Bold Prime Review 2025: Everything You Need to Know

Executive Summary

Bold Prime has emerged as a notable player in the forex brokerage landscape since its establishment in 2020. This bold prime review reveals a broker that has positioned itself as a competitive option for traders seeking flexible trading conditions and diverse asset access. Based in Mauritius with ASIC regulation, Bold Prime operates under a No Dealing Desk (NDD) model. This ensures transparent trading environments without broker intervention.

The broker's standout features include spreads starting from 0 pips and leverage up to 1:2000. These features make it particularly attractive for both small-scale investors and professional traders. According to TradingFinder reports, Bold Prime supports multiple trading platforms including MetaTrader 4, MetaTrader 5, and cTrader. The platform provides access to forex, stocks, cryptocurrencies, commodities, and indices. With a minimum deposit requirement as low as $15 for standard accounts, the broker has positioned itself as accessible to entry-level traders. It maintains professional-grade services for experienced investors.

The broker's 24/7 customer service and reported platform stability have contributed to its growing reputation in the competitive forex market. However, as with any emerging broker, potential clients should carefully evaluate all aspects before committing funds.

Important Notice

Due to Bold Prime's headquarters location in Mauritius and its regulatory framework under ASIC, users should be aware of potential differences in legal protections and regulatory oversight across different jurisdictions. The regulatory landscape for forex brokers can vary significantly between regions. Clients should understand their local legal protections before engaging with any international broker.

This review is based on publicly available information and user feedback compiled from multiple sources as of 2024-2025. The analysis aims to provide comprehensive reference material for potential users, though individual experiences may vary. Prospective traders should conduct their own due diligence and consider consulting with financial advisors before making investment decisions.

Rating Framework

Broker Overview

Bold Prime entered the forex market in 2020 with a clear mission to provide transparent, intervention-free trading environments. Headquartered in Mauritius, the company has built its reputation around the No Dealing Desk (NDD) model, which ensures that client trades are executed without broker interference. This approach has resonated with traders who prioritize transparency and direct market access in their trading activities.

The broker's business model focuses on providing institutional-grade trading conditions to retail clients. This bridges the gap between professional trading environments and accessible retail services. According to BrokersRank analysis, Bold Prime has maintained consistent growth since its inception, expanding its service offerings and client base across multiple jurisdictions while maintaining its core commitment to transparent trading practices.

Bold Prime's platform ecosystem supports MetaTrader 4, MetaTrader 5, and cTrader. These platforms provide traders with industry-standard tools and advanced charting capabilities. The broker's asset portfolio encompasses forex pairs, individual stocks, cryptocurrencies, commodities, and market indices, offering diversification opportunities within a single trading account. Under ASIC regulation, Bold Prime operates within established regulatory frameworks designed to protect client funds and ensure fair trading practices. However, traders should verify specific regulatory protections applicable to their jurisdiction.

Regulatory Jurisdiction: Bold Prime operates under ASIC (Australian Securities and Investments Commission) regulation, providing a framework for compliance and client protection. The ASIC regulatory environment is generally regarded as robust within the forex industry. However, specific license details should be verified directly with the regulator.

