Vestrado 2025 Review: Everything You Need to Know

Executive Summary

This vestrado review gives you a complete look at one of the newer forex trading companies. Vestrado started in 2020 and has its main office in Saint Vincent and the Grenadines, which makes it a fairly new player in the trading world. The company calls itself a modern trading platform for forex traders and people who want to spread their money across different types of investments. You can trade forex, indices, stocks, commodities, and futures contracts using the popular MetaTrader 4 platform.

Our research shows mixed results from users and market information. Vestrado says it offers good features like tight spreads and leverage up to 1:500, but people have very different experiences with the company. Some users like the learning materials, with one person saying that "my brain was fine tuned to even greater heights thanks to the seminar brought by Vestrado." But there are also worrying reports about frozen accounts, money safety problems, and poor customer support.

The platform mainly targets forex traders and people who want to invest in different types of assets. However, you should think carefully about the mixed user reviews and do your own research before putting money with this new broker.

Important Disclaimers

Regional Entity Differences: Vestrado works from Saint Vincent and the Grenadines, but we don't have clear details about what rules they follow. You should check what regulations apply in your area before opening an account.

Review Methodology: This review looks at user feedback, market data, and public information about Vestrado's services. Since there isn't much clear regulatory information and users have mixed experiences, you should be extra careful and do your own research before trading with this broker.

Overall Rating Framework

Broker Overview

Vestrado started in the busy forex trading world in 2020. The company set up its main office in Saint Vincent and the Grenadines and tries to be a tech-focused broker that gives people access to many different financial products. Their business plan focuses on helping regular traders reach global markets through advanced trading technology, and they say they can help both new and experienced traders who want to try different types of investments.

The platform tries to stand out by offering what they call "cutting-edge technology" for traders to explore many instruments from regular forex pairs to more complex products. Vestrado wants to be more than just a trading platform - they present themselves as a complete financial services company that combines trading with learning materials and market analysis tools.

This vestrado review shows that while the broker offers standard industry features, the fact that it's new and doesn't have clear regulatory oversight creates important concerns for potential users. The company seems to target traders who want diverse portfolio strategies, especially those who want exposure to both traditional forex markets and alternative investments like commodities and futures contracts.

Regulatory Status: We don't have specific regulatory information from available sources, which is a big concern for traders who want to know about oversight and compliance standards.

Deposit and Withdrawal Methods: Available sources don't tell us about supported payment methods, how long processing takes, or what fees you might pay for deposits and withdrawals.

Minimum Deposit Requirements: We don't see specific minimum deposit amounts in available documents, which creates uncertainty for traders planning their first investment.

Bonus and Promotions: Current promotional offers and bonus structures aren't detailed in accessible information, which suggests either limited promotional activity or lack of clear marketing materials.

Tradeable Assets: Vestrado offers access to multiple asset classes including foreign exchange pairs, stock indices, individual stocks, commodities, and futures contracts. This gives traders diverse investment opportunities across global markets.

Cost Structure: The broker promotes tight spreads as a key advantage, but specific spread ranges and commission structures aren't detailed in available sources. This makes it hard to compare costs with competitors.

Leverage Options: Maximum leverage of up to 1:500 is available, which matches industry standards for offshore brokers. However, traders should know about the increased risk that comes with high leverage trading.

