Lexatrade 2025 Review: Everything You Need to Know

Lexatrade has garnered mixed reviews since its inception, with many users expressing skepticism about its legitimacy. While some traders report satisfactory experiences, others have raised concerns about withdrawal issues and the broker's regulatory status. Key features include a minimum deposit of $250 and access to the popular MT4 trading platform, but potential investors should tread carefully due to the broker's questionable regulatory oversight.

Note: It's important to be aware of the different entities operating under the Lexatrade name across various regions, as this can significantly impact user experience and regulatory protections.

Ratings Overview

We rate brokers based on user feedback, expert analysis, and regulatory compliance.

Broker Overview

Founded in 2022, Lexatrade operates as a forex and CFD broker primarily targeting European markets. The broker is registered in Saint Vincent and the Grenadines and claims to be regulated by the International Financial Market Relations Regulation Center (IFMRRC), although this regulatory body is not widely recognized. Lexatrade offers trading through the MT4 platform, which is favored for its user-friendly interface and robust analytical tools. Traders can access various asset classes, including forex, stocks, commodities, and cryptocurrencies.

Detailed Breakdown

Regulatory Landscape

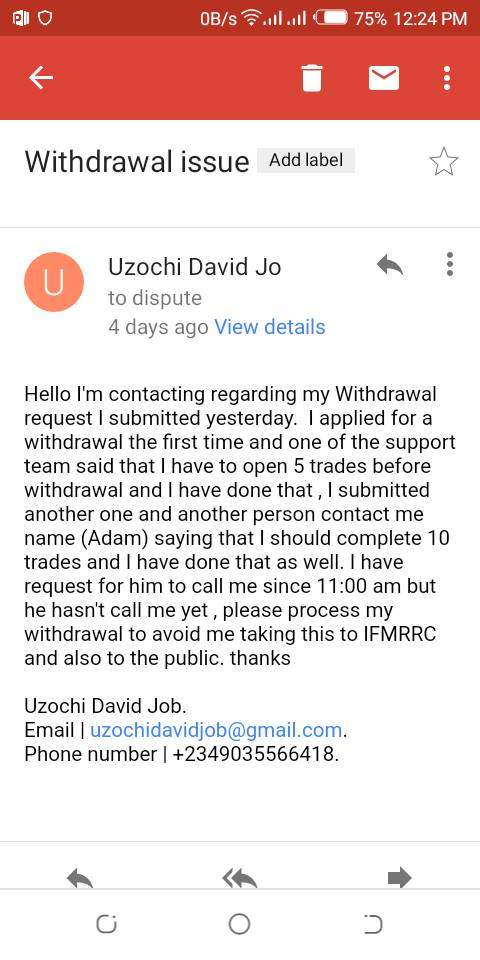

Lexatrade claims to operate under the IFMRRC, but this organization lacks the stringent oversight associated with more reputable regulatory bodies like the FCA or CySEC. This raises concerns about the safety of funds and the legitimacy of operations. According to multiple sources, including BrokersView, Lexatrade has been flagged by regulators in certain jurisdictions, indicating potential legal issues.

