Is Center focus safe?

Pros

Cons

Is Center Focus Safe or a Scam?

Introduction

Center Focus, officially known as Center Focus Guide Global Limited, positions itself as a forex broker offering a range of financial products, including forex and cryptocurrencies. As the forex market continues to grow, so does the number of brokers vying for traders' attention. However, this influx has also led to an increase in fraudulent schemes, making it imperative for traders to conduct thorough due diligence before committing their funds. In this article, we will explore whether Center Focus is a safe trading option or a potential scam. Our investigation is based on a comprehensive review of various online sources, including regulatory information, customer feedback, and trading conditions, allowing us to provide a balanced assessment of this broker's legitimacy.

Regulation and Legitimacy

One of the primary indicators of a broker's trustworthiness is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict operational standards. Unfortunately, Center Focus operates without any regulatory oversight, which significantly raises the risk for potential investors. Below is a summary of the regulatory information related to Center Focus:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation is alarming, as it leaves traders without any recourse should issues arise. Regulatory bodies like the FCA, ASIC, or CySEC enforce stringent rules that protect traders' interests, including fund segregation and negative balance protection. Without such oversight, traders are exposed to potential fraud and mismanagement of funds.

Company Background Investigation

Center Focus was established in 2021 and claims to be based in China. However, there is a significant lack of transparency regarding its operational history and ownership structure. The company's website does not provide a physical address or detailed information about its management team, which raises concerns about its legitimacy. A reputable broker typically offers clear information about its founders and management, showcasing their professional backgrounds and experience in the financial sector.

Moreover, the company's anonymous nature and broken website further contribute to doubts about its credibility. A transparent broker should maintain an informative and accessible online presence, allowing potential clients to verify its legitimacy. The lack of such transparency is a red flag that traders should not ignore when assessing whether Center Focus is safe.

Trading Conditions Analysis

Understanding a broker's trading conditions is crucial for evaluating its overall reliability. Center Focus claims to offer competitive trading fees; however, the lack of transparency regarding its fee structure raises concerns. Below is a comparison of Center Focus's trading costs against industry averages:

| Fee Type | Center Focus | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | TBD | 1.0 pips |

| Commission Model | TBD | $5 per lot |

| Overnight Interest Rates | TBD | Varies |

The absence of specific fee information makes it difficult for traders to assess the true cost of trading with Center Focus. Furthermore, unregulated brokers often employ hidden charges that can significantly impact profitability. Traders should be wary of any broker that does not provide clear and upfront information about its fees, as this can indicate a lack of integrity.

Client Fund Security

The safety of client funds is a paramount concern for any trader. Unfortunately, Center Focus does not seem to prioritize fund security. There is no information available regarding fund segregation, investor protection, or negative balance protection policies. Without these safeguards, traders risk losing their entire investment if the broker encounters financial difficulties.

Additionally, the absence of a compensation fund is concerning. Regulatory bodies typically require brokers to participate in compensation schemes that protect traders in the event of broker insolvency. The lack of such measures at Center Focus raises serious questions about the safety of client funds and whether investors can trust this broker with their capital.

Client Experience and Complaints

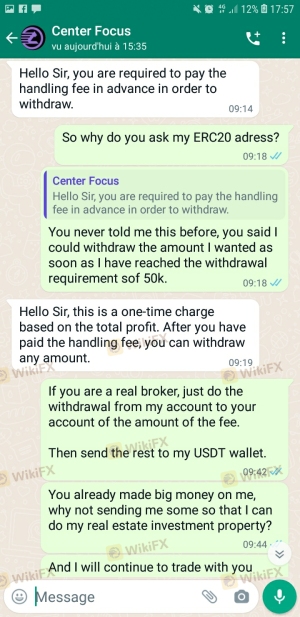

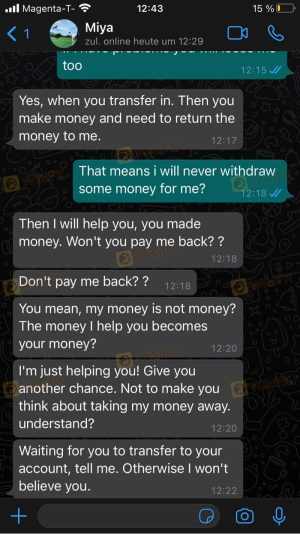

Customer feedback is a valuable tool for assessing a broker's reliability. Unfortunately, reports about Center Focus indicate numerous complaints regarding withdrawal issues and poor customer service. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Poor Customer Support | Medium | Inconsistent |

| Account Blocking | High | Non-responsive |

Traders have reported difficulties in withdrawing their funds, with some claiming that their accounts were blocked without clear explanations. Such patterns of complaints are significant warning signs that potential clients should consider when determining if Center Focus is safe.

Platform and Execution

The trading platform is another critical aspect of a broker's offering. Center Focus claims to provide access to the MetaTrader 5 (MT5) platform, a widely respected trading software. However, the absence of user reviews and feedback raises concerns about the platform's reliability and execution quality.

Issues such as slippage, requotes, and order rejections can significantly impact a trader's performance. Without transparent information and user feedback, it is challenging to ascertain whether Center Focus maintains a stable and efficient trading environment.

Risk Assessment

Using Center Focus poses several risks that potential traders should be aware of. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Risk | High | Lack of fund protection and transparency. |

| Operational Risk | Medium | Reports of withdrawal issues and poor service. |

To mitigate these risks, traders should consider using regulated brokers with a proven track record of reliability. Conducting thorough research and starting with a demo account can also help traders gauge a broker's performance before committing significant funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that Center Focus raises numerous red flags regarding its legitimacy and safety. The lack of regulation, transparency, and poor customer feedback strongly indicates that traders should exercise caution when considering this broker.

For those looking to trade forex, it is advisable to opt for well-regulated brokers that prioritize security and customer service. Some reputable alternatives include brokers regulated by top-tier authorities such as the FCA or ASIC. These brokers not only offer a secure trading environment but also provide comprehensive support and transparent fee structures.

Ultimately, the question "Is Center Focus safe?" leans heavily towards a negative response. Traders are encouraged to prioritize their safety and conduct thorough research before engaging with any broker, especially one that exhibits the concerning traits associated with Center Focus.

Is Center focus a scam, or is it legit?

The latest exposure and evaluation content of Center focus brokers.

Center focus Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Center focus latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.