Gofx Review 2025: Everything You Need to Know

Summary

This Gofx review looks at a forex broker that worries many traders. GOFX shows a troubling profile for people who want to trade based on data from multiple sources. The broker started in 2020, giving it less than five years in the market. This raises questions about how stable it is.

TrustFinance gives GOFX a very low trust score of 2.39 out of 10, which shows big reliability problems among experts. Even worse is that no users have left any reviews at all. Multiple sources like WikiFX and ForexPeaceArmy question if this broker can be trusted.

The broker seems to want short-term traders who take big risks, but this comes with serious warnings given the trust problems. Our analysis shows big gaps in public information about GOFX's work, rules, and services. This makes the concerns about credibility and transparency even worse.

Important Notice

This review uses comprehensive analysis of public information, user feedback data, market trust ratings, and operational history indicators. Our method uses multiple data sources to give traders an honest look at GOFX's services and reliability.

Traders should know that information about GOFX's operations, rule following, and services is very limited across industry databases and review platforms. This lack of openness is itself a big concern for potential clients thinking about this broker.

Rating Framework

Broker Overview

GOFX started in the forex market in 2020, making it a new player in online trading. With less than five years of work history, the broker lacks the proven track record that many traders want when picking a trading partner. The company's short time in business raises questions about its experience with different market conditions and client needs.

The broker's business model and main structure stay mostly hidden, with little public information about its leadership, management team, or plans. This lack of openness is very concerning in an industry where trust and following rules are most important. Multiple industry sources, including specialized forex review platforms, have questioned GOFX's reliability.

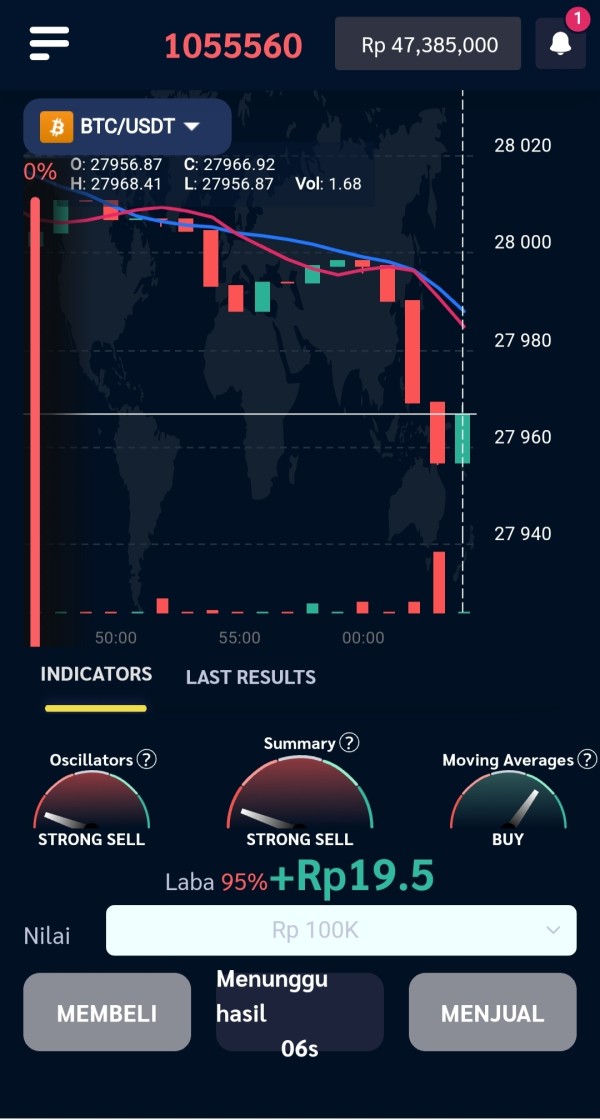

This Gofx review shows that the broker's market position seems to focus on short-term trading strategies, though specific details about their target clients and service areas are not clearly written in available resources. The absence of complete public information about trading platforms, assets, and work procedures is a major red flag for potential clients.

