KALO 2025 Review: Everything You Need to Know

Summary

This kalo review shows big problems with KALO as a forex broker. The company operates under the name KALO GLOBAL LIMITED and claims to be based in the UK with FCA supervision, but our research found serious issues that traders need to know about. KALO has been marked with a "SCAM" status, which is a major red flag for anyone thinking about trading with them.

The broker's website at kalofx.com does not have the clear information that good brokers usually provide. Real licensed brokers always show their licenses and permits clearly, but KALO fails to give proper regulatory proof. This missing information is something you often see with unlicensed brokers who try to hide their true status.

Traders who want safe forex services should stay away from KALO because of these regulatory problems and lack of clear information. The scam label is especially worrying for people who care about keeping their money safe and having proper protection. This review looks at all the facts to help traders make smart choices before they decide to trade anywhere.

Important Notice

Regulatory Status Warning: KALO claims to operate under KALO GLOBAL LIMITED with FCA supervision, but checking their status shows big problems with their regulatory claims. The broker has been marked as a "SCAM," which means there are serious concerns about whether they are legitimate and follow proper rules.

Review Methodology: This review uses public information, regulatory databases, and user feedback to make its conclusions. Because the broker has questionable status, we did not test their platform directly to keep our reviewers safe and secure.

Rating Framework

Broker Overview

KALO says it is a forex broker that operates through KALO GLOBAL LIMITED, claiming to be a UK-based company. The broker's official website is kalofx.com, but when the company started and other basic company details are not clear from what we can find. The lack of basic company information, including when they were founded and their business history, makes us worry about whether the broker is honest and legitimate.

The company's business plan and what they focus on trading are not clearly explained in public materials. This missing basic information is very different from real, legitimate brokers who usually give complete company backgrounds, business histories, and clear explanations of how they work to build trust with potential clients.

KALO claims the UK Financial Conduct Authority supervises them, trying to position itself as a regulated company. However, this kalo review has found big differences between what they claim and what regulatory checking actually shows. The broker's current status shows as "SCAM," which means there are serious regulatory and operational problems that potential traders must think about carefully before using this platform.

Regulatory Status: KALO claims FCA supervision through KALO GLOBAL LIMITED, but checking shows the broker operates without proper regulatory oversight and carries a "SCAM" label.

Deposit and Withdrawal Methods: The company does not provide specific information about available deposit and withdrawal methods in materials we can access, leaving potential traders without important operational details.

Minimum Deposit Requirements: The broker has not told anyone about minimum deposit amounts or account funding requirements in documentation we can find.

Promotional Offers: No information about bonuses, promotional campaigns, or special offers is available from current sources.

Trading Assets: Details about available trading instruments, currency pairs, commodities, or other tradeable assets are not specified in available materials.

Cost Structure: Important information about spreads, commissions, overnight fees, and other trading costs stays hidden, preventing proper cost analysis for potential traders.

Leverage Options: Specific leverage ratios and margin requirements are not mentioned in available documentation.

Platform Options: Information about trading platforms, whether they made their own or use third-party solutions like MetaTrader, is not provided in sources we can access.

Geographic Restrictions: Details about country restrictions or regional limitations are not specified in available materials.

Customer Support Languages: Available customer service languages and communication options are not clearly outlined.

This kalo review shows the big information gaps that characterize how KALO presents itself to the public, which is very different from transparent, regulated brokers who provide complete operational details.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions evaluation for KALO shows a complete lack of essential information that traders need to make smart decisions. Good brokers usually offer detailed breakdowns of available account types, ranging from basic retail accounts to professional and institutional options. However, KALO provides no clear information about account varieties, their specific features, or the benefits that come with different account levels.

Minimum deposit requirements stay hidden, preventing potential traders from understanding how much money they need to start trading. This lack of transparency extends to account opening procedures, verification requirements, and documentation needed for account activation. Professional brokers usually outline clear, step-by-step account opening processes, but KALO fails to provide such guidance.

