Is Goldmar safe?

Pros

Cons

Is Goldmar Safe or Scam?

Introduction

Goldmar is an offshore forex broker that has garnered attention in the trading community for its aggressive marketing tactics and promises of high returns. Operating under the name Goldmar, this broker claims to offer a range of trading services, including forex, commodities, indices, and cryptocurrencies. However, the lack of regulation and numerous warnings from financial authorities raise significant concerns about its legitimacy. As traders navigate the complex landscape of online trading, it is essential to evaluate brokers carefully to avoid potential scams that could lead to substantial financial losses. This article aims to provide a thorough analysis of Goldmar, examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. The findings are based on comprehensive research, including reviews from regulatory bodies, user feedback, and industry analyses.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial for ensuring the safety of traders' funds and the integrity of trading practices. Goldmar operates under the ownership of Combobulating Group LLC, registered in Saint Vincent and the Grenadines. Unfortunately, this jurisdiction is known for its lax regulatory framework, which does not provide adequate oversight for forex and CFD brokers. The Financial Services Authority (FSA) of Saint Vincent and the Grenadines does not regulate forex trading, which raises red flags about the broker's legitimacy.

Here is a summary of Goldmar's regulatory information:

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of a regulatory license means that Goldmar is not subject to any legal obligations to protect clients' funds or ensure fair trading practices. Moreover, the Italian financial regulator, Consob, has blacklisted Goldmar, warning potential investors to steer clear of this broker. This lack of oversight and the presence of regulatory warnings strongly suggest that Goldmar may not be a safe option for traders.

Company Background Investigation

Goldmar's company history and ownership structure raise further questions about its credibility. Established in 2022, the broker is relatively new to the market, which can be a concern for potential investors. The lack of transparency regarding the company's management team and their professional experience is another red flag. Legitimate brokers typically provide detailed information about their leadership and operational practices, which helps build trust with clients.

Moreover, the company's website offers minimal information about its operations, with no clear contact details or physical address. This lack of transparency can be indicative of a broker attempting to operate under the radar, making it challenging for clients to hold them accountable in case of disputes. The overall opacity surrounding Goldmar's operations further complicates the assessment of its safety and reliability.

Trading Conditions Analysis

When evaluating a forex broker, it is crucial to examine the trading conditions they offer, including fees, spreads, and commissions. Goldmar presents itself as a competitive broker with enticing trading conditions, but a closer look reveals potential pitfalls. The broker requires a minimum deposit of €250, which is relatively high compared to industry standards.

Here is a comparison of Goldmar's core trading costs:

| Fee Type | Goldmar | Industry Average |

|---|---|---|

| Spread for Major Pairs | 2 pips | 1-1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | N/A | Varies |

While Goldmar claims to have no commissions, the spreads are higher than the average, which may lead to increased trading costs for clients. Additionally, the broker's fee structure lacks transparency, as there is little information available regarding any hidden fees or penalties for withdrawals. Traders should be cautious of brokers that do not clearly disclose their fee structure, as this can lead to unexpected costs that diminish potential profits.

Customer Funds Safety

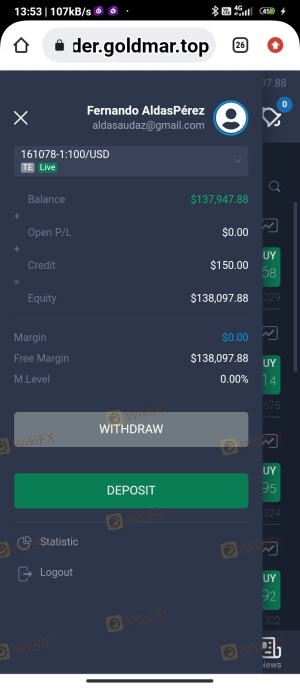

The safety of customer funds is paramount when choosing a forex broker. Goldmar's lack of regulation raises significant concerns about the security of clients' investments. The broker does not appear to have any measures in place to protect traders' funds, such as segregated accounts or investor compensation schemes. In regulated environments, brokers are required to maintain client funds in separate accounts to ensure that they are not misused for operational expenses.

Moreover, there is no indication that Goldmar offers negative balance protection, which is a critical feature for traders using high leverage. This absence of safeguards means that clients could potentially lose more than their initial investment, placing them at significant financial risk. Traders should be particularly wary of brokers that do not prioritize the security of their clients' funds, as this can lead to severe losses in the event of mismanagement or fraud.

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding a broker's reputation and the quality of its services. Goldmar has received numerous negative reviews from users, with complaints primarily centered around withdrawal issues and poor customer support. Many clients report difficulties in accessing their funds, with withdrawal requests often delayed or denied altogether.

Here is a summary of the main complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Quality | Medium | Inconsistent |

| Transparency Concerns | High | Lacking |

Typical cases include clients who have reported that their withdrawal requests were met with excuses or were simply ignored. This pattern of behavior is alarming and strongly indicates that Goldmar may not operate in good faith. The company's lack of responsiveness to complaints further exacerbates the situation, leaving clients feeling frustrated and helpless.

Platform and Execution

The trading platform is a crucial component of any trading experience, influencing both user experience and order execution quality. Goldmar offers a web-based trading platform that lacks the advanced features found in popular platforms such as MetaTrader 4 or MetaTrader 5. While the platform may be user-friendly for beginners, it does not provide the necessary tools for experienced traders to implement complex strategies.

Concerns about order execution quality also arise, as users have reported instances of slippage and rejected orders. Such issues can significantly impact trading performance, particularly in volatile market conditions. The absence of a reliable and sophisticated trading platform raises further doubts about Goldmar's commitment to providing a safe and efficient trading environment.

Risk Assessment

Using Goldmar as a broker presents several risks that potential traders should consider. The combination of unregulated status, poor customer reviews, and questionable trading conditions creates a high-risk environment for investors.

Here is a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Financial Risk | High | Potential loss of funds |

| Operational Risk | Medium | Poor execution and support |

To mitigate these risks, traders should conduct thorough research and consider using regulated brokers that offer better protections and transparency. Additionally, implementing risk management strategies, such as setting stop-loss orders and limiting leverage, can help safeguard investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that Goldmar is not a safe broker for forex trading. The lack of regulation, combined with numerous complaints about withdrawal issues and poor customer support, raises serious concerns about its legitimacy. Traders should exercise extreme caution and consider alternative options that offer better security and transparency.

For those seeking reliable trading platforms, it is advisable to explore brokers that are well-regulated and have positive user reviews. Options such as brokers regulated by the FCA, ASIC, or CySEC typically provide a higher level of safety for traders' funds and a more trustworthy trading experience. Ultimately, the decision to trade with Goldmar should be approached with caution, as the risks associated with this broker far outweigh the potential rewards.

Is Goldmar a scam, or is it legit?

The latest exposure and evaluation content of Goldmar brokers.

Goldmar Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Goldmar latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.