Regarding the legitimacy of FX CORP forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is FX CORP safe?

Business

Risk Control

Is FX CORP markets regulated?

The regulatory license is the strongest proof.

ASIC Inst Market Making (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Inst Market Making (MM)

Licensed Entity:

FX CORP PTY LTD

Effective Date:

2014-10-30Email Address of Licensed Institution:

smaytom@fxcorp.com.auSharing Status:

No SharingWebsite of Licensed Institution:

www.fxcorp.com.auExpiration Time:

--Address of Licensed Institution:

L 9 1-7 CASTLEREAGH ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0280769535Licensed Institution Certified Documents:

Is FX Corp A Scam?

Introduction

FX Corp is a forex brokerage that has garnered attention in the trading community, primarily due to its claims of offering a diverse range of trading services. Positioned as a platform for both novice and experienced traders, FX Corp presents itself as a gateway to the global forex market. However, the importance of conducting thorough due diligence when selecting a forex broker cannot be overstated. Traders need to be cautious as the forex industry is rife with unregulated entities that may pose significant risks to their investments. This article aims to critically evaluate the legitimacy of FX Corp by examining its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is a key indicator of its legitimacy and reliability. A regulated broker is typically subject to oversight by a financial authority, which ensures compliance with industry standards and protects clients' funds. In the case of FX Corp, the broker claims to operate under the laws of Samoa, a jurisdiction known for its lenient regulatory environment. However, this raises significant concerns regarding the safety of client funds.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Samoa | Unverified |

The absence of a regulatory license from a reputable authority such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) is alarming. Without regulatory oversight, FX Corp operates with minimal accountability, making it difficult for clients to seek recourse in the event of disputes or financial malpractice. Furthermore, the claim that it operates under the laws of Samoa, while failing to provide a valid license, raises red flags about the broker's transparency and intentions.

Overall, the lack of regulation is a significant factor that makes FX Corp a potential risk for traders. Engaging with an unregulated broker can expose investors to various forms of fraud, including the possibility of losing their entire investment without any means of recovery.

Company Background Investigation

Understanding a broker's history and ownership structure is crucial in assessing its credibility. FX Corp claims to have been established in 2013, with its operations based in Sydney, Australia. However, there is conflicting information regarding its regulatory status and operational transparency. While some sources suggest that FX Corp is regulated by ASIC, others indicate it is unregulated and operates as an offshore entity.

The management teams background is another important aspect to consider. Unfortunately, there is limited information available regarding the qualifications and experience of FX Corp's leadership. A lack of transparency in this area can be indicative of a broker that may not prioritize the interests of its clients.

The overall opacity surrounding FX Corp's operational details raises concerns about its commitment to ethical business practices and client protection. A broker that is unwilling or unable to provide clear information about its history and management may not be trustworthy.

Trading Conditions Analysis

The trading conditions offered by FX Corp are essential for potential clients to evaluate. A thorough understanding of the broker's fee structure, spreads, and commissions is critical for assessing its competitiveness in the market. Reports indicate that FX Corp offers a starting spread of 0.7 pips for major currency pairs, which is relatively standard in the industry. However, the absence of a clear commission structure and potential hidden fees could lead to unexpected costs for traders.

| Fee Type | FX Corp | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.7 pips | 0.5 - 1.5 pips |

| Commission Model | Not disclosed | Typically 0-0.5% |

| Overnight Interest Range | Not disclosed | Varies widely |

The lack of transparency regarding commissions and overnight interest rates can be a red flag, as traders may encounter unexpected charges that can erode their profits. Additionally, the high leverage options offered by FX Corp, which can go as high as 1:400, can be enticing but also pose significant risks. High leverage can amplify losses, especially for inexperienced traders who may not fully understand the implications of margin trading.