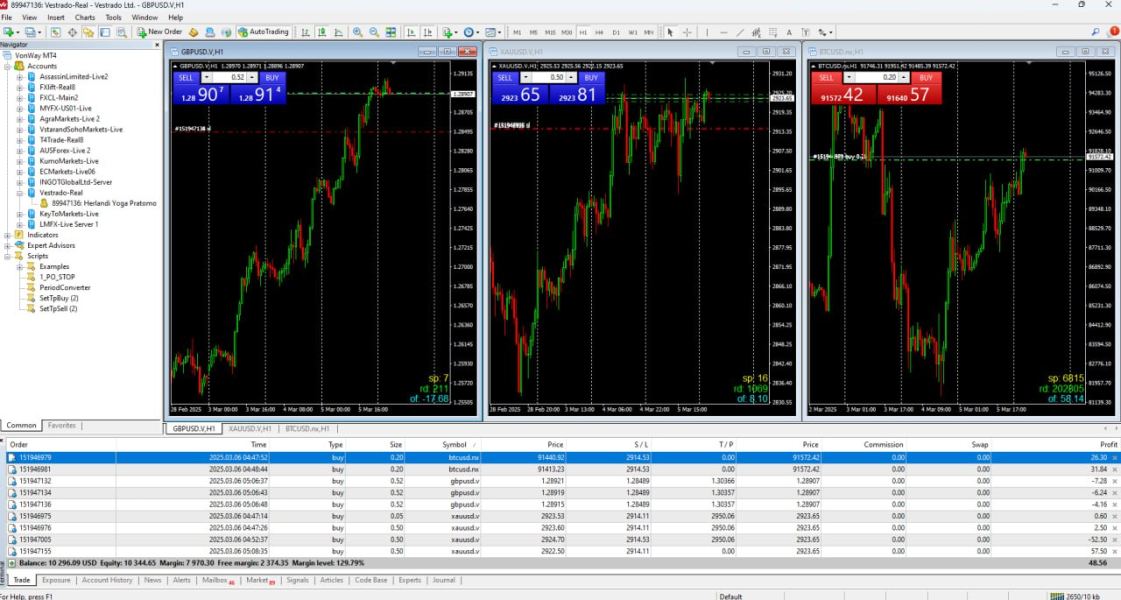

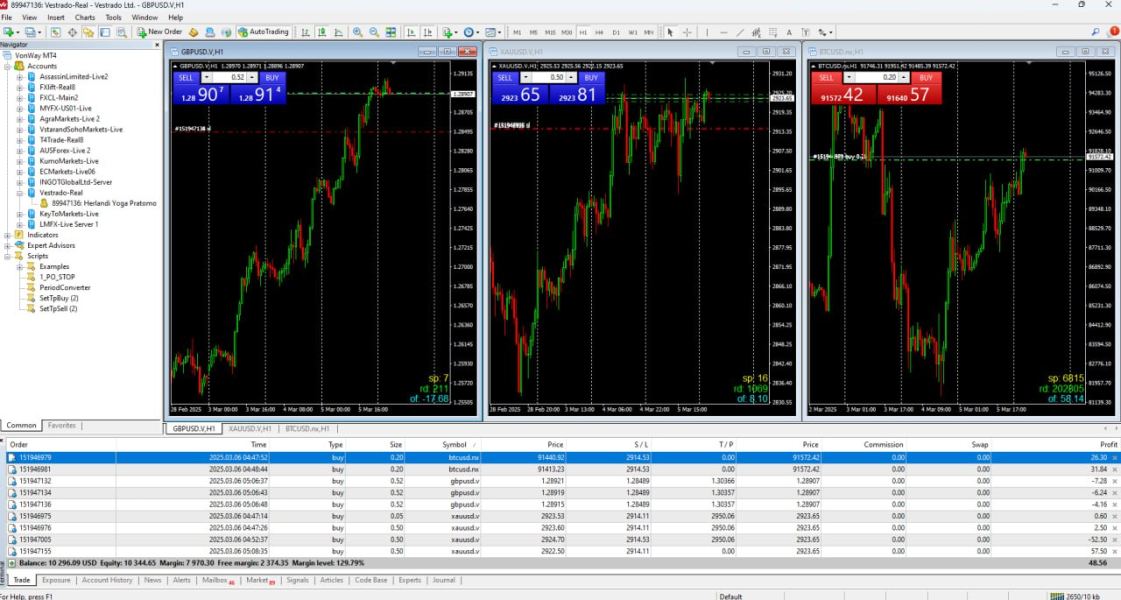

Trading Platforms: MetaTrader 4 serves as the main trading platform. This gives traders access to the widely recognized and feature-rich trading environment that many forex traders around the world prefer.

Geographic Restrictions: Specific information about restricted areas or regional limitations isn't provided in available sources.

Customer Support Languages: Available documents don't specify what languages customer service supports.