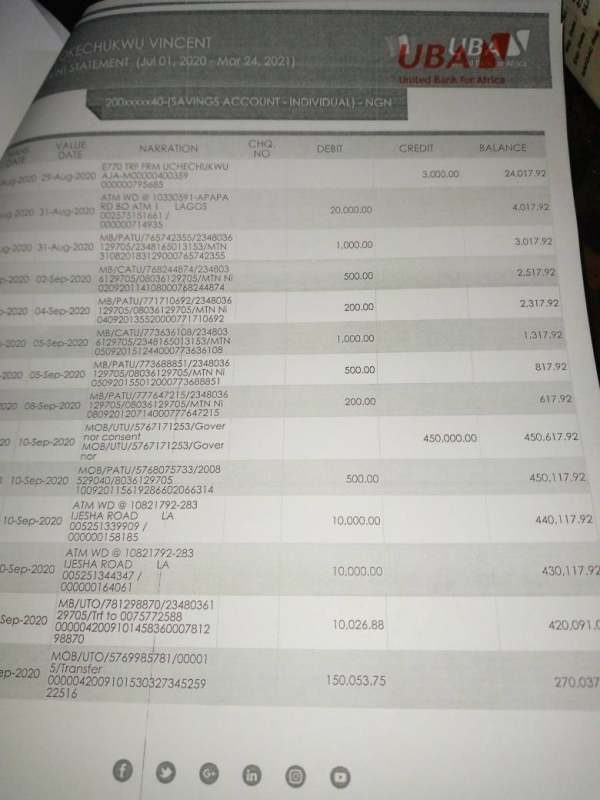

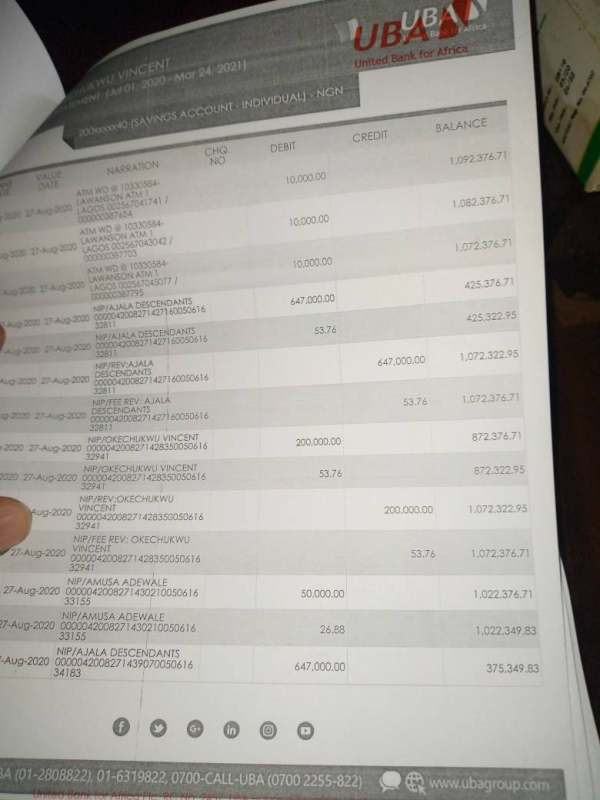

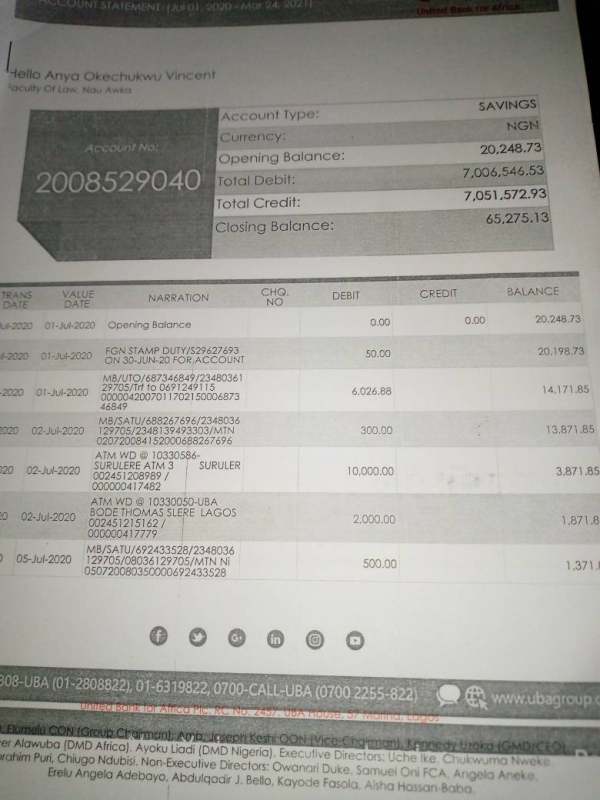

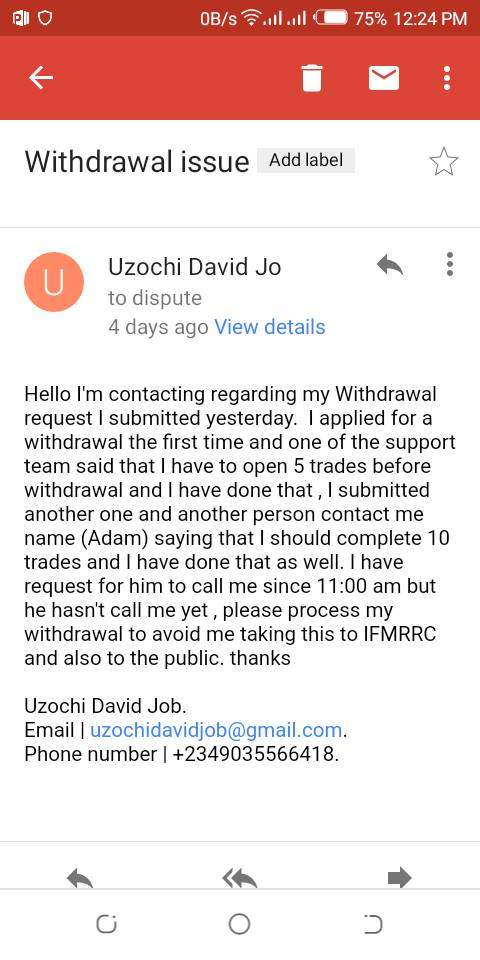

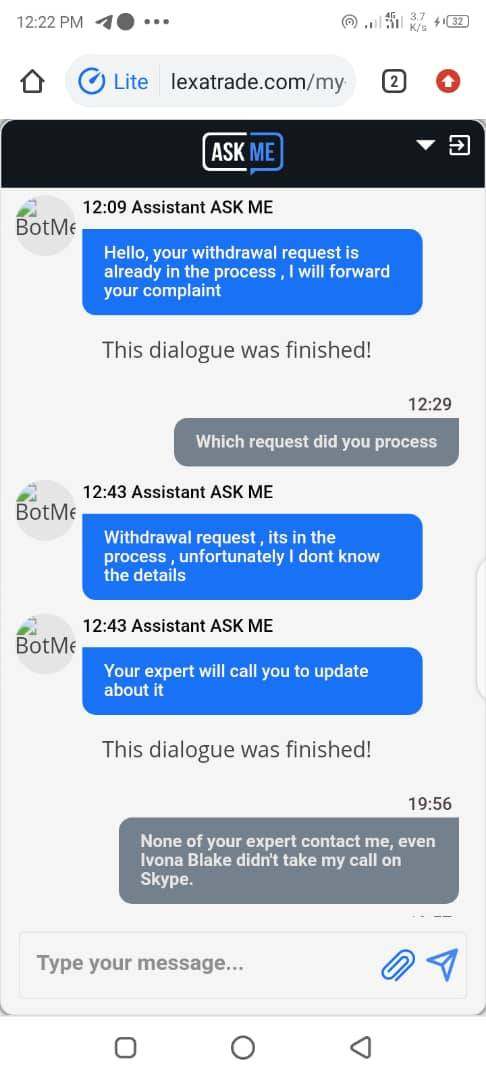

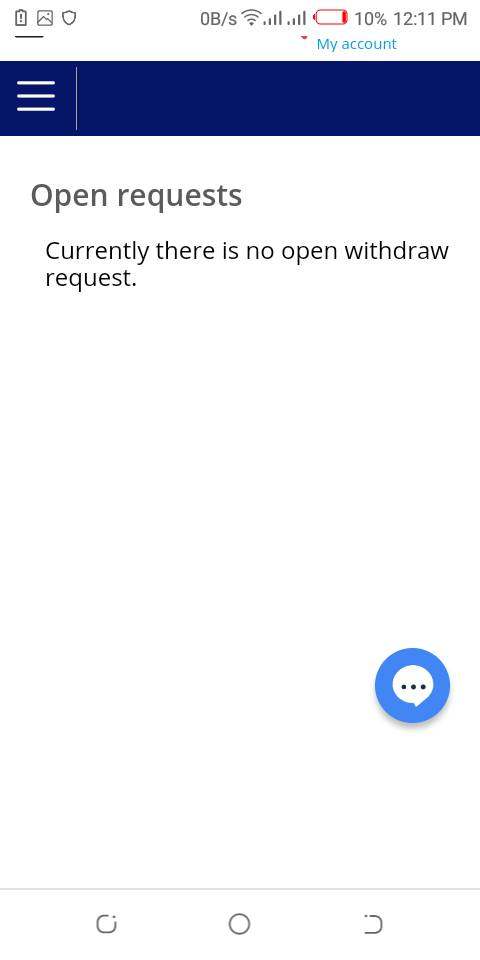

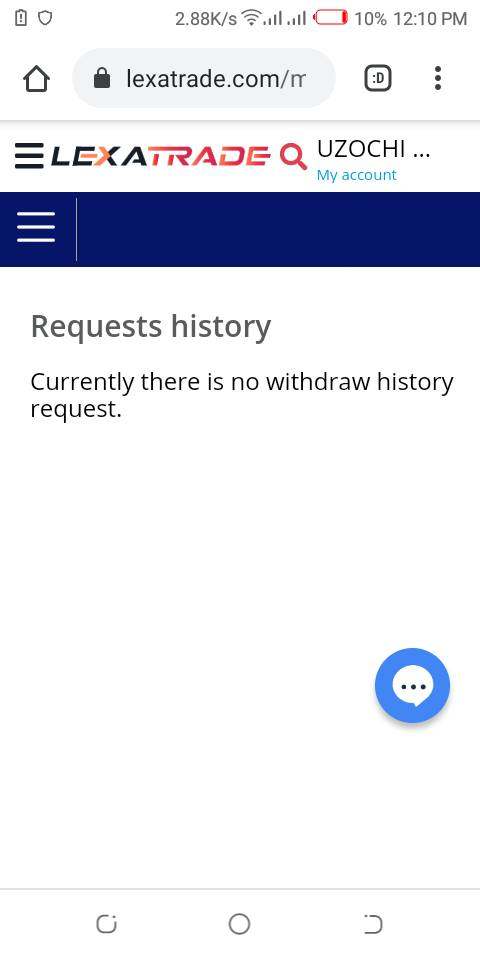