Industry databases show mixed or incomplete information about GOFX's regulatory status, trading conditions, and business operations, which makes any thorough check of the broker's legitimacy and service quality even harder.

Regulatory Jurisdiction: Available sources do not give clear information about GOFX's regulatory status or licensing jurisdictions, which is a major concern for trader protection and fund security.

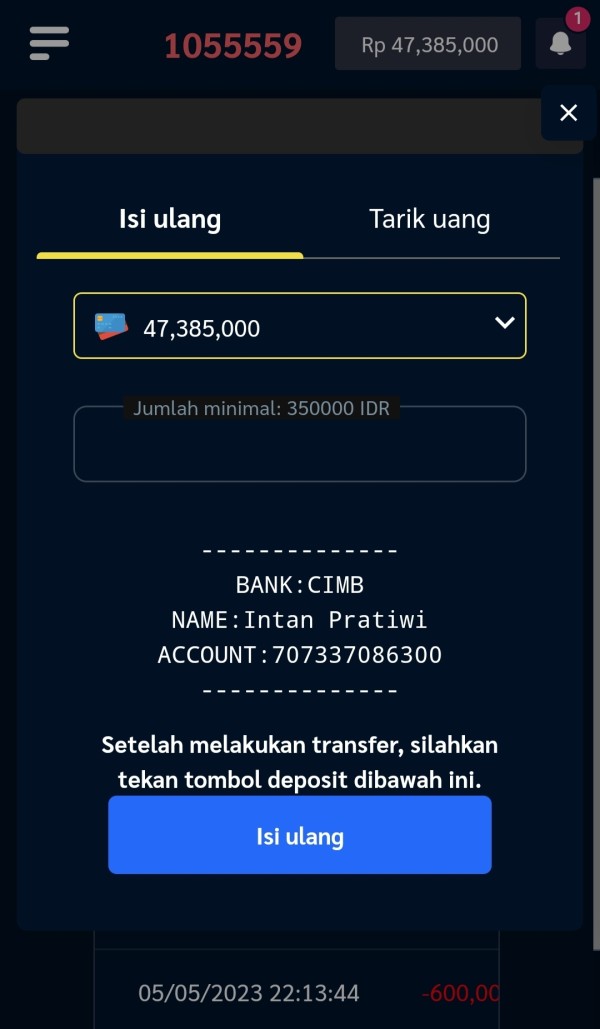

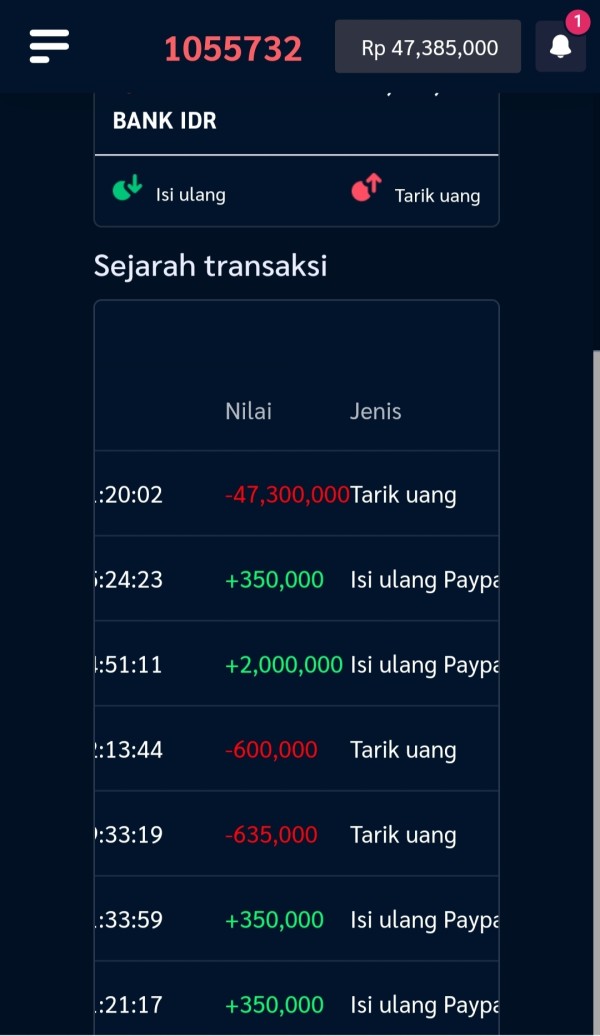

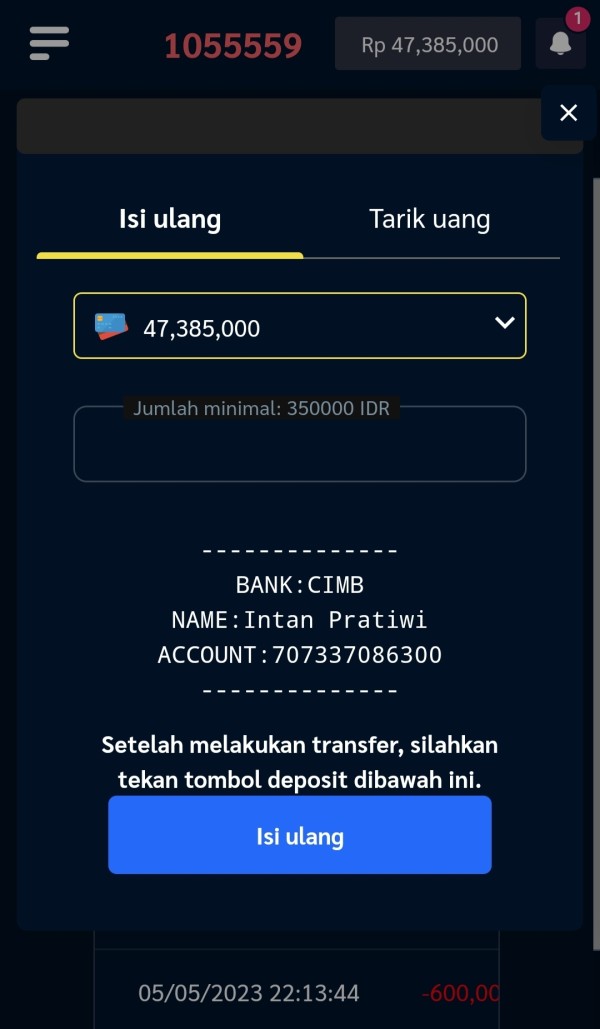

Deposit and Withdrawal Methods: Specific information about payment processing options, supported currencies, and transaction procedures is not detailed in accessible documentation.

Minimum Deposit Requirements: The broker's entry-level investment requirements are not clearly specified in available public sources.

