Is CUW safe?

Pros

Cons

Is CUW Safe or Scam?

Introduction

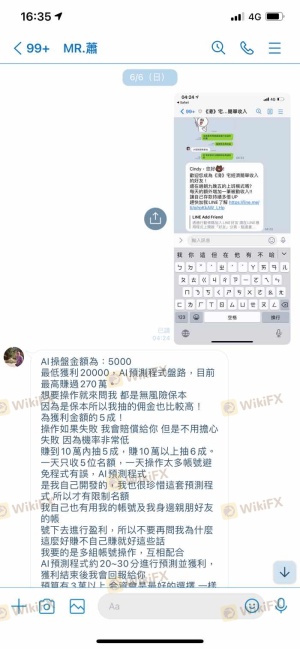

CUW is a forex broker that has garnered attention in the trading community, positioning itself as a platform offering a variety of financial products, including forex currency pairs, stocks, and cryptocurrencies. However, the rise of online trading has also brought about numerous scams and fraudulent activities, making it essential for traders to conduct thorough evaluations of brokers before committing their funds. The significance of assessing a broker's credibility cannot be overstated, as it directly impacts the safety of traders investments. In this article, we will investigate whether CUW is a safe broker or a potential scam. Our analysis is based on various sources, including regulatory information, company background, trading conditions, customer feedback, and risk assessments.

Regulation and Legitimacy

One of the most critical aspects of evaluating a forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict operational standards and protect clients' funds. Unfortunately, CUW does not appear to be regulated by any recognized financial authority, which raises significant concerns regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | No valid regulation |

The absence of regulation means that CUW operates without oversight, increasing the risk of fraudulent practices. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK and the Securities and Exchange Commission (SEC) in the US enforce strict compliance measures to protect investors. Without such oversight, traders may find it challenging to seek recourse in case of disputes or financial losses. Additionally, the lack of historical compliance records further complicates the assessment of CUW's safety. Thus, it is crucial for potential clients to approach CUW with caution given its unregulated status.

Company Background Investigation

Understanding the company behind a broker is essential for evaluating its trustworthiness. CUW's history, ownership structure, and management team play a vital role in determining its reliability. Unfortunately, detailed information regarding CUWs history and ownership is sparse, which is often a red flag in the financial services industry. A lack of transparency can indicate that the broker may not have the best interests of its clients at heart.

Moreover, the management teams background is critical in assessing the broker's credibility. A strong team with relevant experience in finance and trading can enhance a broker's reputation. However, if the team lacks experience or has a history of complaints, it may indicate potential issues with the broker's operations. Transparency in information disclosure is also vital; brokers that willingly share their operational details and team qualifications generally foster greater trust among clients. Given the limited information available about CUW, traders should exercise caution and conduct further research before engaging with this broker.

Trading Conditions Analysis

The trading conditions offered by a broker, including fees and spreads, significantly influence a trader's experience. CUW claims to provide competitive trading conditions, but without clear information on its fee structure, traders are left in the dark.

| Fee Type | CUW | Industry Average |

|---|---|---|

| Spread for Major Pairs | 0.9 - 1.0 pips | 1.0 - 1.5 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While CUW may advertise low spreads, the absence of detailed information on commissions and overnight fees may suggest hidden costs that could affect profitability. Traders often face unexpected charges, which can lead to frustration and financial losses. Furthermore, if a brokers fee structure is not transparent, it can be indicative of potential scams. Therefore, it is essential for traders to seek clarity on all costs associated with trading on the CUW platform.

Client Fund Safety

The safety of client funds is paramount when evaluating a forex broker. CUW's measures for ensuring the security of client deposits are unclear, which is a concern for potential traders. Effective fund safety practices typically include segregating client funds from the broker's operational funds, providing investor protection schemes, and implementing negative balance protection policies.

