GFS Partners 2025 Review: Everything You Need to Know

Executive Summary

This GFS Partners review looks at a forex broker that started in 2018. The company offers online trading services but gets mixed feedback from users and has some trust issues. GFS Partners gives traders access to over 250 trading tools including currency pairs, stocks, gold, and oil CFDs with leverage up to 500:1, but the broker has big problems with keeping users happy and staying reliable.

The platform works mainly through MetaTrader 4, which helps traders who want high leverage and different types of assets. However, there are big problems including no mobile and web app support, which makes it hard for users to trade in today's mobile-focused world. Data shows the broker got a WikiFX rating of 1.94 out of 10, plus many user complaints that make people question how good and reliable their service is.

GFS Partners seems to target traders who care more about high leverage and lots of different assets than new platform features and great customer service. But people thinking about using this broker should carefully look at the mixed user feedback and trust problems before choosing them, especially since there are many other forex brokers that offer better user experiences and reliability scores.

Important Notice

This GFS Partners review uses information that anyone can find and user feedback from different sources. We could not find detailed regulatory information for GFS Partners in the materials we looked at, which might mean they have different compliance rules in different places. Traders should check regulatory status and licensing information on their own before opening accounts.

The way we evaluated things in this review uses data sources anyone can access, what users said, and standard ways the industry measures brokers. But readers should know that broker services and rules might be different depending on where you live and can change over time. This review has not been checked on-site or directly tested all the features and services they claim to have.

Rating Framework

Broker Overview

GFS Partners started working in 2018 as an online forex and CFD broker based in the United Kingdom. The company says it provides high-leverage trading chances across many types of assets, targeting both regular people and big traders who want access to global financial markets. Even though it only recently entered the competitive forex broker space, GFS Partners has tried to find its place by offering big leverage ratios and many different instruments you can trade.

The broker's business plan focuses on giving access to currency pairs, precious metals, energy products, and stock CFDs through the well-known MetaTrader 4 platform. This GFS Partners review shows that while the company offers over 250 different trading instruments, how well they execute trades and deliver service overall has gotten mixed reactions from the trading community. The broker seems to care more about having lots of products and easy leverage access than new technology and great customer service.

GFS Partners works mainly through the MetaTrader 4 trading platform, which is still one of the most recognized and used platforms in the retail forex industry. The broker's asset choices include major, minor, and exotic currency pairs, along with CFDs on stocks, gold, silver, crude oil, and other commodities. But we could not find clear information about specific regulatory oversight in available sources, which might affect how much traders trust them and what regulatory protection they get depending on where they live.

Regulatory Status: The information we found does not say which specific regulatory authorities watch over GFS Partners operations, which is something important for potential clients who want regulatory protection and oversight.

Deposit and Withdrawal Methods: We could not find complete details about funding options, how long processing takes, and what fees they charge in available materials, so you need to contact the broker directly for complete information. Trading Assets: The broker gives access to over 250 trading instruments including major currency pairs like EUR/USD, GBP/USD, and USD/JPY, along with CFDs on stocks, precious metals including gold and silver, and energy commodities such as crude oil and natural gas.

Minimum Deposit Requirements: We could not find exact minimum deposit amounts for different account types in the sources we could access, which suggests they might vary based on what account you choose and where you live.

Promotions and Bonuses: Current promotional offers and bonus structures were not detailed in available information, which suggests they have limited marketing incentives or they are only available in certain regions. Cost Structure: We could not find complete information about spreads, commissions, overnight fees, and other trading costs in the sources we reviewed, so you need to ask directly for complete pricing details.

Leverage Options: Maximum leverage reaches 500:1, which puts GFS Partners among brokers that offer higher leverage ratios, though traders should think about the risks and regional regulatory limits that come with this.

Platform Selection: Trading happens through MetaTrader 4, but notably they do not have mobile and web-based app support, which limits how easy it is to access compared to modern broker offerings. Geographic Restrictions: This GFS Partners review could not find specific details about country restrictions and availability limits, so you need to check for your region before opening an account.