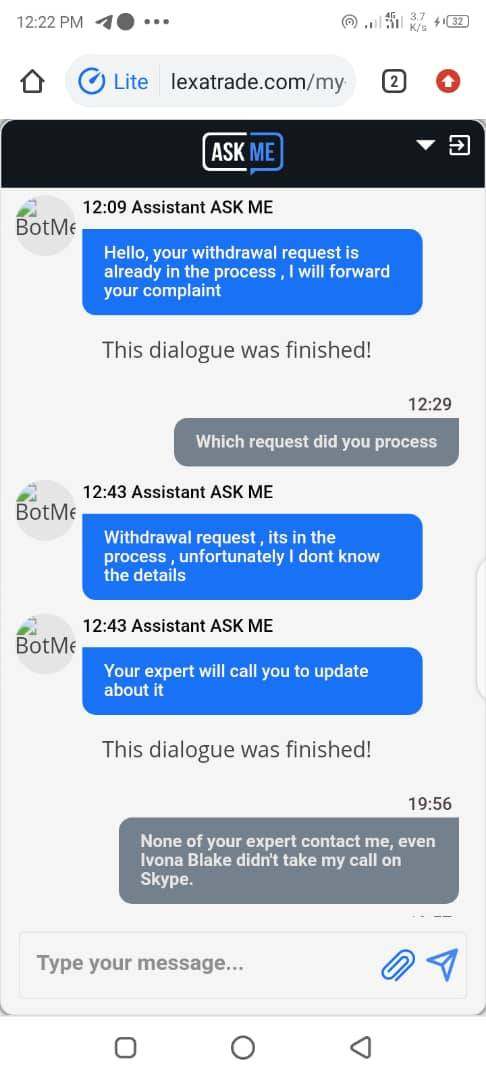

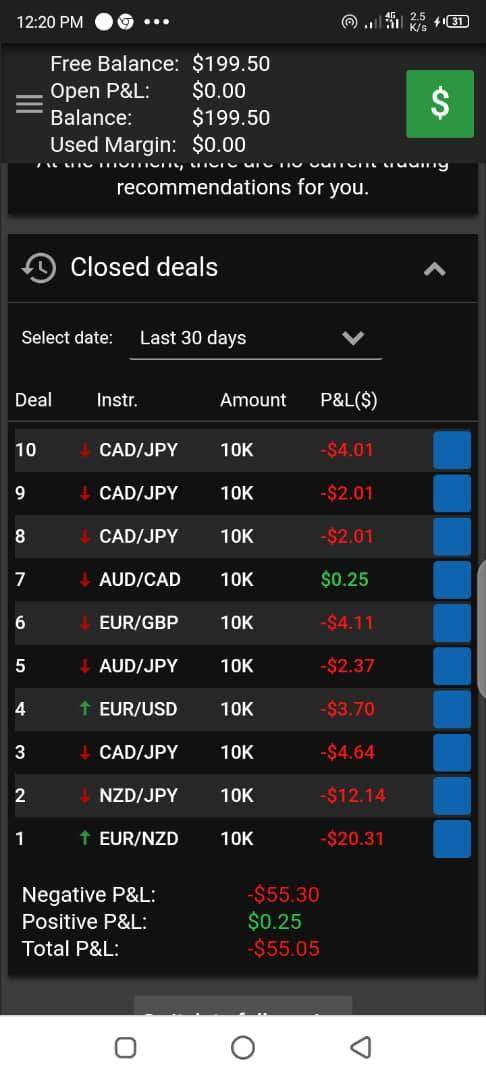

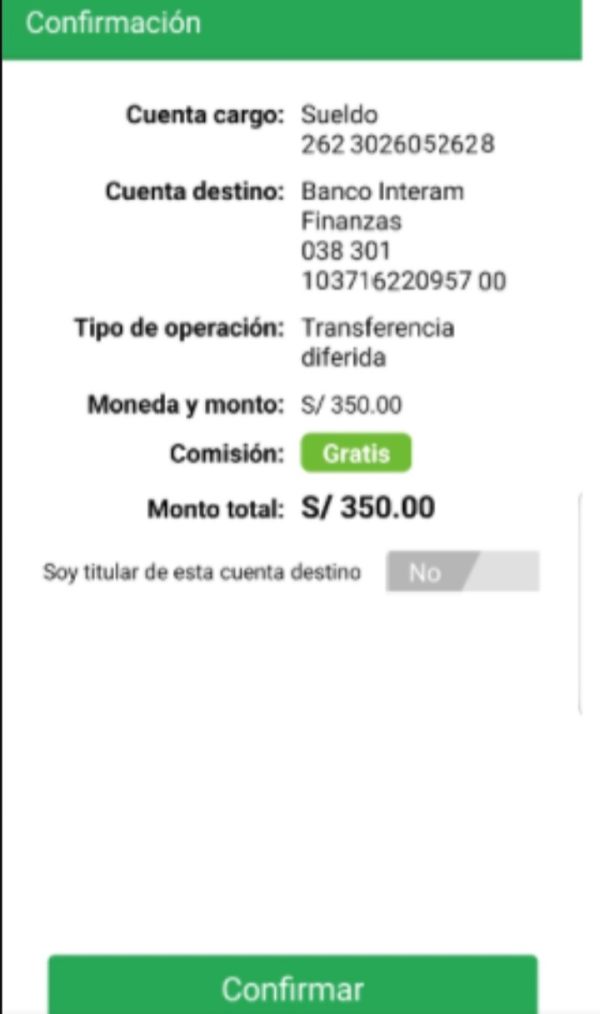

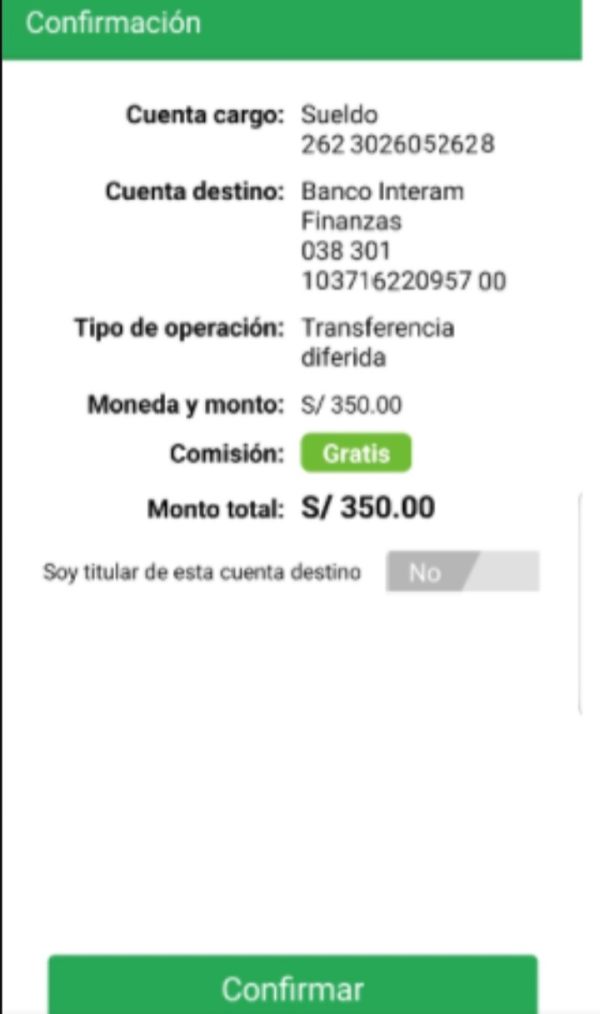

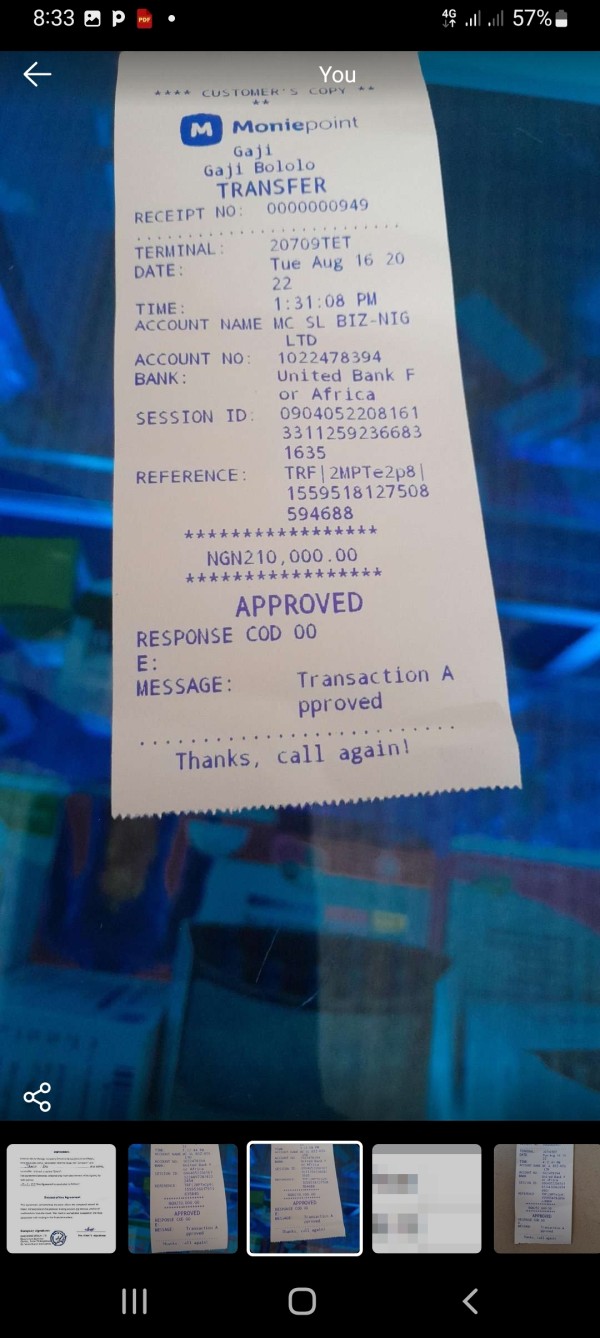

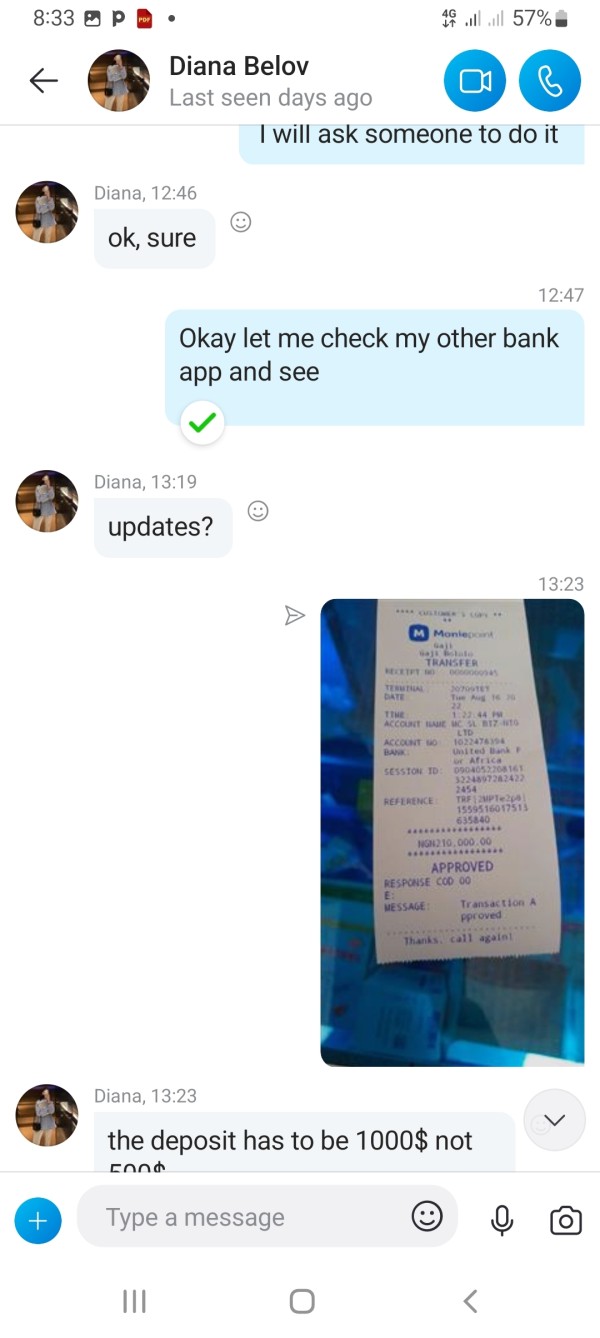

