Is GFS PARTNERS safe?

Business

License

Is GFS Partners A Scam?

Introduction

GFS Partners is an online forex broker that has garnered attention in the trading community since its establishment in 2018. Operating primarily in the United Kingdom, GFS Partners claims to offer a wide range of trading instruments, including forex, commodities, and CFDs, through the popular MetaTrader 4 platform. However, the lack of regulatory oversight and transparency raises significant concerns for potential traders. Given the complexities and risks inherent in forex trading, it is crucial for traders to conduct thorough evaluations of brokers before committing their funds. This article aims to provide an objective assessment of GFS Partners, focusing on its regulatory status, company background, trading conditions, customer fund safety, client experiences, platform performance, and overall risk profile.

Regulation and Legitimacy

Regulation is a critical factor in determining the safety and reliability of a forex broker. GFS Partners has not been found to be regulated by any recognized financial authority, which poses significant risks for traders. The absence of regulation means that there are no guarantees regarding the protection of clients' funds, and the broker is not subject to the same stringent oversight as regulated firms.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of regulatory oversight raises red flags about the broker's legitimacy. Regulated brokers are typically required to adhere to strict compliance measures designed to protect investors, such as maintaining segregated accounts and providing compensation schemes in case of insolvency. The absence of such measures at GFS Partners significantly increases the risk of fraud and mismanagement of funds. As a result, it is essential for potential clients to carefully consider these factors before proceeding with any investment.

Company Background Investigation

GFS Partners was founded in 2018, but details regarding its ownership structure and management team remain unclear. The broker's website lacks comprehensive information about the company's history, making it challenging for potential clients to assess its credibility. Transparency is a vital aspect of trust in the financial sector, and the lack of information about the company's leadership raises concerns about its operational integrity.

The absence of a clear management team and ownership structure is alarming. A reputable broker typically discloses information about its executives and their qualifications, which can provide insight into the companys reliability and expertise. Without this information, it is difficult for traders to ascertain whether GFS Partners is a trustworthy entity or merely a facade for fraudulent activity.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions and cost structure is essential. GFS Partners offers various trading instruments, but the specifics of its fee structure are not clearly outlined. Reports suggest that the broker may impose high fees and commissions, which could significantly impact traders' profitability.

| Fee Type | GFS Partners | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | N/A | 1-2 pips |

| Commission Model | N/A | $5-10 per lot |

| Overnight Interest Range | N/A | Varies |

The lack of transparency regarding trading costs is a significant concern. Traders may find themselves facing unexpected fees that could erode their profits. Additionally, the absence of information about spreads and commissions raises questions about the broker's overall trading environment. Traders should be wary of brokers that do not provide clear information about their fee structures, as this can often indicate potential hidden costs.

Customer Fund Safety

The safety of customer funds is paramount in the forex trading industry. GFS Partners does not appear to have implemented robust measures to protect client funds. The absence of regulatory oversight means that there are no guarantees regarding fund security, and traders may be at risk of losing their investments without recourse.

GFS Partners has not provided information about client fund segregation, investor protection mechanisms, or negative balance protection policies. These are essential features that regulated brokers typically offer to ensure the safety of their clients' funds. The lack of such measures at GFS Partners is a significant cause for concern, as it leaves traders vulnerable to potential financial losses.

Customer Experience and Complaints

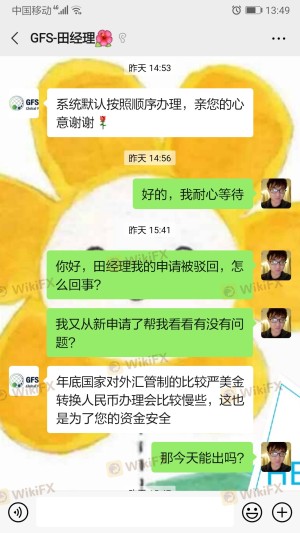

Analyzing customer feedback is crucial for assessing a broker's reliability. GFS Partners has received numerous complaints from clients regarding withdrawal issues and poor customer service. Many users have reported difficulties in accessing their funds, often citing excuses from the broker as to why withdrawals were delayed or denied.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Complaints | Medium | Slow |

Typical complaints include claims of being unable to withdraw funds and experiencing unresponsive customer service. In some cases, clients have reported being asked to pay additional fees before they could access their funds. These patterns of complaints indicate a troubling trend that potential clients should consider before opening an account with GFS Partners.

Platform and Trade Execution

The trading platform offered by GFS Partners is MetaTrader 4, which is widely recognized for its user-friendly interface and robust features. However, the performance and reliability of the platform are critical factors in determining overall user experience. Reports suggest that traders have experienced issues with order execution, including slippage and rejected orders.

The quality of order execution is vital for traders, as delays or errors can lead to significant financial losses. If GFS Partners exhibits signs of platform manipulation or poor execution quality, it could further compromise the trustworthiness of the broker.

Risk Assessment

When considering GFS Partners, traders must weigh the associated risks carefully. Without regulatory oversight, the broker poses a higher risk of fraud and mismanagement of funds. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight. |

| Fund Safety Risk | High | Lack of protection measures. |

| Customer Service Risk | Medium | Reports of unresponsive support. |

| Trading Cost Risk | Medium | Unclear fee structure. |

To mitigate these risks, potential traders should consider using regulated brokers with established reputations. Conducting thorough research and reading reviews from other traders can provide valuable insights into the broker's reliability.

Conclusion and Recommendations

In conclusion, GFS Partners presents several red flags that suggest it may not be a safe choice for traders. The absence of regulation, unclear trading conditions, and numerous customer complaints indicate a higher risk of fraud and financial loss. While GFS Partners may offer appealing trading features, the potential dangers outweigh the benefits.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternative brokers that are regulated and have a proven track record of customer satisfaction. Some reputable options include brokers regulated by the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). These brokers typically offer better protection for client funds and more transparent trading conditions.

In summary, potential clients should exercise caution and conduct thorough due diligence before engaging with GFS Partners. The question of "Is GFS Partners safe?" leans towards a negative response, and traders should prioritize their financial security by choosing regulated and established brokers.

Is GFS PARTNERS a scam, or is it legit?

The latest exposure and evaluation content of GFS PARTNERS brokers.

GFS PARTNERS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GFS PARTNERS latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.