Is FOGO safe?

Pros

Cons

Is Fogo A Scam?

Introduction

Fogo is an online forex broker that has recently emerged in the trading landscape, claiming to offer a diverse range of trading products, including forex, commodities, stocks, and cryptocurrencies. As the forex market continues to attract a growing number of traders, it becomes increasingly vital for investors to exercise caution and thoroughly evaluate the legitimacy of brokers before committing their funds. With the prevalence of scams and fraudulent activities in the financial sector, ensuring that a broker is trustworthy and regulated is paramount for safeguarding investments.

This article aims to provide a comprehensive assessment of Fogo by examining its regulatory status, company background, trading conditions, client experiences, and overall risk profile. The analysis is based on a review of various online sources, including regulatory databases, trader reviews, and industry reports. By utilizing a structured framework, this evaluation will help potential investors make informed decisions regarding their engagement with Fogo.

Regulation and Legitimacy

The regulatory landscape is a critical factor in assessing the credibility of any forex broker. Regulation serves as a safeguard for investors, ensuring that brokers adhere to strict operational standards and financial practices. In the case of Fogo, the broker claims to operate under the registration of Fogo Global Limited, which is registered with the U.S. Money Services Business (MSB). However, this registration only permits currency exchange operations and does not extend to forex trading or financial derivatives.

Core Regulatory Information

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| U.S. Money Services Business (MSB) | Not Applicable | United States | Registered (Currency Exchange Only) |

| UK Financial Conduct Authority (FCA) | None | United Kingdom | Unregulated |

The absence of regulation by reputable authorities such as the UK's Financial Conduct Authority (FCA) raises significant concerns. While the MSB oversees currency exchange activities, it does not provide the necessary regulatory framework to protect investors' funds in forex trading. This lack of oversight exposes traders to potential risks, including the possibility of fund mismanagement and fraudulent practices. Given these regulatory gaps, it is crucial for potential investors to approach Fogo with caution.

Company Background Investigation

Fogo Global Limited, the entity behind the Fogo trading platform, is relatively new to the market, having launched in 2023. The company claims to be based in the United Kingdom, but there is limited publicly available information regarding its ownership structure and management team. A thorough investigation into the company's history and leadership is essential to assess its reliability.

The management team's background and professional experience play a significant role in determining a company's credibility. However, Fogo's website lacks transparency regarding its executives and their qualifications. This absence of information raises red flags about the company's commitment to accountability and transparency. Without clear insights into the management's expertise and track record, potential investors may find it challenging to trust the broker.

Furthermore, the lack of comprehensive information about the company's operations and financial health further complicates the assessment of Fogo's legitimacy. Investors should be wary of platforms that do not provide adequate disclosure about their corporate structure and operational practices, as this can indicate a lack of transparency.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions, including fees and spreads, is essential. Fogo claims to offer a variety of trading options, but the specifics of its fee structure are not clearly outlined on its website. A thorough analysis of the broker's overall cost structure is necessary to determine whether it aligns with industry standards.

Core Trading Costs Comparison

| Fee Type | Fogo | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1-2 pips |

| Commission Model | Not Disclosed | Varies (0-10 USD per lot) |

| Overnight Interest Range | Not Disclosed | Varies (0-5%) |

One of the significant concerns regarding Fogo is the lack of transparency about its fee structure. Potential investors should be cautious of brokers that do not disclose their spreads, commissions, and overnight interest rates, as this may indicate hidden fees or unfavorable trading conditions. Additionally, the absence of industry-standard trading platforms such as MetaTrader raises questions about the overall trading experience and execution quality.

Client Funds Security

The safety of client funds is a paramount concern for any forex trader. Fogo's measures to protect investor funds are unclear, and the lack of regulation raises questions about the security of deposits. In a regulated environment, brokers are typically required to segregate client funds from their operational accounts, ensuring that traders' money is protected in the event of insolvency.

Fogo's website does not provide detailed information regarding its fund protection policies, such as whether it offers negative balance protection or investor compensation schemes. The absence of these safeguards increases the risk for traders, as they may find themselves vulnerable to financial losses without recourse.

Additionally, historical issues regarding fund security and disputes with clients can serve as indicators of a broker's reliability. However, there is limited information available about Fogo's past performance in this regard, making it difficult for potential investors to assess the broker's track record.

Customer Experience and Complaints

Customer feedback is a valuable resource for evaluating a broker's reputation and reliability. A thorough analysis of user experiences with Fogo reveals a mix of positive and negative reviews. While some traders report satisfactory experiences, others have raised significant complaints regarding withdrawal issues and unresponsive customer support.