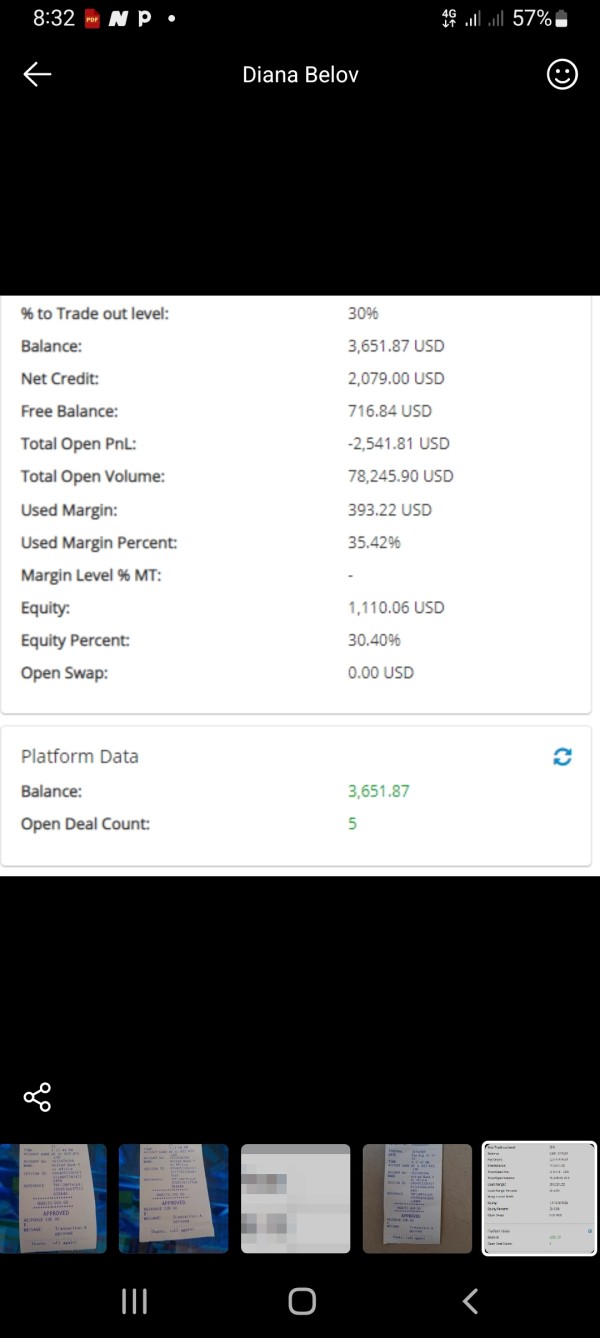

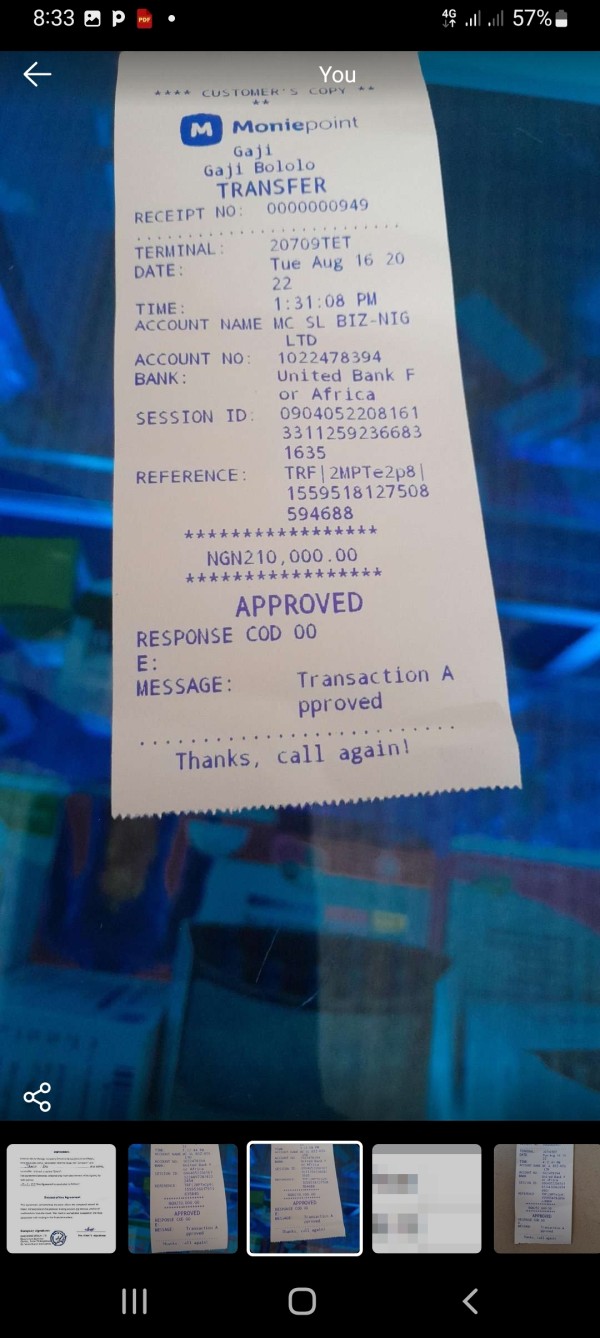

Deposit and Withdrawal Methods

Lexatrade allows deposits through various methods, including credit/debit cards, bank transfers, and cryptocurrencies. The minimum deposit to open an account is set at $250. Withdrawal processes have been criticized, with some users reporting delays and difficulties in accessing their funds. As noted by SiteJabber, user experiences vary widely, with some traders successfully withdrawing funds while others faced significant hurdles.

