Is BOT safe?

Business

License

Is Bot Safe or Scam?

Introduction

Bot is a trading platform that has garnered attention in the forex market for its automated trading solutions. As trading becomes increasingly digital, the reliance on automated systems like bots has surged, prompting traders to seek efficient ways to manage their investments. However, with the rise of automated trading comes the necessity for traders to exercise caution and thoroughly evaluate the legitimacy of these platforms. Given the prevalence of scams in the financial sector, it is essential for traders to assess the credibility of Bot before engaging in any trading activities. This article aims to provide a comprehensive analysis of Bot, focusing on its regulatory status, company background, trading conditions, client safety, user experiences, and overall risk profile.

Regulation and Legitimacy

A crucial aspect of evaluating any trading platform is its regulatory status. Regulation serves as a safeguard for traders, ensuring that the broker adheres to specific standards of conduct and operational transparency. In the case of Bot, it is imperative to investigate whether it is regulated by a reputable authority.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

Currently, Bot does not appear to be regulated by any recognized financial authority. This lack of oversight raises significant concerns regarding the platform's legitimacy and its ability to protect traders' interests. Unregulated brokers often operate with fewer restrictions, which can lead to unethical practices and potential scams. It is vital for traders to be wary of platforms that lack regulatory backing, as this can significantly increase the risk of fraud and financial loss.

The absence of regulation also raises questions about the quality of service and compliance history. Without a regulatory body to oversee operations, there is little recourse for traders in the event of disputes or unethical conduct by the broker. Therefore, when considering whether Bot is safe or a scam, the lack of regulatory oversight is a critical factor that cannot be overlooked.

Company Background Investigation

Understanding the company behind the trading platform is essential for assessing its credibility. Bot was founded with the intention of providing automated trading solutions to users seeking efficiency in their trading strategies. However, the details surrounding its ownership structure and history remain somewhat opaque.

The management team behind Bot comprises individuals with varying degrees of experience in the financial and tech sectors. However, specific information regarding their professional backgrounds, qualifications, and track records is limited. This lack of transparency can be concerning for potential users, as it raises questions about the competence and reliability of the management team.

Furthermore, the overall transparency of the company regarding its operations, financial health, and business practices is crucial. A reputable broker should openly disclose information about its ownership, management, and operational practices. Unfortunately, Bot's limited disclosure raises red flags, making it difficult for traders to ascertain whether it is a trustworthy platform or potentially a scam.

Trading Conditions Analysis

An essential factor in determining the safety of a trading platform is its fee structure and trading conditions. Bot claims to offer competitive trading fees and conditions; however, a closer examination is warranted to uncover any hidden costs or unusual policies that may affect traders.

| Fee Type | Bot | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | N/A |

| Commission Structure | N/A | N/A |

| Overnight Interest Range | N/A | N/A |

Unfortunately, detailed information regarding the specific fees associated with trading on Bot is not readily available. This lack of transparency can be a warning sign, as hidden fees can significantly impact a trader's profitability. Traders should be cautious of platforms that do not provide clear and comprehensive information about their fee structures, as this may indicate potential scams or unfair trading practices.

Moreover, it is essential to consider the overall trading conditions, including leverage options, margin requirements, and the variety of trading instruments available. A reputable broker should provide clear guidelines and competitive conditions that align with industry standards. The absence of such information on Bot's platform further compounds the uncertainty surrounding its legitimacy and safety.

Client Fund Security

The safety of client funds is paramount when evaluating any trading platform. Traders need to understand the measures that Bot implements to safeguard their investments. This includes assessing the segregation of client funds, investor protection schemes, and any policies in place to prevent negative balances.

Bot's website lacks comprehensive details regarding its client fund security measures. Without clear information about how client funds are managed and protected, traders may find themselves at risk of potential losses. A reputable broker should provide transparent information about fund segregation, ensuring that clients' funds are held in separate accounts from the broker's operational funds. This practice is crucial for safeguarding traders' investments in the event of financial difficulties faced by the broker.