Major Complaint Types and Severity Assessment

| Complaint Type | Severity Level | Company Response |

|---|---|---|

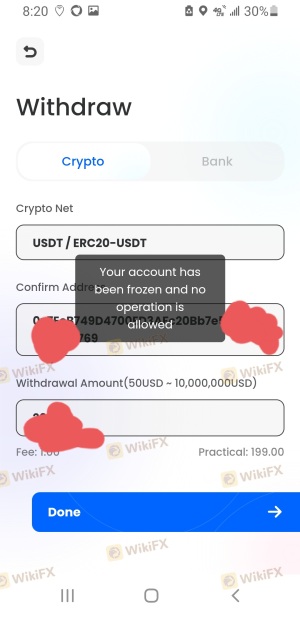

| Withdrawal Issues | High | Unresponsive |

| Account Locking | High | Unresponsive |

| Misleading Promotions | Medium | Limited Response |

Common complaints include difficulties with fund withdrawals, where users have reported being unable to access their money after making deposits. Such issues are red flags that indicate potential operational problems or unethical practices. Additionally, reports of accounts being locked without explanation further exacerbate concerns about Fogo's reliability.

Case Studies

-

Withdrawal Denial: One user reported attempting to withdraw $7,700 from their Fogo account, only to have their request rejected without explanation. After multiple attempts to contact customer support, the user found themselves locked out of their account, raising suspicions about the broker's practices.

Unresponsive Support: Another trader shared their frustration with Fogo's customer service, stating that inquiries regarding account issues went unanswered for weeks. This lack of responsiveness is a significant concern for traders who may require assistance during critical trading periods.

- Conduct thorough research and due diligence before depositing funds.

- Start with a small investment to test the platform's reliability and performance.

- Look for regulated alternatives that offer better protections and transparency.

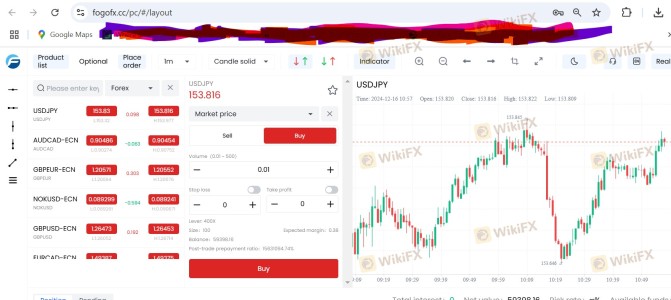

Platform and Execution

The trading platform is a crucial component of the trading experience, influencing execution quality and user satisfaction. Fogo's platform lacks industry-standard features, which may hinder traders' ability to execute trades efficiently. Additionally, the absence of information regarding order execution quality raises concerns about potential slippage and rejections.

Traders have reported mixed experiences with Fogo's execution speed, with some experiencing delays during volatile market conditions. Such issues can significantly impact trading outcomes, particularly for those employing short-term strategies. The lack of transparency regarding execution quality and the absence of a robust trading platform may deter potential investors from engaging with Fogo.

Risk Assessment

Engaging with Fogo presents several risks that potential investors should carefully consider. The lack of regulation, transparency, and client fund protection measures contributes to an overall high-risk profile.

Risk Scorecard

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unregulated broker with limited oversight. |

| Fund Security | High | No clear measures for fund protection. |

| Customer Support | Medium | Reports of unresponsive customer service. |

| Trading Conditions | High | Lack of transparency regarding fees and spreads. |

To mitigate risks when engaging with Fogo, traders should consider the following recommendations:

Conclusion and Recommendations

In conclusion, the evidence suggests that Fogo raises significant red flags that warrant caution. The broker's lack of regulation, unclear fee structure, and reports of withdrawal issues indicate potential risks for traders. While some users may have had positive experiences, the overall lack of transparency and accountability is concerning.

For potential investors, it is advisable to approach Fogo with skepticism and consider more reputable, regulated alternatives in the forex market. Brokers that are overseen by recognized regulatory authorities provide greater assurances regarding fund safety and operational integrity.

If you are considering entering the forex market, it is prudent to research and choose brokers that prioritize transparency, regulatory compliance, and customer support.

Is FOGO a scam, or is it legit?

The latest exposure and evaluation content of FOGO brokers.

FOGO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FOGO latest industry rating score is 1.32, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.32 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.