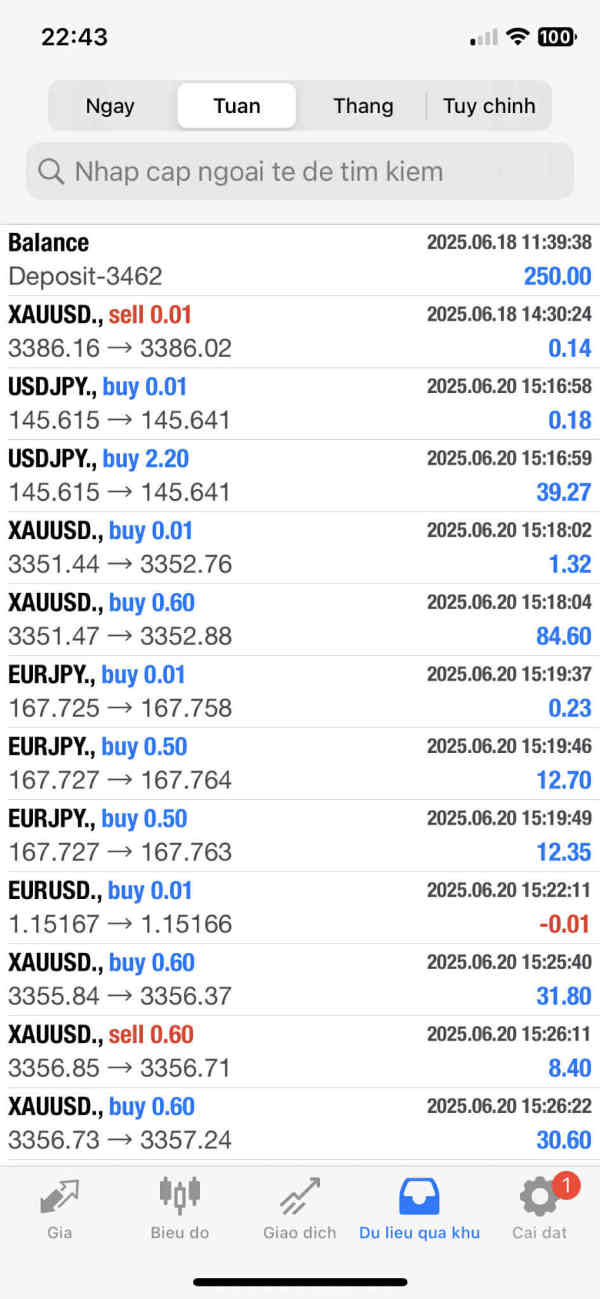

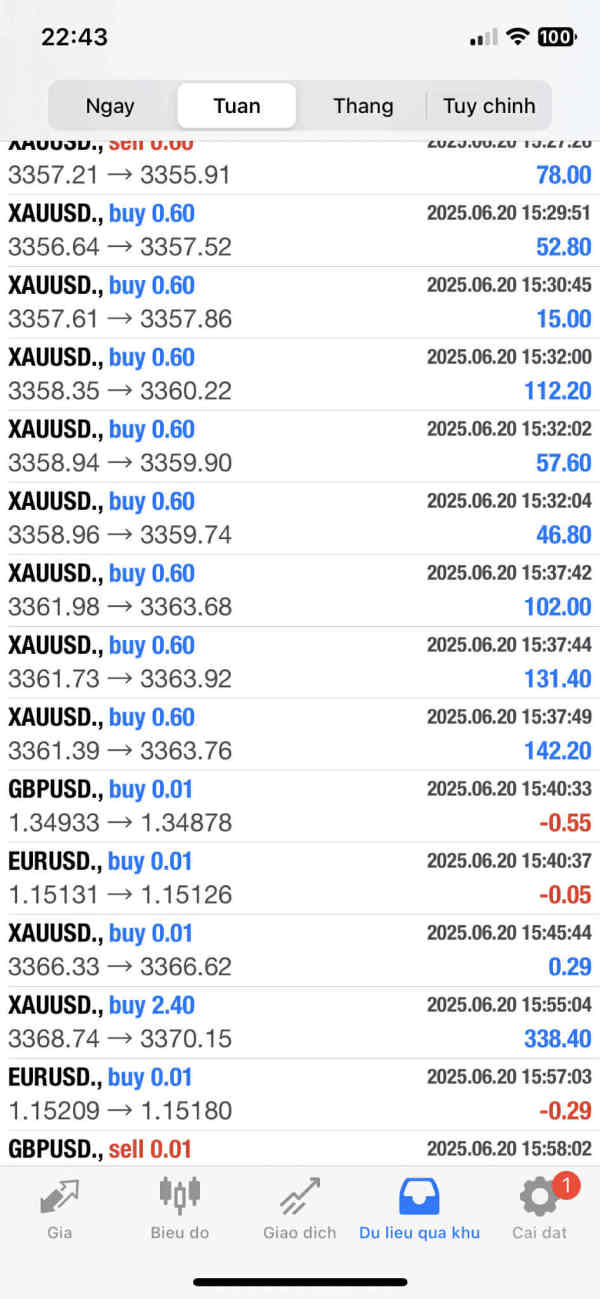

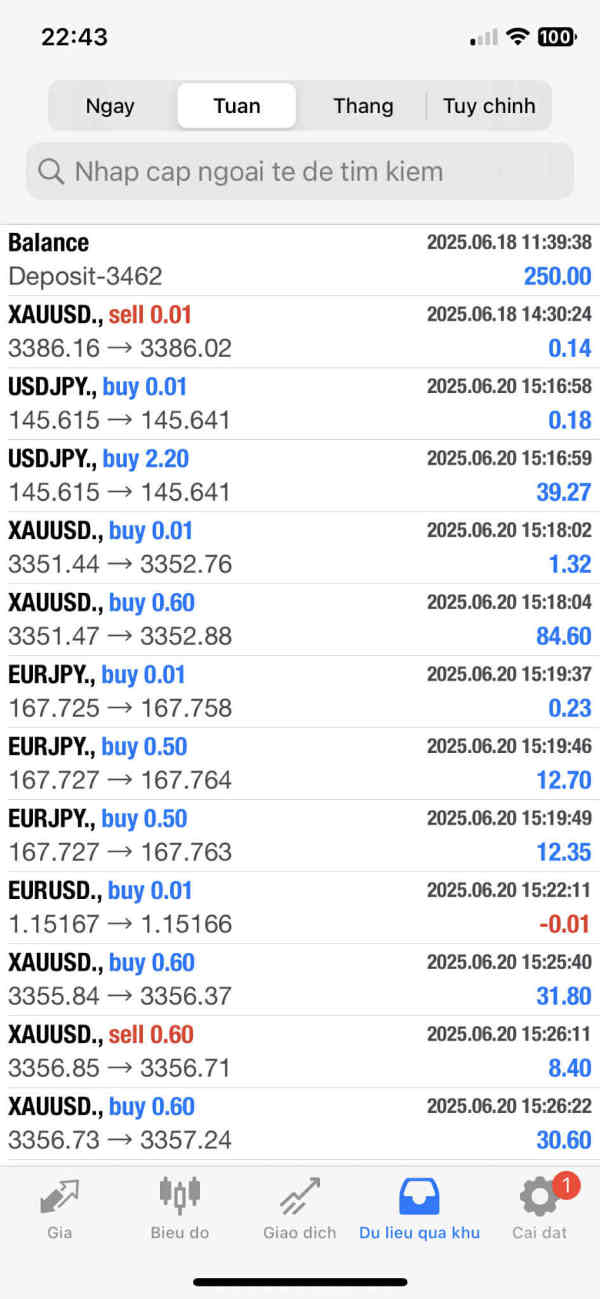

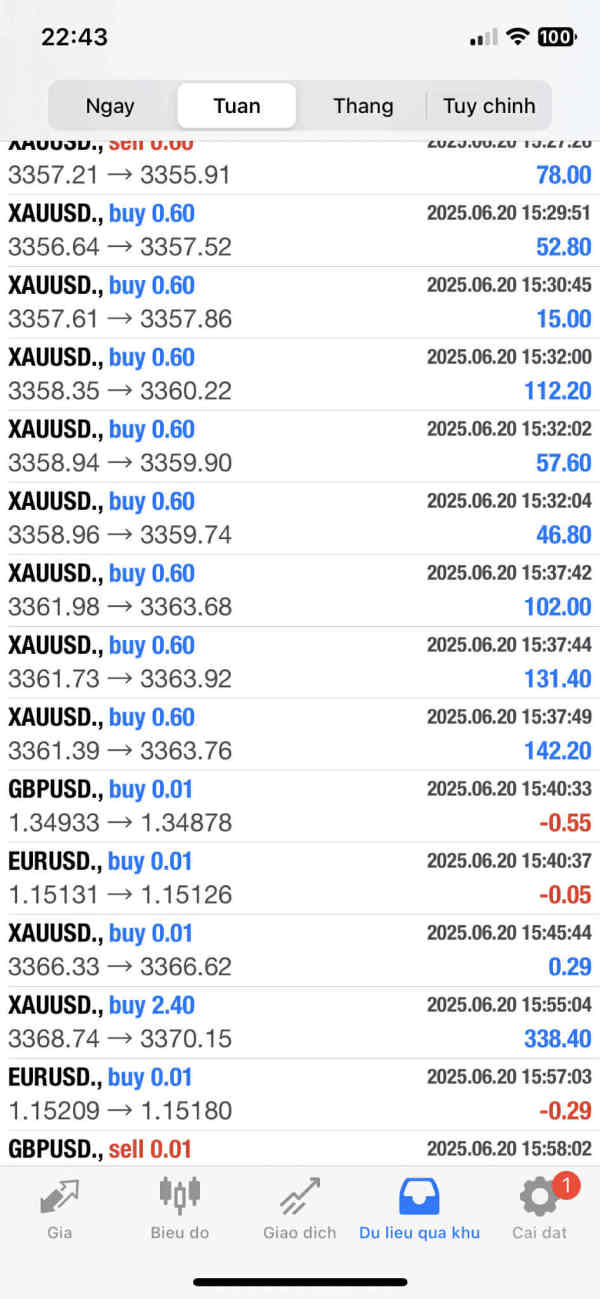

The trading experience evaluation encounters significant challenges due to limited information about platform performance, execution quality, and overall trading environment characteristics. Platform stability and execution speed lack detailed user feedback or performance metrics in available sources. These factors are fundamental to successful forex trading.

Order execution quality is not documented in available sources. This includes information about slippage rates, rejection frequencies, or execution speed statistics. These factors are crucial for traders, particularly those employing scalping strategies or trading during high-volatility periods. The absence of such data makes it difficult to assess the broker's execution capabilities.

Platform functionality completeness remains unclear from available documentation. This includes charting capabilities, order types, risk management tools, and analytical features. Modern traders expect comprehensive platform features that support various trading strategies and risk management approaches.

Mobile trading experience is not detailed in current sources. This experience is increasingly important as traders seek flexibility in managing positions. Information about mobile app availability, functionality, and performance would be valuable for active traders who need platform access across devices.

The macro markets review scoring in this category reflects the substantial uncertainty about core trading experience elements. The below-average rating emphasizes the need for potential clients to conduct thorough platform testing, preferably through demo accounts, before committing to live trading.

Trust and Security Analysis (Score: 5/10)

Trust and security evaluation for Macro Markets presents a mixed picture based on available information. The regulatory framework includes licenses from multiple jurisdictions including Australia, Seychelles, and Hong Kong. This provides some degree of regulatory oversight. However, the varying standards and protection levels across these jurisdictions create complexity in assessing overall security.