Customer Support Languages: Multi-language support includes English, Chinese, Korean, Japanese, and Vietnamese, which shows they focus on getting into Asian markets alongside English-speaking regions.

Account Conditions Analysis

The account structure that GFS Partners offers has both good and bad points for potential traders. While we could not find complete details about specific account type varieties in available information, the broker's focus on high leverage ratios up to 500:1 suggests they target active traders who want bigger market exposure. This leverage level puts GFS Partners in the higher range of what the industry offers, though traders must carefully think about the risks and their area's regulatory restrictions.

We could not find detailed information about account opening procedures and minimum deposit requirements in accessible sources, which might mean either simple sign-up processes or not enough transparency in how they get clients. The lack of clear account tier structures and their benefits is a notable information gap that potential clients would need to fix by talking directly to the broker.

User feedback about account conditions shows mixed experiences, with some traders liking the leverage availability while others worry about overall account management and service delivery. The lack of detailed account features such as Islamic accounts, demo account terms, or professional trading account options suggests either limited specialized offerings or not enough information sharing.

This GFS Partners review notes that the broker's account conditions seem to care more about leverage accessibility than complete account management features, which may appeal to experienced traders but could leave newer market participants wanting more structured guidance and account growth options. The overall account condition assessment reflects these mixed qualities and information limits.

GFS Partners' trading setup relies mainly on the MetaTrader 4 platform, which gives experienced forex traders a familiar environment but lacks the technology advancement seen in modern broker offerings. MT4's established functionality includes expert advisor support, custom indicators, and complete charting tools, though the platform's age shows when compared to newer alternatives that offer better user interfaces and mobile optimization.

A big limitation found in this analysis is that there are no mobile and web-based trading applications, which is a major disadvantage in today's mobile-first trading environment. Most modern brokers know that mobile trading is essential, making GFS Partners' lack of mobile support a notable competitive weakness that affects how easily traders can access and use their services.

We could not find complete details about research and analytical resources in available information, which suggests either limited market analysis offerings or not enough promotion of available tools. Educational resources, market commentary, and trading guides seem to get minimal attention, which could hurt newer traders who want learning opportunities and market insights.

Automated trading support through MT4's expert advisor functionality provides some technology capability, though the lack of proprietary trading tools or advanced analytical resources limits the overall tool ecosystem. User feedback shows moderate satisfaction with available tools, though many want more complete platform options and mobile accessibility.

