Is AURO MARKETS safe?

Software Index

License

Is Auro Markets Safe or Scam?

Introduction

Auro Markets is an online brokerage that positions itself as a global provider of trading services in the forex market. As with any financial service, potential traders must exercise caution and rigorously evaluate brokers before committing their funds. The forex market is rife with both legitimate and fraudulent entities, making it crucial for investors to discern which brokers can be trusted. This article aims to provide an objective analysis of Auro Markets, utilizing various sources and a structured framework to assess its legitimacy and safety.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety. Auro Markets operates without any valid licenses from recognized financial authorities, raising significant red flags. The absence of regulation means that there is no oversight to ensure fair trading practices, which can expose investors to considerable risks.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of regulatory oversight is alarming, as it suggests that Auro Markets may engage in practices that are not compliant with industry standards. Legitimate brokers are typically required to adhere to strict regulations, which include maintaining client fund segregation and participating in compensation schemes to protect traders' investments. Auro Markets' unregulated status should raise concerns for anyone considering investing with them.

Company Background Investigation

Auro Markets claims to be a reputable online trading platform, but a deeper investigation into its background reveals a lack of transparency. The companys ownership structure is unclear, and there is little information available about its management team. This lack of clarity can be indicative of potential fraudulent activity, as reputable brokers usually provide detailed information about their executives and their qualifications.

The absence of a verifiable physical address further complicates the picture. Many fraudulent brokers operate anonymously, and Auro Markets appears to follow this pattern. The lack of transparency and information disclosure is a significant concern for potential investors, as it prevents them from making informed decisions about the safety of their funds.

Trading Conditions Analysis

When evaluating the safety of a broker, understanding their fee structure and trading conditions is essential. Auro Markets has a complex fee model that may not be immediately clear to new traders. Reports indicate that they may impose hidden fees that can significantly impact profitability.

| Fee Type | Auro Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Model | Variable | Fixed |

| Overnight Interest Range | Unclear | Transparent |

The potential for hidden fees and unclear commission structures raises questions about the broker's integrity. Traders should be wary of brokers that do not disclose their fees upfront, as this can lead to unexpected costs that diminish returns. Evaluating the overall cost of trading with Auro Markets is essential for understanding whether it is a safe choice for trading.

Client Fund Safety

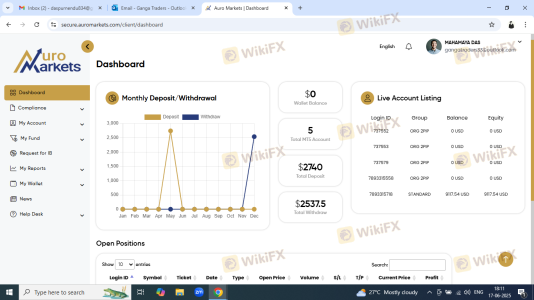

The safety of client funds is paramount when selecting a broker. Auro Markets lacks clear information about its fund safety measures. Without proper regulation, there is no guarantee that client funds are protected or segregated from the company's operational funds. This poses a significant risk, especially in the event of the broker's insolvency or fraudulent practices.

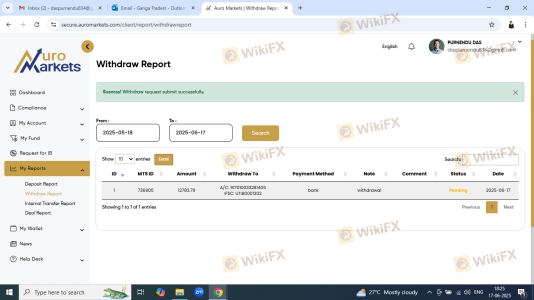

Additionally, there are no known policies regarding negative balance protection, which can leave traders vulnerable to losing more than their initial investment. Historical issues related to fund security, such as delayed withdrawals and unresponsive customer service, further exacerbate concerns about the safety of funds held with Auro Markets.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. Unfortunately, many reviews regarding Auro Markets are overwhelmingly negative. Users frequently report issues such as difficulties in withdrawing funds, aggressive sales tactics, and lack of customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| High-Pressure Sales | Medium | Poor |

| Customer Support Issues | High | Poor |

For instance, numerous clients have claimed that their accounts were blocked or funds were withheld without explanation. These patterns of complaints are consistent with those typically seen in fraudulent schemes, leading many to question: Is Auro Markets safe? The prevailing sentiment among users suggests that it is not.

Platform and Trade Execution

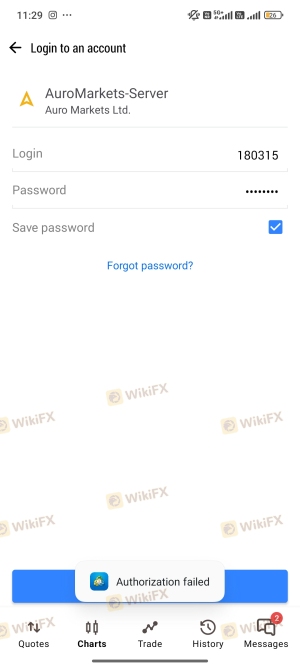

The trading platform's performance is another critical aspect to consider. Auro Markets' platform has been described as outdated and prone to technical issues. Users have reported instances of slippage and order rejections, which can significantly affect trading outcomes.

The quality of order execution is crucial for traders, as any delays or inaccuracies can lead to financial losses. If Auro Markets exhibits signs of platform manipulation or consistently poor execution quality, it raises further doubts about its legitimacy and safety.

Risk Assessment

Engaging with Auro Markets presents multiple risks that potential traders should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status exposes funds to high risk. |

| Financial Risk | High | Potential for hidden fees and losses. |

| Operational Risk | Medium | Platform issues and withdrawal difficulties. |

To mitigate these risks, it is advisable for traders to conduct thorough research before engaging with Auro Markets. Seeking regulated alternatives with transparent practices can help protect investments.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Auro Markets is not a safe option for trading. The lack of regulation, transparency, and numerous complaints from users indicate that it may operate more like a scam than a legitimate broker.

For traders looking to invest their funds, it is crucial to prioritize safety and choose brokers that are regulated and have a proven track record of reliability. Alternatives such as well-established brokers with transparent practices should be considered. Always perform due diligence and be cautious of any broker that raises red flags regarding its legitimacy.

Is AURO MARKETS a scam, or is it legit?

The latest exposure and evaluation content of AURO MARKETS brokers.

AURO MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AURO MARKETS latest industry rating score is 1.81, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.81 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.