Is FXTM Global Market safe?

Business

License

Is FXTM Global Market A Scam?

Introduction

FXTM Global Market, also known as ForexTime (FXTM), has carved out a significant niche in the forex trading landscape since its inception in 2011. With a presence in over 150 countries, FXTM has positioned itself as a versatile broker catering to both novice and experienced traders. Given the volatile nature of the forex market, its crucial for traders to conduct thorough evaluations of their brokers to ensure safety and reliability. In this article, we will investigate the legitimacy of FXTM Global Market, focusing on its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks. Our analysis is based on extensive research, including reviews from reputable financial platforms and regulatory bodies.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in determining its trustworthiness. FXTM operates under several regulatory frameworks, which is a positive indicator of its compliance and operational integrity. Below is a summary of its core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 777911 | United Kingdom | Verified |

| CySEC | 185/12 | Cyprus | Verified |

| FSC | C113012295 | Mauritius | Verified |

| CMA | 135 | Kenya | Verified |

FXTM is regulated by the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), the Financial Services Commission (FSC) in Mauritius, and the Capital Markets Authority (CMA) in Kenya. This multi-regulatory framework is indicative of a broker that adheres to stringent compliance measures, including capital requirements, fund segregation, and anti-money laundering protocols. However, it is essential to note that while the FCA represents a top-tier regulatory body, the oversight from the FSC in Mauritius is comparatively less rigorous. Historical compliance records suggest that FXTM has maintained a good standing with these regulatory authorities, reinforcing its reputation as a legitimate broker.

Company Background Investigation

FXTM was founded by Andrey Dashin, a seasoned professional in the trading industry, and has since evolved into a well-respected entity within the forex space. The company operates under the Exinity Group, which has established a robust operational framework with offices in key regions, including the UK, Cyprus, Kenya, and Mauritius. FXTMs management team comprises experienced professionals with extensive backgrounds in banking, trading, and financial technology, which adds to its credibility.

In terms of transparency, FXTM provides comprehensive information about its operations, regulatory licenses, and trading conditions on its website. This level of disclosure is vital for building trust with clients. However, some critiques have emerged regarding the accessibility of certain information, particularly for clients in regions where FXTM is not regulated.

Trading Conditions Analysis

FXTM offers a variety of trading accounts, each with distinct features and fee structures tailored to different trader needs. The overall cost structure is competitive, but it is essential to scrutinize the details to avoid unexpected charges. Below is a comparison of core trading costs:

| Cost Type | FXTM Global Market | Industry Average |

|---|---|---|

| Spread on Major Pairs | From 0.0 pips | 1.0 - 1.5 pips |

| Commission Structure | $3.5 per lot (Advantage Account) | Varies widely |

| Overnight Interest Range | Varies by account type | Standard rates |

FXTMs spreads are particularly attractive for its ECN accounts, which can start as low as 0.0 pips. However, the commission structure can add to the overall cost, especially for traders who frequently execute trades. Additionally, FXTM imposes overnight interest charges, which can vary significantly depending on the asset class and account type. This fee structure is not uncommon in the industry, but traders should be aware of the potential costs associated with holding positions overnight.

Customer Funds Security

The safety of client funds is a critical aspect of any reputable forex broker. FXTM has implemented several measures to protect traders' capital. Customer funds are kept in segregated accounts, separate from the company's operational funds, which is a standard practice among regulated brokers. Furthermore, FXTM offers negative balance protection, ensuring that clients cannot lose more than their account balance, even during extreme market conditions.

FXTM also provides an insurance policy for accounts held with its Mauritius entity, offering coverage of up to $1 million through Lloyds of London. This additional layer of security is a significant advantage for traders concerned about fund safety. However, it is important to note that clients under the Mauritius entity may not enjoy the same level of regulatory protection as those under the FCA or CySEC.

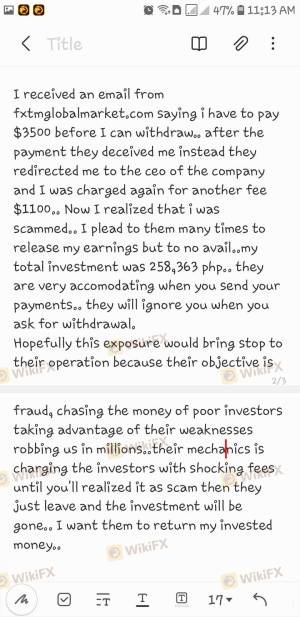

Customer Experience and Complaints

Analyzing customer feedback is essential for assessing the reliability of any broker. FXTM has garnered a mix of reviews from its users, with many praising its trading conditions and educational resources. However, common complaints include withdrawal delays and customer support responsiveness. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| Customer Support Issues | Medium | Mixed experiences |

| Account Verification Delays | Medium | Generally resolved |

For instance, some users have reported waiting extended periods for withdrawals, leading to frustration and skepticism about the broker's reliability. In contrast, others have praised the speed and efficiency of deposit processes. FXTMs customer support has received mixed reviews, with some clients highlighting quick response times, while others experienced delays, particularly during high-demand periods.

Platform and Trade Execution

FXTM offers the widely-used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are known for their robust functionality and user-friendly interfaces. These platforms provide traders with advanced charting tools, technical indicators, and various order types. However, some users have reported occasional issues with order execution quality, including slippage and re-quotes.

The execution speed at FXTM is generally competitive, with claims of average speeds around 71 milliseconds. However, real-world testing showed some variability, particularly during volatile market conditions. Traders should remain vigilant regarding these aspects, as execution quality can significantly impact trading outcomes.

Risk Assessment

Using FXTM Global Market does come with inherent risks, as is the case with any trading platform. Below is a concise risk assessment:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Varies by jurisdiction |

| Fund Safety | Low | Strong protections in place |

| Execution Risk | Medium | Potential slippage and delays |

While FXTM is generally considered a safe broker due to its regulatory oversight and fund protection measures, traders should be aware of the risks associated with trading, especially in volatile markets. To mitigate these risks, it is advisable to use risk management strategies, including stop-loss orders and proper position sizing.

Conclusion and Recommendations

In conclusion, FXTM Global Market is not a scam but rather a legitimate forex broker with a solid reputation and regulatory oversight. However, potential clients should remain cautious and consider the following recommendations:

New Traders: If you are a beginner, FXTM offers a wealth of educational resources and a user-friendly platform. However, be prepared for a slightly higher minimum deposit compared to some competitors.

Active Traders: Experienced traders may find FXTM appealing due to its competitive spreads and advanced trading tools. Just be mindful of the commission structure and potential withdrawal fees.

Risk Management: Always implement risk management strategies to protect your capital, especially when trading with high leverage.

Alternatives: If you are seeking a broker with more extensive regulatory coverage or lower fees, consider alternatives like IG or OANDA, which may offer different advantages.

Overall, while FXTM Global Market provides a robust trading environment, it is essential for traders to conduct their due diligence and remain informed about the inherent risks of forex trading.

Is FXTM Global Market a scam, or is it legit?

The latest exposure and evaluation content of FXTM Global Market brokers.

FXTM Global Market Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXTM Global Market latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.