Goldmar 2025 Review: Everything You Need to Know

Goldmar, an offshore broker based in Saint Vincent and the Grenadines, has garnered significant scrutiny since its inception. Overall, the consensus among various reviews is overwhelmingly negative, with multiple regulatory warnings highlighting its unregulated status and potential for fraudulent practices. Key features include a high minimum deposit requirement and a basic web-based trading platform, which lacks the advanced functionalities offered by industry-standard platforms like MetaTrader 4 or 5.

Note: It is essential to be aware that Goldmar operates under different entities across regions, which may affect user experiences and regulatory oversight. This review aims to provide a fair and accurate assessment based on multiple sources.

Ratings Overview

How We Rate Brokers: Our ratings are based on a thorough analysis of user reviews, expert opinions, and factual data regarding the broker's services.

Broker Overview

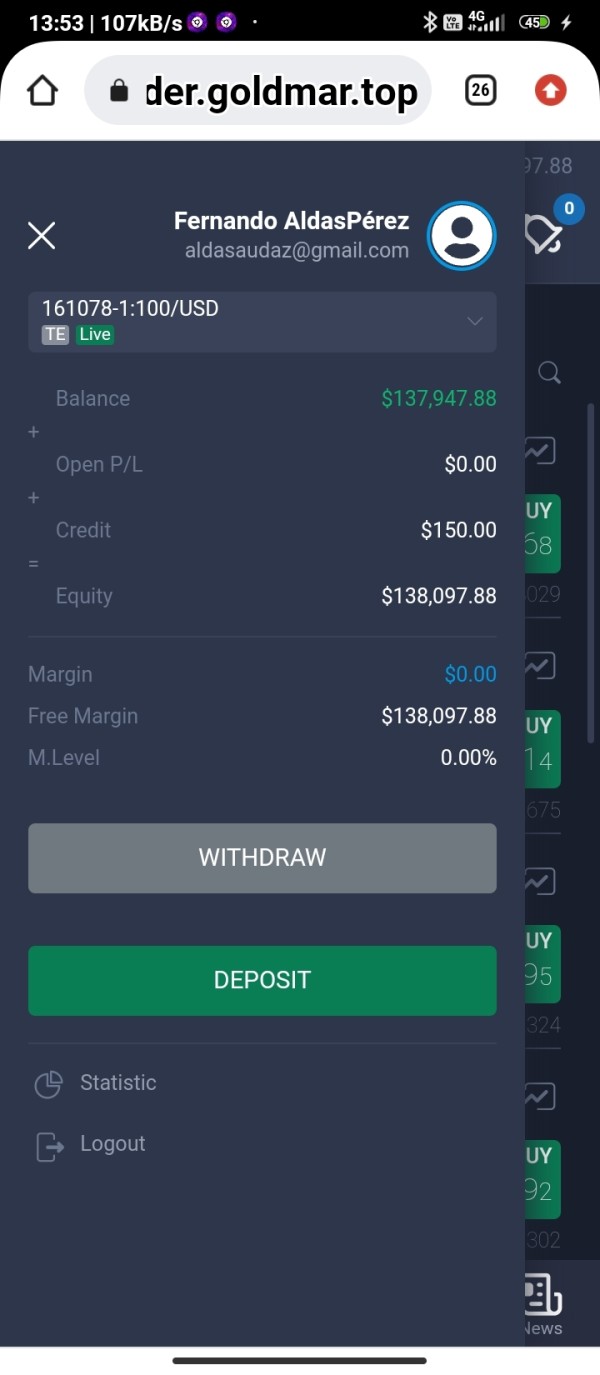

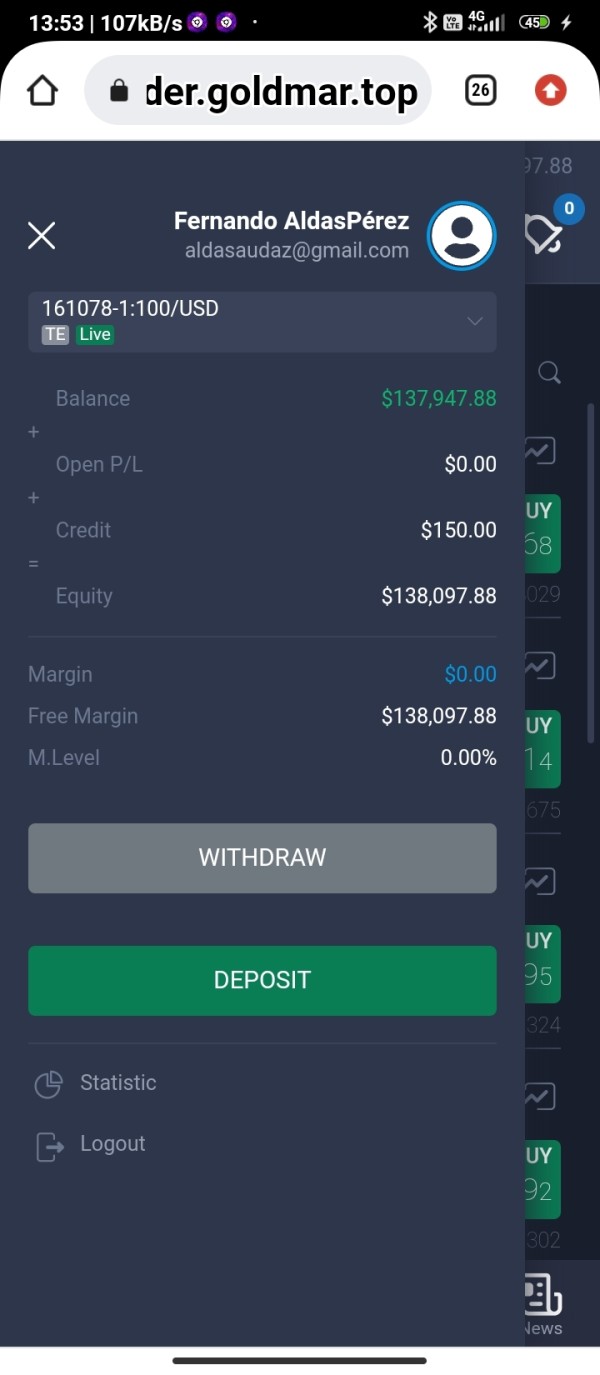

Founded in 2022, Goldmar operates under the name Combobulating Group LLC, with its headquarters in Saint Vincent and the Grenadines. This broker offers a web-based trading platform but lacks support for popular platforms like MetaTrader 4 or 5. Goldmar provides access to various asset classes, including forex, commodities, indices, and cryptocurrencies. However, it is crucial to note that Goldmar is unregulated, having been blacklisted by several financial authorities, including Italy's CONSOB, which raises significant red flags regarding its credibility.

Detailed Analysis

Regulated Regions: Goldmar is not regulated by any reputable financial authority, which poses a considerable risk to traders. The Financial Services Authority (FSA) of Saint Vincent does not oversee forex and CFD trading, making it a haven for unlicensed brokers. According to Scambrokers Reviews, multiple jurisdictions, including Italy, Spain, and Russia, have issued warnings against Goldmar.

Deposit/Withdrawal Currencies/Cryptocurrencies: Goldmar accepts deposits via credit/debit cards and cryptocurrencies, with a minimum deposit requirement of €250. This amount is notably higher than many legitimate brokers that allow entry for as little as $10. Be cautious when using cryptocurrencies, as these transactions are irreversible, which can complicate attempts to recover funds.

Bonuses/Promotions: Goldmar offers bonuses, which often come with stringent withdrawal conditions. According to Global Fraud Protection, accepting a bonus may require traders to achieve a trading volume of 25 times the bonus amount before any withdrawals can be made. Such conditions are common among scam brokers and should be approached with caution.

