Center Focus 2025 Review: Everything You Need to Know

Executive Summary

This Center Focus review gives you a complete look at a new company in financial services. Center Focus started in 2022 and has its main office in Toronto, Canada. The company is privately owned and focuses on risk management, insurance, commercial insurance solutions, and brokerage services. It has a small team of 2-10 employees, making it a new player in the competitive brokerage world.

The company works on risk management and professional insurance solutions. This business model might interest traders who want specialized services from newer companies. However, our review shows major gaps in information about traditional forex trading services, regulatory oversight, and client feedback. These gaps make it hard to fully judge their trading abilities.

We don't have enough public information about their trading platforms, regulatory status, and client experiences. Because of this, our review stays neutral while pointing out that potential clients need to do careful research before using this new brokerage service.

Important Notice

We have limited detailed regulatory and operational information from public sources. This review uses available company data and industry analysis. Potential clients should know that we could not find complete information about specific trading conditions, regulatory compliance, and client protection measures during our research.

Users thinking about Center Focus should check regulatory status, trading conditions, and service availability in their own areas on their own. Our evaluation method recognizes these information limits while giving analysis based on available company background and industry context.

Rating Framework

Broker Overview

Center Focus started in the financial services sector in 2022. The company set up its headquarters in Toronto, Canada. According to available company information, it operates as a privately held business with a focused team of 2-10 employees.

The company's main business model centers on risk management, insurance services, commercial insurance solutions, and brokerage operations. This suggests a complete approach to financial risk reduction. The company's specialization areas show a professional focus on providing insurance-based solutions and brokerage services to commercial clients.

Center Focus has over 30 years of combined team experience. The organization positions itself as an experienced provider despite starting recently. The company emphasizes delivering knowledgeable and responsible insurance solutions through what they describe as a personal approach to client service.

However, specific information about forex trading platforms, asset classes, and regulatory oversight was not detailed in available company documentation. The absence of clear regulatory information and traditional trading service descriptions suggests potential clients should ask the company directly about their specific trading service offerings and compliance framework.

Regulatory Status

Available company information does not specify regulatory oversight from recognized financial authorities. Potential clients should check regulatory compliance and licensing status on their own before using services.