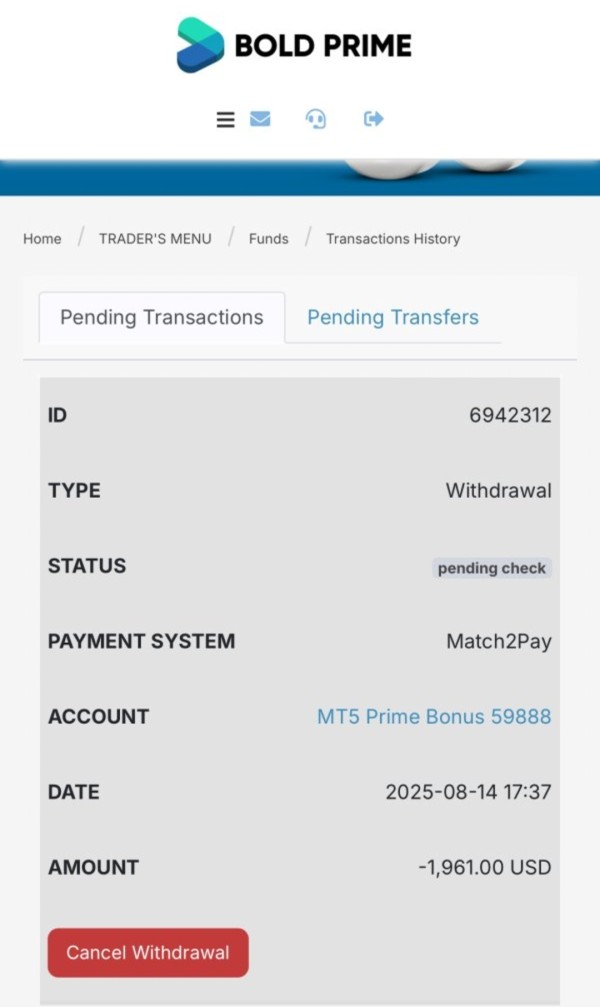

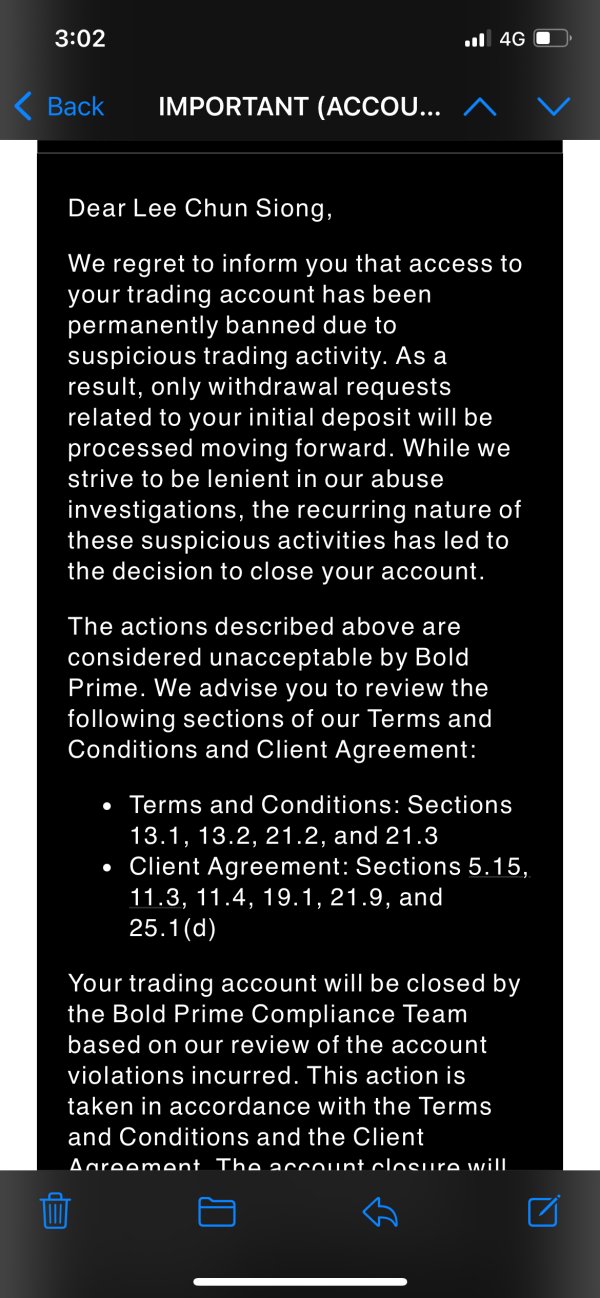

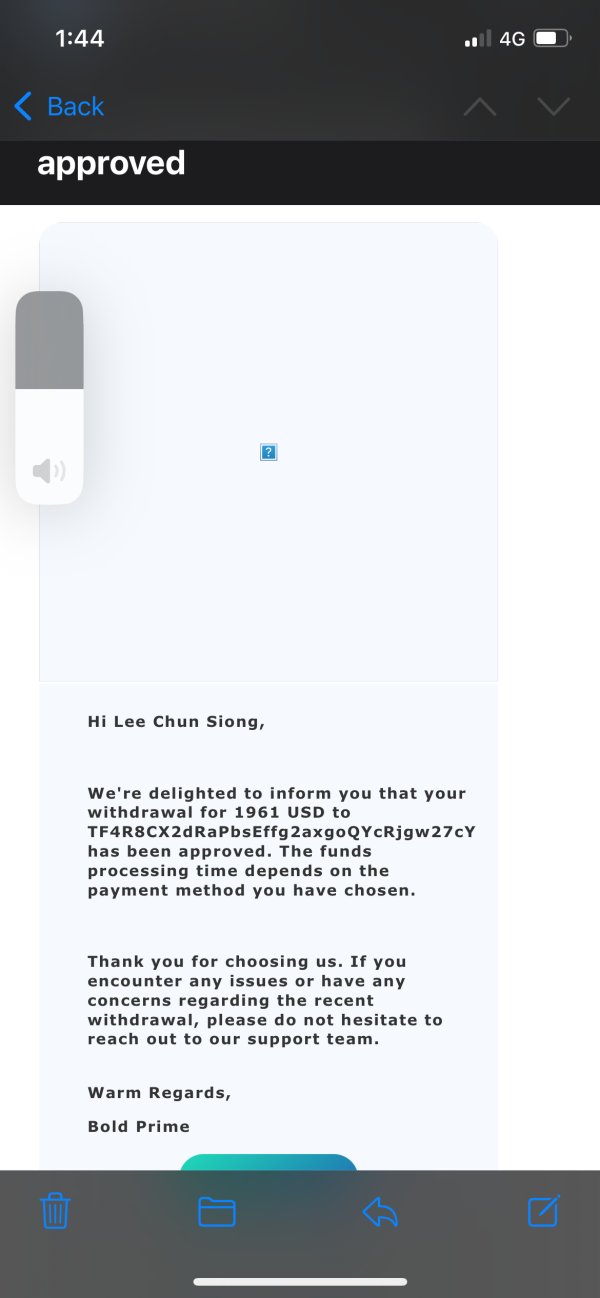

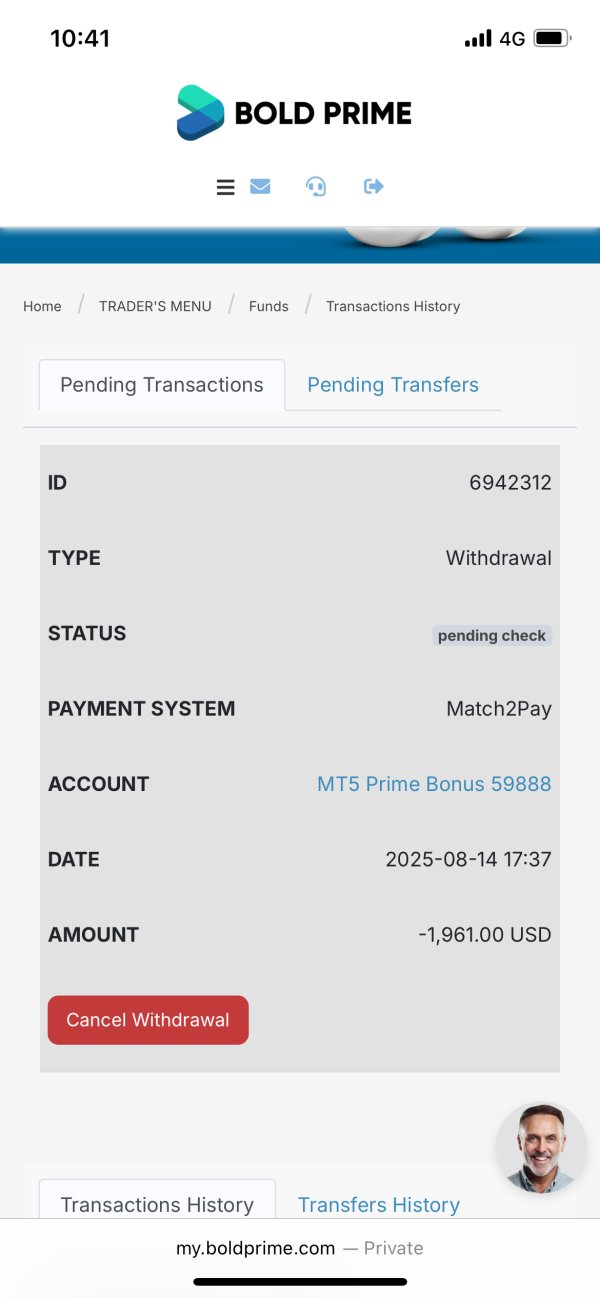

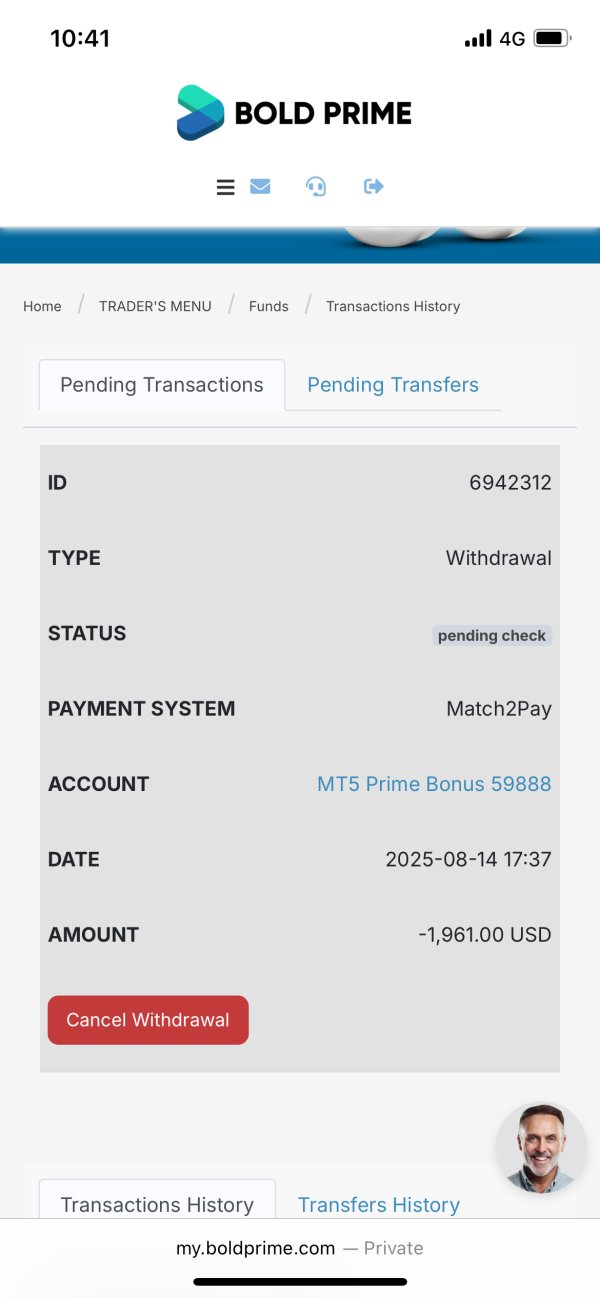

