Is MT5 Online trading safe?

Pros

Cons

Is MT5 Online Trading A Scam?

Introduction

MT5 Online Trading is a relatively new player in the forex market, having been established in 2022. It positions itself as a comprehensive trading platform that allows users to trade various asset classes, including forex, stocks, commodities, and cryptocurrencies. However, the rise of online trading has also seen an increase in scams and fraudulent activities in the industry, making it essential for traders to exercise caution when selecting a broker. This article aims to provide an objective assessment of MT5 Online Trading, evaluating its legitimacy, regulatory status, and overall trustworthiness. Our investigation will rely on a comprehensive framework that includes regulatory compliance, company background, trading conditions, customer safety measures, and user experiences.

Regulation and Legitimacy

A broker's regulatory status is a critical factor in determining its legitimacy. Regulation serves as a protective measure for traders, ensuring that brokers adhere to specific standards and practices. Unfortunately, MT5 Online Trading has been identified as an unregulated broker, which raises significant red flags. Operating without oversight from recognized financial authorities means that traders may not have recourse in the event of disputes or issues with the broker.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation is concerning, as it exposes traders to higher risks. Regulated brokers are required to maintain transparency, segregate client funds, and offer investor protection schemes. MT5 Online Trading's lack of regulatory oversight indicates that it does not follow these essential practices, making it imperative for potential users to tread carefully.

Company Background Investigation

MT5 Online Trading's company history is another aspect worth examining. Established in 2022, the broker has not yet built a substantial track record in the industry. The ownership structure and management team remain largely undisclosed, which diminishes transparency and raises questions about the broker's reliability. A lack of information regarding the management team means that potential investors cannot assess the experience and qualifications of those running the company.

Transparency is a key indicator of a trustworthy broker. The absence of clear information about MT5 Online Trading's leadership and operational history is a significant drawback. Traders should be wary of engaging with platforms that do not provide adequate information about their background, as this can be indicative of potential issues down the line.

Trading Conditions Analysis

Understanding the trading conditions offered by MT5 Online Trading is crucial for potential investors. A review of the broker's fee structure reveals that it operates with a commission-based model, but the details surrounding spreads and other costs are not easily accessible.

| Fee Type | MT5 Online Trading | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 pips |

| Commission Model | N/A | $3 per 100k units |

| Overnight Interest Range | N/A | Varies |

The lack of transparency regarding trading costs raises concerns. Traders should expect a clear outline of all fees before committing to a broker, as hidden costs can significantly impact profitability. The absence of detailed fee information is a notable issue for MT5 Online Trading, which may deter potential clients.

Customer Funds Safety

The safety of customer funds is paramount when selecting a broker. In the case of MT5 Online Trading, there is little information available regarding its safety measures. It is essential for brokers to implement robust security protocols, including fund segregation and negative balance protection. Without these measures, clients' funds may be at risk.

The absence of regulatory oversight further exacerbates concerns related to fund safety. Traders should be particularly cautious with brokers that do not provide guarantees for the protection of their investments. Historical issues related to fund security can also provide insight into a broker's reliability; however, MT5 Online Trading lacks any substantial history, making it difficult to evaluate its track record in this regard.

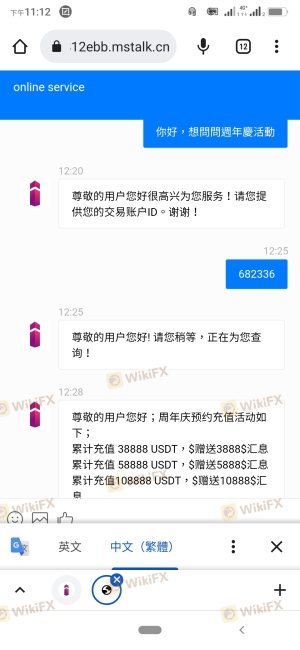

Customer Experience and Complaints

Customer feedback is a crucial element in assessing a broker's reputation. Unfortunately, MT5 Online Trading has garnered a mix of reviews, with many users expressing concerns about the platform's reliability and customer service. Common complaints include difficulties with withdrawals, lack of responsiveness from customer support, and issues with the trading platform itself.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Average |

| Platform Stability | High | Poor |

These complaints highlight significant issues that potential users should consider. A broker's ability to address client concerns is a vital part of its service quality. The negative feedback surrounding MT5 Online Trading suggests that traders may face challenges if issues arise during their trading experience.

Platform and Execution

The performance and stability of the trading platform are critical for successful trading. MT5 Online Trading claims to offer a robust trading environment, but user experiences suggest otherwise. Reports of slippage, execution delays, and system outages have been prevalent among user reviews.

The quality of order execution is particularly important for traders who rely on precise entry and exit points. If MT5 Online Trading fails to provide reliable execution, it could lead to significant financial losses for its users. The potential for platform manipulation is also a concern, especially with an unregulated broker.

Risk Assessment

Engaging with MT5 Online Trading carries inherent risks, particularly due to its unregulated status. Users should be aware of the following risks:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight from financial authorities. |

| Fund Safety Risk | High | Lack of fund segregation and protection policies. |

| Customer Support Risk | Medium | Poor responsiveness to user issues. |

| Platform Stability Risk | High | Reports of execution issues and outages. |

To mitigate these risks, potential traders should conduct thorough research, consider using regulated brokers, and only invest what they can afford to lose. It is also advisable to start with a demo account to test the platform without financial commitment.

Conclusion and Recommendations

In conclusion, MT5 Online Trading presents several concerns that warrant caution. The lack of regulatory oversight, transparency issues, and negative customer feedback suggest that it may not be a safe option for traders. While the platform itself is legitimate, the surrounding circumstances raise significant red flags.

Traders should be particularly wary of engaging with unregulated brokers like MT5 Online Trading. For those looking for reliable alternatives, consider well-regulated brokers such as IC Markets, FP Markets, or Pepperstone, which offer robust features and a proven track record of customer satisfaction. Always prioritize safety and conduct due diligence before committing to any trading platform.

Is MT5 Online trading a scam, or is it legit?

The latest exposure and evaluation content of MT5 Online trading brokers.

MT5 Online trading Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MT5 Online trading latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.