Special account features, such as Islamic accounts for traders requiring Sharia-compliant trading conditions, are not mentioned in available materials. The absence of information about account-specific benefits, trading conditions variations, or premium account features further hurts the broker's credibility and transparency.

The overall account conditions framework appears poorly developed or deliberately hidden, which is especially concerning given the broker's "SCAM" label. This kalo review emphasizes that the lack of clear account information represents a major red flag for potential traders seeking reliable trading partners.

KALO's trading tools and resources evaluation shows a concerning lack of essential trading infrastructure. Established brokers usually provide complete suites of analytical tools, including technical indicators, charting packages, economic calendars, and market analysis resources. However, no information about such tools is available from KALO's public materials.

Research and analysis resources, which form the backbone of informed trading decisions, appear to be completely missing from KALO's offering. Professional brokers usually provide daily market analysis, expert commentary, economic forecasts, and research reports to support trader decision-making. The complete absence of such resources suggests either poor service development or deliberate information hiding.

Educational resources, crucial for trader development and platform familiarization, are not mentioned in available documentation. Quality brokers usually offer webinars, tutorials, trading guides, and educational materials to support both new and experienced traders. KALO's lack of educational content indicates a significant service gap.

Automated trading support, including expert advisor compatibility, algorithmic trading tools, and copy trading features, remains unspecified. The absence of information about trading automation capabilities further limits the platform's appeal to modern traders who increasingly rely on such technologies.

Customer Service and Support Analysis

Customer service evaluation for KALO shows significant concerns about support quality and availability. The broker has not clearly outlined available customer support channels, leaving potential traders uncertain about how to get help when they need it. Professional brokers usually provide multiple contact methods, including phone, email, live chat, and sometimes social media support.

Response times and service quality metrics are not disclosed, preventing assessment of support efficiency. Established brokers usually guarantee specific response timeframes and maintain service level agreements to ensure consistent customer support quality. KALO's absence of such commitments raises questions about their dedication to customer service excellence.

Multilingual support capabilities remain unspecified, which is especially important for international traders who may need help in their native languages. The lack of information about customer service hours, timezone coverage, and support availability during market hours further adds to service uncertainty.

User feedback regarding customer service quality is limited, but the overall lack of transparent support information aligns with the broker's "SCAM" label. The absence of clear customer service protocols and support channel information represents another significant concern for potential traders considering KALO's services.

Trading Experience Analysis

The trading experience evaluation for KALO is severely limited by the complete absence of platform information and trading condition details. Professional brokers usually provide complete information about platform stability, execution speeds, server locations, and uptime statistics. KALO offers no such transparency, making it impossible to assess the technical quality of their trading environment.

Order execution quality, including execution speeds, slippage rates, and fill quality metrics, remains completely hidden. These factors are crucial for trader success, especially for scalpers and high-frequency traders who depend on precise execution. The lack of execution quality information suggests either poor performance or deliberate hiding of substandard services.

Platform functionality completeness cannot be evaluated due to absent information about available features, analytical tools, order types, and trading capabilities. Modern traders expect sophisticated platform features, including advanced charting, multiple order types, and complete trade management tools.

Mobile trading experience details are not provided, despite mobile trading becoming increasingly important for modern traders who need platform access across devices. The absence of mobile platform information, including app availability and mobile feature sets, further reduces KALO's appeal.

This kalo review emphasizes that the complete lack of trading experience information, combined with the broker's "SCAM" status, makes KALO unsuitable for serious trading activities.

