Is CityTrade safe?

Pros

Cons

Is CityTrade Safe or a Scam?

Introduction

CityTrade positions itself as a prominent player in the online trading space, offering a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies. For many traders, especially those new to the market, the allure of high returns can be tempting. However, the forex market is fraught with risks, and the choice of broker can significantly impact a trader's experience and safety. Thus, it is crucial for traders to thoroughly evaluate their options before committing funds. In this article, we will investigate the legitimacy of CityTrade by examining its regulatory status, company background, trading conditions, and customer experiences. Our analysis is based on a review of various credible sources and user feedback to provide a comprehensive overview of whether CityTrade is a safe trading platform or a potential scam.

Regulation and Legitimacy

One of the first indicators of a broker's reliability is its regulatory status. Regulation ensures that brokers adhere to certain standards, providing a level of protection for investors. CityTrade claims to operate under the jurisdiction of Saint Vincent and the Grenadines, a location known for its lax regulatory framework. This raises significant concerns regarding the safety of funds and the brokers accountability.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Saint Vincent and the Grenadines | Unregulated |

The absence of a valid license from a reputable financial authority is a major red flag. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US impose strict guidelines on brokers to protect investors. In contrast, CityTrade operates without such oversight, which can lead to potential fraudulent activities and a lack of recourse for clients. Additionally, the German financial supervisory authority, BaFin, has issued warnings against CityTrade, labeling it as a scam. This further solidifies the notion that CityTrade is not safe for traders looking to protect their investments.

Company Background Investigation

CityTrade's history and ownership structure are also critical factors in assessing its reliability. Established recently, the broker lacks a transparent background, which is often indicative of potential risks. Information about the companys founders or management team is scarce, making it difficult for traders to gauge their expertise and credibility.

The lack of transparency raises concerns about the broker's intentions. A reputable company typically provides detailed information about its operations, management, and regulatory compliance. Unfortunately, CityTrade does not meet these standards, which can lead to uncertainty regarding the safety of clients' funds. Furthermore, the absence of a physical address or contact information is alarming. Traders should be wary of companies that conceal their identities, as this is a common tactic employed by fraudulent brokers.

Trading Conditions Analysis

When evaluating whether CityTrade is safe, it is essential to consider its trading conditions. CityTrade requires a minimum deposit of $500, which is relatively high compared to industry standards. Additionally, the brokers fee structure lacks transparency, with many users reporting unexpected charges and difficulties during the withdrawal process.

| Fee Type | CityTrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.4 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While CityTrade advertises competitive spreads, the overall lack of clarity regarding fees and commissions raises concerns. Traders have reported issues with withdrawal requests being ignored or delayed, which is a common tactic used by scam brokers to retain clients' funds. This lack of transparency in trading conditions suggests that CityTrade is not safe for traders looking to engage in a fair and transparent trading environment.

Client Fund Security

The safety of client funds is paramount when assessing a brokers reliability. CityTrade claims to keep client funds in segregated accounts, yet there is no independent verification of this practice. Without proper regulation, there is no guarantee that these funds are safe.

The absence of investor protection measures, such as negative balance protection, further exacerbates the risks associated with trading on this platform. Traders must be particularly cautious, as many have reported losing significant amounts of money with CityTrade, often without recourse. The lack of a clear refund policy or insurance for deposits is another indicator that CityTrade is not safe for potential investors.

Customer Experience and Complaints

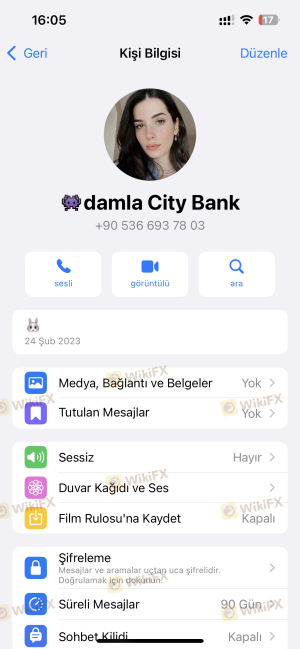

Analyzing customer feedback is crucial in determining the legitimacy of a broker. Reviews of CityTrade reveal a troubling pattern of complaints regarding withdrawal issues, lack of customer support, and overall dissatisfaction with the trading experience.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Transparency | High | None |

Many users have reported being unable to withdraw their funds, often facing high withdrawal fees or being pressured to make additional deposits before they can access their money. Such practices are indicative of a scam, as they are designed to trap clients into depositing more funds. The overall sentiment among users suggests that CityTrade is not safe, and potential investors should approach with caution.

Platform and Trade Execution

The performance of a trading platform is another essential aspect to consider. CityTrade offers a web-based platform that lacks the advanced features and reliability found in industry-standard platforms like MetaTrader 4 or 5. Users have reported issues with order execution, including slippage and rejections, which can significantly impact trading outcomes.

The absence of robust trading tools and a user-friendly interface raises concerns about the platform's reliability. If traders face difficulties executing trades or experience frequent outages, their ability to capitalize on market opportunities is compromised. This further reinforces the notion that CityTrade is not safe for serious traders.

Risk Assessment

When evaluating the overall risk associated with CityTrade, it is evident that several factors contribute to a high-risk rating.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Fund Safety Risk | High | Lack of segregation and protection |

| Customer Service Risk | Medium | Poor response to complaints |

| Platform Reliability Risk | High | Frequent issues with execution |

To mitigate these risks, potential traders should consider alternatives that offer robust regulatory oversight, transparent fee structures, and reliable customer support. Engaging with a regulated broker can provide a safer trading environment and greater peace of mind.

Conclusion and Recommendations

In conclusion, the evidence gathered strongly indicates that CityTrade is not safe for traders. The lack of regulation, transparency, and consistent complaints from users point towards a high likelihood of fraudulent activities. For traders seeking to enter the forex market, it is advisable to steer clear of CityTrade and consider more reputable alternatives.

For those looking for reliable trading options, brokers regulated by credible authorities such as the FCA or ASIC provide a safer environment. Always conduct thorough research and due diligence before committing funds to any trading platform. Remember, safeguarding your hard-earned money should always be your top priority.

Is CityTrade a scam, or is it legit?

The latest exposure and evaluation content of CityTrade brokers.

CityTrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CityTrade latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.