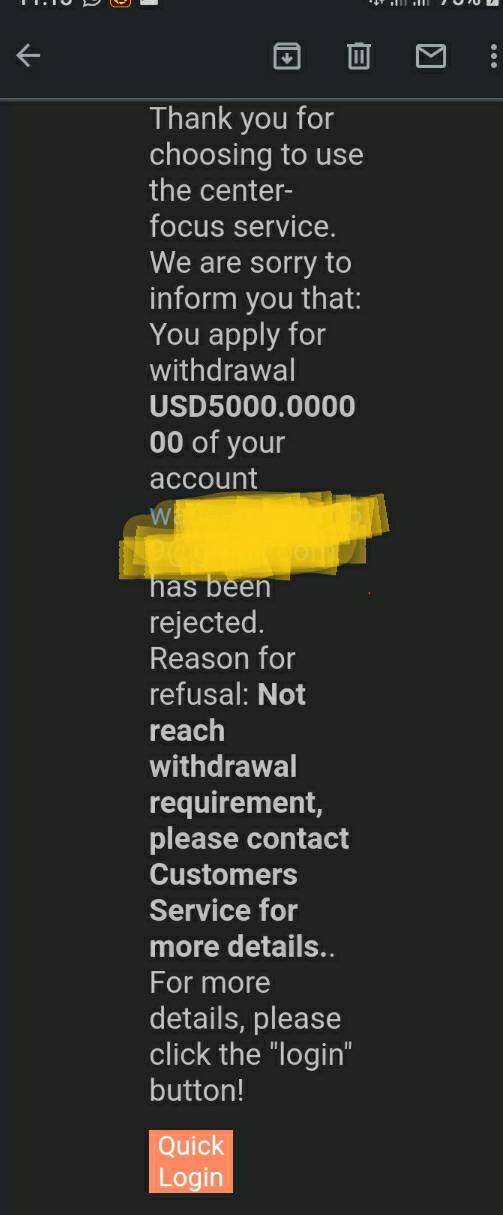

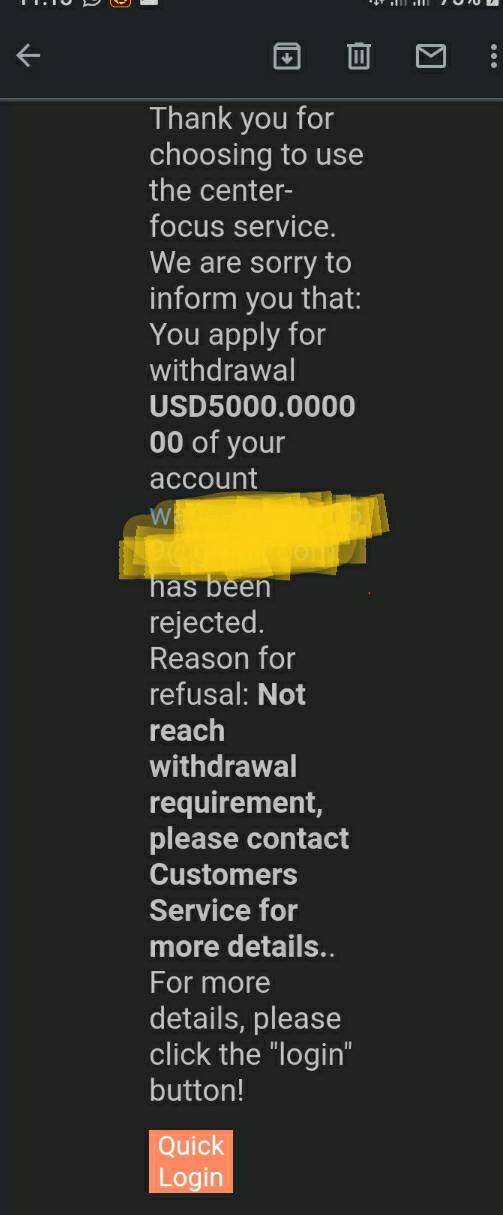

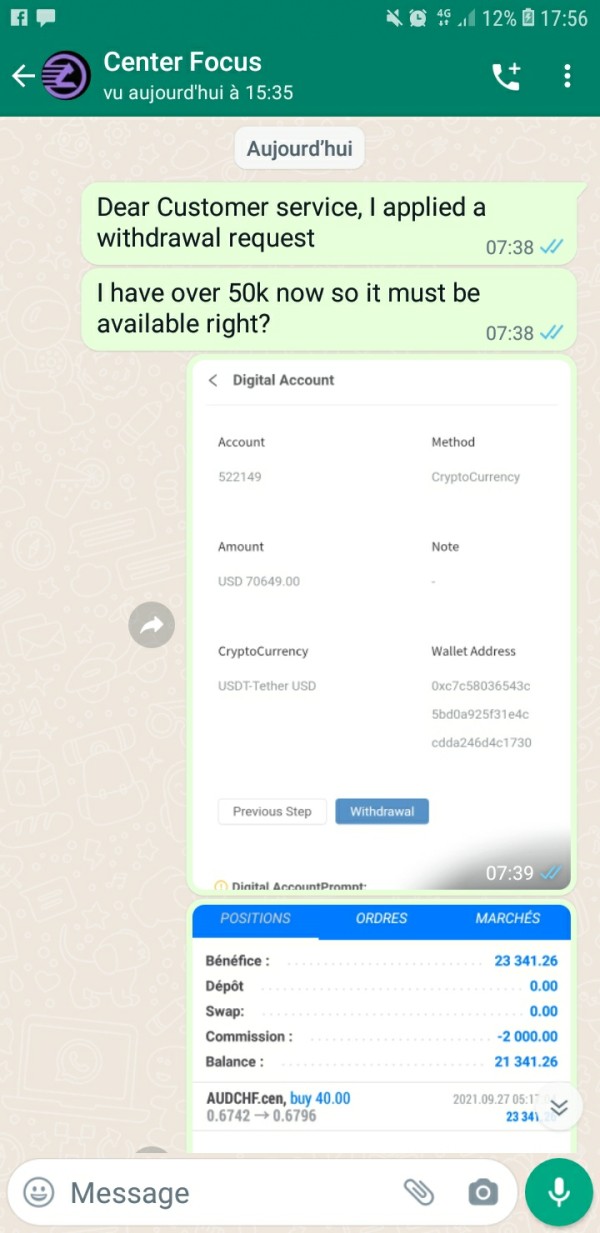

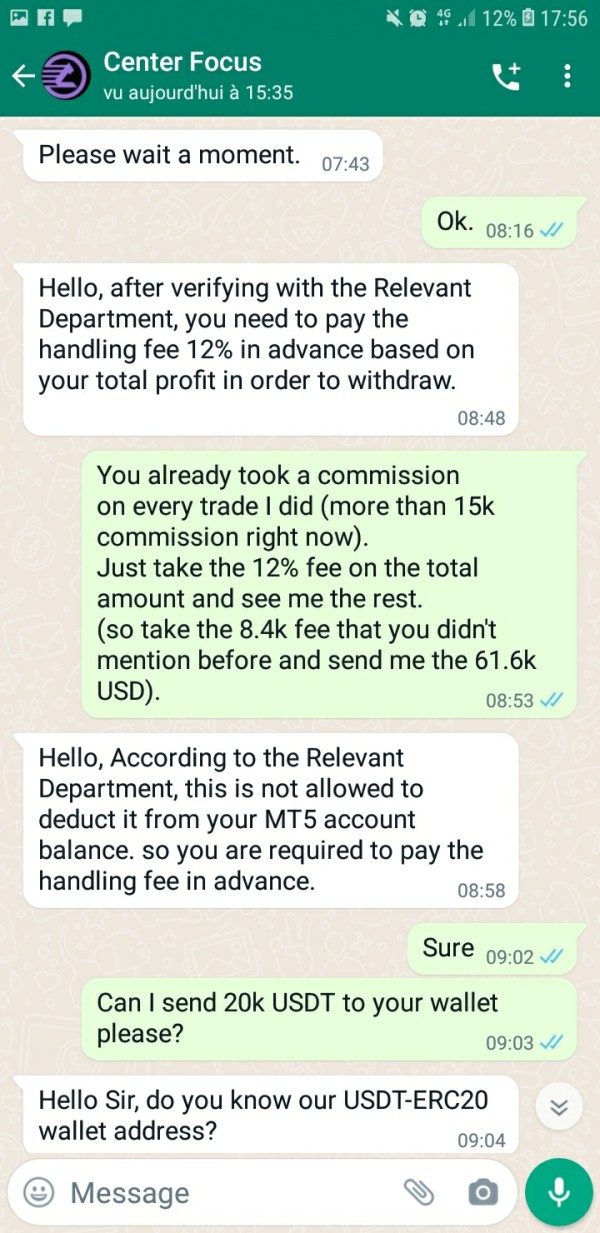

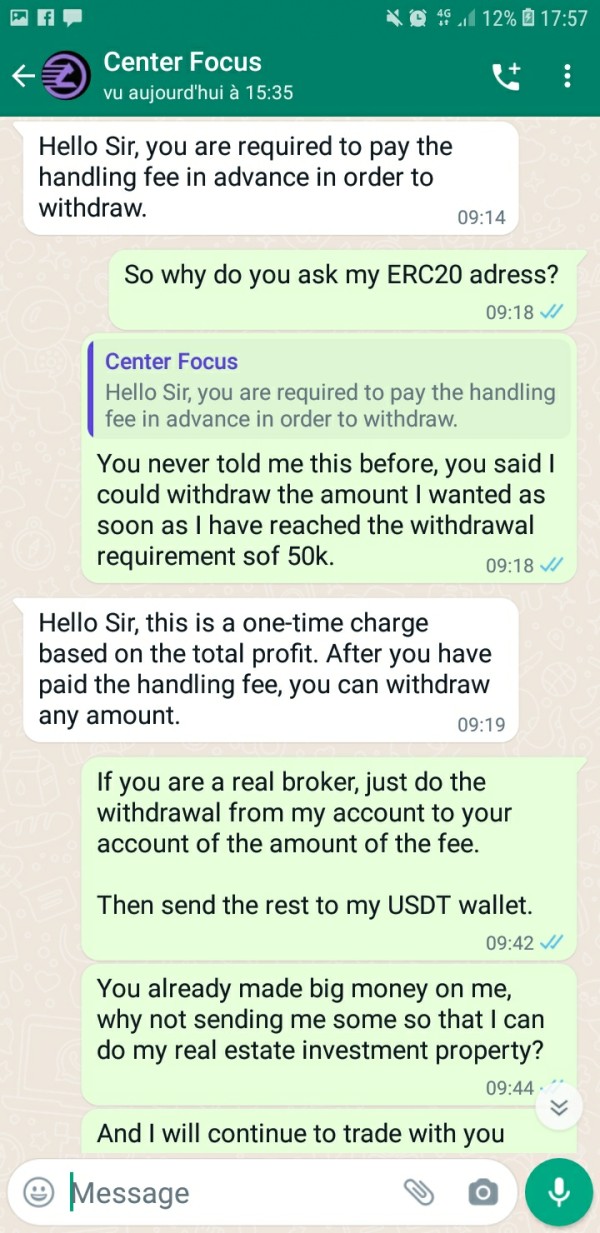

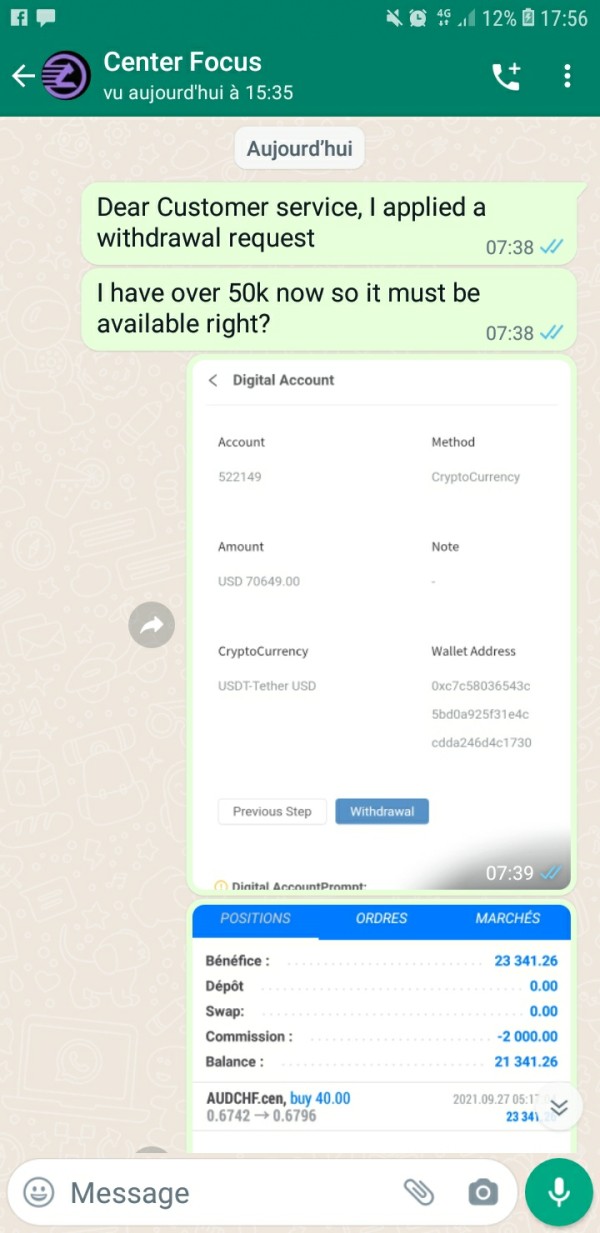

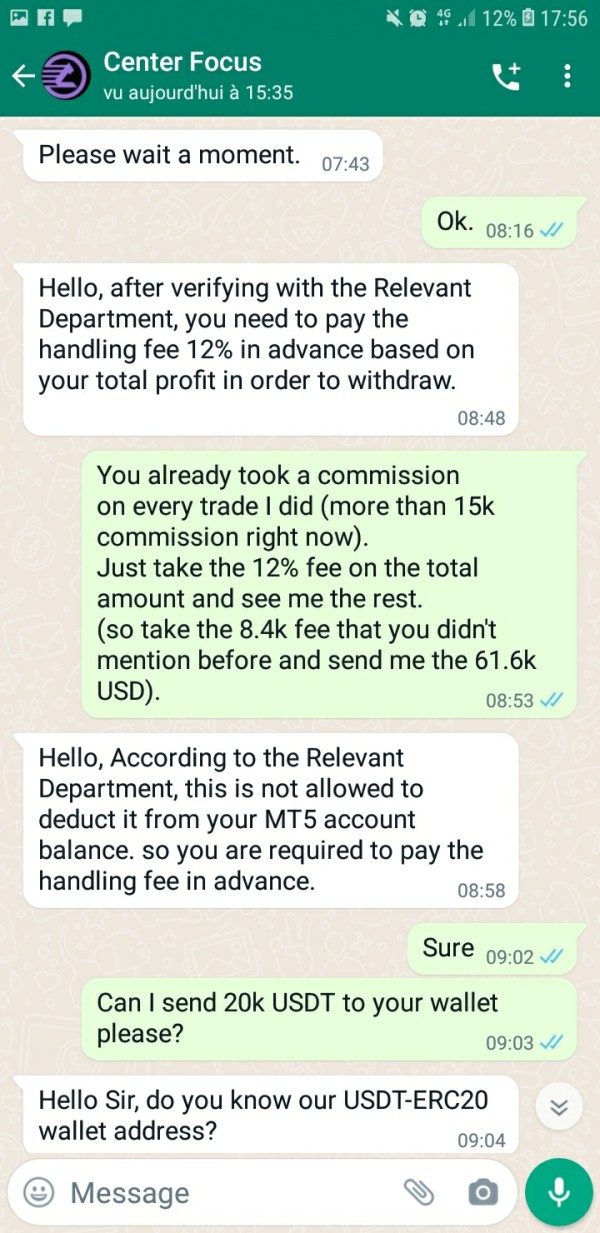

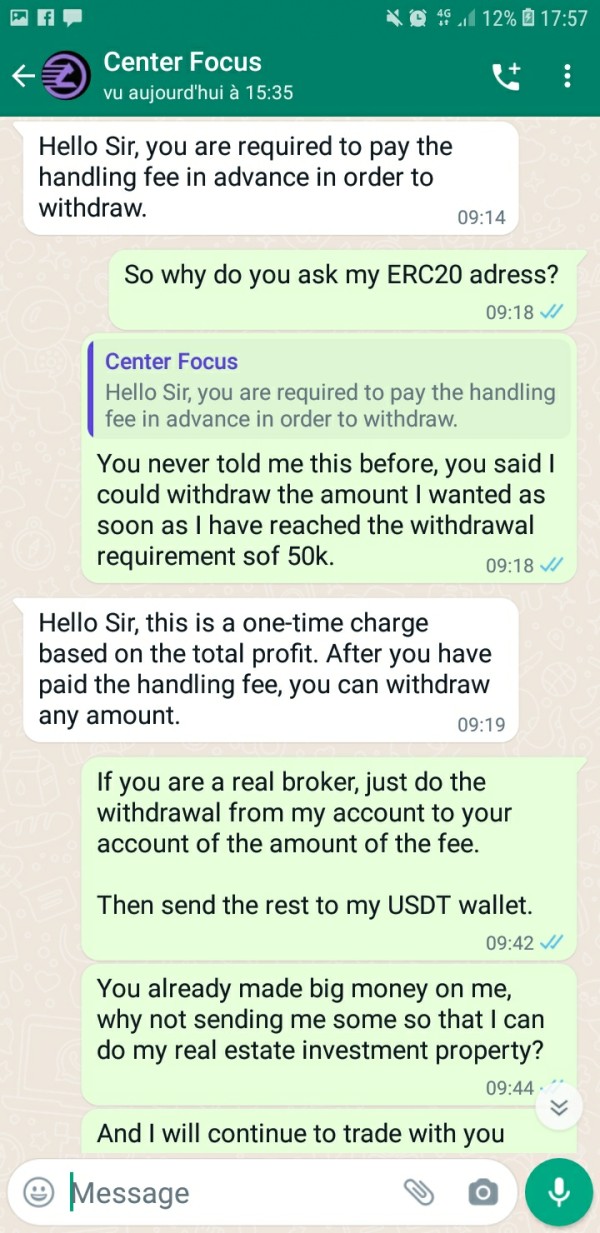

Deposit and Withdrawal Methods

Specific information about funding methods, processing times, and fees was not available in accessible company documentation.

Minimum Deposit Requirements

Minimum funding requirements for account opening were not detailed in available sources. This means you need to ask the company directly.

Current bonus structures, promotional campaigns, or incentive programs were not documented in accessible company materials.

Trading Assets

The range of tradeable instruments was not specified in available information. This includes forex pairs, commodities, indices, or other financial products.