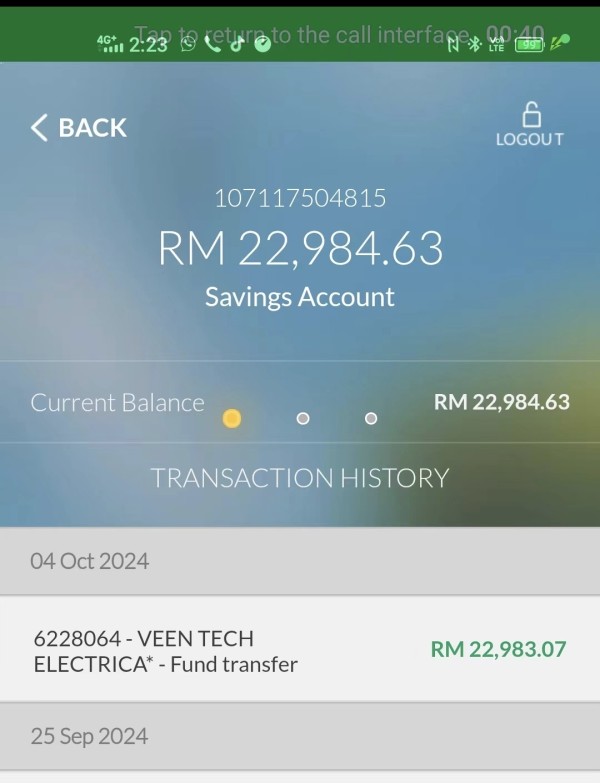

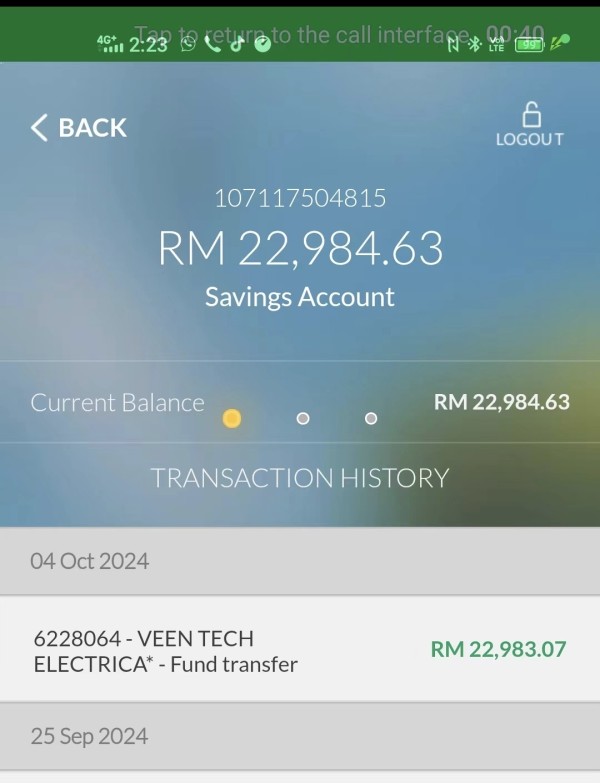

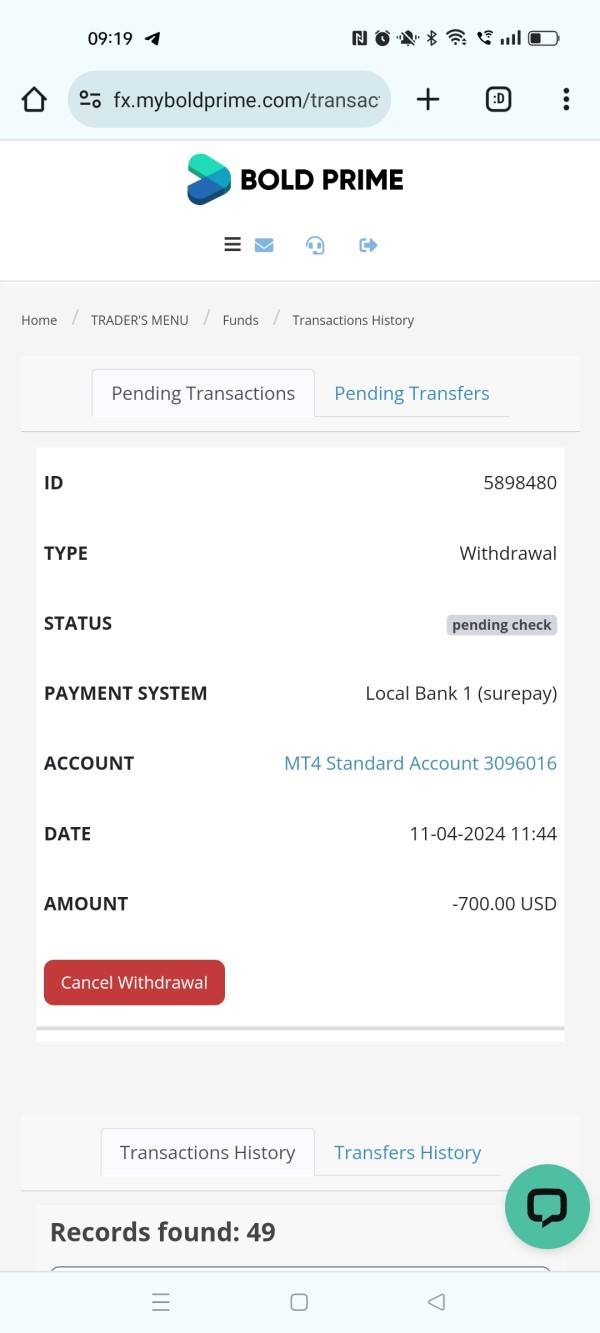

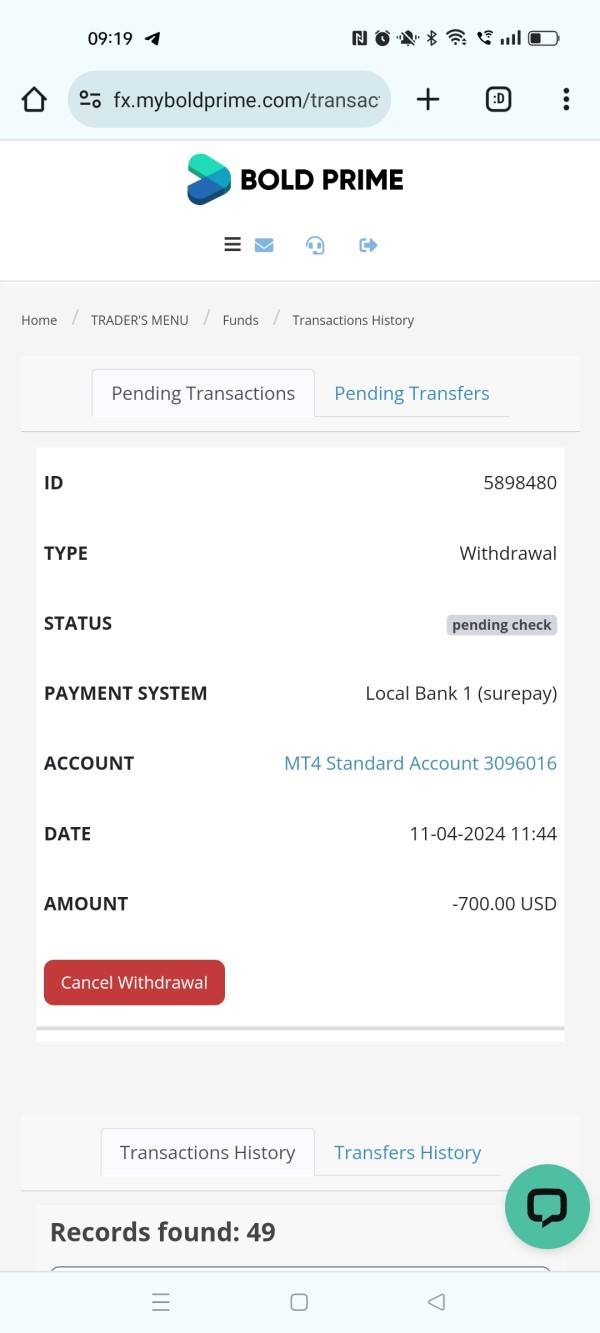

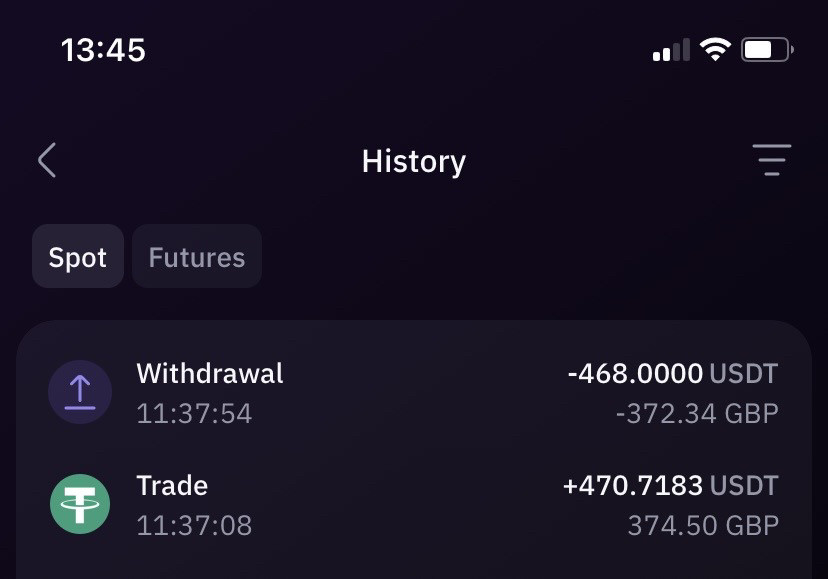