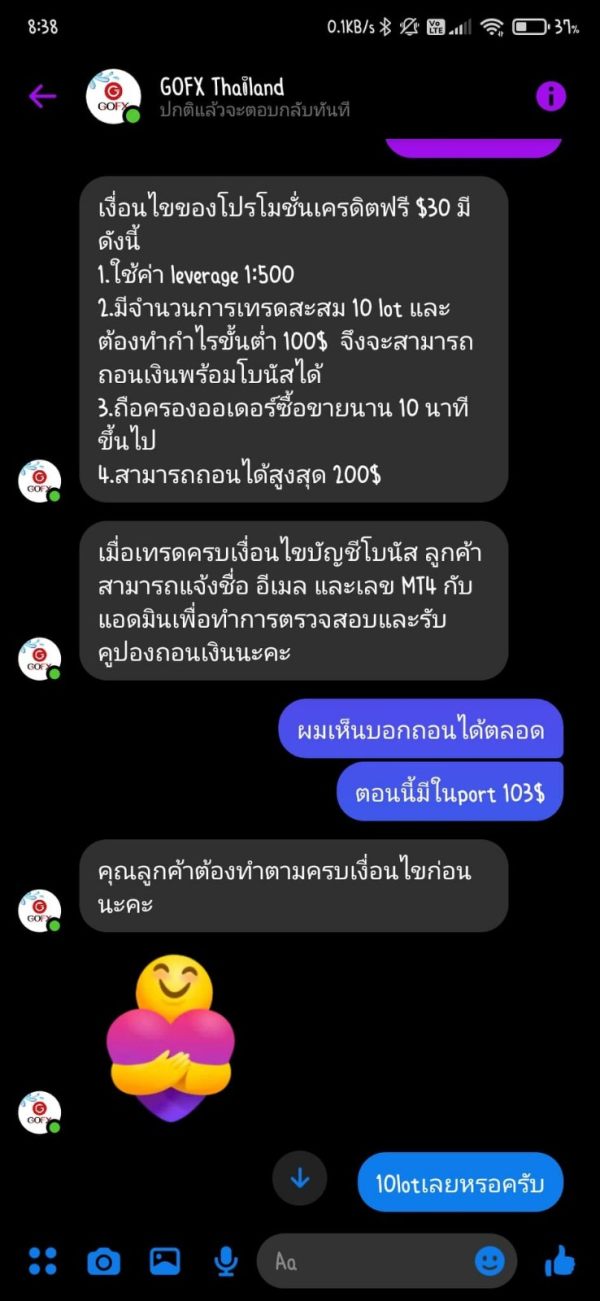

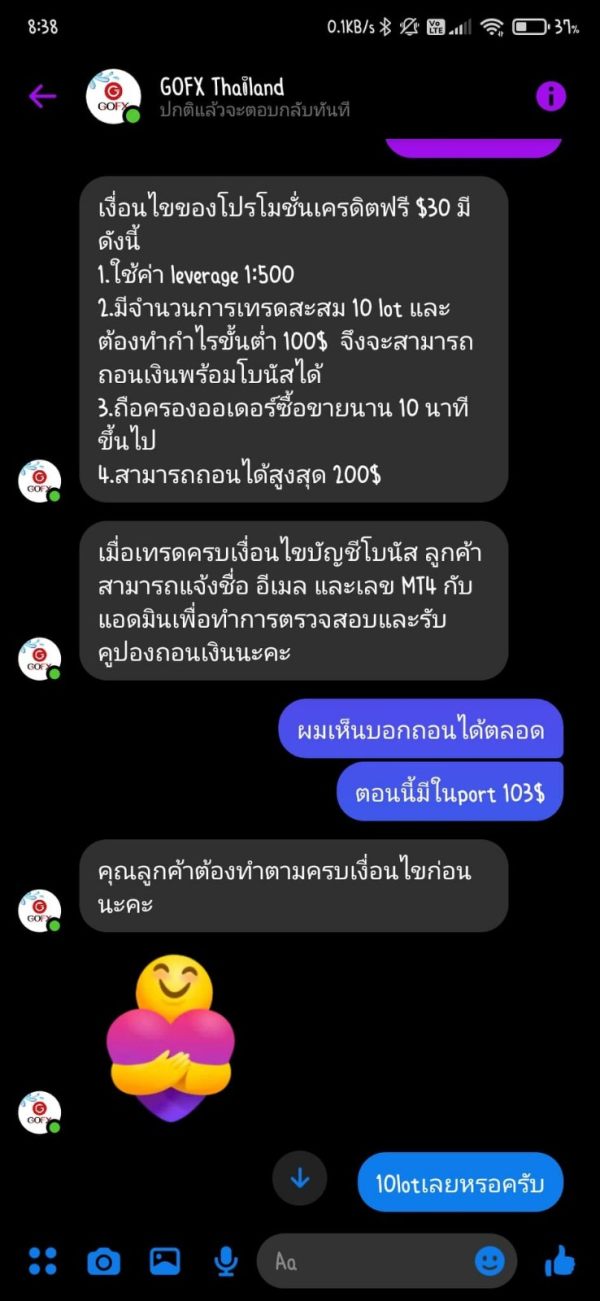

Bonus and Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns are not documented in reviewed materials.