Additionally, the absence of negative balance protection policies raises concerns. Negative balance protection is a critical feature that prevents traders from losing more than their initial investment, providing an essential safety net in volatile market conditions. Without such protections in place, traders may face significant financial risks when using the Bot platform.

Customer Experience and Complaints

Analyzing customer feedback and experiences is vital for assessing the reliability of any trading platform. User reviews can provide valuable insights into the strengths and weaknesses of Bot, as well as highlight any recurring issues or complaints.

| Complaint Type | Severity | Company Response |

|---|---|---|

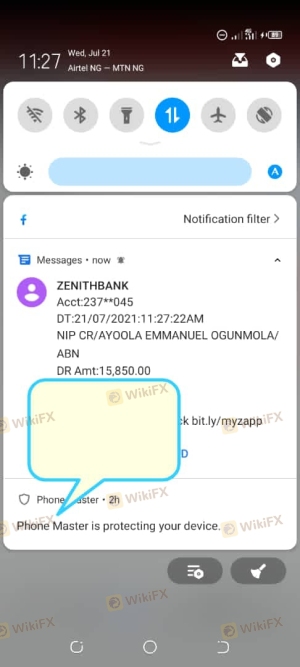

| Withdrawal Delays | High | Unresponsive |

| Account Verification Issues | Medium | Slow Response |

| Poor Customer Support | High | Unresolved |

Common complaints from users of Bot include withdrawal delays, issues with account verification, and inadequate customer support. The severity of these complaints suggests that users may face challenges when attempting to access their funds or resolve issues with the platform. The lack of timely responses from the company further exacerbates these concerns, indicating a potential lack of commitment to customer service.

For instance, one user reported experiencing significant delays in withdrawing funds, with the company providing little to no communication regarding the status of their request. Such experiences can lead to frustration and distrust among users, raising questions about the overall reliability of the platform.

Platform and Trade Execution

The performance and reliability of the trading platform itself are essential considerations for traders. It is crucial to evaluate the user experience, stability, and execution quality provided by Bot.

Bot's platform has received mixed reviews regarding its performance. Users have reported occasional issues with stability, including downtime and slow loading times. These factors can significantly impact trading efficiency, especially in fast-paced markets where timely execution is critical.

Additionally, the quality of order execution is a significant concern. Traders need to assess whether the platform experiences slippage or high rejection rates, which can adversely affect their trading outcomes. Reports of slippage and rejected orders on Bot's platform raise questions about its reliability and whether it can adequately support traders in executing their strategies effectively.

Risk Assessment

Using Bot for trading carries inherent risks that traders must carefully evaluate. Understanding the potential risks associated with the platform can help users make informed decisions about their trading activities.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of regulation raises concerns about legitimacy. |

| Financial Risk | Medium | Potential for hidden fees and poor trading conditions. |

| Operational Risk | High | Reports of platform instability and execution issues. |

| Customer Service Risk | High | Poor response times and unresolved complaints. |

Traders should be particularly cautious about the high regulatory risk associated with Bot. The absence of oversight can expose traders to potential scams and unethical practices. Additionally, the operational risks highlighted by user experiences further complicate the safety of using this platform.

To mitigate these risks, traders should conduct thorough research before engaging with Bot. This includes seeking alternative platforms with better regulatory backing, transparent fee structures, and proven track records of customer service.

Conclusion and Recommendations

In conclusion, the analysis of Bot raises significant concerns regarding its safety and legitimacy. The lack of regulatory oversight, coupled with limited transparency about its operations, trading conditions, and customer experiences, suggests that traders should approach this platform with caution.

While some users may find value in using Bot, the potential risks associated with unregulated trading platforms cannot be ignored. For traders seeking safer alternatives, it is advisable to consider platforms that are well-regulated, offer transparent fee structures, and have a proven history of reliable customer service.

In light of the findings, it is prudent for traders to prioritize their safety by opting for reputable brokers that provide comprehensive protections and transparent operations. By doing so, they can enhance their trading experience while minimizing the risks associated with using potentially unsafe platforms like Bot.

Is BOT a scam, or is it legit?

The latest exposure and evaluation content of BOT brokers.

BOT Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BOT latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.