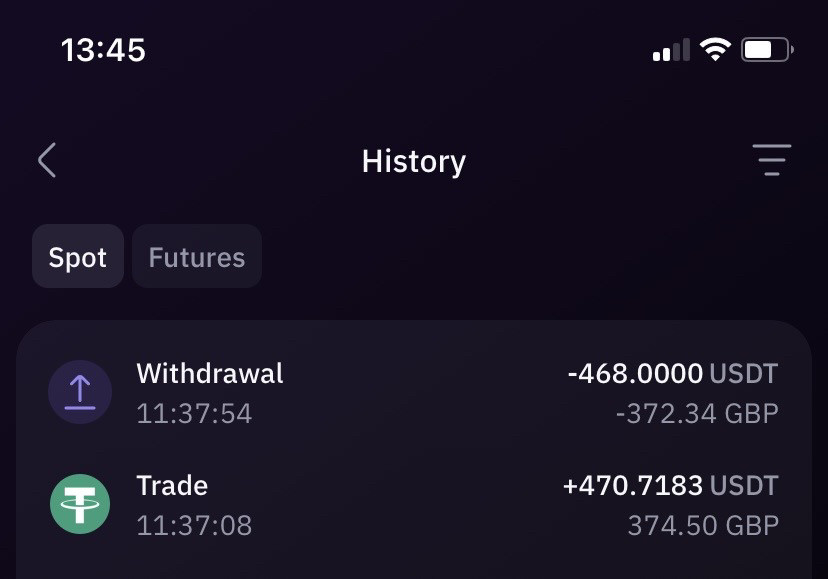

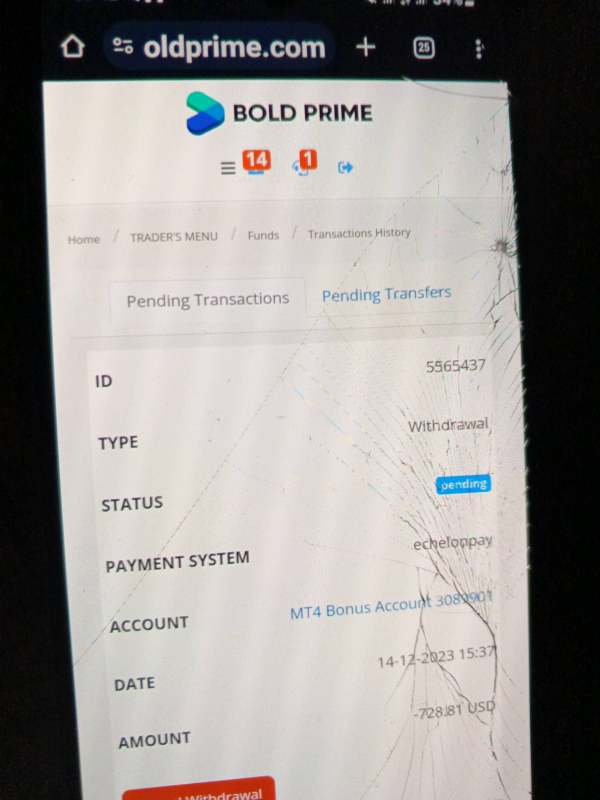

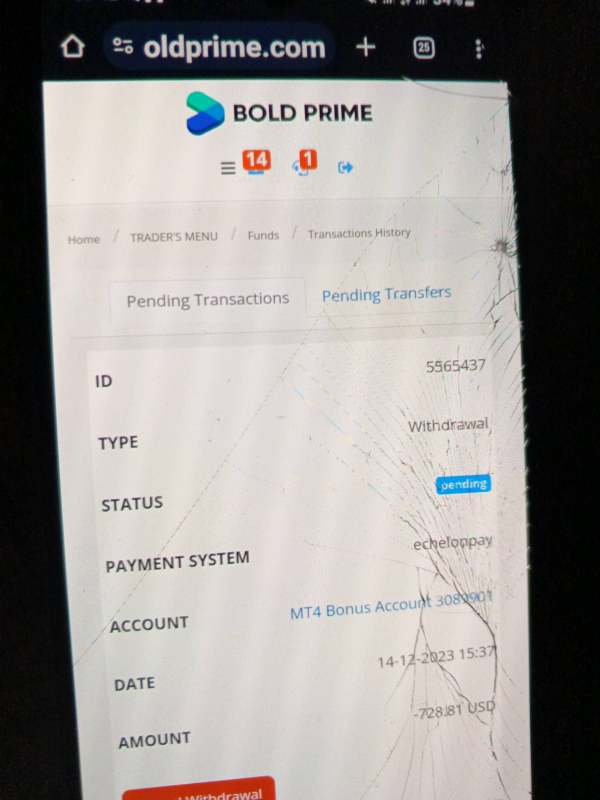

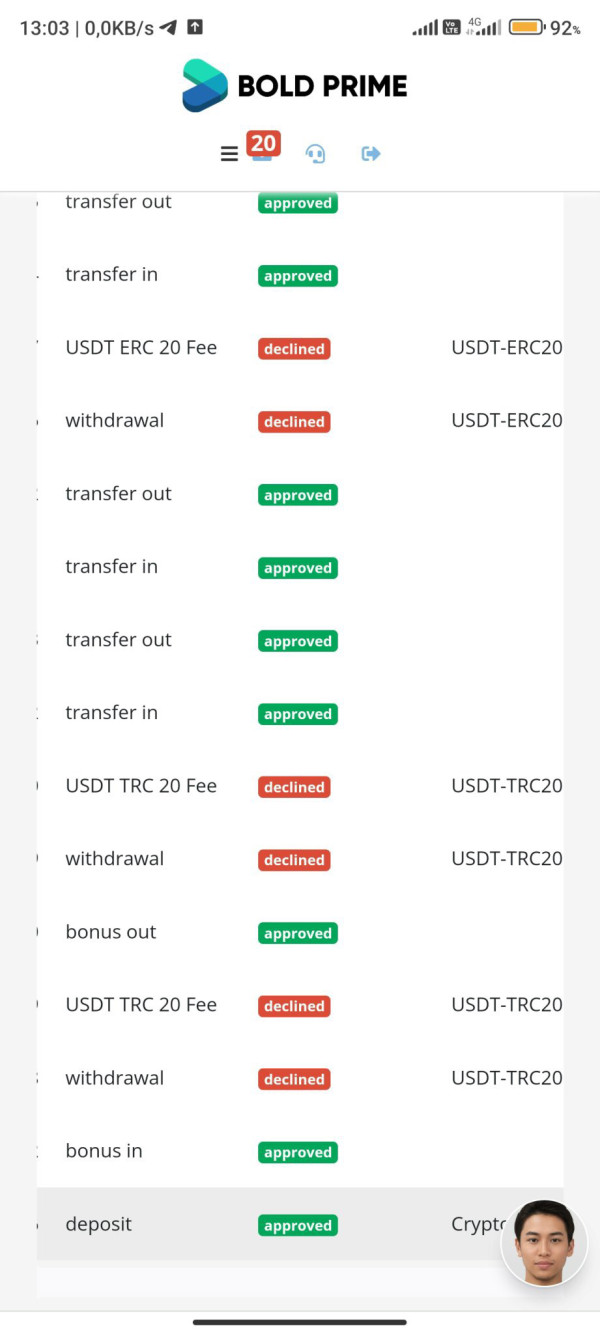