This vestrado review notes that the limited availability of specific operational details represents a transparency concern that potential traders should consider when evaluating the broker.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

Vestrado's account conditions show a mixed picture for potential traders. The lack of detailed information about specific account types is a big limitation when trying to evaluate what the broker offers. Available sources don't give clear details about different account levels, their features, or the benefits that come with higher-level accounts. This lack of transparency makes it hard for traders to understand what they can expect from their trading relationship with the broker.

The minimum deposit requirements aren't specified in available documents. This creates uncertainty for traders who are planning their first investment. The lack of clarity also extends to account opening procedures, verification requirements, and how long it takes to activate trading accounts. There's also no mention of special account types like Islamic accounts for traders who need Sharia-compliant trading conditions.

User feedback has raised concerns about account freezing issues, with some traders reporting unexpected restrictions on their accounts. These reports suggest potential problems with account management procedures or risk management policies that may not be clearly explained to traders. The absence of detailed terms and conditions in publicly available information makes it difficult to assess whether account-related policies are fair and transparent.

This vestrado review finds that the limited information about account conditions, combined with user reports of account issues, contributes to an average rating that reflects the need for greater transparency and clearer communication of account terms and conditions.

Vestrado shows strength in its trading tools and educational resources. This contributes to a relatively positive assessment in this category. The broker gives you access to MetaTrader 4, one of the most widely used and respected trading platforms in the forex industry. MT4 offers comprehensive charting capabilities, technical analysis tools, and automated trading support through Expert Advisors, giving traders professional-grade trading functionality.

The platform's educational component appears to be a notable strength. User feedback specifically highlights the value of educational seminars. One trader noted that their understanding was "fine tuned to even greater heights thanks to the seminar brought by Vestrado," which shows that the broker invests in trader education and skill development. This focus on education is particularly valuable for new traders entering the complex world of forex trading.

Vestrado's technology infrastructure supports trading across multiple asset classes. This enables traders to access forex, indices, stocks, commodities, and futures contracts from a single platform. The diversification capability allows traders to implement sophisticated portfolio strategies and take advantage of opportunities across different markets without needing multiple broker relationships.

However, available information doesn't provide detailed descriptions of proprietary research tools, market analysis resources, or advanced trading features beyond the standard MT4 offering. The absence of information about mobile trading capabilities, web-based platforms, or additional analytical tools represents a gap in the assessment of the broker's complete technological ecosystem.

Customer Service and Support Analysis (Score: 4/10)

Customer service represents a significant weakness in Vestrado's offering based on available user feedback and limited information about support infrastructure. User reports consistently highlight concerns about customer support responsiveness, with traders expressing frustration about slow response times and inadequate assistance when issues arise. This pattern of feedback suggests systematic problems with the broker's customer service operations.

The lack of detailed information about customer support channels, availability hours, and response time commitments raises additional concerns about the broker's commitment to client service. Professional forex brokers typically provide multiple contact methods including phone, email, and live chat support, along with clear service level agreements about response times and issue resolution procedures.

User feedback indicates particular problems with support quality during critical situations such as account issues or technical problems. Some traders have reported difficulty getting adequate assistance when dealing with account freezing or fund access problems, which is a serious concern for any financial services provider. The inability to receive timely and effective support during trading issues can result in significant financial losses for traders.

The absence of information about multilingual support capabilities further limits the assessment of customer service quality. Given the global nature of forex trading, professional brokers typically offer support in multiple languages to serve their international client base effectively. The lack of transparency about language support suggests potential limitations in serving diverse trader populations.

Trading Experience Analysis (Score: 6/10)

The trading experience with Vestrado presents a mixed assessment based on available user feedback and platform capabilities. The broker's use of MetaTrader 4 provides a solid foundation for trading operations, offering traders access to a proven platform with comprehensive functionality. MT4's stability, execution capabilities, and extensive feature set contribute positively to the overall trading experience for users familiar with the platform.

However, user feedback has raised concerns about specific trading execution issues that impact the overall experience. Reports of account freezing problems and fund access difficulties represent serious concerns that can significantly disrupt trading activities. These issues suggest potential problems with the broker's operational procedures or risk management systems that may not be adequately communicated to traders.

The broker's promotion of tight spreads as a competitive advantage should theoretically contribute to improved trading conditions. However, specific spread data and execution statistics aren't available for independent verification. The lack of detailed information about order execution speeds, slippage rates, and requote frequency makes it difficult to assess the actual quality of trade execution compared to industry standards.