Overall, while FX Corp may offer attractive trading conditions on the surface, the lack of clarity in its fee structure and potential hidden costs necessitates a cautious approach.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. A reputable broker should implement robust measures to protect clients deposits, including segregated accounts and investor protection schemes. Unfortunately, FX Corp has not provided sufficient information regarding its fund safety measures.

Reports indicate that FX Corp does not offer segregated accounts, which means that clients' funds may not be kept separate from the broker's operational funds. This lack of segregation increases the risk of clients losing their deposits in the event of the broker's insolvency. Additionally, the absence of negative balance protection can leave traders vulnerable to losing more than their initial investment.

Historically, unregulated brokers have been associated with numerous financial scandals and fraudulent activities, including the misappropriation of client funds. The lack of transparency surrounding FX Corp's fund safety policies raises concerns about the security of clients' investments.

Customer Experience and Complaints

Customer feedback is an invaluable resource for evaluating a broker's reliability. Unfortunately, FX Corp has received a considerable amount of negative reviews from its clients. Common complaints include difficulties in withdrawing funds, lack of responsiveness from customer support, and issues with the trading platform's performance.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Support Delays | Medium | Slow response |

| Platform Performance | High | Unresolved |

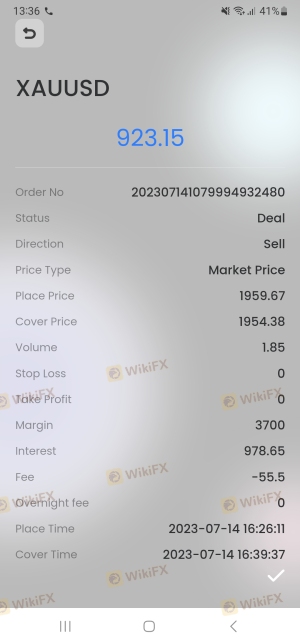

One notable case involved a trader who reported being unable to withdraw funds after initially receiving payouts. This situation reflects a common tactic employed by fraudulent brokers, where they lure clients in with initial withdrawals to build trust, only to impose unreasonable conditions later, effectively trapping clients' funds.

The overall sentiment among clients suggests a pattern of dissatisfaction and frustration, which should serve as a warning for potential investors considering FX Corp.

Platform and Trade Execution

The performance of a trading platform is critical for a trader's success. FX Corp claims to offer a proprietary trading platform; however, many users have reported issues with its functionality and reliability. Complaints include slow execution times, frequent disconnections, and a lack of advanced trading features that are typically available on more reputable platforms.

The quality of order execution is another vital aspect to consider. Traders have reported instances of slippage and rejected orders, which can significantly impact trading outcomes. Moreover, any signs of platform manipulation, such as artificially inflating prices or preventing withdrawals, are serious concerns that warrant further investigation.

Risk Assessment

Engaging with FX Corp presents several risks that potential clients should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of regulation increases vulnerability. |

| Fund Safety Risk | High | Absence of segregated accounts and protections. |

| Withdrawal Risk | High | Numerous complaints about withdrawal issues. |

| Platform Reliability Risk | Medium | Reports of poor performance and execution. |

To mitigate these risks, traders should conduct thorough research before engaging with FX Corp. It is advisable to consider alternative brokers that are regulated and have a proven track record of reliability and client satisfaction.

Conclusion and Recommendations

Based on the evidence presented, it is clear that FX Corp poses significant risks for potential traders. The lack of regulatory oversight, transparency regarding fund safety, and numerous customer complaints indicate that FX Corp may not be a trustworthy broker.

For traders seeking reliable options, it is recommended to consider regulated brokers with a strong reputation for client protection and satisfaction. Alternatives such as brokers regulated by ASIC or FCA, which offer robust safety measures and transparent trading conditions, would be prudent choices for those looking to enter the forex market. Engaging with a reputable broker can help mitigate risks and enhance the overall trading experience.

Is FX CORP a scam, or is it legit?

The latest exposure and evaluation content of FX CORP brokers.

FX CORP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FX CORP latest industry rating score is 4.13, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.13 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.