Is Pioneer Capital safe?

Pros

Cons

Is Pioneer Capital Safe or a Scam?

Introduction

Pioneer Capital is an online investment platform that positions itself as a provider of financial services, including forex trading, investment planning, and wealth management. In the rapidly evolving world of forex trading, where opportunities for profit can be enticing, it is crucial for traders to thoroughly assess the legitimacy and safety of their chosen brokers. The potential risks associated with unregulated or unscrupulous firms can lead to significant financial losses. This article aims to provide a comprehensive evaluation of Pioneer Capital, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. The findings are based on a thorough analysis of online reviews, regulatory databases, and user feedback.

Regulation and Legitimacy

The regulatory status of a brokerage is a critical factor in determining its legitimacy. A regulated broker is subject to oversight by financial authorities, which can provide a level of security and accountability for clients. Unfortunately, Pioneer Capital has been reported to operate without valid regulatory oversight.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of a regulatory license raises significant concerns about the safety and security of client investments. Without regulatory oversight, investors have limited protections, and the risk of encountering fraudulent practices increases. The lack of transparency regarding its regulatory status and the potential for high-risk trading environments makes it essential for traders to exercise caution. It is advisable to only engage with brokers that are regulated by reputable authorities such as the FCA (Financial Conduct Authority) or ASIC (Australian Securities and Investments Commission).

Company Background Investigation

Pioneer Capital Limited was reportedly established in Canada and has been operating for approximately two to five years. However, details regarding its ownership structure and management team are sparse, which raises questions about its transparency. The company's website is often inaccessible, further complicating efforts to gather information.

The management teams background and professional experience are critical indicators of a company's reliability. Unfortunately, there is little publicly available information regarding the qualifications or experience of Pioneer Capital's leadership. This lack of transparency can be a red flag for potential investors, as a reputable firm should provide clear information about its management team and their qualifications.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value. Pioneer Capital claims to provide competitive trading conditions, including various investment plans and potential profit margins. However, the actual fee structure remains unclear and may contain hidden costs.

| Fee Type | Pioneer Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clear information regarding spreads and commissions is concerning, as it can lead to unexpected costs for traders. Moreover, any unusual or opaque fee policies should be treated with caution, as they may indicate potential issues with the broker's practices.

Customer Funds Security

The safety of client funds is paramount in the forex trading industry. Pioneer Capitals policies regarding fund security, including fund segregation, investor protection, and negative balance protection, are not well-documented.

Without proper segregation of client funds, there is a risk that investors' money could be misused or lost in the event of the company's insolvency. Furthermore, the absence of investor protection schemes means that clients may have little recourse if issues arise. Historical data on any past security issues or disputes is also lacking, which is a significant concern for potential investors.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews of Pioneer Capital reveal a mixed bag of experiences, with some users reporting positive interactions while others express dissatisfaction.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Lack of Transparency | Medium | Limited information |

| Poor Customer Support | High | Inconsistent support |

Common complaints include difficulties with withdrawals and a lack of transparency regarding fees and trading conditions. The company's response to these complaints has been criticized for being slow and inadequate, which can further erode trust among clients.

Platform and Trade Execution

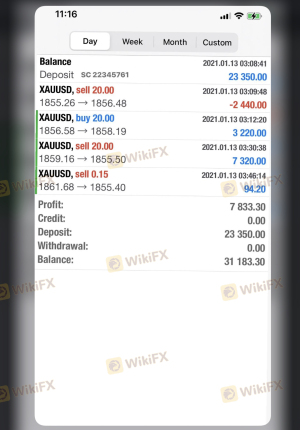

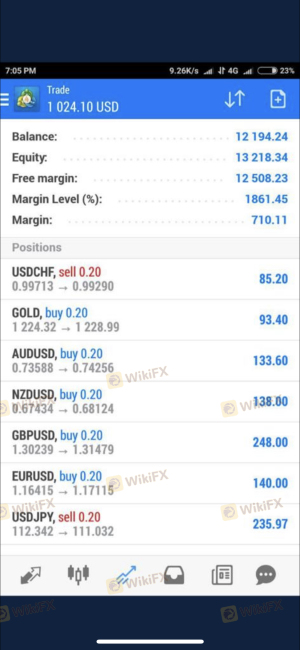

The performance and reliability of a trading platform are critical for a positive trading experience. Pioneer Capital utilizes the MT5 trading platform, which is known for its advanced features and user-friendly interface. However, user experiences regarding execution quality and slippage have been mixed.

Issues with order execution, such as slippage and high rejection rates, can significantly impact trading outcomes. Traders should be wary of any signs of platform manipulation, as this can indicate deeper issues within the brokerage.

Risk Assessment

Engaging with Pioneer Capital involves several risks that potential investors should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases risk. |

| Financial Risk | Medium | Lack of transparency regarding fees. |

| Operational Risk | High | Poor customer support and withdrawal issues. |

To mitigate these risks, it is advisable for traders to conduct thorough due diligence before investing and to consider using alternative brokers that are regulated and have a proven track record.

Conclusion and Recommendations

In conclusion, the evidence suggests that Pioneer Capital raises several red flags regarding its legitimacy and safety as a trading platform. The lack of regulation, unclear fee structures, and mixed customer experiences point to a higher level of risk for potential investors.

For traders seeking a reliable and safe trading environment, it is recommended to consider alternative brokers that are regulated by reputable authorities and have a solid reputation for customer service and transparency. Always conduct comprehensive research and due diligence before making any investment decisions, as the risks associated with unregulated brokers can be substantial.

In summary, Is Pioneer Capital Safe? Given the current evidence, it is prudent for traders to proceed with caution and consider other options.

Is Pioneer Capital a scam, or is it legit?

The latest exposure and evaluation content of Pioneer Capital brokers.

Pioneer Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Pioneer Capital latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.