Is MSB e -Trade safe?

Business

License

Is MSB E-Trade Safe or a Scam?

Introduction

MSB E-Trade, founded in 1993 and headquartered in New Delhi, India, positions itself as a versatile player in the forex and trading markets. It offers a range of services, including trading in equities, derivatives, and mutual funds. However, the rise of online trading platforms has made it crucial for traders to carefully evaluate the legitimacy and reliability of their chosen brokers. The forex market, known for its volatility and complexity, presents various risks, making it essential for traders to work with trustworthy brokers. This article aims to investigate whether MSB E-Trade is a safe trading option or if it exhibits characteristics of a scam. Our analysis is based on a comprehensive review of regulatory status, company background, trading conditions, customer experiences, and risk assessments.

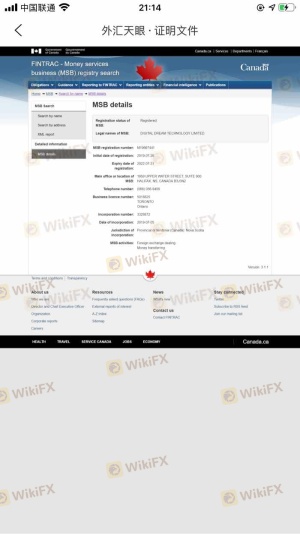

Regulation and Legitimacy

A broker's regulatory status is a vital aspect of its credibility. Regulation serves as a safeguard for traders, ensuring that the broker adheres to specific standards of conduct and financial practices. Unfortunately, MSB E-Trade operates without any significant regulatory oversight.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation raises red flags about the safety of traders' funds and the overall integrity of the trading environment. Regulatory bodies are essential as they provide a framework for accountability, ensuring that brokers maintain transparency and fairness in their dealings. Without such oversight, traders may face higher risks of fraud or mismanagement of funds. Historical compliance issues and a lack of transparent reporting further exacerbate concerns regarding MSB E-Trade's legitimacy.

Company Background Investigation

MSB E-Trade has a history of over three decades in the financial services industry. However, its lack of significant regulatory affiliation raises concerns about its operational standards. The company is privately owned and has a relatively small management team, which may limit its capacity to provide comprehensive services.

The management team lacks extensive experience in the forex and trading sectors, which could affect the quality of service and the strategic direction of the firm. Transparency in company operations is crucial for building trust with clients. Unfortunately, MSB E-Trade has not consistently demonstrated a commitment to clear information disclosure, which is a critical factor for potential investors.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is paramount. MSB E-Trade's fee structure is not clearly defined, which can lead to unexpected costs for traders.

| Fee Type | MSB E-Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | N/A | $0 - $10 per trade |

| Overnight Interest Range | High | Low to Moderate |

The lack of transparency in fees can be problematic, as traders may not fully understand the costs associated with their trades. Additionally, any unusual or excessive fees could indicate a potential scam. Such practices are often employed by unregulated brokers to exploit traders.

Client Funds Safety

The safety of client funds is a critical concern for any trader. MSB E-Trade does not provide clear information regarding its fund segregation policies, investor protection measures, or negative balance protection. This lack of clarity poses significant risks to traders, as their funds may not be adequately safeguarded in the event of financial difficulties faced by the broker.

There are no documented cases of fund security issues at MSB E-Trade; however, the absence of a robust regulatory framework makes it difficult to ascertain the broker's compliance with industry standards. Without investor protection schemes in place, traders may find themselves vulnerable to potential losses.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. Reviews and testimonials about MSB E-Trade indicate a mix of experiences, with some users praising the platform's user-friendliness while others report difficulties in accessing support and resolving issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delay | Moderate | Average |

| Unclear Fee Structure | High | Poor |

Common complaints include challenges in withdrawing funds and slow customer service responses. These issues can lead to frustration and may signal deeper operational problems within the brokerage. The company's response to complaints has been less than satisfactory, indicating a potential lack of commitment to customer service.

Platform and Execution

The performance and reliability of the trading platform are crucial for a successful trading experience. MSB E-Trade offers a trading platform that is generally easy to navigate; however, the execution quality and speed are critical factors that need thorough evaluation. Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

The absence of any notable platform manipulation signs is a positive aspect; however, the lack of transparency regarding execution quality metrics raises concerns. Traders should be cautious about potential discrepancies between expected and actual execution prices.

Risk Assessment

Using MSB E-Trade carries inherent risks, primarily due to its unregulated status and lack of transparency.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential mismanagement of funds |

| Customer Service Risk | Medium | Complaints about support and withdrawals |

To mitigate these risks, traders should conduct thorough due diligence before engaging with MSB E-Trade. It may also be wise to consider alternative brokers that offer better regulatory protection and customer service.

Conclusion and Recommendations

In summary, the evidence suggests that MSB E-Trade poses significant risks to traders. Its lack of regulation, unclear fee structure, and customer service issues raise red flags that warrant caution. While there are no outright signs of fraud, the absence of robust oversight and transparency is concerning.

For traders seeking a reliable platform, it may be prudent to consider alternatives that are well-regulated and have a proven track record of customer satisfaction. Brokers such as E*TRADE or Charles Schwab, which offer comprehensive regulatory protection and transparent trading conditions, are worth exploring.

In conclusion, is MSB E-Trade safe? The current analysis indicates that potential traders should approach with caution and consider their options carefully before committing funds.

Is MSB e -Trade a scam, or is it legit?

The latest exposure and evaluation content of MSB e -Trade brokers.

MSB e -Trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MSB e -Trade latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.