Minimum Deposit

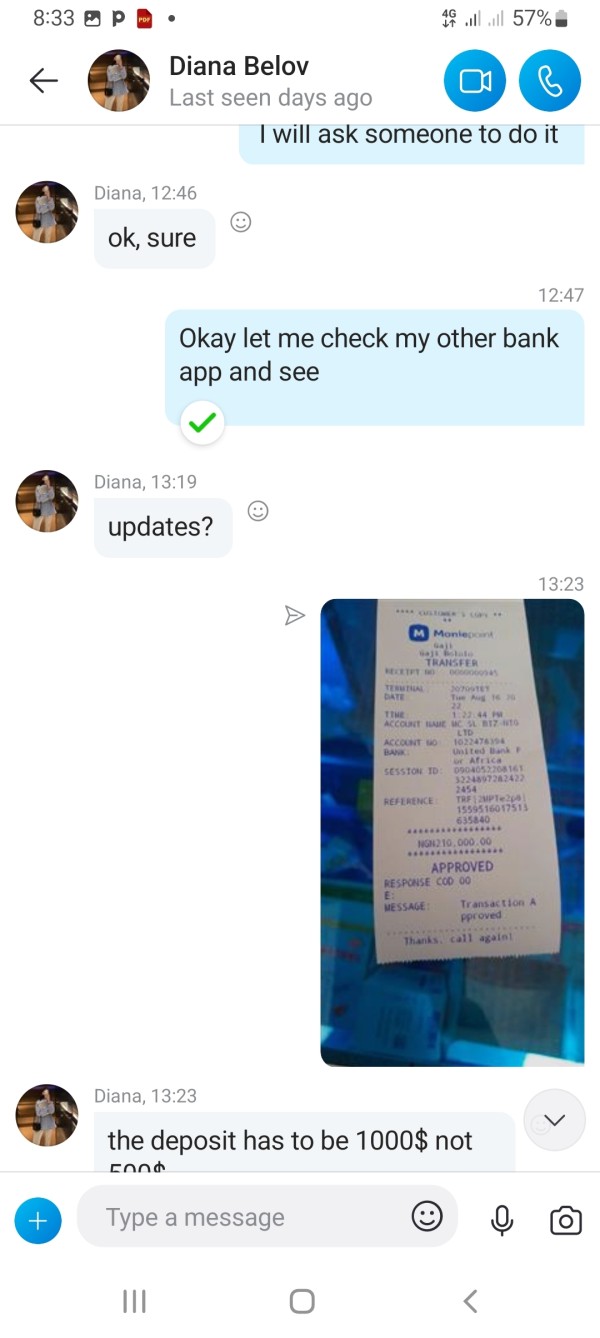

The minimum deposit required to start trading with Lexatrade is $250, which is relatively low compared to other brokers that often require higher amounts. This makes it accessible for beginner traders. However, as highlighted in various reviews, the basic account features may be limited, pushing traders to deposit more to access better conditions.

Lexatrade offers various bonuses, including a deposit match that can go up to 120% for higher-tier accounts. While such promotions can be enticing, they often come with conditions that may restrict withdrawals or require high trading volumes before the bonus can be accessed. This has been flagged as a potential red flag by users who have experienced issues with accessing their funds after accepting bonuses.