Trust and Security Analysis

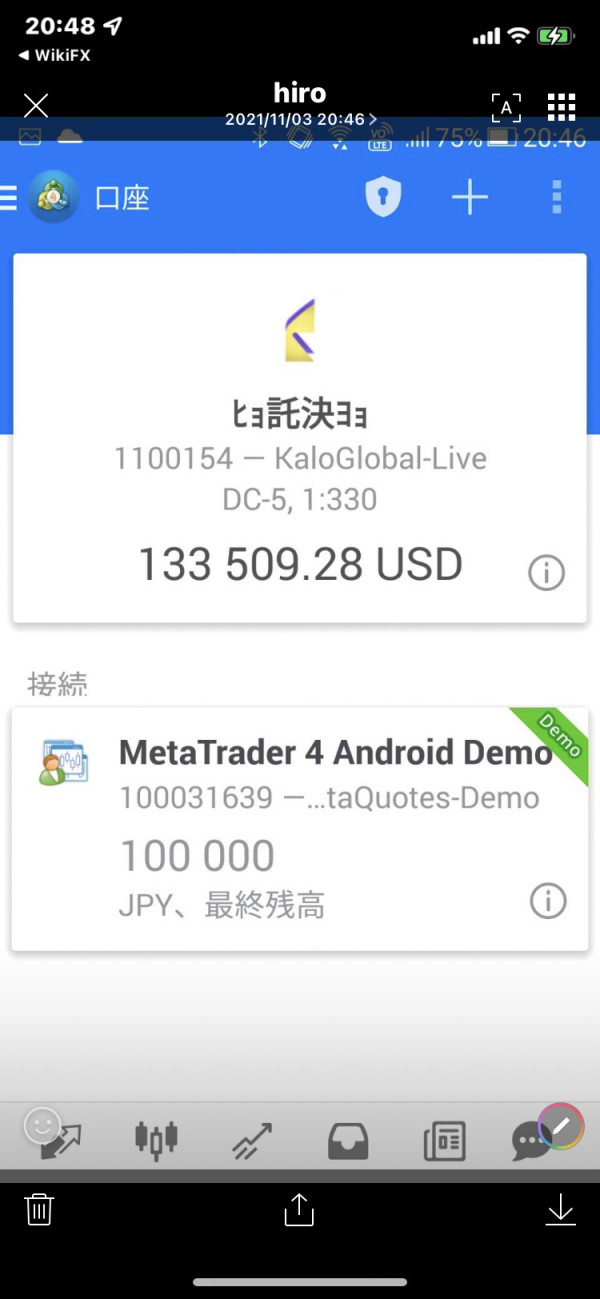

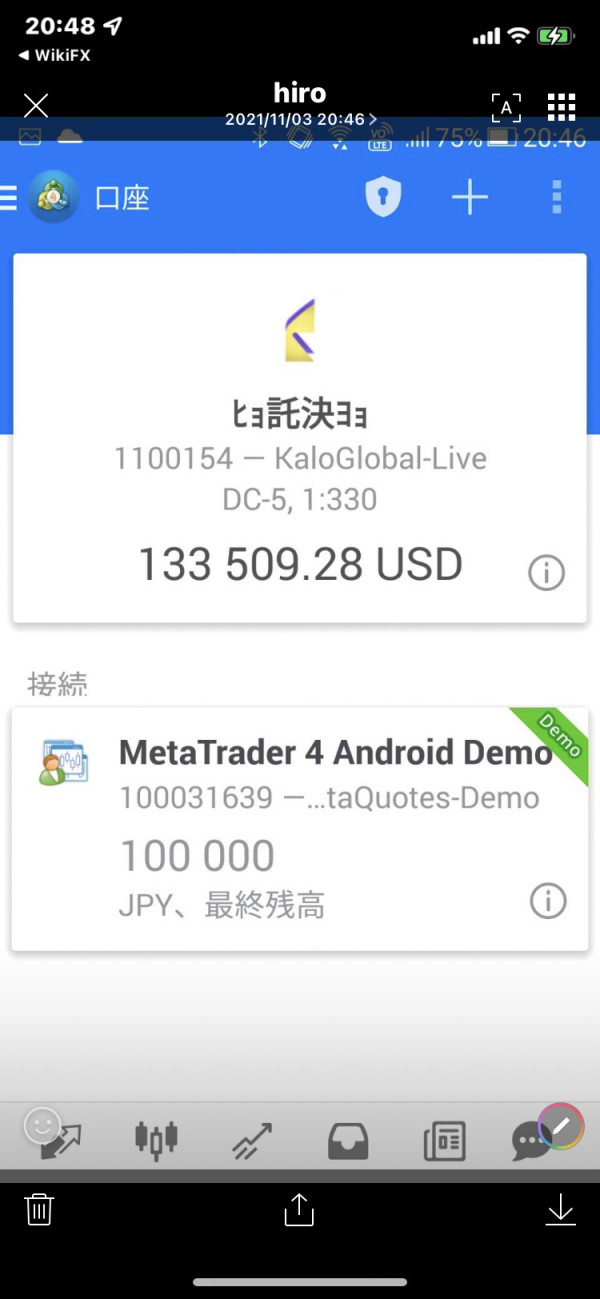

KALO's trust and security evaluation reveals the most concerning aspects of this broker review. While the broker claims FCA supervision through KALO GLOBAL LIMITED, independent verification has resulted in a "SCAM" label, indicating serious regulatory and operational concerns. Legitimate brokers maintain verifiable regulatory licenses that can be confirmed through official regulatory databases.

Fund safety measures, including client fund segregation, deposit protection schemes, and insurance coverage, are not disclosed in available materials. Regulated brokers usually provide detailed information about how client funds are protected, including segregated account arrangements and compensation scheme participation.

Company transparency is severely lacking, with minimal information about company ownership, management team, operational history, or financial standing. Professional brokers usually provide complete company information, including executive profiles, operational transparency, and regular financial reporting.

Industry reputation assessment reveals significant concerns, with the "SCAM" label representing the most serious red flag possible for a forex broker. This classification indicates that the broker has failed to meet basic regulatory and operational standards expected in the forex industry.

The handling of negative events and regulatory concerns appears inadequate, with the broker's current status suggesting unresolved serious issues that have led to the scam classification.

User Experience Analysis

User experience evaluation for KALO is challenging due to limited available feedback and the broker's questionable operational status. Overall user satisfaction metrics are not available from reliable sources, preventing complete assessment of client experiences with the platform and services.

