Is JAFX safe?

Pros

Cons

Is JAFX Safe or a Scam?

Introduction

JAFX is a forex broker that positions itself as a provider of transparent trading solutions for both forex and cryptocurrency markets. Established in 2016, it offers various trading instruments, including over 55 currency pairs and numerous cryptocurrencies. Given the volatile nature of the forex market, traders must exercise caution when selecting a broker, as the risk of encountering scams or unregulated entities is significant. This article aims to provide an objective assessment of JAFX's credibility, focusing on its regulatory status, company background, trading conditions, client fund safety, customer experiences, and overall risks. The investigation relies on a thorough analysis of various online reviews, regulatory databases, and industry reports.

Regulation and Legitimacy

The regulatory environment is a critical factor in assessing whether a broker is safe to trade with. JAFX claims to be registered in Saint Vincent and the Grenadines; however, it lacks a valid regulatory license from any recognized financial authority. This absence of regulation raises significant concerns regarding the safety of client funds and the broker's operational legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Saint Vincent and the Grenadines | Not Regulated |

The lack of oversight from reputable regulatory bodies such as the FCA (UK), ASIC (Australia), or CFTC (USA) indicates that JAFX operates in a high-risk environment. Offshore brokers often exploit lax regulatory frameworks to operate without stringent compliance, making it difficult for clients to seek recourse in case of disputes or fraud. Furthermore, historical compliance issues, including a lawsuit filed by the CFTC against JAFX for operating illegally in the U.S. market, further emphasize the risks associated with trading with this broker. Thus, the question remains: Is JAFX safe? The evidence suggests otherwise.

Company Background Investigation

JAFX is owned and operated by JAFX Ltd, a company that claims to be based in Saint Vincent and the Grenadines. However, the lack of transparency regarding its ownership structure and management team raises red flags. There is limited publicly available information about the individuals behind JAFX, which further complicates the assessment of its reliability.

The company's website offers minimal insights into its operational history, and there are no mentions of awards or recognitions that could enhance its credibility. Transparency is crucial in the financial sector, and the absence of detailed disclosures about the management team or operational practices makes it challenging for potential clients to trust JAFX.

In terms of information disclosure, JAFX's website lacks comprehensive educational resources or market analysis tools, which are often provided by reputable brokers to assist traders in making informed decisions. Given these factors, potential clients must question whether JAFX is safe or if it operates under a veil of secrecy.

Trading Conditions Analysis

JAFX offers a single standard account type with a low minimum deposit requirement of just $10, which may attract novice traders. The broker claims to provide competitive trading conditions, including a maximum leverage of 1:500 and variable spreads starting from 0.4 pips. However, the overall fee structure raises concerns, particularly regarding the commission model.

| Fee Type | JAFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.6 pips | 1.0 pips |

| Commission Model | $4 per lot | $5 per lot |

| Overnight Interest Range | Varies | Varies |

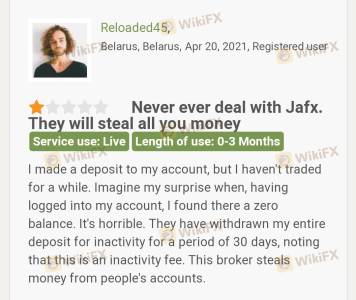

While the spreads appear competitive, the commission structure is not significantly lower than industry standards. Moreover, JAFX charges an inactivity fee of $10 for accounts that have not traded for 30 days, which can be seen as a punitive measure against traders who may not be active. This fee structure, combined with the broker's unregulated status, suggests that potential hidden fees could exist, raising further doubts about whether JAFX is safe for traders.

Client Fund Safety

When evaluating whether a broker is safe, the security of client funds is paramount. JAFX does not provide sufficient information regarding its fund protection measures. There are no indications that client funds are kept in segregated accounts, a standard practice among regulated brokers that protects clients in the event of insolvency.

Additionally, JAFX does not offer any form of investor compensation scheme, which means that clients have no safety net if the broker fails. The lack of transparency surrounding these critical aspects of fund safety poses a significant risk to clients. Historical complaints from users also indicate issues with fund withdrawals, further complicating the security landscape. Given these factors, it is reasonable to conclude that JAFX is not safe for trading.

Customer Experience and Complaints

The customer experience at JAFX has been mixed, with numerous complaints surfacing online. Many users report difficulties with withdrawals, citing delays and unresponsive customer service as significant pain points.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Poor |

| Inactivity Fee Disputes | Low | Average |

Typical cases involve clients waiting weeks or even months to retrieve their funds, raising serious concerns about the broker's operational integrity. Furthermore, some users have alleged that JAFX engages in unethical practices, such as charging inactivity fees without proper notification. The overall sentiment among users leans towards skepticism, leading to the conclusion that JAFX is not a safe option for potential traders.

Platform and Trade Execution

JAFX offers the widely used MetaTrader 4 platform, which provides essential trading tools and features. However, user reviews indicate that the platform may suffer from stability issues, with reports of slippage and order rejections during high volatility periods.

The quality of order execution is a critical factor for traders, and any signs of manipulation or poor performance can severely impact trading outcomes. While the platform itself is reputable, the execution quality at JAFX raises concerns about whether JAFX is safe for serious traders.

Risk Assessment

Trading with JAFX involves several inherent risks, primarily due to its unregulated status and questionable business practices.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection |

| Fund Safety Risk | High | Lack of fund segregation and compensation |

| Customer Service Risk | Medium | Poor response times and unresolved issues |

| Trading Execution Risk | Medium | Reports of slippage and order rejections |

To mitigate these risks, potential traders should consider using a regulated broker with a solid reputation, ensuring that their funds are protected and that they have access to reliable customer support.

Conclusion and Recommendations

In summary, the investigation into JAFX raises significant concerns regarding its safety and legitimacy. The broker operates without regulation, lacks transparency, and has a history of customer complaints, particularly related to fund withdrawals and customer service. Given these factors, it is advisable for traders to approach JAFX with caution.

For those seeking reliable trading options, it is recommended to consider brokers that are regulated by reputable authorities, such as the FCA or ASIC, which ensure a higher level of investor protection and service quality. Ultimately, the evidence suggests that JAFX is not safe for trading, and potential clients would be wise to explore more reputable alternatives.

Is JAFX a scam, or is it legit?

The latest exposure and evaluation content of JAFX brokers.

JAFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JAFX latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.