Is GOFX safe?

Pros

Cons

Is Gofx A Scam?

Introduction

Gofx is a forex and CFD broker that has positioned itself as a competitive player in the online trading market since its inception in 2020. With a wide array of trading instruments and a low minimum deposit requirement, Gofx appeals to both novice and experienced traders. However, with the increasing number of scams in the forex market, it is crucial for traders to thoroughly evaluate the legitimacy and safety of their chosen brokers. This article aims to provide a comprehensive analysis of Gofx, focusing on its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. The findings are based on a review of multiple credible sources and user feedback to form an objective assessment of whether Gofx is safe or a potential scam.

Regulation and Legitimacy

The regulatory environment is a critical factor in determining a broker's legitimacy. Gofx operates under licenses from the Seychelles Financial Services Authority (FSA) and the Mwali International Services Authority in the Comoros. While these licenses provide some level of oversight, they are often viewed as less stringent compared to regulations from top-tier authorities like the UK‘s Financial Conduct Authority (FCA) or Australia’s Australian Securities and Investments Commission (ASIC).

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD118 | Seychelles | Active |

| Mwali International Services Authority | T2023205 | Comoros | Active |

The quality of regulation is paramount as it directly influences the protection offered to traders. Although Gofx is regulated, the oversight from the Seychelles FSA is considered weaker than that of more reputable regulators. Furthermore, Gofx does not provide negative balance protection, which poses a risk to traders, particularly those using high leverage. The combination of offshore regulation and the absence of robust investor protections raises concerns about the overall safety of trading with Gofx.

Company Background Investigation

Gofx is operated by Touchstone Markets Limited, a company registered in Seychelles. The broker primarily targets traders from Southeast Asia, particularly Thailand, which is reflected in its website and customer support options. The management team at Gofx comprises individuals with a background in financial technology and market trading, but specific details about their professional experience and qualifications remain vague.

Transparency is a significant concern, as Gofx does not provide comprehensive information about its ownership structure or financial health. The lack of detailed disclosures about the company's operations and management team raises red flags regarding its credibility. Traders should be cautious when engaging with brokers that do not offer clear insights into their corporate governance and operational practices.

Trading Conditions Analysis

Gofx offers a variety of trading accounts, each with different conditions. The broker's fee structure is designed to attract traders with low spreads and a minimal initial deposit requirement. However, several reviews indicate that the spreads and commissions may not be as competitive as advertised.

| Fee Type | Gofx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 pips | 1.0 pips |

| Commission Model | $3.50 per lot (Pro account) | Varies |

| Overnight Interest Range | Not specified | Varies |

The absence of clear information regarding overnight interest rates and the lack of a detailed fee schedule can potentially mislead traders. Furthermore, the presence of service fees on certain account types, particularly the Pro account, could diminish the overall profitability of trading with Gofx. It is essential for traders to fully understand the fee structure before committing to any trading activity.

Client Fund Security

When assessing the safety of a broker, it is vital to consider the measures in place to protect client funds. Gofx claims to keep client funds in segregated accounts, which is a positive aspect as it prevents the commingling of client and company funds. Additionally, Gofx is a member of an investor compensation fund, which could offer some level of protection in the event of insolvency.

However, the lack of negative balance protection is concerning, especially for traders utilizing high leverage, which can lead to significant losses. Historical complaints from users regarding withdrawal issues further exacerbate concerns about the security of funds held with Gofx. Traders should thoroughly evaluate the broker's fund security measures and historical performance before proceeding.

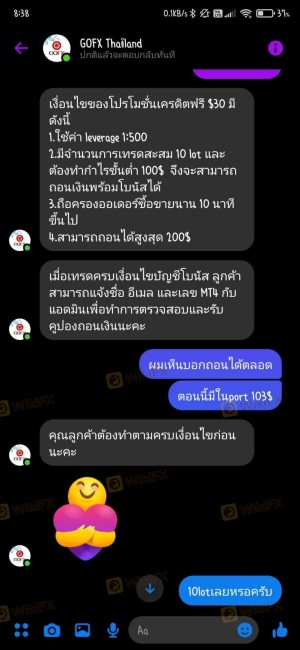

Customer Experience and Complaints

Customer feedback is a critical component of evaluating a broker's reliability. Many reviews of Gofx highlight a range of experiences, with common complaints revolving around withdrawal difficulties and inadequate customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support Availability | Medium | Limited options |

Several users have reported delays in receiving their funds, with some stating that their withdrawal requests were not processed in a timely manner. Additionally, the limited customer support options, which primarily include live chat and email, have left many traders frustrated. While Gofx may not be classified as a scam, these complaints indicate potential operational inefficiencies that could affect the overall trading experience.

Platform and Trade Execution

Gofx utilizes the widely recognized MetaTrader 4 (MT4) platform, which is known for its robust functionality and user-friendly interface. However, user reviews suggest that the platform's performance may not always meet expectations, particularly concerning order execution quality.

Traders have reported instances of slippage and rejected orders, which can significantly impact trading outcomes. The absence of evidence indicating platform manipulation is a positive aspect, but the overall execution quality remains a concern that traders should consider.

Risk Assessment

Engaging with Gofx presents several risks that traders should be aware of before opening an account.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with weak oversight. |

| Fund Security Risk | Medium | Lack of negative balance protection. |

| Customer Support Risk | Medium | Limited support options and responsiveness. |

To mitigate these risks, traders are advised to conduct thorough due diligence, ensure they understand the fee structures, and consider using risk management strategies such as setting stop-loss orders. Additionally, it may be prudent for traders to diversify their investments across multiple brokers to spread risk.

Conclusion and Recommendations

In conclusion, while Gofx is a regulated broker, several factors raise concerns regarding its overall safety and reliability. The combination of offshore regulation, lack of negative balance protection, and negative customer feedback suggests that traders should exercise caution when considering Gofx as their trading platform.

For those seeking alternatives, brokers regulated by top-tier authorities such as the FCA or ASIC are recommended, as they typically offer more robust investor protections and better overall trading conditions. Traders should always prioritize safety and transparency when selecting a broker to ensure a secure trading experience.

In summary, while Gofx may not be a scam, it is essential for traders to remain vigilant and informed about potential risks associated with trading on this platform.

Is GOFX a scam, or is it legit?

The latest exposure and evaluation content of GOFX brokers.

GOFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GOFX latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.