Is IntertradesFx safe?

Business

License

Is Intertradesfx Safe or Scam?

Introduction

Intertradesfx positions itself as a player in the forex trading market, claiming to offer a range of financial instruments and trading opportunities. However, the rise of online trading has brought with it a plethora of unregulated brokers, making it crucial for traders to carefully assess the legitimacy and safety of any trading platform they consider. The purpose of this article is to investigate whether Intertradesfx is a safe trading option or a potential scam. Our analysis draws on various credible sources, including regulatory warnings, user reviews, and expert assessments to provide a comprehensive overview of the broker's safety profile.

Regulation and Legitimacy

The regulatory status of a broker is a fundamental aspect that determines its legitimacy and the safety of client funds. Intertradesfx has been flagged by multiple regulatory authorities, including the UK's Financial Conduct Authority (FCA) and Spain's Comisión Nacional del Mercado de Valores (CNMV), as an unregulated or clone firm. This raises significant concerns about the broker's operations and the security of traders investments.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Not Authorized |

| CNMV | N/A | Spain | Blacklisted |

The lack of regulation by a top-tier authority such as the FCA or ASIC is alarming. Regulatory bodies enforce strict standards to protect investors and ensure fair trading practices. The absence of oversight leaves clients vulnerable to unfair practices, including the risk of losing their investments without any recourse. Furthermore, the claims made by Intertradesfx regarding regulatory compliance have been proven false, as the broker is not listed in any credible financial registers. This lack of transparency and accountability is a major red flag for potential investors.

Company Background Investigation

Intertradesfx claims to operate from the United Kingdom, but there is little verifiable information about its actual ownership or operational history. The company has not disclosed its management team or their qualifications, which is a common practice among legitimate brokers. Transparency about the team behind a trading platform is critical, as it reflects the broker's credibility and reliability.

The absence of information regarding the company's history, including its establishment date and ownership structure, raises questions about its legitimacy. Moreover, the lack of a physical address and verifiable contact details further complicates the assessment of Intertradesfx's trustworthiness. In an industry where trust is paramount, these factors contribute to the perception that Intertradesfx may not be a safe option for traders.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer can reveal a lot about their reliability. Intertradesfx has set a high minimum deposit requirement of $1,000, which is significantly above the industry average. This practice is often associated with unregulated brokers that aim to extract as much money as possible from new traders before they become wary.

| Fee Type | Intertradesfx | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | N/A | 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of transparent information regarding spreads, commissions, and overnight interest rates further complicates the evaluation of Intertradesfx. High costs and unclear fee structures can significantly impact a trader's profitability and overall trading experience. Without clear and competitive trading conditions, traders may find themselves at a disadvantage, further questioning the broker's integrity.

Client Funds Safety

The safety of client funds is a primary concern for any trader. Intertradesfx has not provided adequate information regarding its fund security measures. There are no indications of segregated accounts, which are crucial for protecting client deposits. Segregation ensures that client funds are kept separate from the broker's operational funds, reducing the risk of loss in case of insolvency.

Additionally, Intertradesfx has not disclosed any investor protection schemes or negative balance protection policies. These safeguards are essential for ensuring that traders do not lose more than their initial investment. The absence of these protections suggests a lack of commitment to client safety, making it difficult to assert that Intertradesfx is a safe trading option.

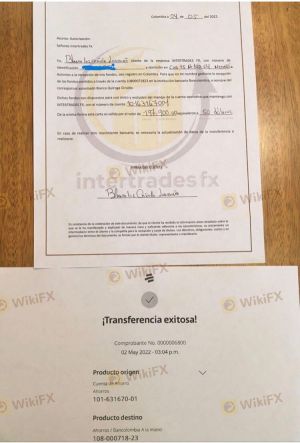

Customer Experience and Complaints

Customer feedback is an invaluable resource when assessing a broker's reliability. Reviews and complaints regarding Intertradesfx reveal a pattern of negative experiences among users. Common complaints include difficulties in withdrawing funds, lack of customer support, and issues related to transparency in trading conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Support | Medium | Poor |

| Transparency Concerns | High | Poor |

One notable case involved a user who reported being unable to withdraw their funds after multiple attempts, leading them to believe they had fallen victim to a scam. Such experiences raise serious concerns about the broker's operational integrity and commitment to customer satisfaction. The overall sentiment among clients suggests that Intertradesfx may not be a safe choice for traders seeking a reliable trading environment.

Platform and Trade Execution

A broker's trading platform is a critical component of the trading experience. Intertradesfx claims to offer a trading platform; however, many users have reported issues with platform functionality and reliability. The lack of a robust and user-friendly trading interface can hinder a trader's ability to execute trades effectively.

Furthermore, reports of slippage and order rejections have surfaced, which are indicative of poor trade execution quality. Reliable brokers typically provide a seamless trading experience with minimal disruptions, whereas Intertradesfx appears to fall short in this regard. The potential for platform manipulation adds another layer of risk for traders, further questioning whether Intertradesfx is a safe option.

Risk Assessment

Using Intertradesfx presents various risks that potential traders should consider. The lack of regulation, transparency, and customer support, combined with the high minimum deposit requirement, creates a precarious trading environment.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Risk | High | High minimum deposit and fees |

| Operational Risk | Medium | Poor platform performance |

To mitigate these risks, it is advisable for traders to conduct thorough research before engaging with any broker. Seeking out regulated alternatives and ensuring that the broker has a proven track record of reliability can help protect investments and enhance the trading experience.

Conclusion and Recommendations

In conclusion, the evidence presented suggests that Intertradesfx exhibits several characteristics commonly associated with scam brokers. The lack of regulation, high minimum deposit requirements, poor customer feedback, and questionable trading conditions all point to significant risks for potential traders.

For those considering forex trading, it is essential to prioritize safety and choose brokers that are well-regulated and transparent. Alternatives such as brokers regulated by the FCA or ASIC should be considered, as they offer a higher level of investor protection and reliability.

In summary, traders should approach Intertradesfx with extreme caution, as the indicators strongly suggest that it may not be a safe option for trading. Always prioritize due diligence and choose brokers wisely to safeguard your investments.

Is IntertradesFx a scam, or is it legit?

The latest exposure and evaluation content of IntertradesFx brokers.

IntertradesFx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IntertradesFx latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.