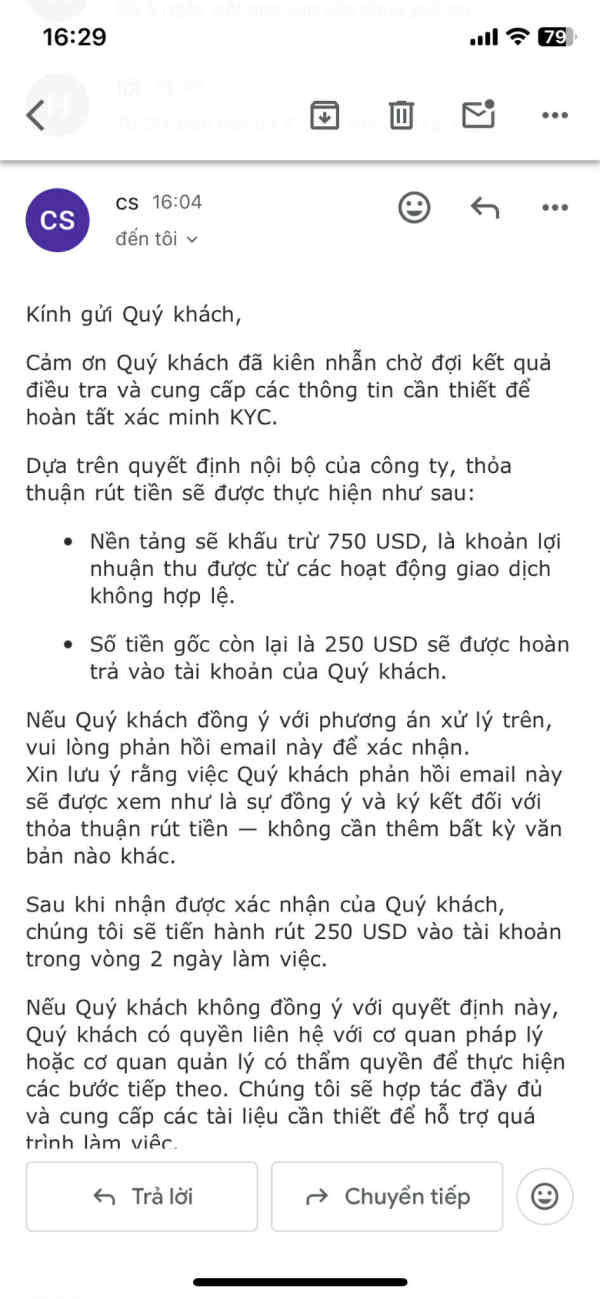

Client fund safety measures are not detailed in available sources. These measures include segregated account policies, deposit insurance coverage, or negative balance protection. These protections are fundamental to broker security assessment. Their absence from public documentation represents a significant information gap.

Company transparency regarding ownership structure, financial statements, or operational details appears limited based on available sources. Transparency in broker operations contributes significantly to trust building. It allows clients to make more informed decisions about fund safety.