Asset Classes Available: Traders can access a variety of asset classes, including forex pairs (e.g., EUR/USD), commodities (e.g., crude oil), indices (e.g., NASDAQ), and cryptocurrencies (e.g., Bitcoin). However, the availability of these assets does not compensate for the broker's lack of regulation and potential for fraudulent activities.

Costs (Spreads, Fees, Commissions): Goldmar's spreads are reported to be around 2-3 pips for major currency pairs, which is above the industry average. Many legitimate brokers offer spreads below 1 pip, making Goldmar's costs relatively high. Furthermore, while Goldmar claims not to charge commissions, the high spreads may effectively serve as their primary source of income, as noted by Forex Brokerz.

Leverage: Goldmar offers leverage up to 1:500, which is significantly higher than the legal limits imposed in many jurisdictions, such as 1:30 in the EU. High leverage can amplify both gains and losses, making it a risky proposition for inexperienced traders.

Allowed Trading Platforms: Goldmar exclusively provides a basic web trader, which lacks the advanced features and community support found in platforms like MetaTrader 4 and 5. This limitation is a significant drawback for traders looking for robust trading tools and resources.

Restricted Regions: Goldmar does not accept clients from the United States, which is a common practice among unregulated brokers to avoid scrutiny from tighter regulatory environments.

Available Customer Support Languages: Goldmar offers customer support primarily in English, with limited options for multilingual assistance. Many users have reported poor customer service experiences, including difficulty in reaching support representatives and slow response times.

Repeated Ratings Overview

Detailed Breakdown

-

Account Conditions: Goldmar requires a minimum deposit of €250, significantly higher than many reputable brokers. The account types offered are basic and lack differentiation in service quality.

Tools and Resources: The web trader platform is simple and lacks advanced features, making it less suitable for experienced traders.

Customer Service and Support: Users have reported poor experiences with customer support, citing long response times and unhelpful representatives.

Trading Setup (Experience): The overall trading experience is hindered by high spreads and a lack of advanced trading tools, which are essential for effective trading.

Trustworthiness: Goldmar has been blacklisted by several regulatory bodies, indicating a high risk of fraudulent activity.

User Experience: User reviews generally reflect a negative experience, particularly regarding withdrawal difficulties and the broker's unresponsive customer service.

In conclusion, Goldmar presents numerous red flags that suggest it is a high-risk broker. The lack of regulation, high minimum deposit, and poor user experiences make it difficult to recommend Goldmar as a viable trading option. Traders are encouraged to exercise caution and consider more reputable alternatives.