Investors should be particularly wary if a broker does not clearly outline its policies regarding fund security. The lack of information regarding CUW‘s fund segregation and protection measures raises questions about the safety of traders’ investments. Any historical issues related to fund security can further exacerbate concerns and should be investigated thoroughly by potential clients. In light of these uncertainties, it is crucial for traders to consider whether they are willing to risk their capital with a broker that lacks transparency in fund safety measures.

Customer Experience and Complaints

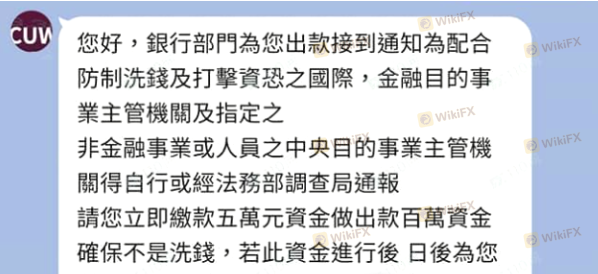

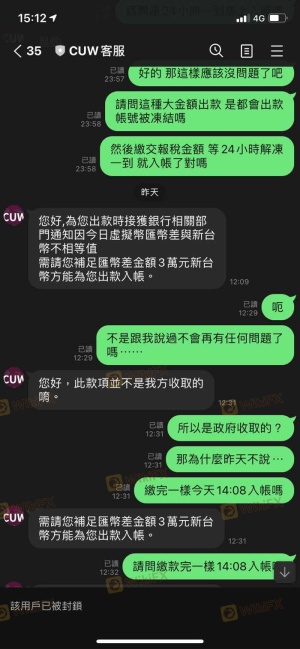

Customer feedback is an invaluable resource for assessing a broker's reliability. Analyzing reviews and complaints can reveal patterns that may indicate systemic issues within a broker's operations. For CUW, several users have reported difficulties in withdrawing funds, which is a common complaint associated with potentially fraudulent brokers.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | Medium | Average |

These complaints are alarming and suggest that CUW may not prioritize customer service or transparency. The quality of a broker's response to complaints is also telling; a broker that addresses issues promptly and effectively is more likely to be trustworthy. In CUW's case, the reported poor response to complaints raises red flags about its operations. Potential clients should consider these factors seriously before choosing to trade with CUW.

Platform and Trade Execution

The performance of a trading platform is crucial for a successful trading experience. Traders expect a stable, user-friendly interface with reliable order execution. However, there are concerns regarding CUWs platform stability and execution quality. Reports of slippage and order rejections have surfaced, which can significantly impact trading outcomes.

Traders should be cautious of platforms that exhibit signs of manipulation or poor execution quality, as these can lead to substantial financial losses. A broker that fails to provide a reliable trading environment may not be acting in the best interests of its clients. Therefore, it is essential for potential traders to gather detailed information about CUWs platform performance before making any commitments.

Risk Assessment

Using CUW for trading involves various risks that potential clients should be aware of. The absence of regulation, coupled with a lack of transparency in operations and customer complaints, suggests a higher risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Financial Transparency | High | Lack of information |

| Customer Service | Medium | Poor complaint responses |

To mitigate risks associated with trading with CUW, traders should conduct extensive research, avoid investing large sums until they are confident in the brokers legitimacy, and consider using alternative brokers with established reputations.

Conclusion and Recommendations

In conclusion, the investigation into CUW raises significant concerns regarding its safety and legitimacy. The lack of regulation, transparency issues, and numerous customer complaints suggest that traders should be cautious when considering this broker. There are clear indications of potential scams, particularly in the areas of fund security and customer service.

For traders seeking reliable options, it is advisable to consider brokers that are well-regulated and have a proven track record of positive customer experiences. Some reputable alternatives include brokers regulated by top-tier authorities, such as the FCA or ASIC, which provide a safer trading environment. In summary, while CUW may present itself as a viable trading option, the risks associated with it warrant serious consideration and caution.

Is CUW a scam, or is it legit?

The latest exposure and evaluation content of CUW brokers.

CUW Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CUW latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.