Is ALPFOREX safe?

Business

License

Is Alpforex A Scam?

Introduction

Alpforex is a forex trading platform that has emerged in the competitive landscape of online trading. Established in 2021, it claims to cater primarily to Asian traders, offering a range of financial instruments, including forex, commodities, and indices. However, the rapid growth of online trading has led to an influx of brokers, making it essential for traders to exercise caution and thoroughly evaluate the legitimacy of any trading platform before committing their funds. This article aims to explore the credibility of Alpforex by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our investigation is based on a comprehensive review of available online resources, user feedback, and expert insights.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical aspects that determine its legitimacy and trustworthiness. Alpforex operates without any recognized regulatory oversight, which raises significant concerns regarding the safety of traders' funds. Below is a summary of the regulatory information available for Alpforex:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Alpforex is not subject to the same stringent oversight that regulated brokers must adhere to. This lack of oversight can lead to various issues, including the potential for fraud, mismanagement of funds, and a lack of recourse for traders in case of disputes. Furthermore, the broker does not provide any licensing details or transparent corporate information on its website, which is a red flag for potential clients. In regulated jurisdictions, brokers are typically required to maintain segregated accounts for client funds, ensuring that traders' money is safeguarded against the broker's operational risks. However, without regulation, Alpforex does not offer such protections, leaving clients vulnerable.

Company Background Investigation

Alpforex claims to be owned by Alp FX Company Limited, with its headquarters purportedly located in Thailand. However, the companys history is relatively unclear, and much of the available information appears speculative. The lack of a clear timeline regarding the establishment and operational history of Alpforex raises concerns about its credibility.

The management team behind Alpforex is not publicly disclosed, and there is little information available regarding their professional backgrounds or expertise in the financial sector. This lack of transparency can be concerning, as a reputable broker typically provides detailed information about its leadership and their qualifications. Moreover, the absence of contact information, such as a physical office address or a reliable customer service line, further diminishes the trustworthiness of the broker.

Transparency and information disclosure are vital for building trust with clients, and the current status of Alpforex indicates a significant shortfall in these areas. Without a clear understanding of who is running the platform, potential clients may hesitate to deposit their funds.

Trading Conditions Analysis

Alpforex offers a variety of trading conditions, but the lack of regulation casts doubt on the overall integrity of these offerings. The broker claims to provide competitive spreads and a low minimum deposit requirement, which can be appealing to novice traders. However, it is crucial to scrutinize the fee structure and any potential hidden costs that could arise.

| Fee Type | Alpforex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips (ECN) | 0.5 - 1.5 pips |

| Commission Model | $5 per lot (ECN) | N/A |

| Overnight Interest Range | N/A | Varies |

The spreads offered by Alpforex are advertised as low, with some accounts boasting spreads starting at 0.0 pips. However, the commission structure, particularly the $5 per lot fee on the ECN account, can significantly impact profitability, especially for high-frequency traders. Moreover, the absence of clear information regarding withdrawal fees and other transactional costs creates uncertainty for potential clients.

The lack of a demo account further complicates the situation, as it prevents traders from testing the platform and its trading conditions before committing real funds. A reputable broker typically offers a demo account to allow potential clients to familiarize themselves with the trading environment. In conclusion, while Alpforex presents itself as a competitive option, the lack of transparency regarding fees and the absence of a demo account warrant caution.

Customer Fund Safety

The safety of customer funds is a primary concern for any trader. Alpforex's unregulated status raises significant red flags regarding the security measures in place for safeguarding client deposits. Regulated brokers are required to implement stringent measures to protect client funds, including maintaining segregated accounts and providing negative balance protection. Unfortunately, Alpforex does not appear to offer these essential protections.

Without regulation, there are no guarantees that client funds are kept separate from the broker's operational funds. This situation poses a risk that, in the event of financial difficulties or bankruptcy, traders could lose their entire investment. Moreover, the absence of a compensation scheme further exacerbates the risk for traders, as there would be no recourse for recovering lost funds.

Historically, unregulated brokers have been associated with various security issues, including fraudulent activities and mismanagement of client funds. Therefore, potential clients must carefully consider these risks before deciding to trade with Alpforex.

Customer Experience and Complaints

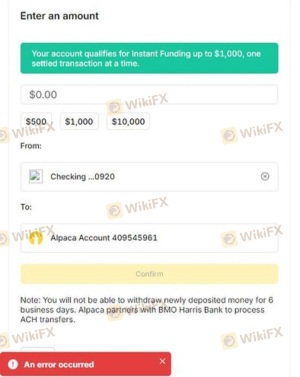

Customer feedback is a vital indicator of a broker's reliability and service quality. A review of user experiences with Alpforex reveals a pattern of negative feedback, with many users reporting significant difficulties in withdrawing their funds. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| High-Pressure Sales Tactics | Medium | Poor Communication |

| Lack of Transparency | High | N/A |

Many users have expressed frustration over delayed or blocked withdrawals, which is a common tactic employed by fraudulent brokers to retain clients' funds. Additionally, the aggressive sales tactics reported by users indicate a troubling approach to client management, where traders are pressured into making further deposits instead of being provided with the support they need.

A typical case involves a trader who deposited funds with Alpforex, only to find that when they attempted to withdraw their money, they faced numerous obstacles and a lack of communication from the broker. Such experiences are alarming and suggest a pattern of behavior consistent with untrustworthy brokers.

Platform and Trade Execution

The performance of the trading platform is crucial for a seamless trading experience. Alpforex claims to offer the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust trading capabilities. However, the platform's real-world performance and execution quality remain unverified due to the lack of access for non-Thai traders.

Issues such as slippage, order rejections, and execution delays can significantly impact trading outcomes. Potential clients should be wary of any signs of platform manipulation, as unregulated brokers may engage in practices that disadvantage traders. The absence of a demo account further complicates the situation, as traders cannot assess the platform's reliability before investing real money.

Risk Assessment

Using Alpforex presents several risks that potential clients must consider. Below is a summary of the key risk areas associated with trading on this platform:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, increasing fraud risk. |

| Fund Safety | High | Lack of fund segregation and protection measures. |

| Withdrawal Issues | High | Reports of blocked withdrawals and poor communication. |

| Platform Reliability | Medium | Unverified performance of the trading platform. |

To mitigate these risks, traders should conduct thorough research, avoid investing more than they can afford to lose, and consider using regulated brokers that offer greater security and transparency.

Conclusion and Recommendations

In conclusion, Alpforex exhibits several characteristics that raise concerns about its legitimacy as a forex broker. The lack of regulation, transparency, and reports of withdrawal issues suggest that this platform may not be a safe choice for traders. While it offers competitive trading conditions, the associated risks far outweigh the potential benefits.

For traders seeking a reliable and secure trading environment, it is advisable to explore regulated brokers that provide the necessary protections and transparency. Brokers with established reputations and proper regulatory oversight are essential for ensuring the safety of your investments. Consider alternatives such as established platforms with proven track records and robust customer support to safeguard your trading activities.

Is ALPFOREX a scam, or is it legit?

The latest exposure and evaluation content of ALPFOREX brokers.

ALPFOREX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ALPFOREX latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.