Is Amcor safe?

Pros

Cons

Is Amcor Safe or Scam?

Introduction

Amcor, a broker established in 2018, positions itself as a player in the foreign exchange market, catering to both individual and institutional traders. As with any forex broker, it is crucial for traders to conduct thorough due diligence before engaging with the platform. The forex market is notoriously volatile and susceptible to scams, making it imperative for traders to assess the legitimacy and safety of their chosen broker. This article aims to provide a comprehensive evaluation of Amcor by examining its regulatory status, company background, trading conditions, customer safety measures, client experiences, platform performance, and overall risk assessment. The analysis is based on information gathered from various reputable sources, including regulatory databases, user reviews, and financial reports.

Regulation and Legitimacy

Understanding a broker's regulatory status is essential in determining its legitimacy. Regulatory bodies enforce strict guidelines to protect traders and ensure fair trading practices. Amcor claims to be regulated by the National Futures Association (NFA), which is crucial for establishing trust with potential clients. Below is a summary of Amcor's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0512532 | United States | Suspicious Clone |

Despite being based in the United States and claiming to operate under the NFA, Amcor has been flagged as a "suspicious clone" by various sources. This term typically indicates that the broker might not be operating under the guidelines of the stated regulatory body or may be a fraudulent entity masquerading as a legitimate broker. The lack of a solid regulatory framework raises significant concerns regarding Amcor's trustworthiness. Furthermore, the absence of negative regulatory disclosures during the evaluation period does not necessarily imply that the broker is safe; it merely indicates a lack of documented infractions. Therefore, when assessing whether Amcor is safe, traders must remain cautious and consider the implications of its regulatory status.

Company Background Investigation

Amcor's history and ownership structure play a vital role in understanding its reliability. The broker was founded in 2018, making it relatively new in the forex industry. A brief examination of its management team reveals a lack of transparency regarding their backgrounds and qualifications, which is a red flag for potential investors. The absence of detailed information about the company's founders and key personnel can lead to questions about the broker's credibility.

Moreover, the company's transparency and information disclosure levels are critical factors in assessing its safety. A broker that does not provide clear information about its operations, ownership, and financial health may not be trustworthy. Amcor's limited disclosure raises concerns about its intentions and operational practices. In summary, while Amcor presents itself as a legitimate trading platform, the lack of a well-established history and transparency in its management raises questions about whether Amcor is safe for traders.

Trading Conditions Analysis

A broker's trading conditions, including fees and spreads, are significant factors that traders should consider. Amcor offers various trading instruments, including forex, commodities, and CFDs, but the details surrounding its fee structure are somewhat opaque. It is essential to evaluate whether the costs associated with trading on Amcor are competitive compared to industry standards.

| Fee Type | Amcor | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1.5 pips |

| Commission Model | Not clear | $5 per lot |

| Overnight Interest Range | Not specified | Varies |

The absence of clear information regarding spreads, commissions, and overnight interest rates can be a warning sign. Traders should be wary of brokers that do not transparently disclose their fee structures, as hidden fees can significantly impact profitability. Furthermore, the lack of competitive trading conditions could indicate that Amcor may not be the best choice for traders seeking favorable trading environments. Therefore, when considering whether Amcor is safe, it is crucial to analyze its trading conditions thoroughly.

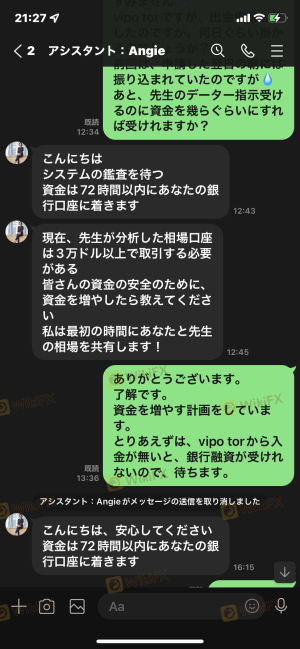

Client Funds Security

The safety of client funds is a paramount concern for any trader. Amcor claims to implement various security measures to protect its clients' funds, including segregated accounts and investor protection policies. However, the effectiveness of these measures is unclear due to the lack of detailed information available.

