Is LexaTrade safe?

Pros

Cons

Is Lexatrade A Scam?

Introduction

Lexatrade is a relatively new player in the forex market, having launched in 2022. Positioned as a multi-asset brokerage, it offers a range of financial instruments, including forex, commodities, and CFDs. As the popularity of online trading continues to rise, traders need to exercise caution when selecting a broker, given the prevalence of scams in the industry. The goal of this article is to investigate whether Lexatrade is a legitimate broker or a potential scam. Our evaluation is based on a thorough review of its regulatory status, company background, trading conditions, client safety measures, customer feedback, platform performance, and associated risks.

Regulation and Legitimacy

Regulation is a cornerstone of trust in the forex trading industry, providing a layer of security and oversight for traders. Lexatrade claims to be regulated by the International Financial Market Relations Regulation Center (IFMRRC), a non-commercial organization based in St. Vincent and the Grenadines. However, the legitimacy and effectiveness of this regulatory body have been called into question due to its lack of stringent oversight compared to more established regulators like the FCA or ASIC.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| IFMRRC | N/A | St. Vincent and the Grenadines | Limited recognition |

While having some form of regulation is better than none, the IFMRRC does not provide the same level of investor protection as more recognized regulatory bodies. This raises concerns about the safety of funds and the potential for Lexatrade to engage in unethical practices. Furthermore, reports indicate that the Polish Financial Supervision Authority has added Lexatrade to its blacklist, highlighting its unregulated status in key markets. This lack of robust regulation is a significant red flag for potential clients.

Company Background Investigation

Lexatrade is operated by Swissone Group Ltd., a company registered in St. Vincent and the Grenadines. The offshore registration raises questions about transparency and accountability. The management teams background and experience are crucial in assessing the brokerage's reliability. However, limited information is available about the team behind Lexatrade, which diminishes trust. A reputable broker typically provides details about its leadership, including their qualifications and industry experience.

Transparency in operations is vital for building trust with clients. Lexatrade's website lacks comprehensive information about its ownership structure and management team, which can be a concern for potential investors. Without clear disclosure of who runs the company, traders may feel hesitant to entrust their funds to Lexatrade.

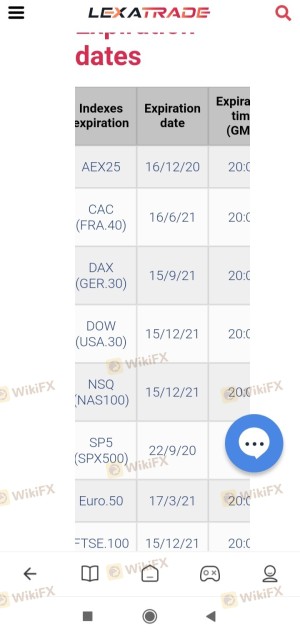

Trading Conditions Analysis

Understanding the trading conditions is essential for traders to gauge the potential profitability and costs associated with their trading activities. Lexatrade offers a tiered account structure, which includes various account types with different features and deposit requirements. The minimum deposit to open an account is $250, which is relatively low compared to industry standards. However, higher-tier accounts require significant capital, with the top-tier VIP account demanding a minimum deposit of $100,000.

The fee structure is another critical aspect. Lexatrade advertises spreads starting from 1.6 pips, but the actual trading costs may vary.

| Fee Type | Lexatrade | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 1.6 pips | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | Varies | Varies |

The relatively wide spreads may impact profitability, particularly for high-frequency traders. Additionally, the lack of clarity regarding commissions and other fees raises concerns about potential hidden costs. Traders should be cautious and thoroughly read the terms and conditions to avoid unexpected charges.

Client Fund Security

The safety of client funds is paramount when evaluating a broker. Lexatrade claims to implement various security measures, including segregated accounts and negative balance protection. Segregated accounts ensure that client funds are kept separate from the brokers operational funds, providing some level of security in the event of insolvency.

However, the effectiveness of these measures is compromised by the lack of stringent regulatory oversight. Since Lexatrade operates under a less recognized regulatory body, the assurance of fund safety may not be as strong as with brokers regulated by more reputable authorities. Additionally, there have been no reported incidents of fund mismanagement or disputes, but the absence of a history does not guarantee future safety.

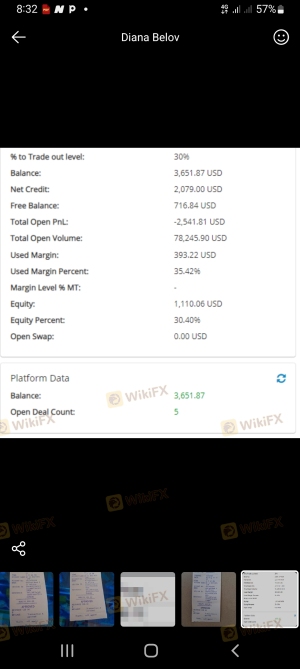

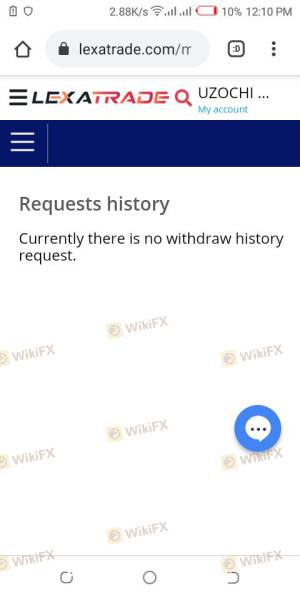

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. Reviews about Lexatrade reveal a mixed bag of experiences. While some clients praise the broker for its user-friendly platform and responsive customer service, others have raised serious concerns about withdrawal processes and aggressive marketing tactics.

Common complaint types include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Aggressive Sales Tactics | Medium | Mixed responses |

| Lack of Transparency | High | Limited information |

One notable case involved a trader who experienced delays in withdrawing funds, leading to frustration and claims of being misled about the withdrawal process. While Lexatrade's customer support is available 24/7, the quality of responses has been criticized, with some users reporting long wait times and unclear answers.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. Lexatrade offers several platforms, including its proprietary web platform and the widely-used MetaTrader 4 (MT4). User reviews generally highlight the platform's reliability and ease of use, but there are concerns about order execution quality. Instances of slippage and rejections have been reported, which can significantly impact trading outcomes.

Risk Assessment

Using Lexatrade comes with inherent risks, particularly due to its regulatory status and customer feedback.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Financial Risk | Medium | Potential hidden fees |

| Operational Risk | Medium | Platform execution issues |

To mitigate these risks, traders should conduct thorough research before investing, use risk management strategies, and consider starting with a demo account if available.

Conclusion and Recommendations

In conclusion, while Lexatrade presents itself as a legitimate forex broker, several red flags warrant caution. The lack of robust regulation, mixed customer feedback, and potential hidden costs suggest that traders should approach this broker carefully.

For those considering trading with Lexatrade, it is advisable to start with a small investment and utilize risk management techniques. However, if you are risk-averse or require a higher level of regulatory protection, it may be prudent to explore alternative brokers with more established reputations and regulatory oversight. Some recommended alternatives include brokers regulated by the FCA or ASIC, which provide a higher level of investor protection and transparency.

Ultimately, the decision to engage with Lexatrade should be made with careful consideration of the associated risks and the broker's overall reliability.

Is LexaTrade a scam, or is it legit?

The latest exposure and evaluation content of LexaTrade brokers.

LexaTrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LexaTrade latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.