Interface design and usability information is not provided in accessible materials, making it impossible to evaluate the platform's user-friendliness, navigation quality, or design sophistication. Modern traders expect intuitive, well-designed interfaces that make efficient trading activities easier.

Registration and verification processes are not clearly outlined, leaving potential users uncertain about account opening requirements, documentation needs, and verification timeframes. Professional brokers usually provide clear guidance about onboarding procedures to ensure smooth account activation.

Fund operation experiences, including deposit and withdrawal processes, processing times, and associated fees, remain hidden. These operational aspects are crucial for trader satisfaction and platform usability assessment.

Common user complaints and satisfaction indicators are not available from reliable sources, though the broker's "SCAM" label suggests significant user experience problems. The absence of positive user feedback, combined with the serious regulatory concerns, indicates poor overall user experience quality.

Conclusion

This complete kalo review concludes that KALO presents significant risks and concerns that make it unsuitable for forex trading activities. The broker's "SCAM" label, combined with questionable regulatory claims and lack of operational transparency, creates an environment of unacceptable risk for potential traders.

KALO is not recommended for any trader category, whether new or experienced, due to the fundamental trust and security issues identified in this evaluation. Traders seeking reliable, regulated forex services should consider established brokers with verifiable regulatory oversight and transparent operational practices.

The main disadvantages significantly outweigh any potential benefits, with the scam label representing the most serious concern possible for a forex broker. The absence of regulatory verification, operational transparency, and reliable customer feedback creates an unsuitable trading environment that responsible traders should avoid entirely.