Customer Service and Support Analysis

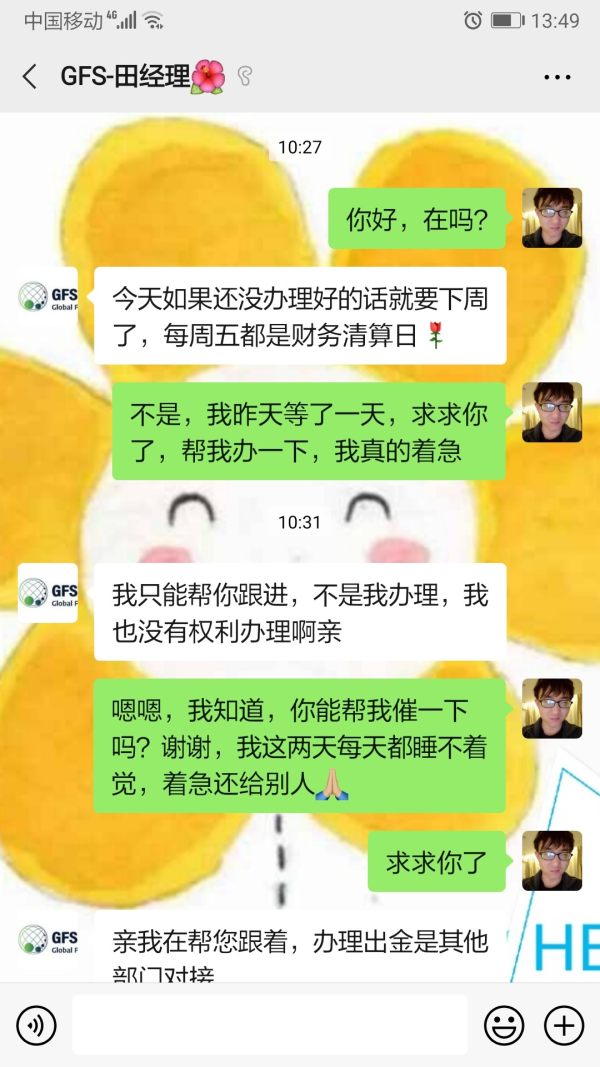

Customer service is a big challenge area for GFS Partners based on available user feedback and complaint data. The broker has collected multiple user complaints, with sources showing at least five formal complaints registered, which suggests ongoing service delivery issues that affect client satisfaction and keeping clients.

Multi-language support covering English, Chinese, Korean, Japanese, and Vietnamese shows the broker's international market focus, particularly targeting Asian trading communities alongside English-speaking regions. However, having language support does not necessarily mean good service quality, as shown by user feedback that indicates inconsistent response times and problem-solving effectiveness.

We could not find details about specific customer service channels, operating hours, and response time guarantees in available information, which may indicate limited service infrastructure or not enough transparency in support procedures. User testimonials suggest different experiences with customer service quality, ranging from okay interactions to big frustration with problem-solving processes.

The complaint volume compared to how long the broker has been operating raises concerns about systematic service issues rather than isolated incidents. This pattern suggests potential understaffing, inadequate training, or structural problems in customer service delivery that prospective clients should carefully consider when evaluating GFS Partners against other broker options.

Trading Experience Analysis

The trading experience with GFS Partners shows a mixed picture based on user feedback and platform capabilities. While the MetaTrader 4 platform provides familiar functionality for experienced traders, the overall execution quality and platform stability get moderate ratings from the user community. Some traders report okay order execution, while others worry about platform reliability during volatile market conditions.

The lack of mobile trading applications significantly affects the overall trading experience, particularly for traders who need flexibility and mobility in their trading activities. In an industry where mobile trading has become standard, this limitation is a big disadvantage that affects both convenience and potential trading opportunities for active market participants.

We could not find specific details about order execution quality and slippage data in available sources, though user feedback suggests different experiences depending on market conditions and trade sizes. The lack of detailed execution statistics or third-party performance verification makes it hard to assess the broker's true execution capabilities compared to industry standards.

Platform functionality through MT4 provides essential trading tools including technical analysis capabilities, automated trading support, and customizable interfaces. However, the lack of proprietary platform enhancements or additional trading tools limits the overall experience compared to brokers offering more complete trading ecosystems. This GFS Partners review shows that while basic trading needs may be met, advanced traders seeking cutting-edge technology and superior execution may find the experience lacking.

Trust and Reliability Analysis

Trust and reliability are the most concerning aspects of GFS Partners' operations based on available assessment data. The WikiFX rating of 1.94 out of 10 shows significant trust issues within the trading community and suggests potential problems with service delivery, financial security, or regulatory compliance that prospective clients should carefully consider.

We could not find clear regulatory oversight information in available sources, which raises additional concerns about client protection and dispute resolution mechanisms. In an industry where regulatory supervision provides crucial trader protections, the lack of clear regulatory information is a significant red flag for potential clients seeking secure trading environments.