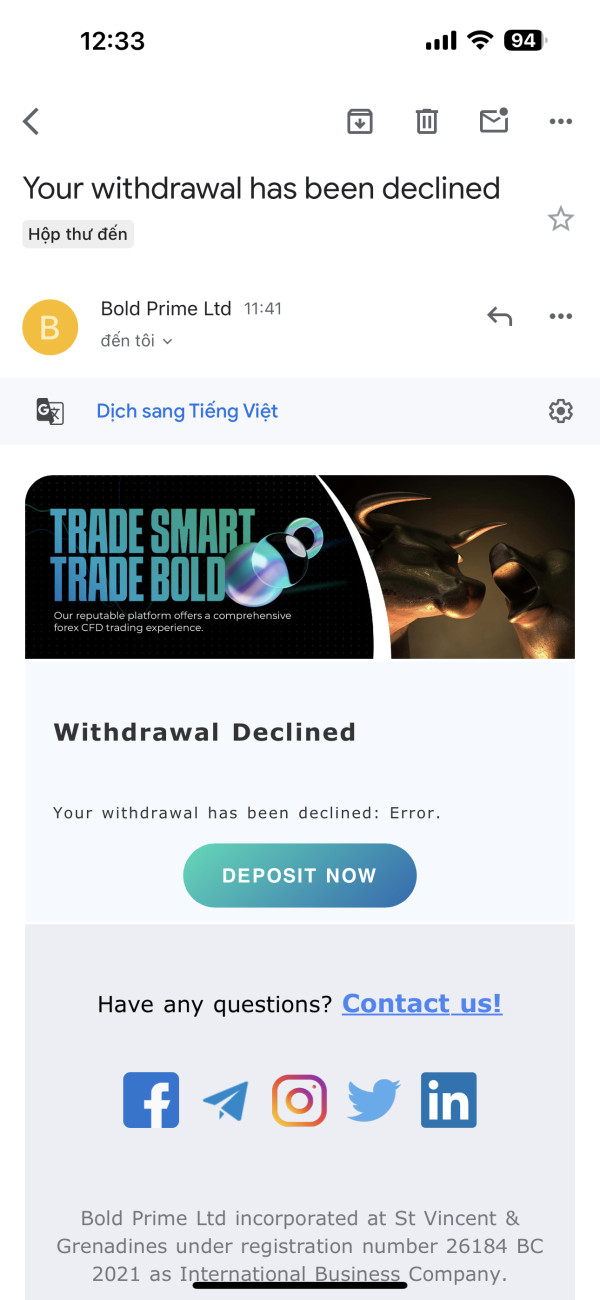

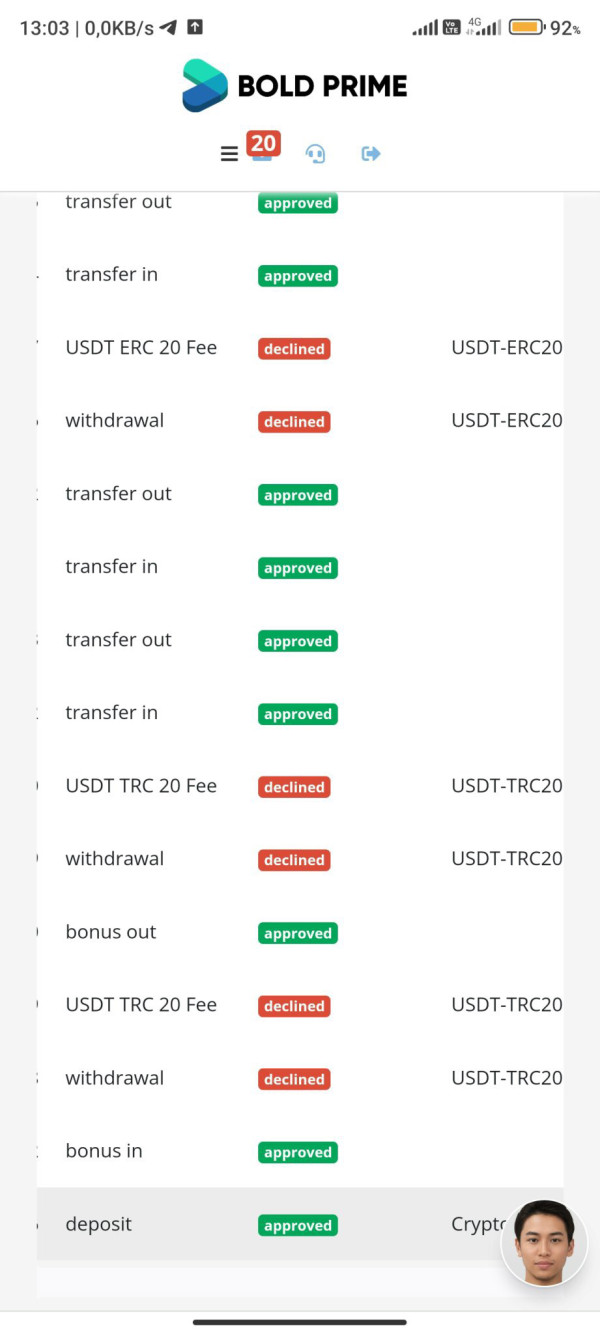

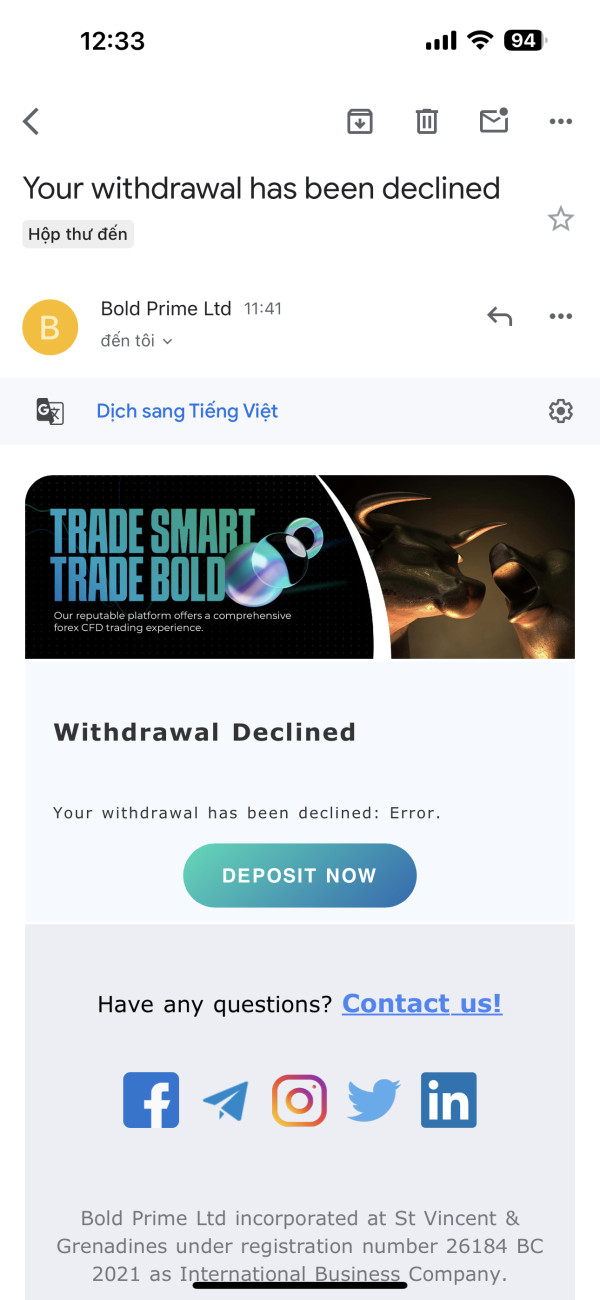

Deposit and Withdrawal Methods: The broker supports multiple payment channels for funding and withdrawing from trading accounts. Specific payment processors and associated fees are not detailed in available documentation. Processing times and minimum withdrawal amounts may vary by payment method.

