Regarding the legitimacy of USG forex brokers, it provides FCA and WikiBit, .

Is USG safe?

Pros

Cons

Is USG markets regulated?

The regulatory license is the strongest proof.

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Union Standard International Group Limited

Effective Date:

2018-11-05Email Address of Licensed Institution:

compliance@ukusg.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

https://www.ukusg.co.uk/Expiration Time:

2022-12-16Address of Licensed Institution:

75 King William Street London EC4N 7BE UNITED KINGDOMPhone Number of Licensed Institution:

+4402078463712Licensed Institution Certified Documents:

Is USG Safe or Scam?

Introduction

In the ever-evolving landscape of the foreign exchange (Forex) market, USG (United Strategic Group) has emerged as a player since its establishment in 2022. Positioned as a broker offering various trading options, USG has attracted the attention of both novice and seasoned traders. However, the Forex market is rife with potential pitfalls, making it crucial for traders to meticulously evaluate the credibility of any broker they consider. This article aims to dissect the various aspects of USG, including its regulatory status, company background, trading conditions, and customer experiences, to determine whether USG is safe for trading or if it exhibits characteristics of a scam.

The investigation is based on a comprehensive review of multiple credible sources, including user feedback, regulatory disclosures, and expert analyses. This structured approach will provide a balanced view of USG's operations, allowing traders to make informed decisions.

Regulation and Legitimacy

A broker's regulatory status is a key indicator of its legitimacy and operational integrity. USG claims to be associated with two entities: United Strategic Group LLC, registered in Saint Vincent and the Grenadines, and Union Standard International Group Limited, which is regulated by the Financial Conduct Authority (FCA) in the UK. However, the regulatory landscape surrounding USG is murky.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 798776 | UK | Suspicious Clone |

| SVG FSA | 648 LLC 2020 | Saint Vincent | Not Applicable |

While the FCA regulates Union Standard International Group, it is essential to note that the only approved domain for this entity is ukusg.co.uk, which does not include USG's trading platforms. Furthermore, reports indicate that the SVG FSA does not issue licenses for Forex trading, raising concerns about the legitimacy of USG's operations. The FCA has also issued warnings against USG for providing financial services without authorization, reinforcing the notion that USG may not be safe for traders.

The lack of a solid regulatory framework raises red flags about the quality of oversight and the potential risks involved in trading with USG. Given these factors, traders should approach USG with caution and consider the implications of engaging with a broker that operates in such a precarious regulatory environment.

Company Background Investigation

USG's company history is relatively brief, having been founded in 2022. The ownership structure includes two entities, but the transparency surrounding their operational practices is questionable. There is limited information available about the company's management team, which raises concerns about accountability and expertise in the Forex trading space.

The lack of a well-established history and a transparent ownership structure can lead to uncertainty regarding the broker's long-term viability. A broker's reputation is often built on its track record, and USG's short existence does not provide sufficient evidence of reliability. Moreover, the absence of comprehensive disclosures about the company's operational practices further complicates the assessment of whether USG is safe for traders.

In a competitive market, established brokers with a history of regulatory compliance and transparent practices tend to inspire more confidence among traders. In contrast, USG's ambiguous background may deter potential clients from engaging with the broker.

Trading Conditions Analysis

When evaluating a Forex broker, understanding the trading conditions is vital. USG offers various account types and claims to provide competitive trading fees. However, the overall fee structure appears convoluted, with reports of hidden charges and unusual fee policies that could impact traders' profitability.

| Fee Type | USG | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.5 pips | From 1.0 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | Not disclosed | Varies widely |

The spread for major currency pairs starts at 1.5 pips, which is higher than the industry average. Additionally, the commission model is not clearly defined, leading to potential unexpected costs for traders. Such lack of clarity can create an environment where traders may feel misled or trapped by unfavorable trading conditions, prompting concerns about the broker's integrity and whether USG is safe for trading.

Traders should be wary of brokers that do not transparently disclose their fee structures, as this can lead to unexpected financial burdens and diminish overall trading experience. The potential for hidden fees is a significant risk factor that traders must consider before committing their capital to USG.