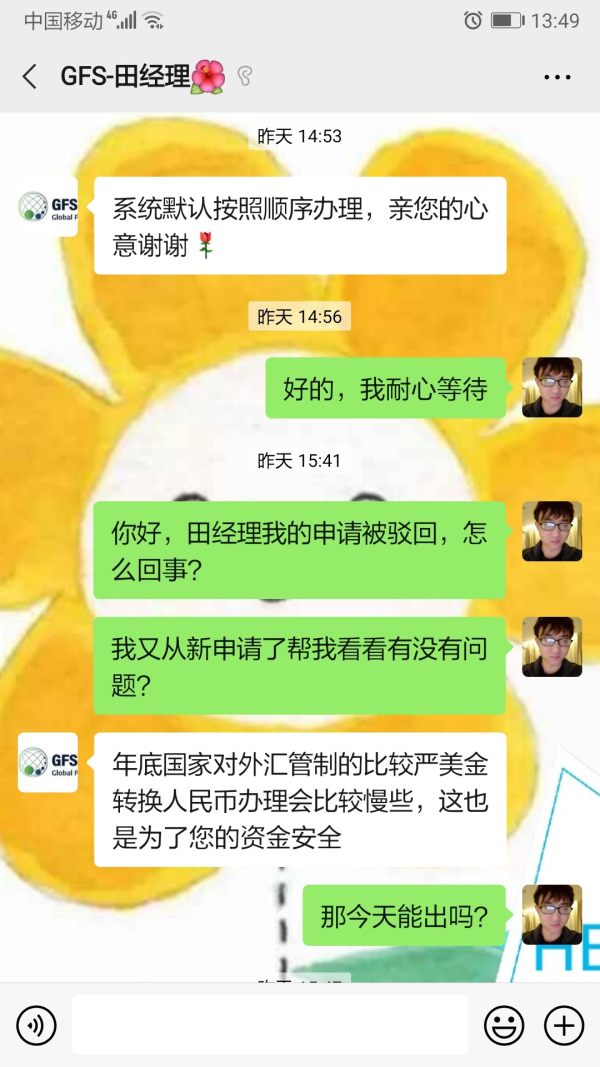

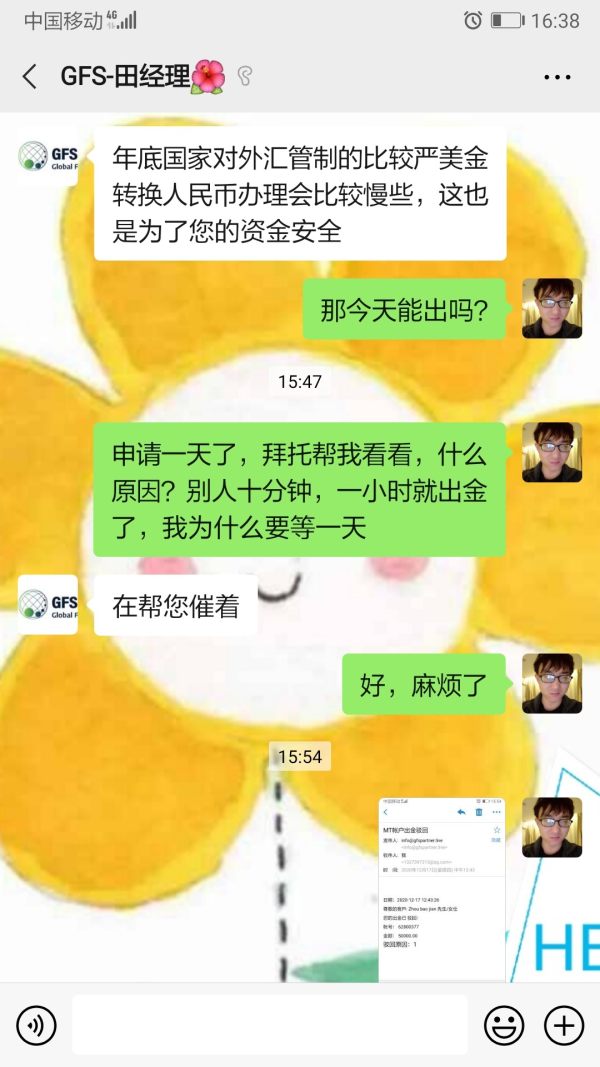

The presence of multiple user complaints alongside the low trust rating suggests systematic issues rather than isolated problems. This pattern shows potential challenges in areas such as withdrawal processing, trade execution, customer service delivery, or other critical operational aspects that directly impact client satisfaction and financial security.