Available information doesn't provide details about mobile trading capabilities, which represents an increasingly important component of the modern trading experience. Professional traders expect seamless access to their accounts and trading capabilities across multiple devices, and the absence of mobile platform information represents a potential limitation.

This vestrado review notes that while the MT4 platform provides a solid technical foundation, the reported operational issues and limited transparency about execution quality contribute to an average assessment of the overall trading experience.

Trustworthiness Analysis (Score: 3/10)

Trustworthiness represents the most significant concern in this Vestrado evaluation. Multiple factors contribute to a low assessment in this critical category. The absence of detailed regulatory information in available sources raises fundamental questions about oversight and compliance standards. Professional forex brokers typically operate under clear regulatory frameworks that provide trader protections and operational standards.

User feedback includes concerning reports about fund security and account management issues that directly impact trader confidence. Reports of account freezing and fund access problems represent serious red flags that suggest potential operational or policy issues that could affect trader assets. These concerns are particularly significant given the lack of clear regulatory protections that might otherwise provide recourse for affected traders.

The limited transparency about company operations, financial reporting, and regulatory compliance contributes to uncertainty about the broker's long-term stability and commitment to professional standards. Established brokers typically provide comprehensive information about their regulatory status, financial backing, and operational procedures to build trader confidence.

The broker's relatively recent establishment in 2020, combined with the operational concerns reported by users, suggests that Vestrado may still be developing the operational maturity and regulatory compliance expected of professional financial services providers. The absence of information about segregated client funds, insurance coverage, or other standard protective measures further contributes to trustworthiness concerns.

Independent verification of the broker's claims about services, execution quality, and operational standards is difficult due to limited regulatory oversight and transparency. This makes it challenging for traders to make informed decisions about the safety of their funds and trading activities.

User Experience Analysis (Score: 5/10)

The overall user experience with Vestrado reflects the mixed nature of trader feedback and the varying quality of different service aspects. While some users have reported positive experiences, particularly with educational resources, the pattern of feedback suggests inconsistent service quality that impacts overall satisfaction levels.

Positive user feedback highlights the value of educational programming, with traders appreciating the learning opportunities provided through seminars and training materials. This educational focus appears to resonate well with traders seeking to improve their market knowledge and trading skills, suggesting that Vestrado has invested meaningfully in trader development resources.

However, the user experience is significantly impacted by the operational and customer service issues reported by other traders. Account management problems, support responsiveness concerns, and fund access difficulties represent major user experience detractors that can overshadow positive aspects of the service. The inconsistency between positive educational experiences and negative operational experiences suggests uneven service quality across different aspects of the broker's operations.

The lack of detailed information about user interface design, account management tools, and self-service capabilities makes it difficult to assess the complete user experience. Modern traders expect intuitive interfaces, comprehensive account management tools, and efficient self-service options for routine transactions and account maintenance.

Common user complaints focus on account freezing issues and inadequate customer support, which represent fundamental service failures that significantly impact the trading experience. These operational problems suggest that while Vestrado may have strengths in certain areas like education, the core operational aspects of the business may require significant improvement to meet professional standards expected by serious traders.

Conclusion

This vestrado review reveals a broker with mixed performance across key evaluation criteria. While Vestrado offers some competitive features including tight spreads, high leverage up to 1:500, and valuable educational resources, significant concerns about operational reliability and customer service quality limit its overall appeal. The broker's educational programming appears to be a genuine strength, with users reporting positive learning experiences that enhance their trading knowledge.

However, the concerning pattern of user feedback regarding account freezing, fund access issues, and inadequate customer support represents serious operational deficiencies that potential traders must carefully consider. The limited regulatory transparency and absence of detailed information about key operational aspects further compound these concerns.

Vestrado may be suitable for experienced forex traders who can navigate potential operational challenges and who value the educational resources offered by the platform. However, the combination of operational concerns, limited regulatory oversight, and customer service issues makes this broker less suitable for new traders or those requiring reliable, professional-grade service standards. Potential users should conduct thorough due diligence and consider starting with minimal deposits while evaluating the broker's services firsthand.