Minimum Deposit Requirements: Standard accounts require a minimum deposit of $15, making Bold Prime accessible to new traders with limited capital. Professional account tiers require higher minimum deposits starting from $150. These reflect enhanced features and trading conditions.

Bonus and Promotional Offers: Current promotional activities and bonus structures are not specified in available broker information. This suggests either limited promotional campaigns or region-specific offerings that require direct inquiry.

Tradeable Assets: The platform provides access to major forex currency pairs, individual equity stocks, popular cryptocurrencies, commodity futures, and stock market indices. This diversification allows traders to build comprehensive portfolios across multiple asset classes within a single account.

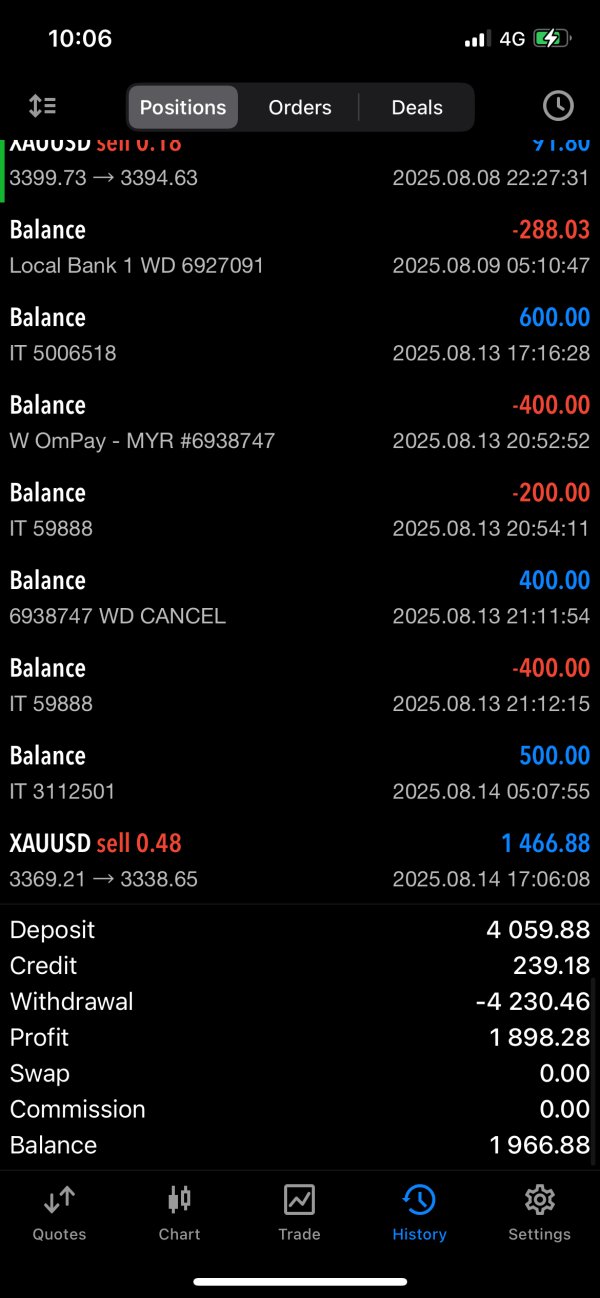

Cost Structure: Spreads begin at 0 pips for major currency pairs, with commission charges starting from $7 per standard lot. This pricing model positions Bold Prime competitively within the low-cost broker segment. It particularly benefits high-volume traders who benefit from tight spreads.

Leverage Ratios: Standard accounts offer maximum leverage of 1:2000, while professional accounts are limited to 1:500. These reflect regulatory requirements for different trader classifications. These leverage levels accommodate various trading strategies and risk management approaches.

Platform Options: Traders can choose between MetaTrader 4, MetaTrader 5, and cTrader platforms. Each offers distinct advantages for different trading styles and technical analysis requirements.

Geographic Restrictions: Specific geographic limitations are not detailed in available information. However, regulatory compliance requirements typically restrict services in certain jurisdictions.

Customer Service Languages: Supported languages for customer service are not specified in current documentation. This requires direct verification with the broker's support team.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

Bold Prime's account structure demonstrates a clear understanding of diverse trader needs, offering multiple account tiers with varying minimum deposit requirements and trading conditions. The standard account minimum of $15 represents one of the most accessible entry points in the forex industry. This makes professional trading platforms available to traders with limited initial capital. This bold prime review finds that the low barrier to entry doesn't compromise account quality, as even basic accounts receive access to institutional-grade spreads and execution quality.

The professional account tier, requiring $150 minimum deposit, provides enhanced trading conditions including reduced commission rates and priority customer service. According to TradingFinder analysis, the account opening process is streamlined and can be completed online with standard documentation requirements. The absence of detailed information regarding Islamic account availability represents a potential limitation for traders requiring Sharia-compliant trading conditions.

The broker's commission structure starting from $7 per lot is competitive within the industry, particularly when combined with zero-spread offerings on major currency pairs. This pricing model benefits active traders who can capitalize on tight spreads while paying transparent commission fees. The account conditions reflect Bold Prime's positioning as a broker serving both entry-level and professional traders within a unified service framework.

Bold Prime's platform selection covers the industry's most established trading environments, with MetaTrader 4, MetaTrader 5, and cTrader each bringing distinct advantages to different trading approaches. MT4 remains popular for its extensive Expert Advisor ecosystem and familiar interface. MT5 offers enhanced charting capabilities and additional timeframes. cTrader appeals to traders preferring modern interface design and advanced order management features.

The platform diversity ensures that traders can select environments that match their technical analysis preferences and automated trading requirements. Support for Expert Advisors and signal services accommodates algorithmic trading strategies, though specific limitations or restrictions on automated trading are not detailed in available documentation. The absence of proprietary platform development suggests Bold Prime's focus on providing proven, industry-standard tools rather than developing unique trading environments.

Market analysis and research resources are not extensively documented in available information. This represents a potential area for improvement in the broker's educational and analytical offerings. Educational materials and market commentary availability require direct verification with the broker, as these resources significantly impact trader development and decision-making capabilities.

Customer Service and Support Analysis (9/10)

Bold Prime's commitment to 24/7 customer service addresses one of the most critical aspects of forex broker evaluation, ensuring that traders can receive assistance across global trading sessions. Multiple contact channels including telephone, email, and live chat provide flexibility in communication preferences and urgency levels. The customer service team is reportedly knowledgeable and responsive, contributing to positive user experiences and problem resolution efficiency.