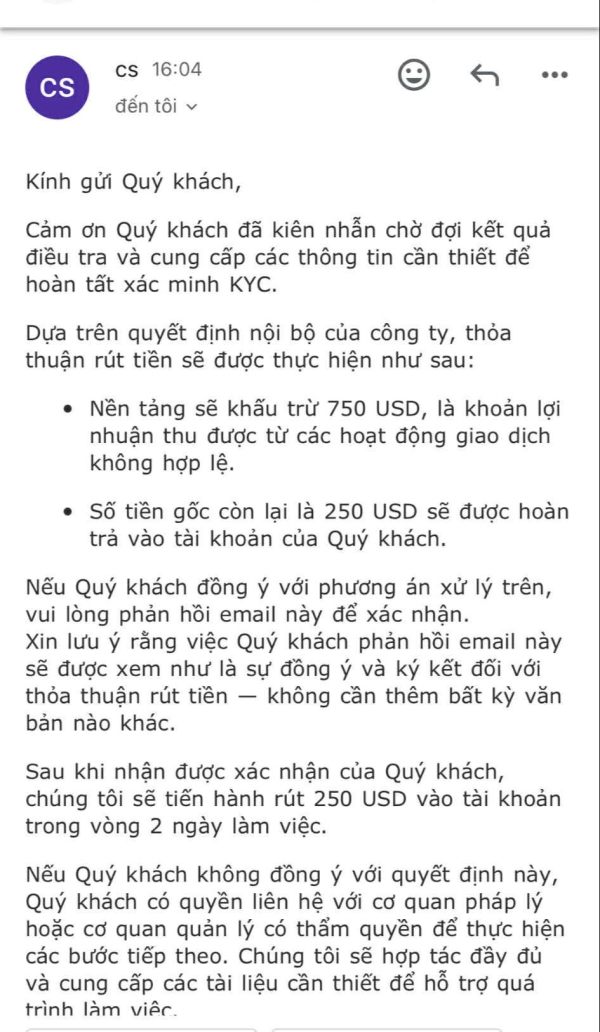

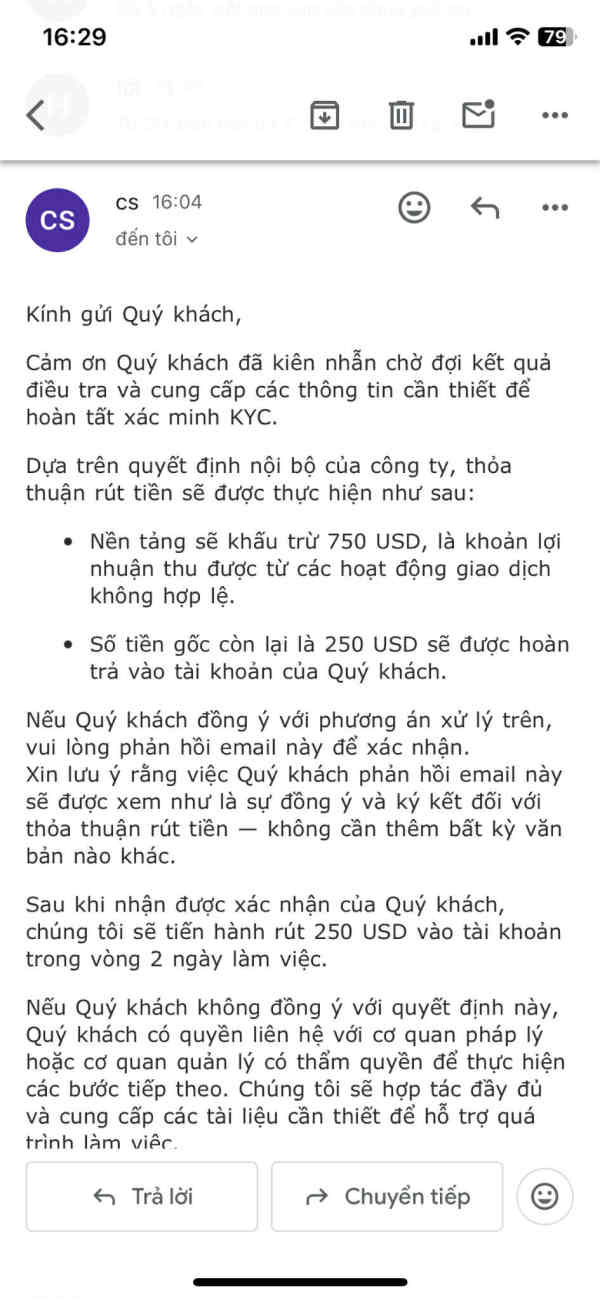

Some user concerns regarding operational practices have been noted. These include mentions of potential scam risks in available feedback. While such concerns require careful verification, their presence in user discussions warrants attention and further investigation by prospective clients.

The moderate scoring reflects the balance between regulatory presence and transparency concerns. The multi-jurisdictional regulatory framework provides some assurance. However, limited transparency about specific security measures and some user concerns prevent a higher trust rating.

User Experience Analysis (Score: 6/10)

User experience evaluation for Macro Markets shows moderate satisfaction levels based on available feedback. However, detailed user experience data remains limited. Available user ratings suggest general satisfaction with an approximate 3.8/5 rating. This indicates acceptable but not exceptional user experience levels.

Interface design and platform usability information is not detailed in available sources. This makes it difficult to assess how intuitive and user-friendly the trading environment might be. Modern traders expect clean, responsive interfaces that facilitate efficient trade management and market analysis.

Registration and account verification processes are not described in available documentation. This represents a gap in understanding the initial user experience. Streamlined onboarding processes can significantly impact overall user satisfaction, particularly for new clients.