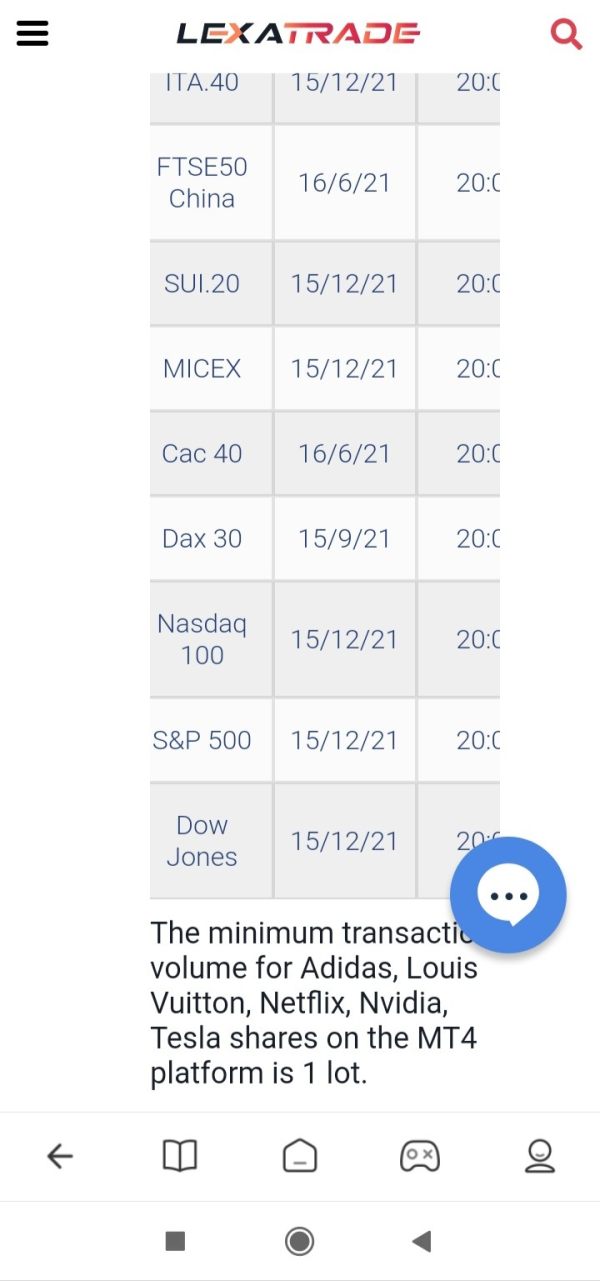

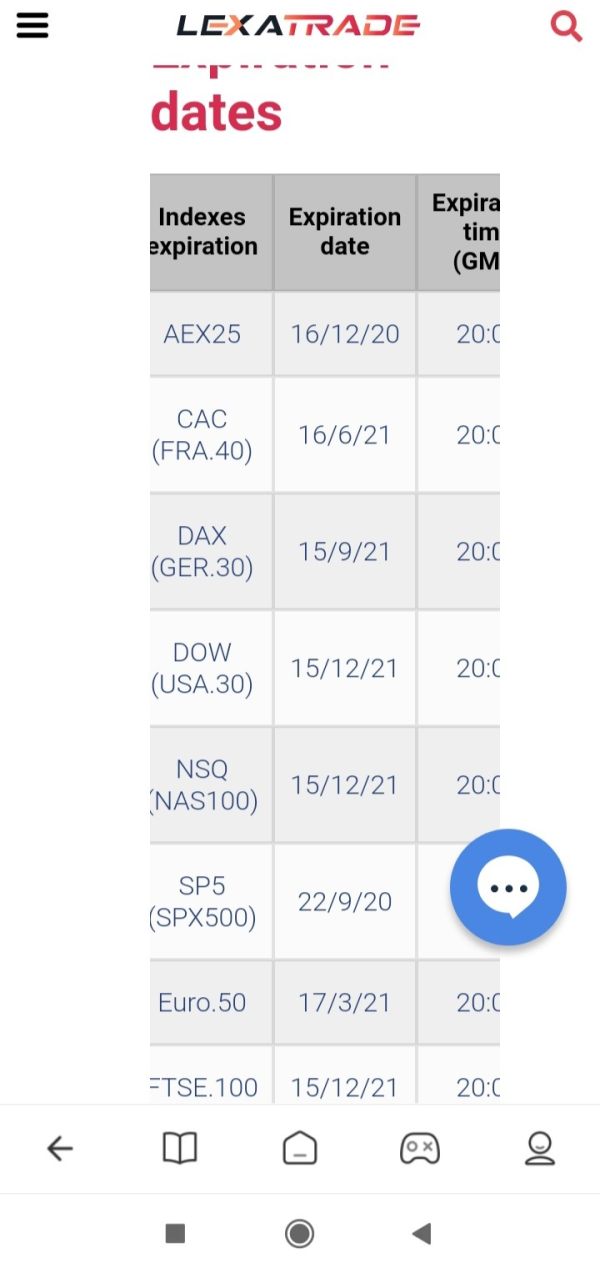

Tradable Asset Classes

The broker provides access to a wide range of financial instruments, including over 50 currency pairs, commodities, indices, and cryptocurrencies. However, the availability of certain assets may depend on the account type, with higher-tier accounts unlocking additional trading options.