Company transparency about financial reporting, operational procedures, and regulatory compliance appears limited based on available information. The lack of detailed disclosure about business operations, financial stability, and regulatory relationships further adds to trust concerns and makes it difficult for potential clients to conduct proper research before committing funds to trading accounts.

User Experience Analysis

User experience with GFS Partners reflects the mixed nature of the broker's service delivery, with feedback showing both positive and negative aspects depending on individual trader requirements and expectations. Some users appreciate the high leverage availability and asset variety, while others express frustration with customer service quality and platform limitations.

Interface design and usability rely heavily on the MetaTrader 4 platform's established framework, which provides familiar navigation for experienced traders but may feel outdated compared to modern broker platforms offering enhanced user interfaces and improved functionality. The lack of web and mobile applications significantly impacts overall user experience by limiting access flexibility.

We could not find complete details about account registration and verification processes in available sources, though user feedback suggests different experiences ranging from straightforward procedures to complications requiring extended customer service interaction. The lack of streamlined digital onboarding processes may indicate outdated operational procedures compared to industry standards.

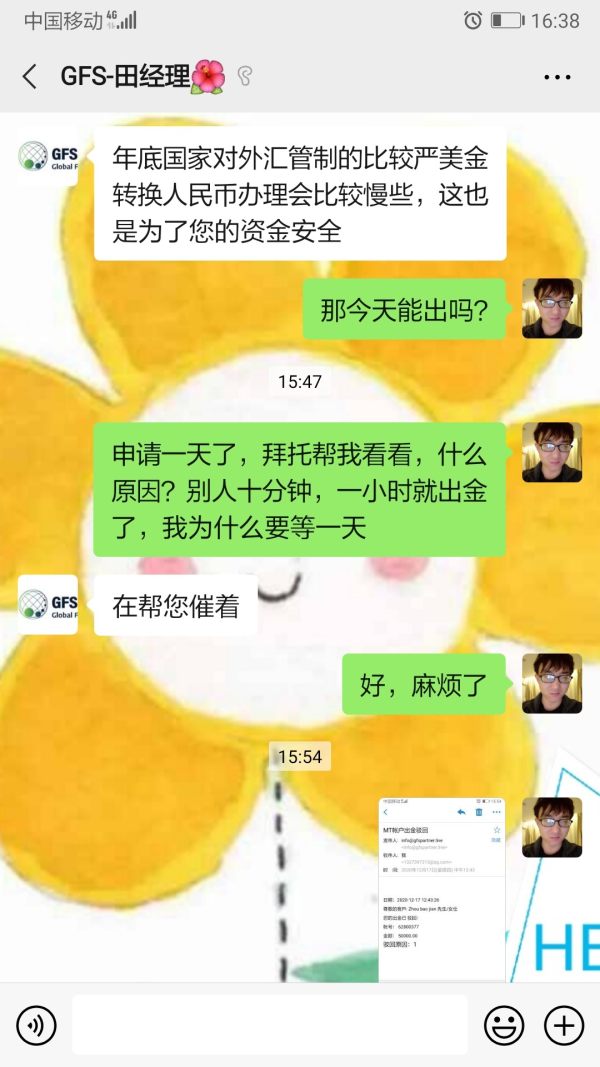

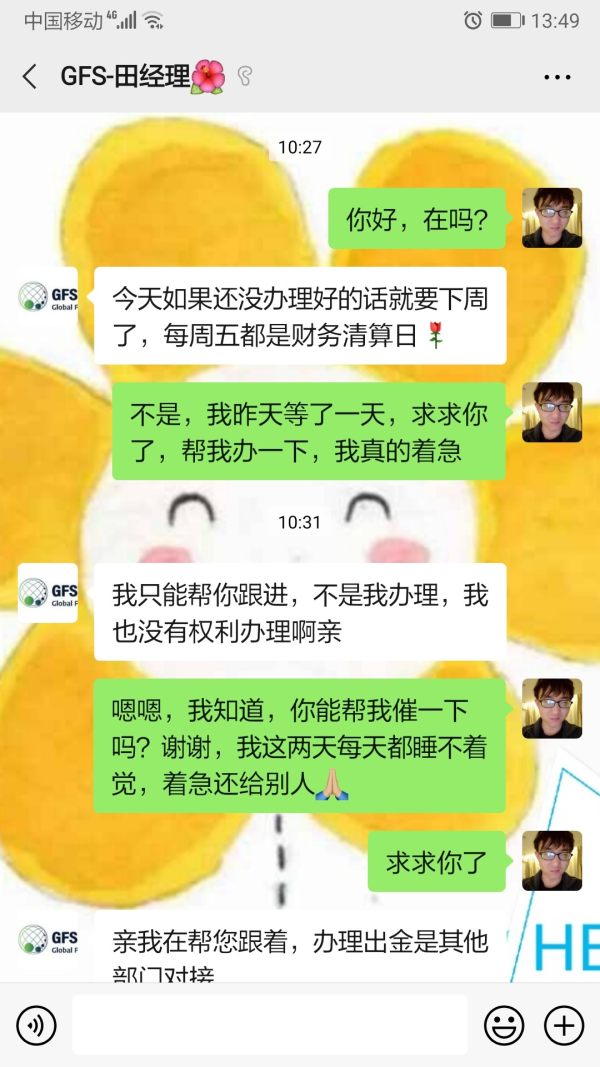

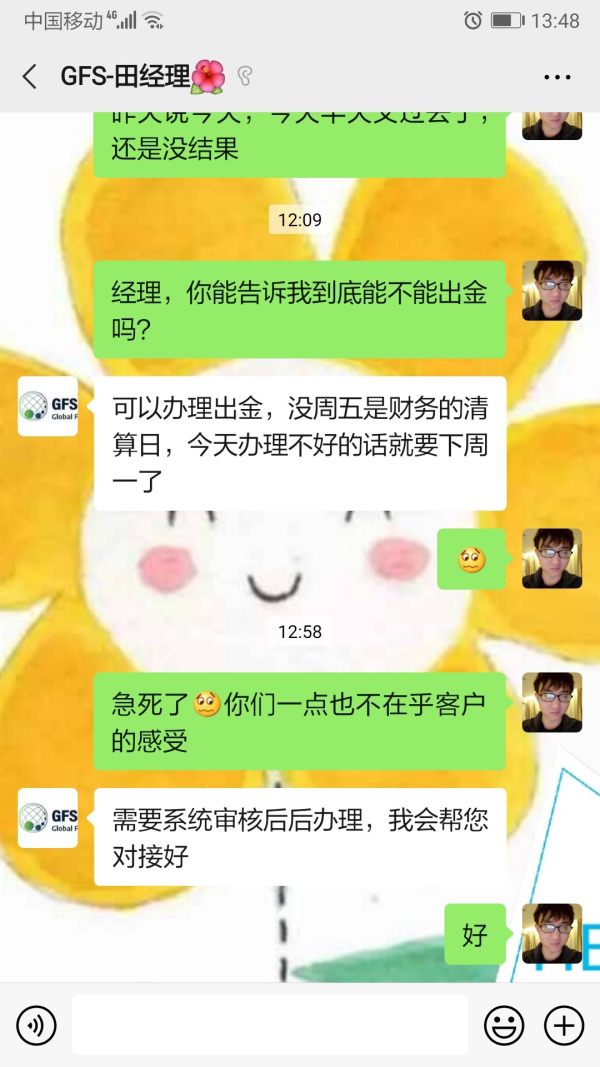

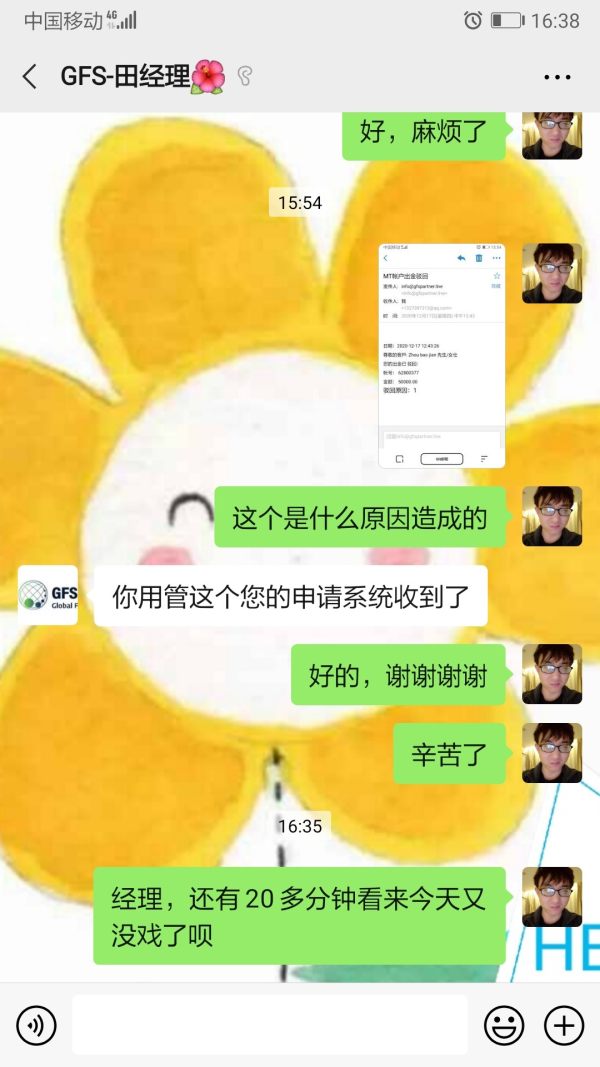

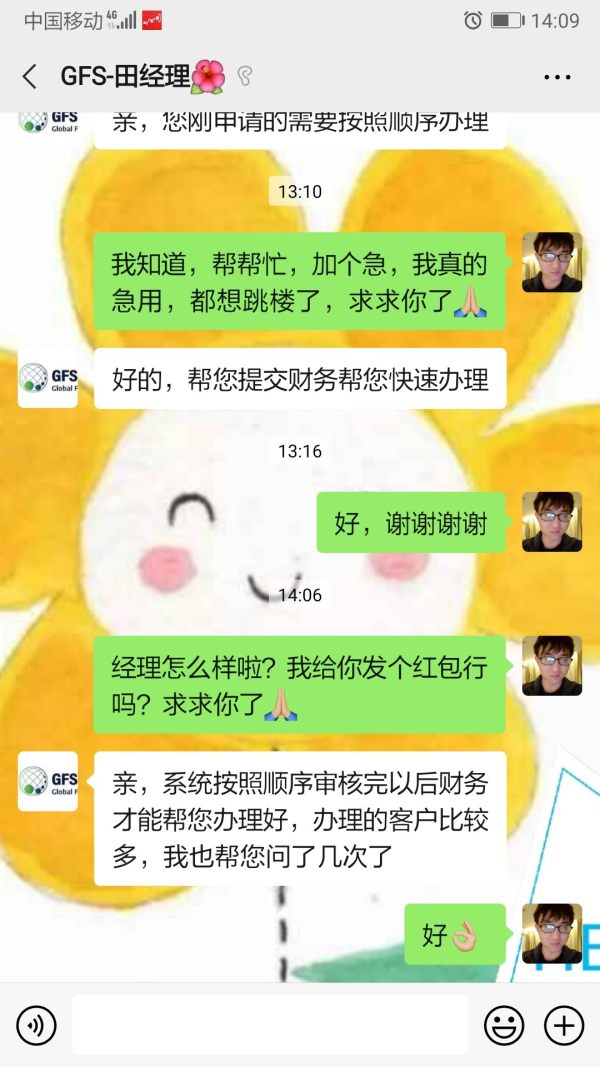

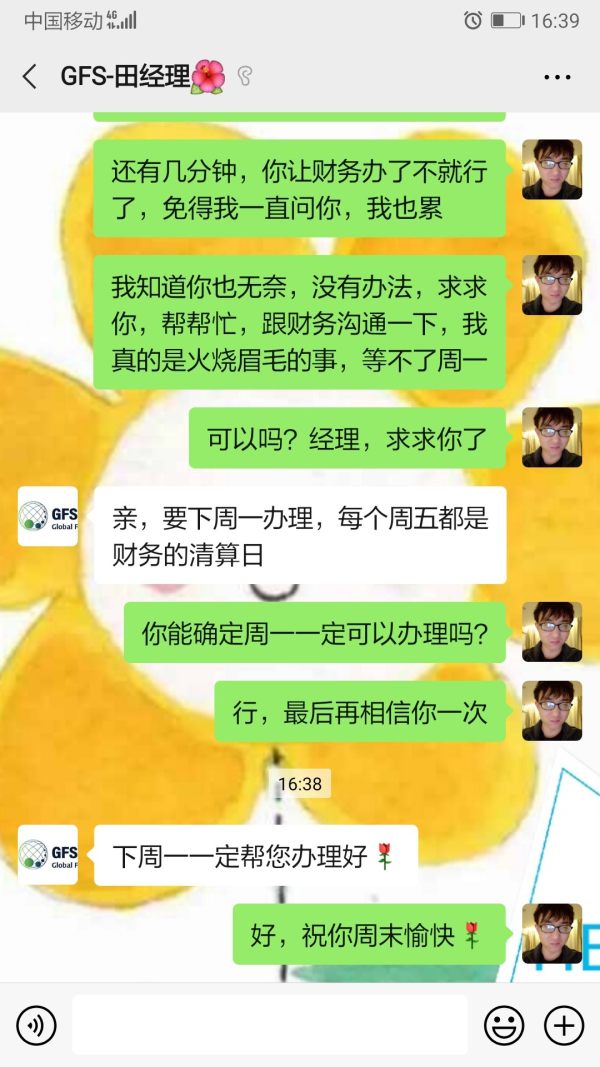