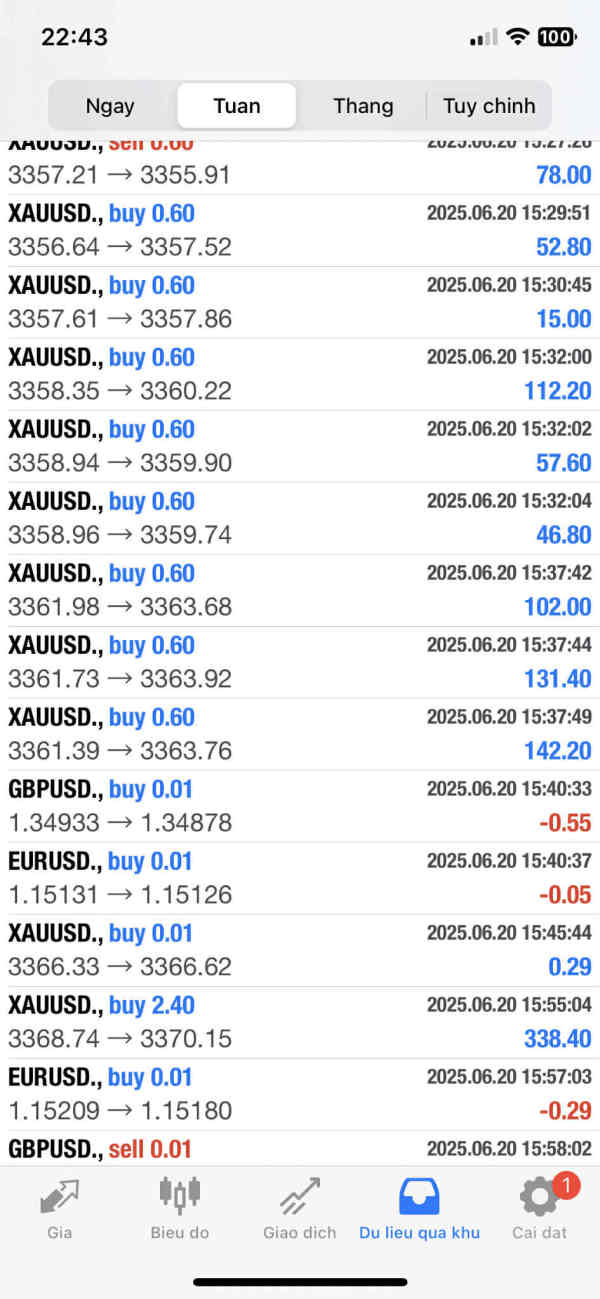

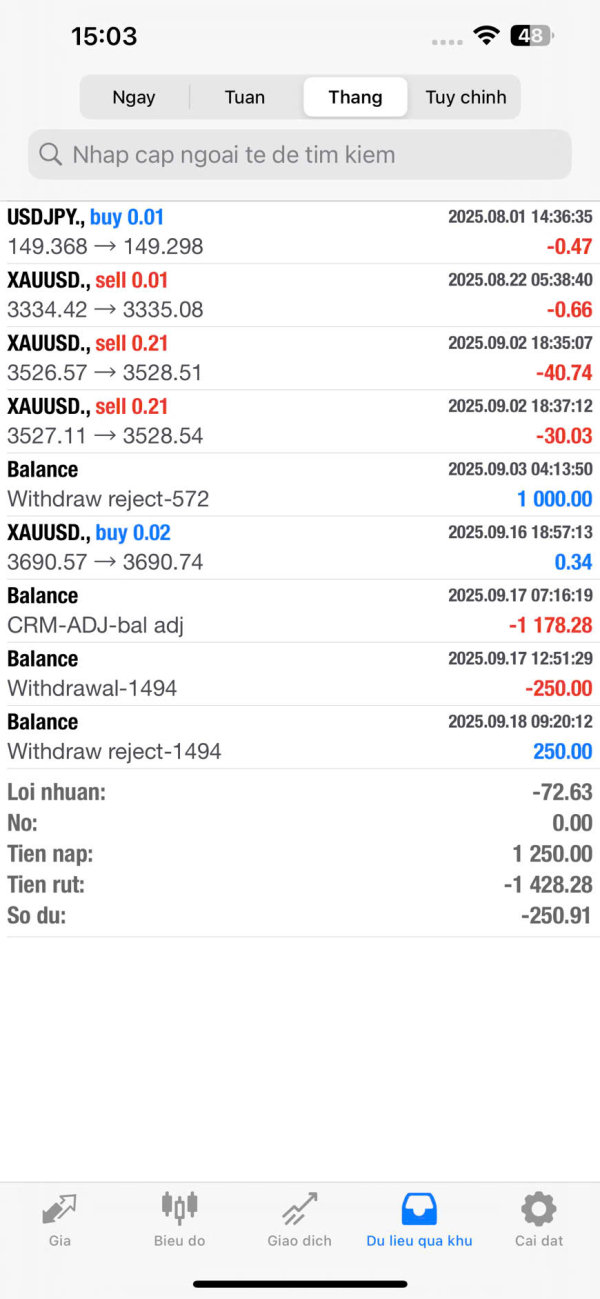

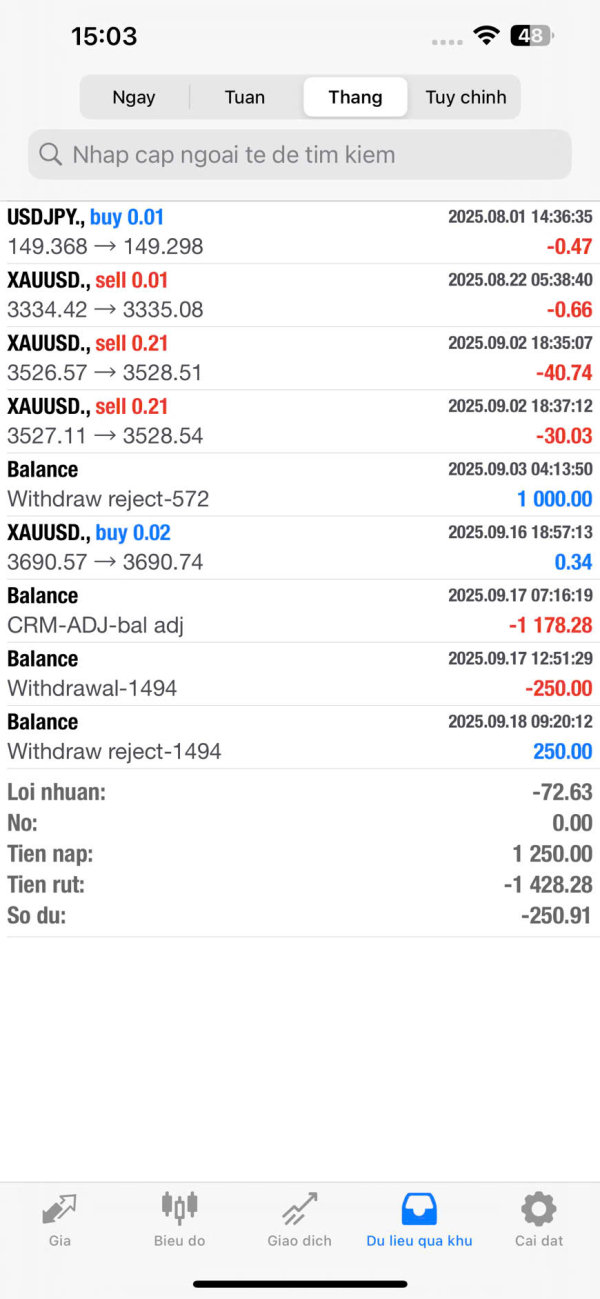

Fund management experience lacks detailed user feedback in available sources. This includes deposit and withdrawal processes, processing times, and associated fees. Efficient fund operations are crucial for positive user experience. Delays or complications in money movement can significantly impact trader satisfaction.

Common user complaints mentioned in available sources include concerns about company trustworthiness and potential operational risks. These concerns, while requiring verification, suggest areas where user experience may be negatively impacted.

The above-average scoring reflects moderate user satisfaction levels while acknowledging areas for potential improvement. The rating suggests acceptable basic functionality. However, it indicates room for enhancement in user experience delivery.

Conclusion

This comprehensive macro markets review reveals a broker with over a decade of operational history but significant transparency challenges that impact overall assessment. Macro Markets operates under the Macro Group umbrella since 2010. The company maintains regulatory licenses across multiple jurisdictions including Australia, Seychelles, and Hong Kong, providing some regulatory framework for operations.

The broker appears most suitable for forex traders willing to conduct extensive due diligence and direct verification of trading conditions before account opening. However, the substantial information gaps regarding trading costs, platform specifications, and service details make it challenging to recommend without reservations.

Key advantages include established operational history, multi-jurisdictional regulatory presence, and moderate user satisfaction levels. Primary concerns center on limited transparency regarding essential trading conditions, unclear platform offerings, and some user concerns about operational practices. Prospective clients should prioritize obtaining comprehensive information directly from the broker before making any commitment. This ensures the services align with their specific trading needs and risk tolerance.