Cost Structure

Details about spreads, commissions, overnight fees, and other trading costs were not available in public company documentation.

Leverage Options

Maximum leverage ratios and margin requirements were not detailed in accessible sources.

Information about trading platforms was not available in company materials. This includes whether they use proprietary or third-party solutions like MetaTrader.

Geographic Restrictions

Service availability by region and any jurisdictional limitations were not specified in available documentation.

Customer Support Languages

Supported languages for client communication were not detailed in accessible company information.

This Center Focus review acknowledges these information gaps. We emphasize the importance of direct verification with the company for specific trading requirements.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Center Focus's account conditions faces big limitations. This is due to the absence of detailed information in publicly available sources. Traditional account metrics such as account types, minimum deposit requirements, and specific trading conditions remain undocumented in accessible company materials.

We cannot find clear documentation of account tiers, Islamic account availability, or specialized trading conditions. Potential clients cannot properly assess whether the company's offerings match their trading requirements. The lack of transparent account information represents a major concern for traders seeking complete service comparisons.

The company's focus on risk management and insurance services suggests a potentially different approach to client accounts. This differs from traditional forex brokers. However, without specific details about account opening procedures, verification requirements, or account management features, this Center Focus review cannot provide clear guidance on account suitability.

Industry standards typically require clear disclosure of account conditions, minimum funding requirements, and available account types. The absence of such information in accessible sources highlights the need for direct communication with the company to get essential account details.

Assessment of Center Focus's trading tools and resources proves challenging. This is due to limited information availability in public sources. Traditional trading tools such as charting software, technical indicators, economic calendars, and automated trading support were not detailed in accessible company documentation.

Educational resources serve as crucial components for trader development. These were not specified in available materials. The absence of information about market analysis, research reports, or educational content limits our ability to evaluate the company's commitment to client education and market insight provision.

Risk management tools were mentioned as a company specialty. However, they were not detailed in terms of specific trading applications or client-facing features. Without documentation of available trading platforms or analytical capabilities, potential clients cannot assess the technological infrastructure supporting their trading activities.

The company's emphasis on professional service delivery suggests potential strength in client support. But specific tools and resources remain undocumented in accessible sources. This information gap represents a major limitation for traders evaluating platform capabilities and available trading support systems.

Customer Service and Support Analysis

Center Focus's customer service evaluation is limited by little publicly available information. This includes support channels, response times, and service quality metrics. The company emphasizes providing "reliable customer service and expertise through a personal approach." This suggests a commitment to client support quality.