Funding operations and withdrawal experiences are areas of particular user concern based on available feedback. While we could not find specific details about processing times and procedures, user complaints suggest potential challenges in these critical operational areas that directly impact trader satisfaction and confidence.

Common user complaints focus on customer service responsiveness, platform accessibility limitations, and concerns about overall service reliability. The balanced mix of positive and negative feedback suggests that while some traders find acceptable service levels, others encounter significant challenges that impact their trading experience and satisfaction with the broker.

Conclusion

This GFS Partners review reveals a broker offering high leverage and diverse trading assets but struggling with fundamental service delivery and trust issues. While the 500:1 leverage and access to over 250 trading instruments may appeal to certain trader segments, the WikiFX rating of 1.94 and multiple user complaints raise serious concerns about reliability and service quality.

GFS Partners may suit experienced traders specifically seeking high leverage opportunities and willing to accept the associated risks and service limitations. However, the lack of mobile trading support, limited customer service quality, and trust concerns make this broker unsuitable for most retail traders who prioritize reliability, comprehensive platform access, and superior customer support.

The broker's main advantages include substantial leverage availability and extensive asset selection, while significant disadvantages include poor trust ratings, limited platform accessibility, inconsistent customer service, and lack of modern trading technology. Potential clients should carefully weigh these factors against alternative broker options offering superior reliability, comprehensive platform ecosystems, and established trust credentials in the competitive forex brokerage landscape.