Is KALO safe?

Pros

Cons

Is Kalo Safe or a Scam?

Introduction

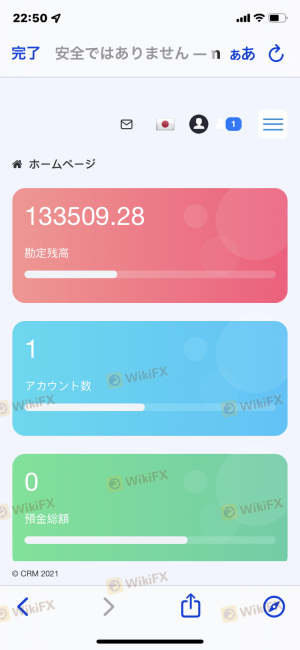

Kalo Global Limited, commonly referred to as Kalo, is a forex broker that has positioned itself in the competitive landscape of foreign exchange trading. With a focus on offering a range of financial instruments including forex pairs, precious metals, and binary options, Kalo claims to provide traders with diverse trading opportunities. However, the forex market is notorious for its potential risks, making it essential for traders to carefully evaluate the legitimacy and reliability of brokers before committing their funds. This article aims to provide an objective assessment of Kalo by examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile. The analysis is based on data gathered from various reputable sources, including broker reviews and customer feedback.

Regulation and Legitimacy

The regulatory framework within which a broker operates is a critical factor in determining its legitimacy. Kalo is registered in Japan; however, it lacks oversight from any major regulatory authority, which raises concerns about its trustworthiness. Below is a summary of Kalo's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Japan | Not Regulated |

The absence of regulation is particularly alarming as it means that Kalo is not held to the standards typically enforced by regulatory bodies, which include transparency, fair trading practices, and protection for client funds. Furthermore, reports suggest that Kalo has a "suspicious regulatory license," indicating a lack of credibility in its operational practices. Historical compliance issues further exacerbate concerns, as some users have reported difficulties in withdrawing funds, which is often a red flag in the forex trading community. Therefore, in assessing whether Kalo is safe, it is crucial to highlight that its lack of regulatory oversight significantly diminishes its reliability as a trading platform.

Company Background Investigation

Kalo Global Limited has been operational for a few years, but detailed information about its ownership structure and management team is sparse. The company's website provides limited transparency regarding its history and the qualifications of its management. This lack of information raises questions about the broker's accountability and operational integrity. A robust management team with relevant experience is essential for effective decision-making and risk management in the highly volatile forex market. However, Kalo's opaque corporate structure makes it difficult for potential clients to ascertain whether the firm is led by industry veterans or inexperienced individuals.

Moreover, the overall transparency of Kalo's operations is questionable, as many reviews indicate a lack of clear communication regarding trading conditions and fees. This opacity can be detrimental to traders, who rely on open and honest information when choosing a broker. In conclusion, the limited information available about Kalo's background and management further contributes to the uncertainty surrounding its safety.

Trading Conditions Analysis

Kalo claims to offer competitive trading conditions, but an in-depth analysis reveals several concerning aspects regarding its fee structure. The broker advertises low spreads; however, it fails to provide specific details about these spreads for various instruments. This lack of clarity can lead to unexpected costs for traders, which is a common tactic employed by less reputable brokers. Below is a comparison of Kalo's core trading costs with industry averages:

| Cost Type | Kalo | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Specified | 1-2 pips |

| Commission Model | Not Specified | Varies |

| Overnight Interest Range | Not Specified | Varies |

The absence of explicit information regarding spreads and commissions raises a significant red flag. Traders may find themselves facing higher costs than anticipated, which can erode profitability. Additionally, Kalo's vague descriptions of trading conditions may indicate an intention to obscure the true costs associated with trading on its platform. Thus, in determining whether Kalo is safe, it is vital to consider these potentially deceptive practices.

Client Fund Safety

The safety of client funds is paramount in forex trading. Kalo's approach to fund security is unclear, with no information readily available regarding fund segregation, investor protection, or negative balance protection policies. Without these safeguards, traders risk losing their entire deposits, especially in the event of the broker's insolvency. Historically, there have been complaints regarding the inability to withdraw funds, which raises concerns about the broker's financial stability and commitment to safeguarding client assets.

A thorough evaluation of Kalo's fund safety protocols reveals a lack of robust measures that are typically expected from reputable brokers. The absence of regulatory oversight further compounds these issues, as clients have no recourse in the event of disputes or financial mishaps. Therefore, when assessing whether Kalo is safe, it is critical to highlight the potential risks associated with inadequate fund protection measures.

Customer Experience and Complaints

Customer feedback is a valuable resource for evaluating a broker's reliability. Reviews of Kalo indicate a mixed experience among users, with several complaints surfacing regarding withdrawal issues and unresponsive customer support. The following table summarizes the primary types of complaints received:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Inconsistent |

| Transparency | High | Lacking |

Many users have reported difficulties in accessing their funds, which is a significant concern in the forex trading community. Additionally, the quality of customer support has been criticized, with users noting slow response times and a lack of helpfulness. These complaints suggest that Kalo may not prioritize customer service, which can be detrimental to traders seeking assistance. A few case studies illustrate these issues, with one user reporting a prolonged wait for a withdrawal that ultimately resulted in frustration and dissatisfaction. Such experiences highlight the potential risks of trading with Kalo and raise questions about its overall safety.

Platform and Trade Execution

The trading platform offered by Kalo is described as user-friendly, but there are concerns regarding its stability and execution quality. Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes. A reliable trading platform should ensure quick and accurate order execution, and any signs of manipulation or technical issues can undermine traders' trust.

Moreover, the lack of transparency regarding the platform's operational metrics raises concerns about its reliability. If traders cannot depend on the platform for timely execution, their trading strategies may be adversely affected. This uncertainty further complicates the assessment of whether Kalo is safe for traders seeking a dependable trading environment.

Risk Assessment

Using Kalo as a trading platform presents a variety of risks that traders should be aware of. Below is a summary of the key risk areas associated with Kalo:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Withdrawal issues reported |

| Operational Risk | Medium | Platform stability concerns |

| Customer Service Risk | Medium | Poor responsiveness noted |

Given the high levels of regulatory and financial risks, traders should proceed with caution when considering Kalo as their broker. It is advisable to implement risk mitigation strategies, such as setting strict limits on investments and maintaining a diversified trading portfolio. Additionally, traders should ensure they have a clear understanding of the trading conditions and potential costs associated with using Kalo.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Kalo Global Limited raises several red flags regarding its safety and reliability as a forex broker. The absence of regulatory oversight, coupled with numerous complaints about withdrawal issues and poor customer support, indicates that traders should approach this broker with caution. While Kalo may offer certain trading opportunities, the potential risks associated with using its platform cannot be overlooked.

For traders seeking a safer alternative, it is recommended to consider brokers that are regulated by reputable authorities, have transparent fee structures, and demonstrate a commitment to customer service. Some alternatives include well-established brokers like OANDA, IG, and Forex.com, which have proven track records in the industry. Ultimately, when evaluating whether Kalo is safe, it is crucial for traders to conduct thorough research and remain vigilant in protecting their investments.

Is KALO a scam, or is it legit?

The latest exposure and evaluation content of KALO brokers.

KALO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KALO latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.