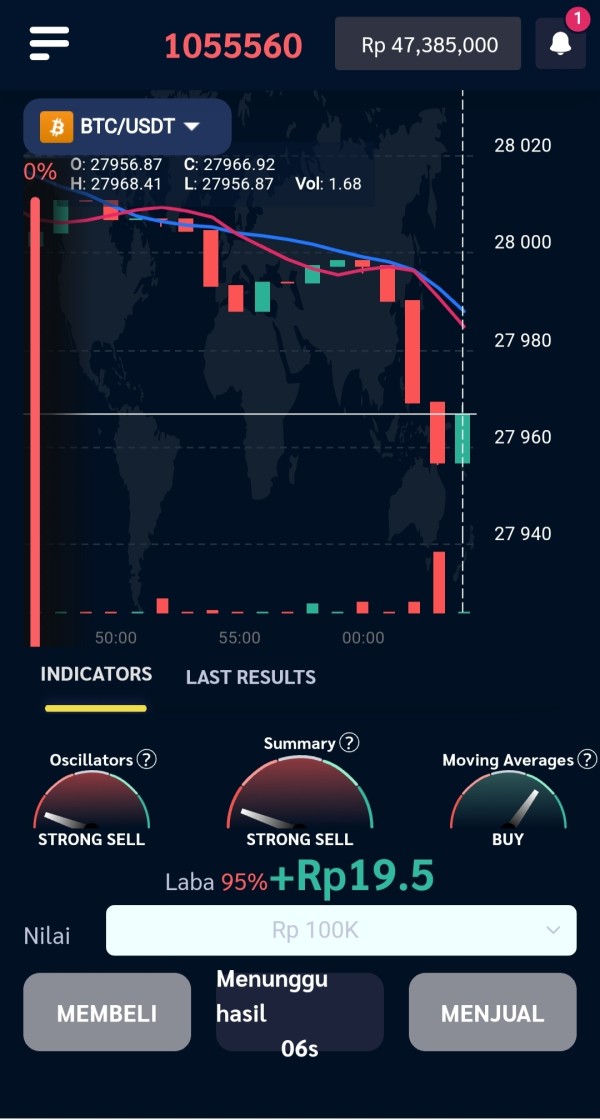

Tradeable Assets: Information about available currency pairs, commodities, indices, or other trading instruments is not fully disclosed.

Cost Structure: Spread ranges, commission rates, overnight fees, and other trading costs are not openly published in accessible sources.

Leverage Options: Maximum leverage ratios and margin requirements are not clearly specified in available documentation.

Platform Selection: Trading software options, mobile applications, and platform features are not detailed in this Gofx review's source materials.

Geographic Restrictions: Information about service availability in different countries or jurisdictions is not clearly outlined.

Customer Support Languages: Available communication languages and support channels are not specified in accessible resources.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of GOFX's account conditions is severely hurt by the lack of publicly available information about their account structures and requirements. Industry-standard practice involves offering multiple account types to fit different trading styles and investment levels, but GOFX has not made such information easy to find for potential clients.

Without clear documentation of minimum deposit requirements, account tiers, or special features, traders cannot make informed decisions about whether the broker's offerings match their needs. The absence of information about Islamic accounts, which are crucial for Muslim traders, further limits the broker's apparent inclusivity.

Professional traders typically require detailed information about account specifications, including leverage options, margin requirements, and any restrictions on trading strategies. The lack of transparency about these basic aspects raises serious questions about GOFX's commitment to serving serious traders.

This Gofx review finds that the broker's failure to provide complete account information represents a significant barrier to client acquisition and suggests either operational immaturity or deliberate opacity that should concern potential traders.

Assessment of GOFX's trading tools and educational resources is impossible due to insufficient public information about their offerings. Modern forex brokers typically provide comprehensive analytical tools, market research, economic calendars, and educational materials to support trader success.

The absence of detailed information about research capabilities, technical analysis tools, or market commentary suggests either limited resources or poor marketing transparency. Professional traders rely heavily on quality research and analytical support, making this information gap particularly problematic.

Educational resources, including webinars, tutorials, and market analysis, are standard offerings in the competitive forex industry. GOFX's failure to prominently feature such resources raises questions about their commitment to client education and success.

Automated trading support, including Expert Advisor compatibility and algorithmic trading capabilities, represents another area where information is notably absent, potentially limiting the broker's appeal to sophisticated trading strategies.

