Regarding the legitimacy of GTM forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is GTM safe?

Business

License

Is GTM markets regulated?

The regulatory license is the strongest proof.

FCA Inst Forex Execution (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

Astral Financial Ltd

Effective Date:

2018-04-18Email Address of Licensed Institution:

compliance@astral-financial.comSharing Status:

No SharingWebsite of Licensed Institution:

www.astral-financial.comExpiration Time:

--Address of Licensed Institution:

3 Shortlands London W6 8DA UNITED KINGDOMPhone Number of Licensed Institution:

+442031437480Licensed Institution Certified Documents:

Is GTM Safe or Scam?

Introduction

GTM, a brokerage firm based in Hong Kong, has positioned itself within the foreign exchange (forex) market, offering traders access to an array of financial instruments, including forex, precious metals, energies, and indices. However, as with any trading platform, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is rife with both legitimate opportunities and potential scams, making it essential for traders to assess the credibility of brokers like GTM. This article will explore the safety and legitimacy of GTM by examining its regulatory status, company background, trading conditions, customer experiences, and more. The analysis is based on a comprehensive review of various online resources and user feedback to provide an objective evaluation of whether GTM is safe or a scam.

Regulation and Legitimacy

The regulatory framework surrounding a broker is a critical aspect that determines its legitimacy and safety. GTM claims to be regulated by the Financial Conduct Authority (FCA) in the United Kingdom; however, it is labeled as a "suspicious clone." This raises significant concerns regarding the authenticity of its regulatory claims. The following table summarizes GTM's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | United Kingdom | Suspicious Clone |

The FCA is known for its stringent regulatory standards, which are designed to protect traders from fraud and malpractice. However, the designation of GTM as a "suspicious clone" suggests that it may not adhere to these standards. This lack of credible regulation is a red flag, indicating that traders may be exposed to higher risks when dealing with this broker. Additionally, the absence of a verified license number further undermines the broker's legitimacy. Traders should be wary of any broker that lacks proper regulatory oversight, as this can lead to potential loss of funds and limited recourse in case of disputes.

Company Background Investigation

GTM operates under the name Global Transaction Market LLC and claims to have been in business for 5 to 10 years. However, the opacity surrounding its ownership structure and management team raises concerns about its transparency. There is limited information available regarding the company's history, development, and the backgrounds of its key personnel. A lack of transparency can often indicate potential issues within a brokerage, as it becomes challenging for traders to assess the competence and integrity of the management team.

Furthermore, the absence of a physical office in the United Kingdom, as reported by some users, adds to the skepticism surrounding GTM. The company's website is also reportedly non-functional, which further complicates the ability to verify its claims and services. In an industry where trust is paramount, the lack of clear information about GTM's operations and management is a significant cause for concern.

Trading Conditions Analysis

When evaluating whether GTM is safe, it is essential to consider its trading conditions, including fees and commissions. GTM offers a minimum deposit requirement of $100 and provides leverage of up to 1:400, which can be attractive for traders seeking to maximize their exposure. However, the overall fee structure and any unusual or problematic fees should be scrutinized. The following table outlines the core trading costs associated with GTM:

| Fee Type | GTM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While the spreads appear competitive, it is crucial to investigate any hidden fees that may not be immediately apparent. Traders have reported issues with withdrawals and unexpected charges, which could indicate a lack of transparency in GTM's fee structure. Such practices can significantly impact a trader's profitability and overall experience. Therefore, potential clients should approach GTM with caution, especially when considering the potential for additional costs that could arise during the trading process.

Customer Funds Security

The safety of customer funds is paramount when assessing whether GTM is safe. A reputable broker typically employs measures such as segregated accounts, investor protection schemes, and negative balance protection to ensure the security of client funds. However, there is limited information regarding GTM's policies in these areas. The absence of clear communication about fund security measures is concerning.

Traders should be particularly cautious if a broker does not provide transparent information about how client funds are managed and safeguarded. Additionally, any history of financial disputes or security breaches could further indicate potential risks. Without robust protections in place, traders may find themselves vulnerable to losses, particularly in the event of broker insolvency or fraudulent activities.

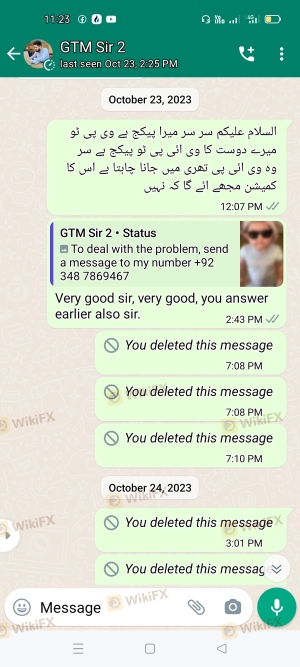

Customer Experience and Complaints

User feedback and real-life experiences are invaluable when determining whether GTM is safe. Reviews and complaints from traders indicate a pattern of issues, particularly regarding withdrawals and customer service responsiveness. The following table summarizes common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Inadequate |

| Customer Service Delays | High | Poor |

Traders have reported difficulties in accessing their funds, with some claiming that their accounts were frozen without explanation. Such complaints should not be taken lightly, as they can signify deeper issues within the brokerage's operational practices. For example, one trader reported that they were unable to withdraw their investment, leading to significant frustration and financial loss. These experiences underscore the need for thorough research and caution when dealing with GTM.

Platform and Trade Execution

The trading platform offered by GTM is a critical aspect of the overall trading experience. GTM utilizes the widely recognized MetaTrader 4 (MT4) platform, known for its stability and user-friendly interface. However, the quality of order execution, including slippage and rejection rates, must also be evaluated to determine whether GTM is safe. Reports from users indicate varying experiences, with some traders experiencing delays and slippage during high volatility periods.

If a broker demonstrates signs of platform manipulation, such as frequent slippage or rejected orders, it can severely impact a trader's ability to execute their strategies effectively. Traders should be vigilant and consider their experiences with GTM's platform performance before committing significant capital.

Risk Assessment

Assessing the overall risk of trading with GTM is essential for potential investors. The following risk scorecard summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of credible regulation raises concerns. |

| Financial Security | High | Limited information on fund protection measures. |

| Customer Service | Medium | Reports of poor responsiveness and unresolved complaints. |

| Platform Reliability | Medium | Mixed reviews on execution quality and platform stability. |

Given the high-risk levels associated with GTM, potential traders should exercise extreme caution. It is advisable to start with a minimal investment and to remain aware of the potential for losses. Additionally, traders should consider implementing risk management strategies to mitigate potential financial harm.

Conclusion and Recommendations

In conclusion, the investigation into GTM raises several red flags that suggest it may not be a safe trading environment. The suspicious regulatory status, lack of transparency, and numerous complaints from users indicate that traders should approach this broker with caution. Is GTM safe? The evidence suggests that it may not be, particularly for those who value regulatory oversight and customer support.

For traders seeking reliable alternatives, it may be prudent to consider brokers with strong regulatory credentials, transparent fee structures, and positive customer feedback. Established firms with a proven track record in the forex market can provide a safer trading experience. Always prioritize due diligence and ensure that any broker you choose aligns with your trading needs and risk tolerance.

Is GTM a scam, or is it legit?

The latest exposure and evaluation content of GTM brokers.

GTM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GTM latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.