Is KIWIBULL safe?

Business

License

Is Kiwibull A Scam?

Introduction

Kiwibull is a forex broker that has emerged in the trading landscape, primarily targeting clients in New Zealand. Established in 2017, it offers a range of trading services, including forex, commodities, and indices. However, as with any financial service, traders must exercise caution when selecting a broker. The foreign exchange market is rife with potential pitfalls, including scams and unregulated entities that can jeopardize traders' investments. Therefore, it is essential to conduct thorough due diligence before committing funds to any trading platform. This article investigates Kiwibull's legitimacy by examining its regulatory status, company background, trading conditions, client safety measures, and customer experiences. The findings are based on a review of various reputable sources, including user comments, regulatory reports, and expert analyses.

Regulation and Legitimacy

Regulatory oversight is crucial for any trading broker as it ensures compliance with industry standards and protects traders' interests. Kiwibull operates under the auspices of the Financial Service Providers Register (FSPR) in New Zealand. However, its regulatory status has raised concerns among traders and analysts. Below is a summary of Kiwibull's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSPR | 502408 | New Zealand | Suspicious Clone |

Kiwibull is categorized as a "suspicious clone," which means that it may not operate under the legitimate licensing framework that protects traders. The lack of transparency surrounding its regulatory status is alarming, as it raises questions about the broker's adherence to compliance standards. Moreover, the absence of robust regulatory oversight can expose traders to significant risks, including potential fraud and loss of funds. Historical compliance issues are also a concern, as Kiwibull has received numerous complaints regarding its operations, which further complicates its credibility.

Company Background Investigation

Kiwibull was founded in 2017 and is primarily based in New Zealand. The company operates under the name KB Group Global Limited, but information about its ownership structure and management team is limited. This lack of transparency can hinder potential traders from fully understanding the broker's operational framework.

The management team's background is another critical factor influencing Kiwibull's credibility. Without publicly available information regarding the team's qualifications and experience, potential clients may find it challenging to gauge the broker's reliability. Transparency in company operations, including clear disclosures about ownership and management, is vital for establishing trust.

Trading Conditions Analysis

Kiwibull offers a variety of trading conditions, including competitive spreads and a low minimum deposit requirement. However, traders should carefully evaluate the overall fee structure and any unusual costs associated with trading. Below is a comparison of Kiwibull's core trading costs:

| Cost Type | Kiwibull | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.3 pips | 1.0 pips |

| Commission Model | $0.5 per side per lot | Varies |

| Overnight Interest Range | Varies | Varies |

While Kiwibull advertises competitive spreads starting from 0.3 pips, traders should be wary of any hidden fees or commissions that may not be immediately apparent. The commission structure, which charges $0.5 per side per lot, is relatively low compared to industry standards, but traders should ensure that they fully understand the implications of these costs on their overall trading profitability.

Client Fund Safety

The safety of client funds is paramount when evaluating a broker's credibility. Kiwibull claims to implement various safety measures, including segregating client funds from operational capital. However, the absence of robust regulatory oversight raises concerns about the effectiveness of these measures. Furthermore, Kiwibull's investor protection policies, such as negative balance protection, are unclear, which could leave traders vulnerable in adverse market conditions.

Historical issues involving fund safety have been reported, with users alleging difficulties in withdrawing funds and instances of account manipulation. These concerns underscore the importance of verifying a broker's track record regarding fund safety before engaging in trading activities.

Customer Experience and Complaints

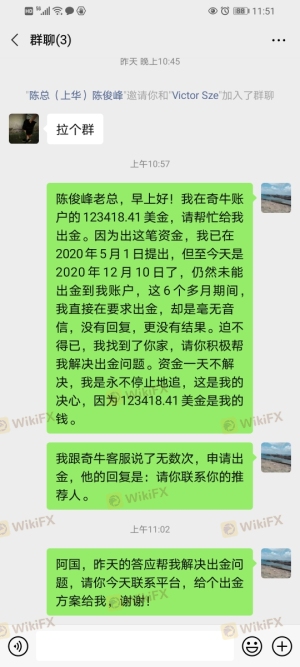

Customer feedback is a valuable indicator of a broker's reliability. Kiwibull has garnered mixed reviews, with many users expressing dissatisfaction regarding its services. Common complaints include difficulties in fund withdrawals, unresponsive customer support, and instances of account manipulation.

The following table summarizes the main types of complaints received about Kiwibull:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Account Manipulation | High | Unresolved |

| Poor Customer Support | Medium | Limited availability |

For instance, several users have reported being unable to withdraw their funds, leading to frustrations and accusations of the broker being a scam. These complaints highlight the necessity for potential traders to exercise caution when considering Kiwibull as their trading platform.

Platform and Trade Execution

Kiwibull utilizes the popular MetaTrader 4 (MT4) platform for trading, which is known for its user-friendly interface and comprehensive analytical tools. However, the performance and stability of the platform have been questioned by users, particularly in terms of order execution quality and slippage rates. Instances of order rejection and manipulation have also been reported, raising concerns about the broker's operational integrity.

Risk Assessment

Trading with Kiwibull presents several risks that traders should be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Lack of proper regulation raises concerns about oversight. |

| Fund Safety | High | Reports of withdrawal issues and fund manipulation. |

| Customer Support | Medium | Limited availability and responsiveness to user inquiries. |

To mitigate these risks, traders should consider employing strict risk management strategies, such as setting stop-loss orders and limiting exposure to volatile assets. Additionally, it would be prudent to conduct thorough research and consider alternative, more reputable brokers if concerns persist.

Conclusion and Recommendations

In conclusion, Kiwibull exhibits several red flags that warrant caution. The lack of regulatory oversight, transparency issues, and numerous customer complaints raise serious concerns about its legitimacy. While Kiwibull offers competitive trading conditions, the potential risks involved may outweigh the benefits for many traders.

For those considering trading with Kiwibull, it is advisable to proceed with caution and consider alternative brokers that have established reputations and regulatory compliance. Reliable options include brokers that are well-regulated and have positive customer feedback. Ultimately, ensuring the safety of your investments should be the top priority when selecting a trading platform.

Is KIWIBULL a scam, or is it legit?

The latest exposure and evaluation content of KIWIBULL brokers.

KIWIBULL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KIWIBULL latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.