Customer Service and Support Analysis

Evaluation of GOFX's customer service capabilities is severely limited by the absence of detailed information about support channels, response times, and service quality metrics. Reliable customer support is crucial in forex trading, where technical issues or account problems can result in significant financial losses.

The lack of published information about customer service hours, available communication methods, or multilingual support capabilities raises concerns about the broker's commitment to client service. Professional traders require responsive, knowledgeable support that can address technical and account issues promptly.

Without user reviews or testimonials, there is no independent verification of service quality or problem resolution capabilities. The complete absence of customer feedback represents a significant red flag in an industry where reputation and service quality are paramount.

Industry best practices include 24/7 support, multiple communication channels, and dedicated account management for active traders, but GOFX's service standards in these areas remain undocumented and unverified.

Trading Experience Analysis

Assessment of GOFX's trading environment and platform performance is impossible due to the lack of available user feedback and technical specifications. Platform stability, execution speed, and order processing quality are fundamental factors that determine trading success, yet no reliable information exists about GOFX's performance in these areas.

Without user reviews or independent testing data, traders cannot evaluate whether the broker provides the reliable, fast execution necessary for profitable trading strategies. Slippage rates, order rejection frequencies, and platform downtime statistics are crucial metrics that remain undocumented.

Mobile trading capabilities and platform functionality across different devices are increasingly important for modern traders, but GOFX has not provided clear information about their mobile offerings or cross-platform compatibility.

This Gofx review cannot provide meaningful analysis of trading conditions without access to user experiences, platform demonstrations, or independent performance testing, which itself represents a significant concern for potential clients.

Trust and Reliability Analysis

GOFX's trust and reliability profile presents serious concerns that potential traders must carefully consider. The broker's TrustFinance score of 2.39 out of 10 indicates significant reliability issues as assessed by industry analysts.

This extremely low rating suggests substantial problems with the broker's operations, transparency, or regulatory compliance. The complete absence of user reviews across major forex review platforms is particularly alarming.

In an industry where trader feedback is abundant and readily shared, the lack of any user testimonials or reviews suggests either very limited client activity or potential issues that prevent users from sharing their experiences. Multiple sources, including WikiFX and other industry watchdogs, have raised questions about GOFX's reliability and legitimacy.

Such concerns from established industry monitors represent serious red flags that traders should not ignore when selecting a broker. The broker's short operational history, combined with limited regulatory transparency and poor trust ratings, creates a risk profile that most prudent traders would find unacceptable for serious trading activities.

User Experience Analysis

The complete absence of user reviews and feedback makes it impossible to assess GOFX's actual user experience quality. With zero user evaluations available across major review platforms, potential clients have no independent verification of the broker's service quality, platform performance, or overall client satisfaction.

This lack of user feedback is particularly concerning in the forex industry, where traders typically share their experiences freely across multiple platforms. The absence of both positive and negative reviews suggests either extremely limited client activity or potential barriers to feedback sharing.

Without user testimonials, there is no way to verify claims about platform usability, account management quality, or problem resolution effectiveness. The registration and verification processes, fund management procedures, and overall client journey remain completely undocumented from actual user perspectives.

The absence of user experience data prevents meaningful analysis of common client concerns, satisfaction levels, or areas where the broker excels or falls short of industry standards.

Conclusion

This comprehensive Gofx review reveals a broker with significant trust and transparency concerns that should give potential traders serious pause. With a TrustFinance score of only 2.39 out of 10 and zero user reviews available across industry platforms, GOFX presents a risk profile that most prudent traders would find unacceptable.

The broker's short operational history since 2020, combined with limited regulatory transparency and poor industry ratings, suggests this platform may only be suitable for extremely risk-tolerant traders willing to accept substantial uncertainty about their broker's reliability and operational standards. Major concerns include the complete lack of user feedback, questionable reliability ratings from industry monitors, and insufficient transparency about regulatory compliance and operational procedures.

These factors combine to create a trading environment where client protection and service quality remain largely unverified and potentially problematic.