With a small team structure of 2-10 employees, the company may offer more personalized service compared to larger institutions. However, this size may also raise questions about support availability. This is particularly true during peak trading hours or crisis situations requiring immediate assistance.

We cannot find detailed information about support channels. This includes live chat, phone support, email response times, or multilingual capabilities. This prevents complete service assessment. Industry standards typically require 24/5 or 24/7 support for active trading environments, but Center Focus's support hours and availability remain undocumented.

Without accessible client feedback or testimonials, this review cannot provide insight into actual service quality. We also cannot assess problem resolution effectiveness or client satisfaction levels. The lack of transparent support information represents a major consideration for traders requiring reliable assistance during their trading activities.

Trading Experience Analysis

The trading experience evaluation for Center Focus encounters substantial limitations. This is due to insufficient information about platform performance, execution quality, and user interface design. Without access to platform specifications, order execution speeds, or slippage data, complete trading experience assessment proves impossible.

Platform stability and reliability metrics are crucial for successful trading operations. These were not documented in available sources. The absence of information about mobile trading capabilities, platform uptime statistics, or technical performance indicators limits our ability to evaluate the actual trading environment quality.

Order execution quality remains undocumented in accessible company materials. This includes fill rates, requote frequency, and execution speeds. These factors significantly impact trading success and represent essential considerations for platform evaluation.

The company's focus on professional service delivery suggests potential attention to trading experience quality. But without specific platform information or user feedback, this Center Focus review cannot provide clear assessment of the actual trading environment. Potential clients should seek direct platform demonstrations or trial access to evaluate trading experience suitability.

Trust and Security Analysis

Trust and security assessment for Center Focus faces major challenges. This is due to limited regulatory information in publicly available sources. The absence of clear regulatory oversight documentation raises important questions about client protection measures and compliance frameworks.

Center Focus was established in 2022. The company's relatively recent formation means limited operational history for trust assessment. While the team claims over 30 years of combined experience, the company itself lacks the operational track record that typically supports trust evaluation in the financial services sector.

Client fund protection measures were not detailed in accessible company information. This includes segregated account policies, deposit insurance, or regulatory compensation schemes. These protections represent fundamental security considerations for client fund safety and regulatory compliance.

The company's focus on risk management suggests awareness of security considerations. But specific implementation of client protection measures remains undocumented. Without clear regulatory status or detailed security protocols, potential clients face uncertainty about fund safety and dispute resolution mechanisms.

User Experience Analysis

User experience evaluation for Center Focus is significantly limited. This is due to the absence of accessible client feedback, satisfaction surveys, or user testimonials. Without direct user input, assessment of overall satisfaction levels and common user experiences proves impossible.

Interface design quality, registration process efficiency, and account management ease remain undocumented in available sources. These factors significantly impact daily trading activities and overall client satisfaction with brokerage services.

The company's emphasis on personal approach and professional service suggests attention to user experience quality. However, without specific examples of user interaction design or client journey optimization, this review cannot provide concrete assessment of user experience effectiveness.

Common user complaints, service improvement areas, or satisfaction metrics were not available in accessible company documentation. This information gap prevents complete understanding of actual client experiences and limits our ability to provide user experience guidance for potential clients.

Conclusion

This Center Focus review concludes with a neutral assessment. This is due to major information limitations about essential trading services and regulatory compliance. While the company demonstrates professional positioning in risk management and insurance services, the absence of detailed trading conditions, regulatory oversight, and client feedback prevents complete evaluation.

The company may appeal to traders interested in emerging brokerage services. It might also attract those seeking personalized attention from smaller service providers. However, the lack of transparent information about trading platforms, regulatory protection, and client experiences represents substantial considerations for potential clients.

Primary limitations include absent regulatory documentation, undisclosed trading conditions, and lack of accessible client feedback. These factors suggest that thorough due diligence and direct communication with the company are essential before considering their services for trading activities.