The high rating in this category reflects user feedback indicating prompt response times and effective issue resolution. Professional customer service becomes particularly important in forex trading where technical issues or account questions can impact trading opportunities. The availability of round-the-clock support aligns with the global nature of forex markets and accommodates traders across different time zones.

While specific language support details are not provided in available documentation, the international nature of Bold Prime's operations suggests multilingual capabilities. However, verification of specific language availability would benefit prospective clients. The customer service excellence appears to be a key differentiator for Bold Prime in the competitive broker landscape.

Trading Experience Analysis (8/10)

Platform stability and execution quality form the foundation of positive trading experiences, and user feedback suggests Bold Prime delivers consistent performance in these critical areas. The NDD execution model contributes to transparent order processing without dealer intervention, reducing potential conflicts of interest between broker and client. Fast execution speeds and minimal slippage reports indicate robust technical infrastructure supporting the trading platforms.

The variety of available platforms ensures that traders can access familiar trading environments with their preferred features and interface designs. Chart functionality, technical indicators, and order management tools meet professional standards across all supported platforms. Mobile trading capabilities, while not extensively detailed in available information, likely follow standard MT4/MT5/cTrader mobile implementations.

Trading environment stability becomes particularly important during high-volatility market conditions when rapid order execution can significantly impact trading outcomes. The positive user feedback regarding platform reliability suggests Bold Prime has invested appropriately in technical infrastructure to support consistent trading experiences across different market conditions.

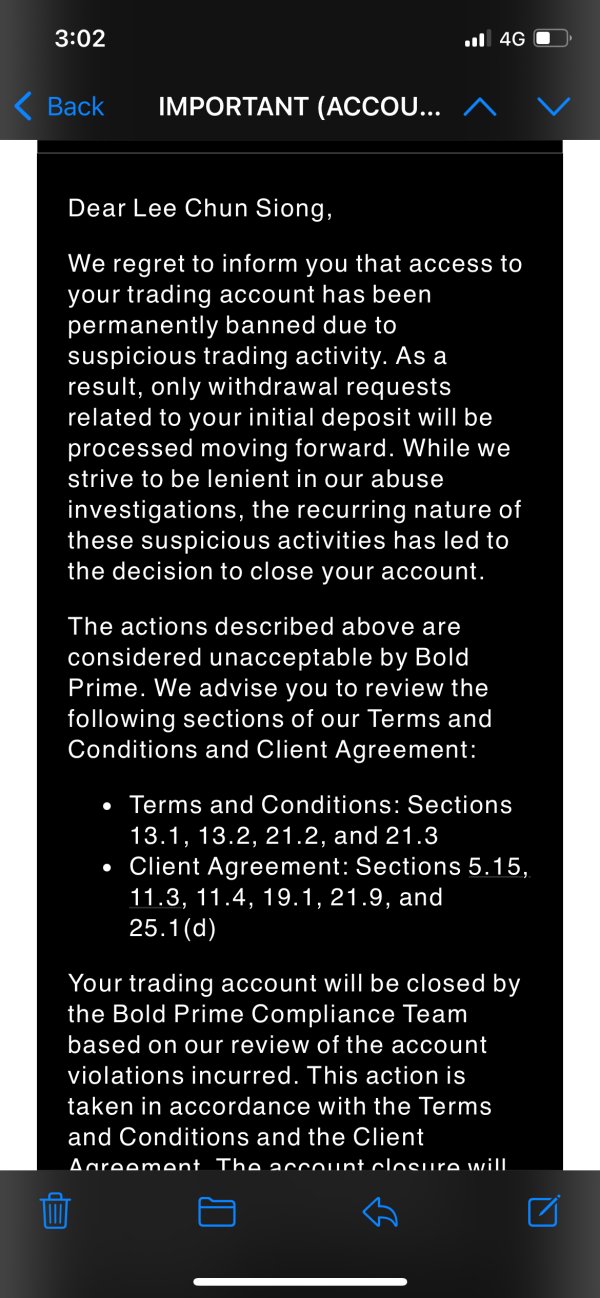

Trust Factor Analysis (7/10)

ASIC regulation provides a solid foundation for Bold Prime's regulatory compliance and client protection measures, as the Australian regulatory environment maintains established standards for forex broker operations. However, the relatively recent establishment in 2020 means the broker has a limited operational history compared to more established competitors. The regulatory framework includes standard client fund protection measures, though specific details regarding segregated accounts and compensation schemes require verification.

Company transparency regarding management, financial reporting, and operational procedures is not extensively documented in available public information. The absence of detailed licensing information or regulatory reference numbers in promotional materials suggests potential areas for improved transparency. Industry reputation and third-party recognition are still developing given the broker's recent market entry.

The trust factor rating reflects the balance between legitimate regulatory oversight and the natural caution appropriate when evaluating newer market entrants. Prospective clients should verify regulatory status directly with ASIC and consider the broker's operational history when making trust assessments.

User Experience Analysis (8/10)

The Trustpilot rating of 4.0 indicates generally positive user satisfaction with Bold Prime's services, representing above-average performance in user experience metrics. Platform interface design across MT4, MT5, and cTrader provides professional-grade functionality with intuitive navigation suitable for both novice and experienced traders. The account registration and verification process is reportedly straightforward, minimizing barriers to account activation.

Funding and withdrawal processes appear streamlined based on available information, though specific processing times and fee structures require direct verification. The low minimum deposit requirement of $15 demonstrates accessibility focus, allowing new traders to experience the platform without significant financial commitment. User interface design follows industry standards with customizable layouts and comprehensive charting tools.

The user experience encompasses both technical platform functionality and overall service delivery, with Bold Prime appearing to maintain consistent quality across both dimensions. The positive Trustpilot rating suggests that users find value in the broker's service offering. However, individual experiences may vary based on trading style, account size, and geographic location.

Conclusion

This comprehensive bold prime review reveals a broker that has established a solid foundation in the competitive forex market despite its relatively recent 2020 launch. Bold Prime's combination of ASIC regulation, competitive trading conditions, and accessible account minimums positions it as a viable option for diverse trader segments. The broker's strengths include transparent NDD execution, tight spreads from 0 pips, high leverage options up to 1:2000, and reportedly excellent 24/7 customer service.

The platform is particularly well-suited for small-scale investors seeking professional trading conditions and experienced traders who value transparent execution environments. The multiple platform options (MT4, MT5, cTrader) and diverse asset classes provide flexibility for various trading strategies and portfolio diversification approaches.

However, potential clients should consider the broker's limited operational history and verify specific regulatory protections applicable to their jurisdiction. Areas requiring further investigation include detailed fee structures, educational resources, and specific terms for promotional offerings. Overall, Bold Prime demonstrates the characteristics of a legitimate, growing broker with competitive offerings, though due diligence remains essential for any broker evaluation.