Is Heying Group safe?

Business

License

Is Heying Group Safe or Scam?

Introduction

Heying Group, also known as Heying Corp, has emerged as a player in the forex market, offering various trading instruments and platforms for investors. With the rise of online trading, it is crucial for traders to meticulously evaluate the legitimacy and safety of forex brokers. Many traders have suffered losses due to scams or unreliable brokers, making it essential to conduct thorough due diligence before investing. This article investigates whether Heying Group is safe or a scam by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and overall risk profile.

Regulation and Legitimacy

Regulation plays a pivotal role in determining the trustworthiness of a forex broker. A regulated broker is typically subject to stringent oversight, which can protect traders from fraud and malpractice. In the case of Heying Group, the broker has been flagged by various sources as lacking regulation from top-tier financial authorities. Here is a summary of the regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The absence of regulation from recognized authorities such as the SEC (U.S. Securities and Exchange Commission), FCA (Financial Conduct Authority, UK), or ASIC (Australian Securities and Investments Commission) raises significant concerns about the safety of trading with Heying Group. Without regulatory oversight, there is a heightened risk of encountering unfair practices, lack of transparency, and potential fraud. It is essential for traders to be wary of brokers that operate without proper regulatory backing, as this is often a red flag indicating possible scams.

Company Background Investigation

Heying Group's history and ownership structure are crucial in assessing its reliability. However, the available information about the company's establishment and management remains notably sparse. The company claims to provide a range of trading services, yet details regarding its founding, development, and ownership are either incomplete or absent. This lack of transparency can be concerning for potential clients.

Furthermore, the management teams background and professional experience are critical indicators of a broker's credibility. Unfortunately, there is little publicly available information on the qualifications and expertise of the team behind Heying Group. Without a clear understanding of who runs the company and their track record in the financial industry, traders may find it challenging to trust the broker. Transparency in company operations and management is paramount for establishing credibility, and the absence of such information about Heying Group raises questions regarding its legitimacy.

Trading Conditions Analysis

When evaluating whether Heying Group is safe, it is essential to consider the trading conditions it offers. The broker provides various trading options, including forex pairs, commodities, and cryptocurrencies. However, the fee structure and trading costs associated with Heying Group can significantly impact a trader's profitability. Heres a comparative overview of core trading costs:

| Fee Type | Heying Group | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | 1.0-2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of specific details regarding spreads, commissions, and overnight interest rates is alarming. A broker that does not clearly disclose its fee structure may be attempting to hide unfavorable terms that could negatively affect traders. Additionally, any unusual fees or policies should be scrutinized, as they can serve as indicators of potential scams. Traders should always seek brokers with transparent and competitive trading conditions.

Customer Fund Security

The security of customer funds is a critical aspect of assessing whether Heying Group is safe. Reliable brokers typically implement robust measures to protect client funds, including segregated accounts, investor protection schemes, and negative balance protection policies. However, information regarding Heying Group's security measures is limited.

The broker claims to have customer funds deposited in a segregated trust fund, which is a positive sign. However, without verification from a regulatory body, it is difficult to ascertain the effectiveness of these measures. Furthermore, any historical issues related to fund security or disputes could indicate a lack of reliability. Traders must prioritize brokers that provide clear information on their fund protection policies and have a history of safeguarding client assets.

Customer Experience and Complaints

Customer feedback is invaluable for understanding the overall experience with a broker. In the case of Heying Group, user reviews and complaints reveal a mixed bag of experiences. Some users report satisfactory trading conditions, while others express concerns regarding withdrawal processes and customer service responsiveness.

Heres a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

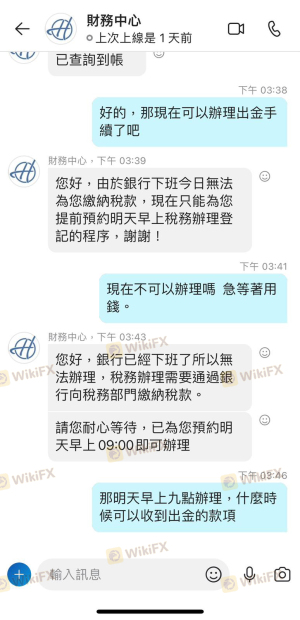

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

| Transparency Concerns | High | Below Average |

Typical cases include traders experiencing delays in fund withdrawals, which raises significant red flags regarding the broker's reliability. If a broker is unable to facilitate timely withdrawals, it may indicate deeper issues with fund management or a lack of operational integrity. Traders should be cautious and consider these complaints when deciding whether to engage with Heying Group.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. Traders expect platforms to be stable, user-friendly, and efficient in executing orders. However, feedback regarding Heying Group's trading platform indicates mixed reviews. Users have reported issues with order execution, including slippage and occasional rejections of trades.

A thorough analysis of order execution quality is necessary to determine whether Heying Group is safe. If a broker frequently experiences execution issues, it may suggest a lack of proper infrastructure or potential manipulation of trades. Such concerns necessitate a careful evaluation of the platform before committing funds.

Risk Assessment

Using Heying Group presents several risks that traders should consider. The absence of regulation, coupled with a lack of transparency regarding fees and company background, poses significant risks. Heres a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation from recognized authorities. |

| Fund Security Risk | Medium | Limited information on fund protection. |

| Customer Service Risk | High | Complaints about withdrawal and support. |

| Platform Stability Risk | Medium | Reports of execution issues and slippage. |

To mitigate these risks, traders should conduct thorough research, consider using demo accounts, and only invest amounts they can afford to lose.

Conclusion and Recommendations

In conclusion, the investigation into Heying Group raises substantial concerns regarding its safety and legitimacy. The lack of regulation, transparency issues, and mixed customer feedback suggest that traders should approach this broker with caution. While some may find trading conditions acceptable, the potential risks associated with unregulated brokers are significant.

For those looking for reliable alternatives, it is advisable to consider brokers regulated by top-tier authorities, such as the FCA or ASIC, which provide a higher level of investor protection. Always prioritize transparency, competitive trading conditions, and a solid track record of customer service when selecting a forex broker. Ultimately, conducting thorough due diligence is essential for safeguarding your investments in the forex market.

Is Heying Group a scam, or is it legit?

The latest exposure and evaluation content of Heying Group brokers.

Heying Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Heying Group latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.