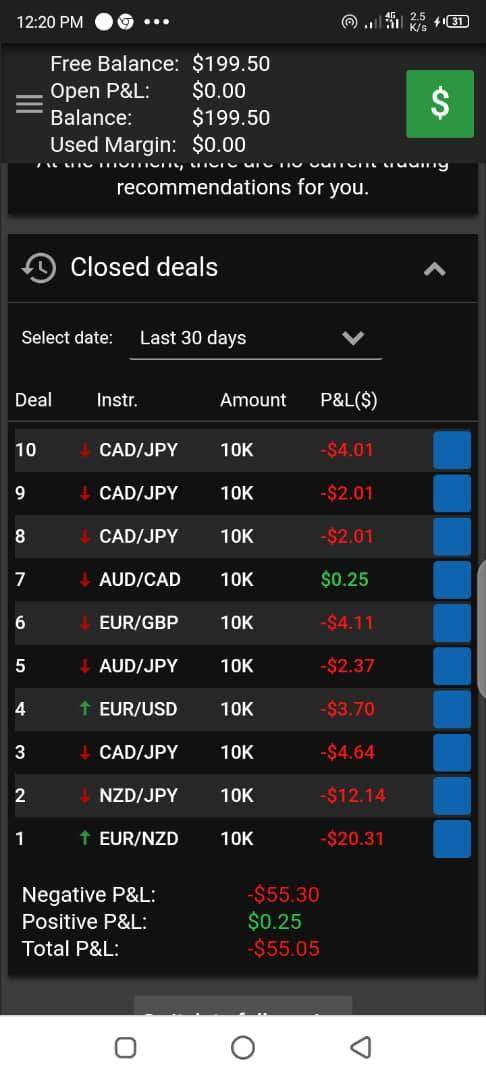

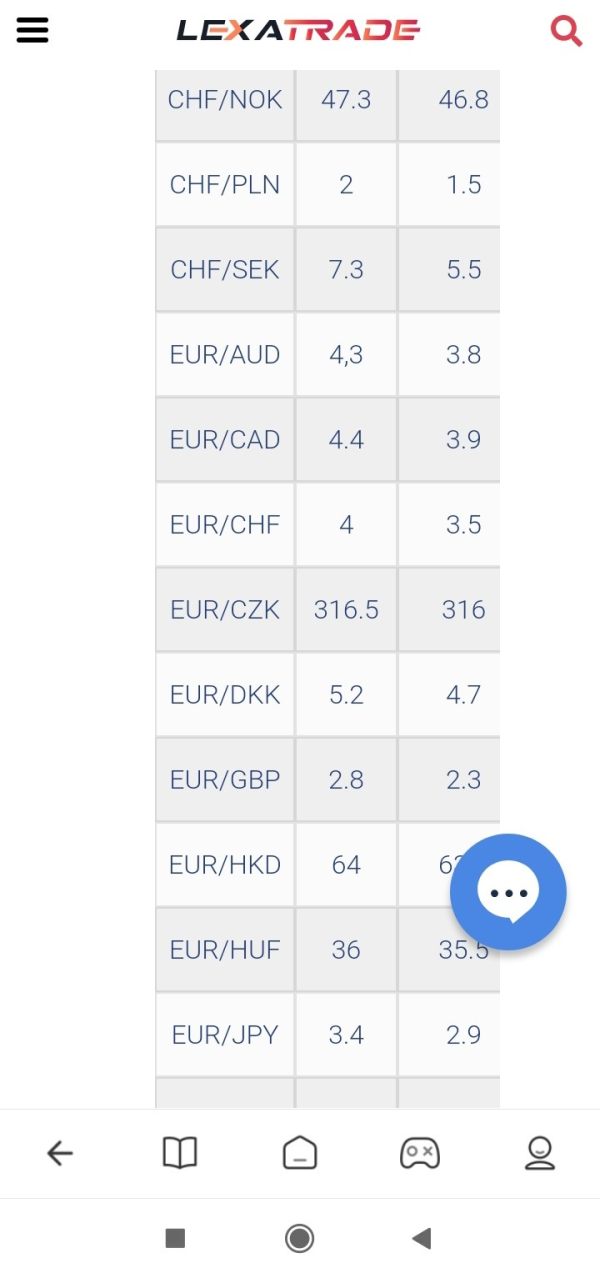

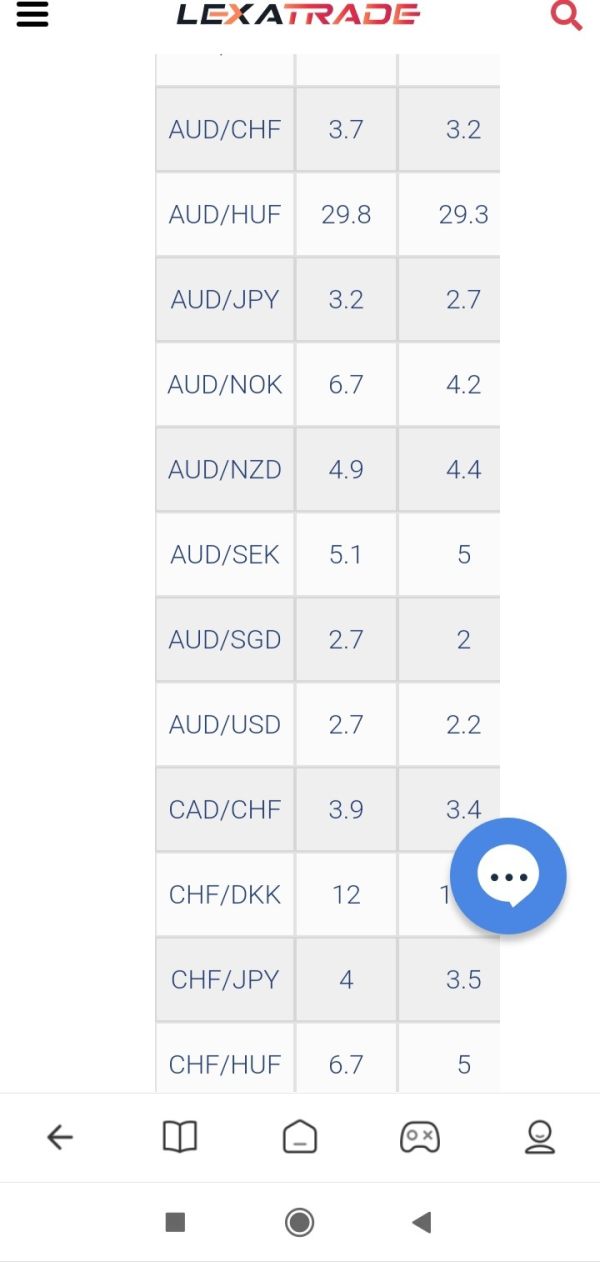

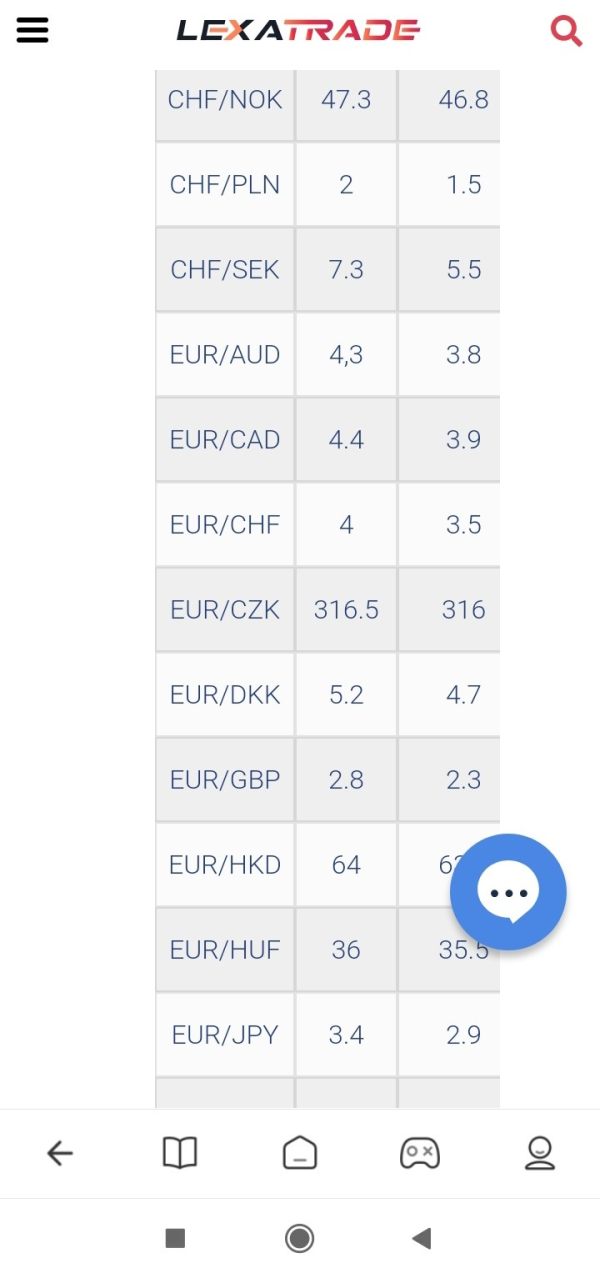

Costs

Spreads at Lexatrade start from 1 pip, which is competitive but can widen significantly depending on market conditions and account type. Users have reported that costs can be higher than those offered by other brokers, particularly at lower account tiers. According to ForexAnalytics, the overall cost structure can be a deterrent for traders looking for low-cost trading options.

Leverage

Lexatrade offers a maximum leverage of 1:200, which is standard in the industry. While higher leverage can amplify profits, it also increases the risk of significant losses, especially for inexperienced traders. This has been a point of concern in user reviews, with some suggesting that the broker's marketing tactics may encourage reckless trading behavior.

Traders can utilize both the proprietary platform and the widely used MT4 platform. However, access to MT4 is restricted based on account type, with only higher-tier accounts gaining full access. This has been criticized as a way to incentivize larger deposits, which some users find off-putting.

Restricted Regions

Lexatrade is not permitted to operate in several jurisdictions, including the US and the EU, due to its regulatory status. This limitation can affect traders looking for a reliable broker in those regions, as they may be left without adequate support or legal recourse if issues arise.

Available Customer Service Languages

Lexatrade provides customer support in English and operates 24/7. However, user reviews indicate that response times may vary, with some experiencing delays in getting assistance. The overall effectiveness of customer support has received mixed feedback, with some users praising the support team while others have expressed frustration over unresponsive service.

Final Ratings Overview

In conclusion, while Lexatrade offers a range of trading options and a low entry point for new traders, significant concerns regarding its regulatory status and user experiences suggest that potential investors should proceed with caution. As always, conducting thorough research and considering alternative brokers may be prudent before committing funds.