Is BarindexFX safe?

Business

License

Is BarindexFX A Scam?

Introduction

BarindexFX is a forex broker that has recently attracted attention in the trading community. Operating under the domain barindexfx.com, it positions itself as an online investment platform offering various financial instruments to traders looking to expand their portfolios. However, as with any financial service provider, it is crucial for traders to carefully evaluate the credibility and reliability of BarindexFX before committing their funds. The forex market is notorious for the presence of unregulated and potentially fraudulent brokers, making due diligence essential for protecting investors' interests.

This article aims to provide a comprehensive analysis of BarindexFX by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The evaluation is based on a review of multiple sources, including user testimonials, regulatory information, and expert analyses. By synthesizing these insights, we aim to answer the pressing question: Is BarindexFX a safe trading platform or a scam?

Regulation and Legitimacy

When it comes to forex trading, regulation is a critical factor that determines a broker's legitimacy. Regulated brokers are subject to strict oversight by financial authorities, which helps to protect investors' funds and ensure transparency in operations. Unfortunately, BarindexFX operates as an unregulated broker, which raises significant concerns regarding its credibility.

Regulatory Information

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulatory oversight means that BarindexFX does not adhere to the stringent operational standards that regulated brokers are required to follow. This lack of regulation increases the risk of potential fraud, as there are no legal protections in place to safeguard investors' funds. Furthermore, BarindexFX claims to be registered in the Comoros and lists an address in South Africa; however, investigations have revealed no matching records with the relevant regulatory bodies, such as the Mwali International Services Authority (MISA) or the Financial Sector Conduct Authority (FSCA). This discrepancy further supports the assertion that BarindexFX may not be operating within legal frameworks.

Company Background Investigation

Understanding a broker's company background is essential in assessing its reliability. BarindexFX is operated by Barindex Wealth (Pty) Ltd, which raises questions about its ownership structure and management team. Information regarding the company's history and development is limited, and there are no comprehensive details about the individuals behind BarindexFX. This lack of transparency is concerning, as reputable brokers typically provide clear information about their management, experience, and operational history.

Moreover, potential investors should be wary of the absence of verifiable information about the firm's physical office location. The listed address appears to be either fictitious or unverifiable, which is a common tactic employed by fraudulent brokers to evade accountability. The overall opacity surrounding BarindexFX's operations and management team contributes to the skepticism regarding its legitimacy.

Trading Conditions Analysis

A broker's trading conditions can significantly impact a trader's experience and profitability. BarindexFX presents itself as a competitive platform; however, the details surrounding its fee structure and trading conditions warrant careful examination.

Fee Structure Comparison

| Fee Type | BarindexFX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | High | Moderate |

| Commission Model | Unclear | Varies |

| Overnight Interest Range | High | Moderate |

BarindexFX's fee structure appears to be less favorable compared to industry standards. Reports indicate that traders have encountered high spreads on major currency pairs, which can erode potential profits. Additionally, the commission model is not clearly defined, leading to confusion among users regarding their trading costs. This lack of clarity raises red flags, as reputable brokers typically provide transparent and straightforward fee structures.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. BarindexFX's unregulated status raises significant questions about its measures for safeguarding investors' money.

Investors should be aware that BarindexFX does not appear to implement segregated accounts for client funds, which is a standard practice among regulated brokers. Segregation ensures that clients' funds are kept separate from the broker's operational funds, providing an additional layer of security in the event of insolvency. Furthermore, there is no indication that BarindexFX offers any form of investor protection or negative balance protection, which further exacerbates the risks associated with trading on this platform.

Historically, unregulated brokers like BarindexFX have faced numerous allegations of mishandling funds and failing to honor withdrawal requests. This pattern of behavior is concerning and indicates a lack of accountability.

Customer Experience and Complaints

Customer feedback serves as a valuable indicator of a broker's reliability and service quality. In the case of BarindexFX, user experiences have been overwhelmingly negative, with many traders reporting issues related to withdrawals and customer support.

Common Complaint Types

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Customer Support | High | Poor |

| Misleading Marketing Tactics | Medium | None |

Traders have frequently reported inability to withdraw funds, with many experiencing unexplained delays and unreasonable demands for additional payments before withdrawals can be processed. Additionally, there are numerous complaints regarding the lack of responsive customer support, with users indicating that their inquiries often go unanswered.

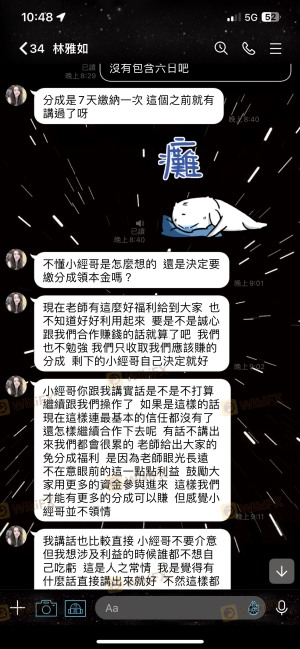

For instance, one user reported that after successfully withdrawing funds for three days, their subsequent withdrawal requests were denied, leading to frustration and confusion. This pattern of complaints raises serious concerns about BarindexFX's operational integrity and its commitment to customer service.

Platform and Trade Execution

The performance and reliability of a trading platform are critical factors that influence a trader's success. BarindexFX's platform has been scrutinized for its stability and execution quality.

Traders have reported experiencing slippage and instances of order rejections, which can significantly impact trading outcomes. Such issues are particularly alarming, as they suggest potential manipulation or operational inefficiencies within the platform. A reliable trading environment should ensure timely execution and minimal slippage, yet BarindexFX appears to fall short in these areas.

Risk Assessment

Using BarindexFX comes with inherent risks that potential traders should carefully consider.

Risk Summary

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Safety Risk | High | No fund segregation or protection. |

| Customer Support Risk | Medium | Poor response to customer inquiries. |

Given the high regulatory and fund safety risks, it is advisable for traders to approach BarindexFX with extreme caution. Engaging with an unregulated broker significantly increases the likelihood of facing issues related to fund recovery and operational transparency.

Conclusion and Recommendations

In conclusion, the evidence overwhelmingly suggests that BarindexFX operates as an unregulated broker with multiple red flags indicating potential fraudulent practices. The absence of regulatory oversight, coupled with poor customer experiences and a lack of transparency, raises serious concerns about the safety and reliability of this trading platform.

For traders seeking to engage in forex trading, it is highly recommended to consider regulated alternatives that offer robust investor protections, transparent fee structures, and responsive customer service. Reputable brokers such as IG, OANDA, or Forex.com provide a safer trading environment and are subject to stringent regulatory standards, ensuring that traders' funds are safeguarded and their interests prioritized.

Is BarindexFX a scam, or is it legit?

The latest exposure and evaluation content of BarindexFX brokers.

BarindexFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BarindexFX latest industry rating score is 1.28, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.28 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.