Traders should inquire about Amcor's policies regarding fund segregation, negative balance protection, and investor compensation schemes. These factors are essential in determining the level of safety provided to clients. Additionally, any historical issues related to fund security or disputes involving client funds should be thoroughly investigated. The absence of documented safety issues does not necessarily guarantee that Amcor is safe; it merely indicates that no significant incidents have been reported.

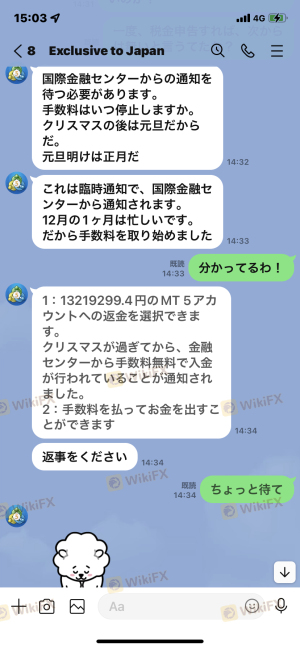

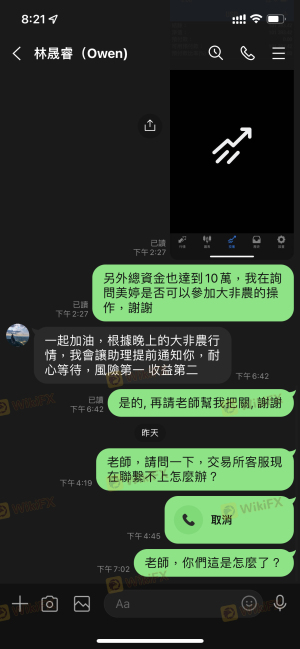

Customer Experience and Complaints

Client feedback is an invaluable resource for assessing a broker's reliability and service quality. Reviews of Amcor reveal a mixed bag of experiences, with some users praising its platform while others report significant issues, particularly regarding withdrawals and customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Service Delays | Medium | Slow to respond |

Common complaints include difficulties in withdrawing funds and a lack of responsive customer service. For instance, one user reported being unable to withdraw funds after multiple requests, highlighting a potential red flag regarding Amcor's operational practices. Such issues can significantly impact a trader's experience and raise concerns about the broker's reliability. Therefore, potential clients should carefully consider whether Amcor is safe based on the collective feedback from existing users.

Platform and Execution

The performance of a trading platform is a critical aspect of the trading experience. Amcor provides a trading platform that is generally well-received, with users noting its user-friendly interface and functionality. However, concerns have been raised regarding order execution quality, including instances of slippage and rejected orders.

Traders should be aware of any signs of platform manipulation or execution issues, as these can severely affect trading outcomes. The quality of order execution is paramount; delays or failures in executing trades can lead to significant financial losses. Consequently, traders must assess whether Amcor is safe by evaluating the platform's performance and execution reliability.

Risk Assessment

Using Amcor as a trading platform entails certain risks that traders should be aware of. Analyzing the overall risk landscape is essential for making informed decisions.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of solid regulation raises concerns. |

| Financial Stability Risk | Medium | Limited information on financial health. |

| Operational Risk | High | Complaints about withdrawals and customer service issues. |

Given the above risks, traders should proceed with caution when considering Amcor as their broker. To mitigate these risks, it is advisable to start with a small investment, use risk management strategies, and continuously monitor the broker's performance and reputation.

Conclusion and Recommendations

In conclusion, while Amcor presents itself as a forex broker, several factors raise concerns about its safety and legitimacy. The lack of robust regulatory oversight, transparency in company operations, unclear trading conditions, and negative user experiences suggest that traders should exercise caution. Potential clients must thoroughly evaluate whether Amcor is safe before committing their funds.

For traders seeking reliable alternatives, consider brokers with strong regulatory oversight, transparent fee structures, and positive client feedback. Brokers such as OANDA, IG, or Forex.com are often recommended due to their established reputations and regulatory compliance. Ultimately, conducting thorough research and considering user experiences will help traders make informed decisions in the forex market.

Is Amcor a scam, or is it legit?

The latest exposure and evaluation content of Amcor brokers.

Amcor Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Amcor latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.