Is A&M Trader safe?

Business

License

Is AM Trader Safe or a Scam?

Introduction

AM Trader is an online forex and CFD brokerage that has garnered attention in the trading community for its competitive offerings and diverse range of financial instruments. Established in 2012, this broker positions itself as a viable option for both novice and experienced traders seeking access to global financial markets. However, the forex trading landscape is fraught with risks, and traders must exercise caution when evaluating brokers. The importance of due diligence cannot be overstated, as the choice of broker can significantly impact a trader's success and safety. This article aims to provide a comprehensive analysis of AM Trader's legitimacy, focusing on regulatory compliance, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

When assessing the safety of any trading platform, the regulatory framework under which it operates is a crucial factor. AM Trader is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory environment. This raises concerns about the level of protection offered to clients. The absence of stringent regulatory oversight can leave traders vulnerable to potential fraud and malpractice.

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unverified |

The lack of regulation from a reputable authority such as the FCA (UK) or ASIC (Australia) means that AM Trader does not have the same level of accountability as more regulated brokers. Furthermore, the regulatory body in Saint Vincent and the Grenadines does not monitor or enforce compliance with strict trading standards, which is a significant red flag for potential investors. Historical compliance issues and a lack of transparency regarding their operational practices further exacerbate concerns about AM Trader's reliability. Therefore, it is critical for traders to consider these factors seriously before deciding to engage with this broker.

Company Background Investigation

AM Trader, owned by Services Com SVG Ltd, has been operating since 2012. The company claims to serve a diverse clientele across various regions, including Asia-Pacific, Africa, and South America. However, the details surrounding its ownership structure and management team are somewhat opaque. The absence of publicly available information regarding the backgrounds of key personnel raises questions about the broker's transparency and trustworthiness.

While the company states that it aims to provide high-quality trading services, the lack of detailed information about its operational history and management can be a cause for concern. Transparency in business practices is essential for building trust, and AM Trader's failure to provide such information may deter potential clients. Furthermore, the absence of any notable awards or recognitions in the industry further diminishes the broker's credibility.

Trading Conditions Analysis

The trading conditions offered by AM Trader are crucial in determining its attractiveness to potential clients. The broker claims to provide competitive spreads and a variety of account types. However, the overall fee structure and any unusual charges merit close scrutiny.

| Fee Type | AM Trader | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1 pip | 0.6 - 1.0 pips |

| Commission Model | None (for standard accounts) | Varies |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

AM Trader's spreads starting from 1 pip for major currency pairs may appear competitive, but they are on the higher side compared to industry averages. The absence of commissions for standard accounts is a positive aspect; however, traders should remain vigilant about any hidden fees that may arise during withdrawals or other transactions. Additionally, the lack of clear information regarding overnight interest rates can lead to unexpected costs for traders holding positions overnight.

Client Fund Safety

The safety of client funds is paramount when evaluating a broker's reliability. AM Trader claims to implement various security measures to protect clients investments. However, the lack of regulatory oversight raises significant concerns regarding the effectiveness of these measures.

Traders often look for features such as segregated accounts, investor protection schemes, and negative balance protection policies. Unfortunately, AM Trader does not prominently advertise any of these safeguards, making it difficult for potential clients to assess the safety of their funds adequately. Historical issues related to fund withdrawals and customer complaints about poor communication further complicate the broker's reputation in this regard.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the reliability of a broker. Reviews of AM Trader reveal a mixed bag of experiences, with several users reporting issues related to withdrawals and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Service Issues | Medium | Average |

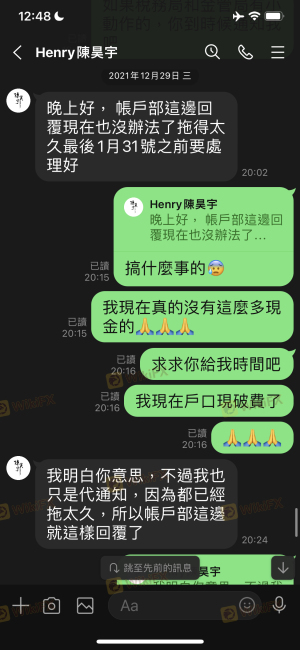

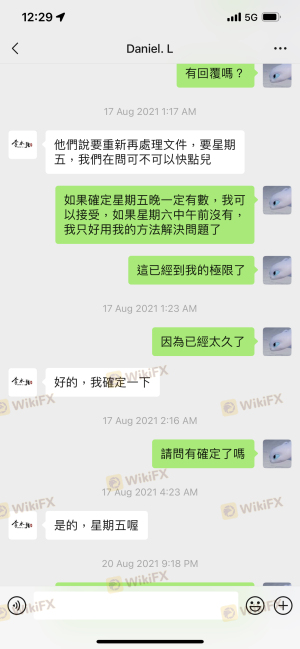

Common complaints include prolonged withdrawal processes, lack of communication from support staff, and difficulties in resolving issues. For instance, several traders have noted that their withdrawal requests took significantly longer than expected, leading to frustration and distrust.

One notable case involved a trader who faced repeated delays in receiving funds after multiple attempts to contact customer support. This situation exemplifies the potential risks associated with trading through AM Trader, as unresolved issues can lead to significant financial losses for clients.

Platform and Trade Execution

The performance of the trading platform is another critical aspect of the overall trading experience. AM Trader utilizes the popular MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust features. However, the reliability and execution quality of the platform merit careful evaluation.

Traders have reported varying experiences with order execution, including instances of slippage and rejected orders. Such occurrences can significantly impact trading strategies and profitability, particularly for those engaged in high-frequency trading or scalping.

Risk Assessment

The comprehensive risk associated with trading through AM Trader is a crucial consideration for potential clients.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of oversight from reputable authorities. |

| Withdrawal Risk | Medium | Reported delays and issues with fund access. |

| Platform Reliability | Medium | Mixed reviews regarding execution quality. |

Given the identified risks, it is advisable for traders to proceed with caution. Engaging in thorough research, utilizing demo accounts, and setting clear risk management strategies can help mitigate potential losses.

Conclusion and Recommendations

In conclusion, while AM Trader offers a variety of trading options, the lack of regulatory oversight, transparency issues, and mixed customer feedback raise significant concerns about its safety. Traders should be particularly wary of the potential risks associated with this broker, especially concerning fund security and withdrawal processes.

For those seeking a more secure trading environment, it may be prudent to consider alternative brokers that are regulated by reputable authorities, such as FCA or ASIC. These brokers typically offer enhanced protections and a more transparent trading experience. Overall, the evidence suggests that AM Trader may not be the safest choice for traders looking to protect their investments.

Is A&M Trader a scam, or is it legit?

The latest exposure and evaluation content of A&M Trader brokers.

A&M Trader Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

A&M Trader latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.