Customer Funds Security

The security of client funds is paramount when assessing a Forex broker's trustworthiness. USG claims to implement various measures to protect client funds, including segregated accounts and negative balance protection. However, the effectiveness of these measures remains questionable given the broker's regulatory shortcomings.

The lack of a robust regulatory framework means that the protections typically afforded to clients by regulated brokers may not apply to USG. Historical complaints from users indicate issues with fund withdrawals and customer service responsiveness, raising alarms about the broker's commitment to safeguarding client assets.

While USG asserts that client funds are kept in segregated accounts, the absence of regulatory oversight diminishes the effectiveness of such measures. Traders should be cautious and consider the implications of engaging with a broker that lacks comprehensive protections for client funds, as this could expose them to significant financial risks.

Customer Experience and Complaints

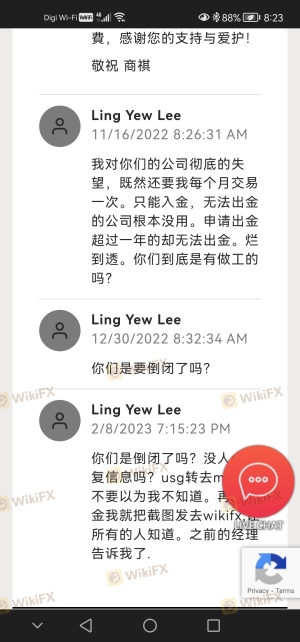

Customer feedback is an essential component in evaluating a broker's reliability. USG has garnered numerous complaints regarding withdrawal issues, unresponsive customer service, and general dissatisfaction with the trading experience. Many users report being unable to withdraw their funds, with some claiming they have been waiting for extended periods without resolution.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | High | Poor |

Common complaints include delays in processing withdrawals and a lack of communication from customer service representatives. This pattern of complaints raises serious concerns about the broker's operational integrity and whether USG is safe for traders.

For instance, one user reported being unable to withdraw funds for over a year, highlighting the broker's failure to address customer concerns effectively. Such experiences suggest that USG may not prioritize customer satisfaction or operational transparency, which are critical elements for any trustworthy Forex broker.

Platform and Trade Execution

The trading platform is a pivotal aspect of the trading experience. USG offers popular platforms like MetaTrader 4 and 5, which are generally well-regarded in the industry. However, the performance and stability of these platforms can vary significantly based on the broker's infrastructure.

Users have reported issues with order execution quality, including slippage and instances of order rejections. Such occurrences can severely impact trading outcomes, especially for those employing high-frequency trading strategies. If traders experience consistent execution problems, it raises questions about the broker's reliability and whether USG is safe for trading.

Furthermore, any signs of platform manipulation or discrepancies in trade execution can be alarming. Traders should remain vigilant and scrutinize their experiences on the platform to ensure they are not subjected to unfair practices.

Risk Assessment

Engaging with any Forex broker involves inherent risks, and USG is no exception. The following risk assessment summarizes key risk areas associated with trading through this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of proper regulation and oversight |

| Financial Risk | High | Potential for hidden fees and costs |

| Operational Risk | Medium | Customer service and withdrawal issues |

| Platform Risk | Medium | Execution issues and potential manipulation |

The risks associated with trading through USG are notably high, particularly concerning regulatory compliance and financial transparency. To mitigate these risks, traders should conduct thorough due diligence, remain informed about their trading environment, and consider alternative brokers with more robust regulatory frameworks.

Conclusion and Recommendations

In conclusion, the evidence suggests that USG may not be a safe option for Forex trading. The broker's questionable regulatory status, numerous customer complaints, and potential hidden fees raise significant concerns about its operational integrity. Traders should approach USG with caution and consider the risks involved before committing their capital.

For those seeking reliable alternatives, it is advisable to explore brokers with established regulatory oversight and positive user feedback. Brokers regulated by reputable authorities such as the FCA or ASIC typically provide greater security and transparency, ensuring a more trustworthy trading experience. Always prioritize due diligence and thorough research to safeguard your investments in the Forex market.

Is USG a scam, or is it legit?

The latest exposure and evaluation content of USG brokers.

USG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

USG latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.